Commodities & Crypto Crushed As Tech Wreck Rolls On; Goldman Sees "Complete Lack Of Willingness" To BTFD

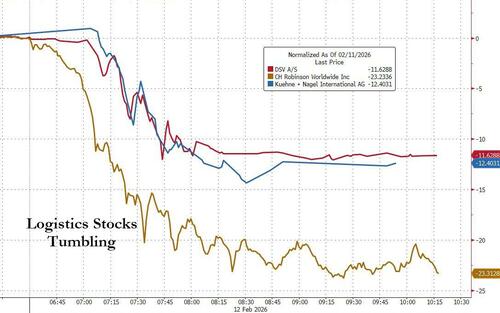

First it was SaaS (in particular, and Software in general), then Private Credit, then Insurance Brokers, then it was Financials/Broker/Wealth Managers that were hammered on Tuesday, then Real Estate Service stocks tumbled yesterday (and extended losses today), and today it is the turn of Logistics stocks to plunge as investors followed the bouncing AI disruption ball and freaked out over the sector’s vulnerability to the newest crop of artificial intelligence applications and tools that can disrupt countless industries.

CHRW's collapse is an 8-sigma event (as debate swirls whether it could be bucketed as a medium-term loser from AI... using chatbots to match loads offers efficiencies (lower headcount) but commoditization enters the conversations)...

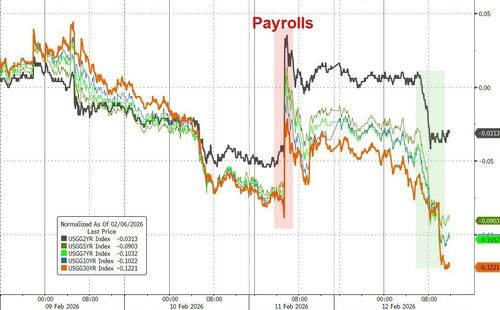

The day started off ugly from a macro perspective with one of the worst monthly drops in existing home sales on record (although the imbalance between housing supply and demand improved slightly) pushing yields and stocks lower as investors lean into traditionally defensive sectors - Utilities, Staples, Healthcare - and continue to assess the health of the US economy (seemingly shrugging off yesterday's very strong Payrolls report).

The 10Y UST yield tested its lowest since December 5th (key support is obvious at 4.10%)...

Small Caps were the day's laggards (most economically sensitive) followed by tech-heavy Nasdaq as the 'AI disruption' trade rolled on. Unlike some of the recently ugly days, the last few minutes did not see a bounce or cover as 0DTE players couldn't ignite enough monentum and gave up..

All the majors were down notably on the day, close to their lows of the day...

The Nasdaq 100 (down 2%) just suffered its 5th 1%-or-worse down-day in the last 10 days...

...as it lost support at the 100DMA...

...and the S&P broke back below its 50DMA...

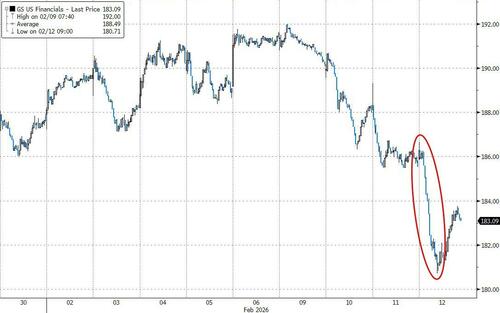

Christian DeGrasse, Goldman's Financials Sector Specialist, noted that today saw the same exact tape as Wednesday just repeating itself...

Almost anything previously tagged by ‘AI-risk’ narrative, whether deemed ‘rational or not’, is underperforming (CRE Brokers, Office REITs, Wealth, Info services, select exchanges, Insurance brokers, payments, Fintech) – while the alts started out somewhat stable but are starting to wobble, as are the banks (which largely have been immune to the ‘scare’ – with superregionals in particular being an attractive hideout within fins).

REITs (especially the large caps) continue to outperform as a hideout zone... Towers, Datacenters (EQIX Earnings +), Senior Housing in Healthcare, SPG in Malls, WY, Triple nets, etc...

DeGrasse adds that he's getting lots of requests for color:

Nothing ‘new’ is out there in Fins (staying vigilant), but this ‘scare’ does continues to broaden out, with the ‘new sector’ of the day under pressure from fears of AI-competition being logistics/transports in industrial (down double digits as of send).

