Citadel Macro Trader Unveils 3 Highest Conviction Trades Across G3 Rates

Authored by Frank Flight via Citadel Securities,

We have been flagging the risk that 10y UST yields break out to the topside as the market reprices the US cyclical outlook (link).

We continue to think this has further to go and retain our key strategic conviction that UST vs German yield spreads continue to widen from the lows. Below we highlight our key convictions:

-

UST vs German Yield Spreads Fail to Reflect Growth Divergence

-

EUR Long End at Risk of High Vol Flattening

-

Long End JGBs Offer Value: Policy Options Abound

The market entered the year set up for a benign macro environment via carry trades with implied volatility at the lows and risk appetite close to the highs. The break out in 10y UST yields represents a key source of upside risk to cross asset volatility and despite the spillovers from the JGB move and geopolitical headlines, rates vol remains at the lows.

As highlighted in last weekend’s Some Macro Thoughts note from Nohshad Shah – “Beware of Complacency”

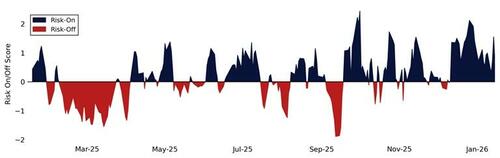

Citadel Securities: Retail Risk-On/Risk-off Indicator

Source: Citadel Securities, January 2026. Figures are for illustrative purposes only. Past performance figures do not guarantee future results

UST vs German Yield Spreads Fail to Reflect Growth Divergence

Our framework (link) decomposes the macro complex into primary macro factors (Growth/Policy) to understand what is discounted by cross asset valuations. We highlighted last week that US growth is around the mid point of its 10y history whereas European growth valuations are elevated and vulnerable. The performance of US cyclical assets relative to broad growth pricing indicates there is continued upside risk to yields as a result.

Cyclical Equity Performance Implies Upside to Broader Growth Pricing

1y Z-score of the first Principal Component of our macro framework vs 1y Z score of Cyclicals vs Defensives

Source: Bloomberg, Citadel Securities, January 2026. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

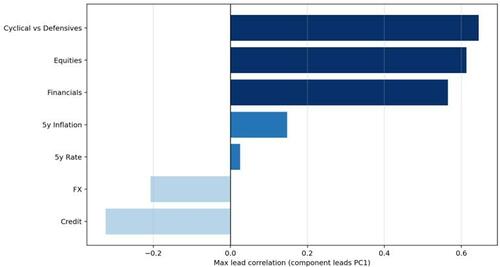

We can isolate whether there is meaningful leading information embedded within asset prices such as cyclicals vs defensives by evaluating how strongly and how early different components of the macro framework tend to move ahead of the aggregate market-implied growth factor (PC1).

For each asset, 1-year rolling z-scores are constructed and compared to the contemporaneous growth factor using lead–lag correlations. In the chart below the horizontal length of each bar reflects the maximum positive correlation observed at any leading lag, providing a measure of how informative that input is for subsequent growth pricing and the timing dimension is summarised using an average lead window, defined as the range of leading lags over which correlations remain elevated. This tends to confirm that equity market internals lead broad growth pricing, that yields tend to move contemporaneously and suggests upside risk to UST yields, in line with the view we outlined at the start of the year.

Equity Market Internals Tend to Lead Broader Growth Pricing

Lead–lag correlations of components relative to aggregate PC1. Darker shading indicates earlier average lead window.

Source: Bloomberg, Citadel Securities, January 2026. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

European macro pricing by contrast appears to look both elevated and vulnerable, as there is no implied catch up yields relative to the leading components of the framework (which in fact are moving lower locally (see European Cyclical stocks)), and market implied growth valuations are at historically elevated levels.

European Growth Pricing is Elevated Particularly vs US

Raw PC1 output US vs EUR Market Implied Growth

Source: Bloomberg, Citadel Securities, January 2026. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

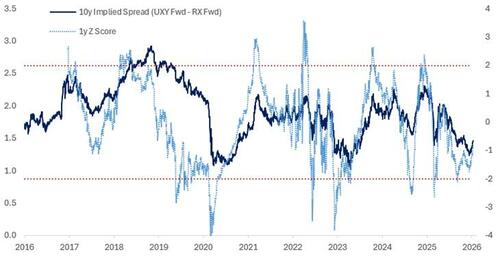

As a result our thematic conviction is that the spread between UST and Bund yields can continue to widen from the lower end of the 10y range.

10y UST vs Germany

Yield Spread + 1y Z- Score, 2016-2026

Source: Bloomberg, Citadel Securities, January 2026. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

EUR Long End at Risk of High Vol Flattening

Long end EUR steepening risk was a well flagged theme in expectation of Dutch Pension Transition flows. That flow appears to be some combination of smaller, slower or well offset by existing positioning. Alternative expressions of the Dutch reform flow have already come under significant pressure – namely the collapse in EUR ultra curves (30s50s), long end ESTR/Euribor basis and Buxl ASW.

Mapping the performance of these Dutch flow proxies onto the valuation of 10s30s implies material flattening risk from this valuation. Furthermore the global steepening impulse from Japan and USTs appears to be holding up the curve valuation, exposing a crowded position to material flattening risk.

Pension Reform Flow Proxies Imply Flattening Risk for EUR Curve

EUR 10s30s vs 30y ESTR 6s Basis, UB ASW and EUR 30s50s

Source: Bloomberg, Citadel Securities, January 2026. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

Long End JGBs Offer Value: Policy Options Abound

The break out in long end JGBs has been helpful to our call for UST yields to move higher on an outright and cross market basis. However we think the most recent leg higher in JGB yields represents an interesting opportunity to lean into the price action via curve flatteners as policy options to stem the rise in long end yields do not appear out of reach.

The policy levers which we’d flag as imminently viable:

-

The BoJ could float the idea of temporary targeted JGB purchases conditional on market functioning continuing to be impaired..

-

.. the BoJ could also hint towards the risk of a quicker pace of hikes (March prices just 5bps, April 15bp) which is consistent with the underlying inflation dynamics anyway and some recent media leaks

-

.. the MoF could also signal a more profound reduction in long end issuance than previous tweaks

The combination of a backstop to yields/market functioning, a more credible pace of policy normalization and a reduction in long end supply delivered in a coordinated manner would likely stabilize the long end of the yield curve by encouraging international sponsorship.

Ultimately the fiscal package announced in November is likely to cost $135bn (link) which is roughly 3% of GDP and the 2y consumption tax cut is likely to cost around $32bn (link) (0.7% GDP). These are not small numbers however its important to place this in the context of a debt to GDP profile which expected to gradually decline, as debt to GDP is measured in nominal terms – and durable inflation is gradually increasing the denominator of the calculation.

Technical Indicators Imply Yield Rise May Stall

14d RSI on 30y JGB and 5s30s JGB Curve

Furthermore technical indicators suggest that pricing in the long end both outright and on curve has reached levels that will be difficult to sustain.