The Complete Flows, Technicals & Positioning Market Summary As We Reach The End Of 2025

And so here we are, just 16 trading days away from the end of 2025, and nearing the middle of December, a month which contrary to conventional wisdom has been mixed at best over the past decade (and when the S&P sees its second worst performance of the year, only worst than September).

After a soggy November, which was rescued by dovish comments from Powell's Vice Chair John Williams on Nov 20, stocks managed modest gains last week, with the S&P gradually recovering from opening lower on Monday, trading in a relatively tight range to end the week up +31bps (before reversing much of the gains today).

A feature of the week was another rotation beneath the surface, out of Defensives (Utes -4.83%, REITs -2.58%, HealthCare -1.69%) and into Cyclicals (Cyclicals vs Defensives ex-Commods +5.01%), as well as the highest beta pockets of the market (Quantum +14.61% over 5 days, Non-Profitable Tech +9.61%, Global Rare Earths +9.07%, Depressed Cyclicals +4.25%, Memes +3.74%, all seemingly tracking the recovery in bitcoin), alongside some elements of short covering (Most Short +3.39%).

The backdrop of this rotation was a visible recovery in investor sentiment, which had some catching-up to do vs positioning. And flow-wise, on the fundamental side, Goldman's Prime Brokerage stats point to another week of Global equities buying by Hedge Funds, while the bank's flow desk notes activity was muted and skew very benign from Long Onlys.

On the ‘non-economic’ side, CTAs have turned buyers under every scenario, while inflows into Equity Mutual funds slowed down but remained positive, and Corporates continue to roll out their Buyback execution programs.

With the S&P500 now back a mere 20 points/30bps from its record close, all eyes turn to Wednesday's FOMC. It seems consensus has moved from unlikely cut to 100% probability of a cut, then to most likely a hawkish cut within the span of 3 weeks. The devil will be in the details of how much the Committee raises the bar for further cuts into 2026, and what the new inflation/growth/employment mix the revised SEP point to.

Let's take a closer look at each of these:

Hedge Funds: Prime Brokerage:

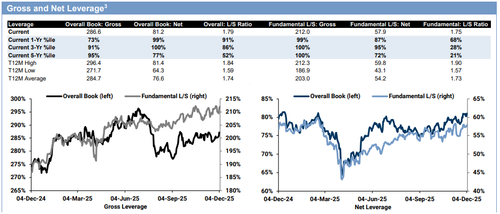

Global: Overall book gross leverage rose 1.5% to 286.6% (73rd percentile 1-year) and Net leverage +0.4 pts to 81.2% (99th percentile 1-year). Overall book L/S ratio unchanged at 1.791 (91st percentile 1-year). Fundamental L/S Gross leverage -0.3 pts to 212.0% (99 th percentile 1- year) and Net leverage -0.1 pts to 57.9% (87th percentile 1-year).

Global equities were net bought for a 7th straight week (9 of the last 10, +0.3 SDs 1-year), as gross trading activity continued to increase driven by long buys outpacing short sales (1.3 to 1).

All major regions (ex-EM Asia) were net bought, led by North America. Single Stocks were net bought for a 7th straight week (and 12 of the last 13), led by long buys, while Macro Products saw little net activity (short sales offset by long buys). Financials, Health Care, and Comm Svcs were the most notionally net bought global sectors, while Cons Disc, Stapes, and Utilities were the most net sold.

Europe: Risk-on flows were observed in Europe this week. The book was net bought with new longs outpacing new shorts. Europe remains overweight vs MSCI world on our book by 1.44% down 0.35 ppts WoW. North America continues to be underweight, at -9.42%, reduced by 0.12ppts.

