Crypto Crashes Up As Stocks, Bonds, & The Dollar Chop

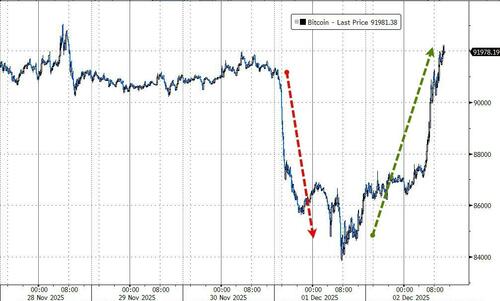

What went down yesterday, prompting doom-mongering and FUD across the mainstream media's discussion about the cryptocurrency world, exploded higher today, erasing all of the losses and then some in an almost perfect mirror (and yet no mainstream media gushing over the rebirth and renaissance as bitcoin spiked by the most since the Liberation Day pause in April). Bitcoin tested back up towards $92,000 intraday...

Source: Bloomberg

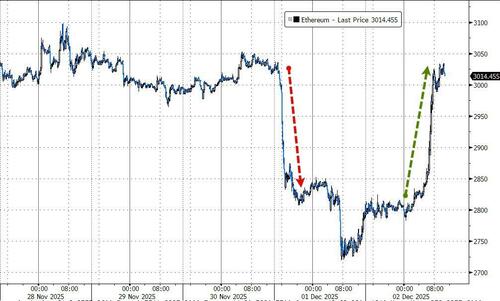

Ethereum also soared, back above $3,000...

Source: Bloomberg

No obvious catalyst though Bloomberg's Eric Balchunas suggested it was THE VANGUARD EFFECT:

"Bitcoin jumps 6% right around US open on first day after bitcoin ETF ban lifted. Coincidence? I think not. Also $1b in IBIT volume in first 30min of trading. I knew those Vanguardians had a little degen in them, even some of the most conservative investors like to add a little hot sauce to their portfolio."

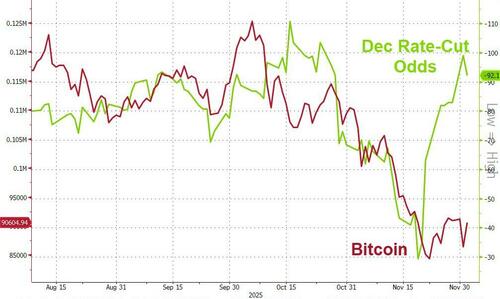

We suspect someone took a look at this chart and realized trying to assassinate Saylor's Strategy was akin to 'Fighting The Fed'...

Source: Bloomberg

And, as a reminder, it's not the first big drawdown bitcoin has suffered...

Source: Bloomberg

Equity markets were far more choppy than the one-way street higher in crypto-land with early gains erased around 11ET after this headline: "Trump Says He'll Probably Announce Fed Chair 'Early Next Year'". Buyers returned but every wave of upward pressure was weaker than the last. Nasdaq outperformed (on its own), while the rest of the majors languished. With an hour to go in the day, Trump seemed to make a slip by suggesting that the "POTENTIAL FED CHAIR IS HERE TOO" at The White House, after noting that "WE HAVE FED CHAIR CANDIDATES DOWN TO ONE"?! Stocks lifted on that... The last few minutes saw selling pressure resume, taking Small Caps into the red...

But, the mid-morning roll off of from intraday highs felt mostly driven by NVDA, with top Goldman trader Brian Garrett pointing to this: NVDA is 3% off the highs, MASSIVE call volume went thru this morning. AMZN chip launch is just another reminder there are many are looking to get a piece of the NVDA moat...

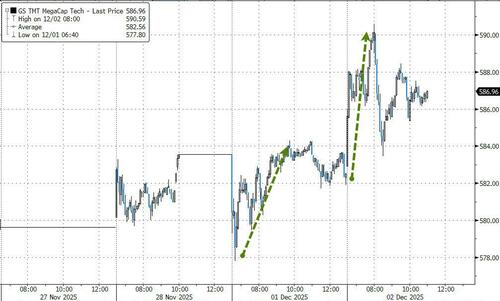

Crypto stability (strength) did support big tech overall...

Source: Bloomberg

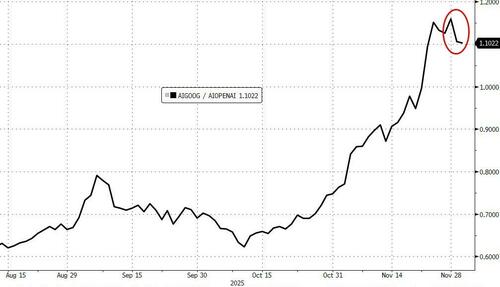

While the divergence between Google and OpenAI's AI ecosystems has grown rapidly...