The best recap of what's going on came from Goldman's Alex Mitola who writes that in terms of Flows:

"what has stood out most over the last few days, is NOT heavy supply like price action might suggest, but the COMPLETE LACK OF WILLINGNESS from investors to step in and defend during any of these sharp sell offs."

Until that changes, we expect to see such sector-specific meltdowns every day, as AI disruption becomes the name of the game.

Names previously thought of as AI winners are getting re-thought and re-assessed for potential risks. Valuation and multiples matter too.

SaaSpocalypse continues...

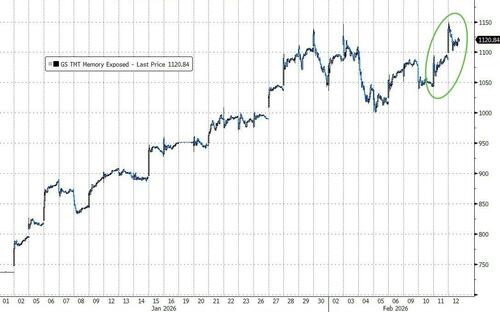

Across TMT, everything was lower outside of memory...

Software, Internet, and newly today Media all under pressure, getting sold in a risk off tape with MegaCaps tumbling back to their lowest in four months..

Notably, Goldman's new 'Good Software vs Bad Software' basket that picks AI-Disruptable names from less-disruptable, outperformed significantly today...

BDCs were hit again...

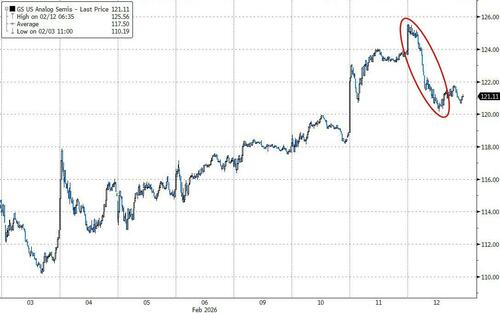

Even Semis suffered today...

With 'AI At Risk' names struggling through an extremely violent period...

Some pointed to this article as part of today’s recent AI related panic - Microsoft AI CEO says most white-collar jobs to be replaced with AI in 12 months; ‘models coding better than humans’

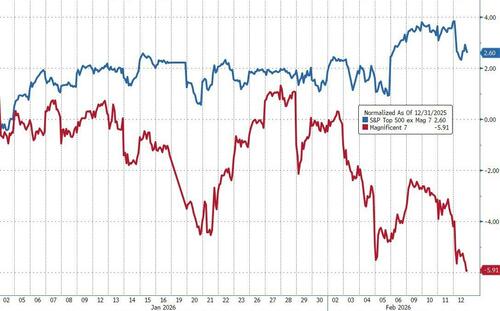

Mag7 names are now lagging the S&P 493 by 900bps YTD...

The bottom line is that, as Goldman trader Ryan Sharkey noted:

"Market remains extremely fragile and the factor moves extreme. > 40 names in the S&P are having more than a 3 sigma move today (for context yesterday's session was 15)...that is the highest I can remember in a long time."

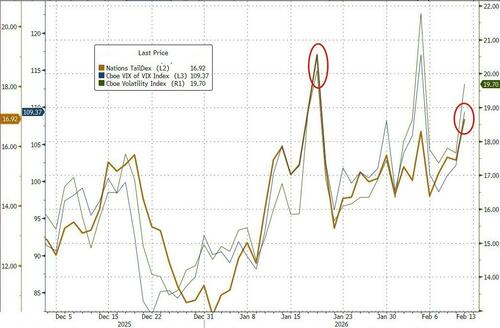

The 'violence' is snapping equity vols higher (VIX above 20 today, Nasdaq vol back above 22), and we are starting to see some movement in bond vol... something that will seriously harsh anyone's mellow as VaR shocks will do nothing to calm the contagion from equity sector/factor/single-name stress...

Treasury yields were all down today with the long-end continuing to outperform (30Y -8bps, 2Y -4bps) help by a strong 30Y auction after the dismal housing data..

Rate-cut expectations rebounded today (almost erasing yesterday's payrolls hawkishness)...

The dollar ended the day unchanged chopping around in a very tight range - unlike every other asset class...