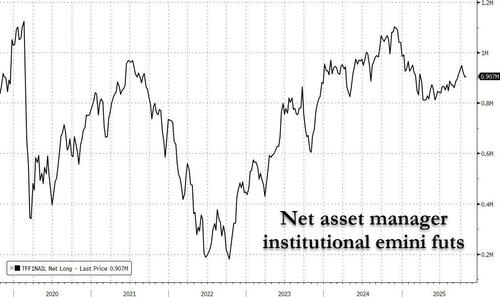

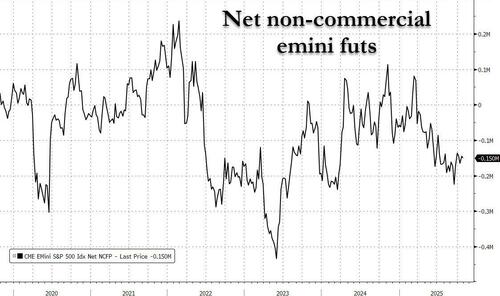

Asset Managers (CFTC/COT report): The CFTC data continues to trickle post Shutdown – the latest dating back from October 28.

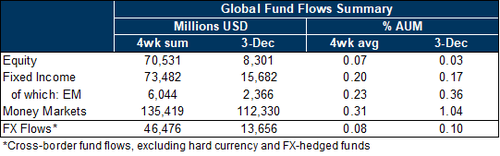

Mutual Funds - EPFR ($30Tn AuM, Global funds): Net flows into global equity funds were subdued in the week ending December 3 (+$8bn vs +$18bn in the previous week). In G10, flows into US equities were modest, while flows into the UK turned net positive, coinciding with the release of the budget. Notably, outflows from South Korea into US equity funds slowed. Retail outflows have likely been a driver of KRW underperformance. Slowing outflows could be a signal that the negative impulse for KRW from flows may be fading. In EM, mainland China saw net outflows; flows into South Korea and Taiwan remained very strong. At the sector level, flows into technology funds turned negative.

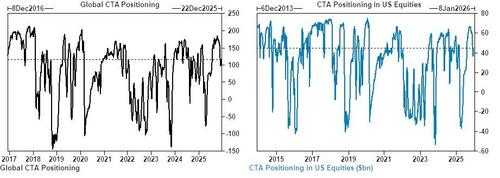

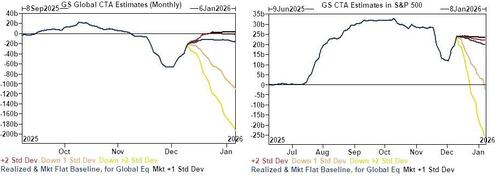

Systematic: In Goldman's latest update from Friday pre-US open, the bank's models estimated CTAs had bought $9bn of Global Equities on the week (after selling $71bn over the prior month), bumping their overall exposure to +$110bn (72nd percentile over a year). .

Looking ahead, the models predict CTAs will continue to buy, with purchases expected in any market scenario over a 1-week horizon

CTA Corner

CTA Flows:

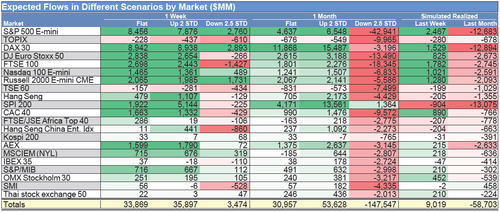

- Over the next 1 week…

- Flat tape: Buyers $29.77B ($9.62B into the US)

- Up tape: Buyers $31.16B ($8.42B into the US)

- Down tape: Sellers $2.88B ($2.62B into the US)

- Over the next 1 month…

- Flat tape: Buyers $30.41B ($5.12B into the US)

- Up tape: Buyers $46.64B ($7.63B into the US)

- Down tape: Sellers $153.5B ($55.35B out of the US)

Interestingly, the bank's prediction is that the amount these strategies will need to deploy in a flat market scenario is the same over 1 week and 1 month, and also similar in a flat or significantly up market scenario. In other words, CTAs should (all else equal) reach their end-target exposure within the next few days before going back to being idle. The short-term trigger level to watch for the SPX is at 6754 points, while the much more important medium-term trigger level is 230 points lower, at 6512.