Source: Bloomberg

...the last couple of days have seen some modest reversion (amid Altman's 'Code Red' warning) with Team OpenAI outperforming Team Gemini...

Source: Bloomberg

But, we note that while some names really outperformed, Goldman's Bitcoin-Sensitive basket only managed modest gains (retracing losses from yesterday before fading again)...

Source: Bloomberg

Retail Favorites were also bid, ripping back against yesterday's losses...

Source: Bloomberg

Momentum names made a big comeback early on (almost entirely erasing yesterday's big puke), but faded as the euphoria wore off...

Source: Bloomberg

Notably 'Alts' have recovered from late-November's ugliness, but remain in a downtrend...

Source: Bloomberg

ORCL CDS continued to inch wider today as ORCL stock remains unable to recover its 200DMA

Source: Bloomberg

Overall tech credit spreads continue to trade wide to the overall IG credit market...

Source: Bloomberg

Treasury yields were lower overall today with the short-end outperforming (2Y USTs rallying this afternoon although the move was very modest, -2bps)...

Source: Bloomberg

Which prompted further bull steepening in the curve...

Source: Bloomberg

Rate-cut odds remain a lock for next week (dipping very minimally today after the Fed head comment), but we also note that January odds are rising...

Source: Bloomberg

“Nothing is going to change our view that the Fed eases next week, but it is looking more like a hawkish cut,” said Andrew Brenner at NatAlliance Securities.

“We can see at least three dissents next week.”

Arguably, given the less than dovish expectations for January and March FOMC meetings, perhaps this rebound in stocks has running on fumes (especially if Powell offers a hawkish cut)...

Source: Bloomberg

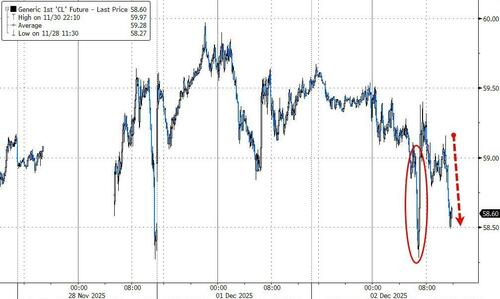

Oil prices were also choppy today, ending near the lows, after dumping-and-pumping early on around Putin's comments (after OPEC+'s decision)...

Source: Bloomberg

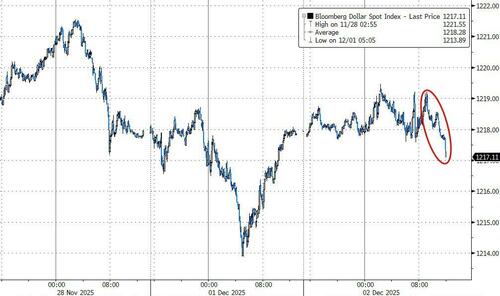

The dollar dipped late on (on the Hassett comments) after treading water all day...

Source: Bloomberg

Despite the modest dollar weakness, gold also lost ground today, losing $4200 in a choppy session...

Source: Bloomberg

Silver managed to extend gains though, back above $58 after early selling pressure...

Source: Bloomberg

Bitcoin's bounce hit at a key support level for the BTC/Gold ratio...

Source: Bloomberg

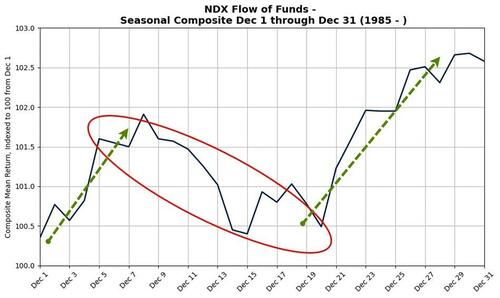

Finally, talk of year-end seasonals have been flying off the shelf, and while supportive, the chart is not straight up and to the right...

As Goldman's Gail Hafif notes, the first half of December is historically choppier for the S&P and Nasdaq. While the mean NDX return for December is 2.58%, it's not time to pack up the skis and bathing suits just yet. The 2nd half of December is remarkably positive for the two indices - we just have to get through the final stretch.

On Wednesday, look for a fresh ISM services Index, an old (September) industrial production release, and the ADP employment report for November.