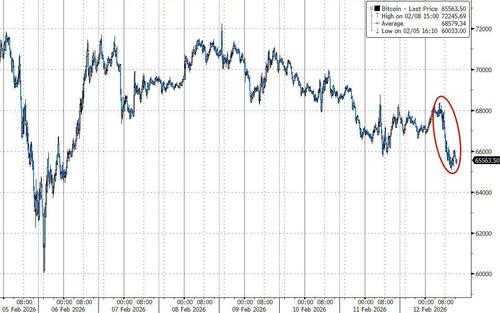

Crypto continued to slide, tagging above $68k only to be liquidated back to a $65k handle by the end of the cash equity session...

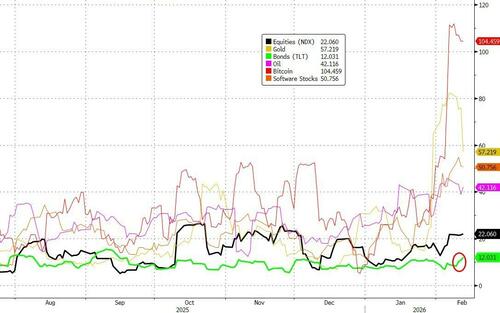

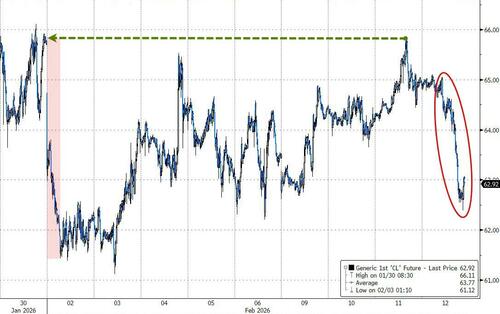

Commodities were clubbed like a baby seal today...

Oil plunged, with WTI now back below $63 as the combination of a broader risk-off tape and geopolitical recalibration (recent build in risk premium is being pared back, given President Trump reiterated his preference for a diplomatic solution with Tehran). Notably, the move gained steam when Israeli PM Netanyahu who said a good deal with Iran may be possible, but tempered that by stressing his skepticism about any agreement that ultimately emerges. For now, the market appears to be easing off the geopolitical bid, leaving oil exposed to a broader tepid risk environment (and not helped by the fact that the IEA cut its demand outlook... again)...

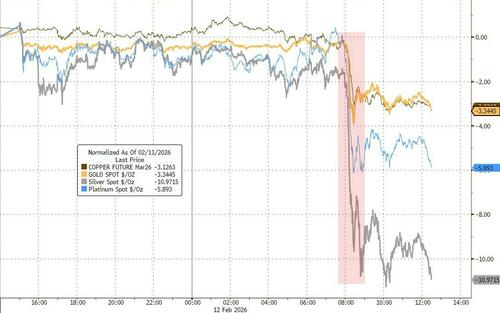

Thursday’s AI-disruption driven risk-off tone in equities is starting to broaden out, with metals dropping suddenly on what looks like algo selling (though some suggested it was Putin's plan to get back on the dollar system)...

The outpeformance of the barbarous relic pulled the Gold/Silver ratio back up to 66x...

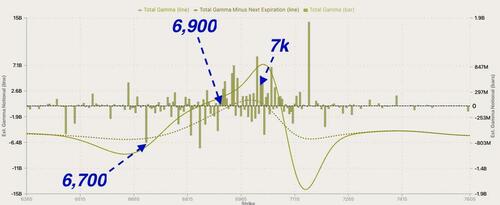

Finally, back to equity-land, where Bloomberg strategist, Michael Ball, notes that the break below 6,950 on the SPX opened the door for a quick deeper drawdown, with a negative-gamma setup underneath accelerating the selling as dealers’ hedging flows turned increasingly negative.

As SpotGamma highlights, there is some positive gamma support below current levels into 6,800, but much of that cushion is rented via 0DTE and resets daily, making it unreliable after today. Longer-term negative gamma grows into 6,700, which is the larger downside inflection zone if the market loses its footing again.

Volatility still looks contained given the drawdown level, even with the VIX curve now in backwardation. VVIX - or vol of vol - and implied correlation have underperformed and are not chasing spot vol higher. Additionally, the TDEX tail risk index is telling a similar story, staying below the levels seen earlier this month.

This all argues, for now, against the idea that traders are panic put buying at the index level or rushing to own VIX upside for tail hedges.

Tomorrow brings the week to a close with the January CPI inflation report due (and Monday sees markets closed)