Key pivot levels for SPX:

- Short term: 6754

- Med term: 6512

- Long term: 6070

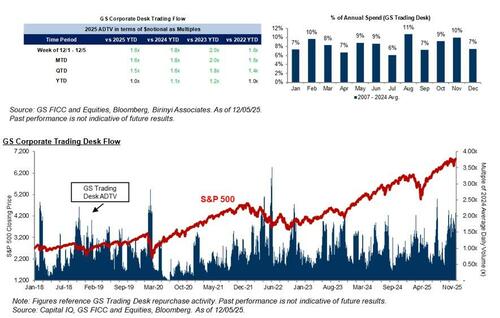

Corporates: Supply (IPOs) vs Demand (Buybacks):

- Issuance: $9.95bn worth of IPOs/additional in North America on the WEEK / $390.19bn of IPOs in North America YTD.

- Buybacks: According to Goldman's dedicated US buyback desk, for the week ending 21-Nov-2025 "a very active week on our desk last week with volumes running 1.8x vs 2024 YTD ADTV and 2.0x vs 2023 YTD ADTV skewed toward Financials, Consumer Disc, and Tech. These levels were approx. 30% higher vs the prior week. We are in the peak of open window with companies actively stepping in with buyback orders on market/stock weakness. Generally, we see a larger uptick in Q4 as companies look to meet their year end buyback goals. We are expecting this current open window to run through 12/19/2025”

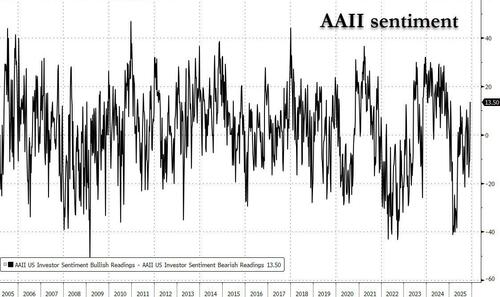

Retail - AAII Sentiment Survey: Bullish. On the week ending December 3rd, the weekly Bull-Bear spread rebounded to its second most bullish reading of the year. Bulls were up 12.3 point to 44.3%, Bears down 11.9 points to 30.8%, while Neutrals were down 0.4 points to 24.9%. To compare to historical averages of Bulls 37.5% / Bears 31% / Neutral 31.5%.

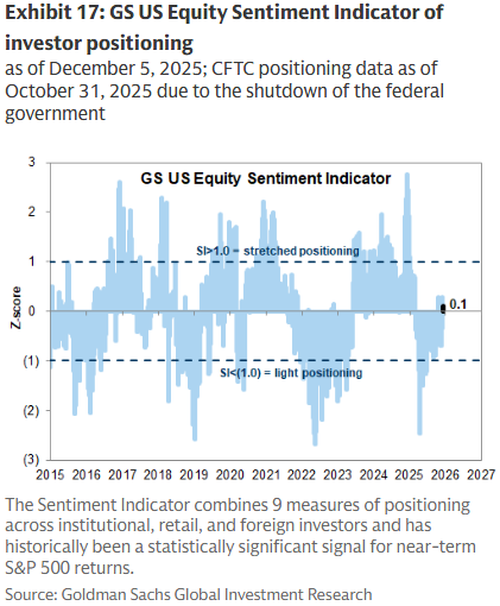

GS Sentiment Indicator: Neutral (i.e. consolidating above the surface line, after spending the past few months in negative territory). The latest reading of the Goldman Sentiment Indicator, which measures US equity investor positioning, edged lower, to +0.1, vs +0.3 prior.

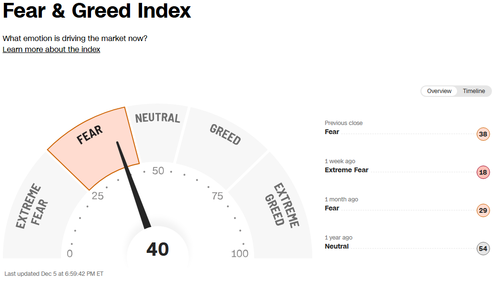

CNN Fear & Greed Index: Up to ‘Fear’. Latest reading at 40/100, vs 18/100 a week ago – highest level since the very end of October (The Fear & Greed Index is a compilation of seven different indicators that measure some aspect of stock market behaviour. They are market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand.).

More in the full Positioning note from Goldman available to pro subs.