Consumer Strain Moves Beyond Low-Income Into Heart Of Middle Class

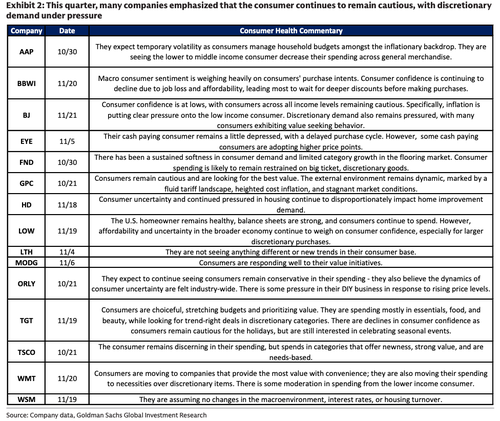

Goldman Sachs Managing Director Kate McShane provided clients with a summary of key takeaways from her meetings with the investor-relations and management teams of Bath & Body Works, BJ's Wholesale Club, The Home Depot, Lowe's, Target, Walmart, and Williams-Sonoma.

McShane noted that nearly every retailer warned of weak consumer demand, especially among squeezed lower-income households.

Low to middle-income consumers remain fragile, value-driven, and cautious ahead of the holiday shopping season that begins Friday.

One commentary that stood out the most came from Advance Auto Parts.

She noted, "They're seeing lower- to middle-income consumers decrease their spending across general merchandise."

Here's the breakdown:

McShane's note reinforces our earlier consumer notes, showing a clear tale of two worlds: one where wealthy households remain healthy, while working-class consumers bear the brunt of financial strain.

-

Early Warning Indicator Signals Sharp Sentiment Deterioration Among Low-Income Consumers, Gen Z

-

"Worst Consumer Sentiment In Decades": Goldman Goes Defcon 1 On Imploding US Consumer

The Trump administration has moved quickly to counter the downturn facing lower-income households, rolling out Operation Affordability in recent weeks.

ZeroHedge Pro subscribers can read the full note in the usual place, which includes much more commentary on consumer health.