Crypto & Silver Soar As Rate-Cut Odds Dip After Mixed Data

With less than 24 hours until The Fed's big decision, we got a slew of mixed data (macro and micro) today pointing in different directions on the consumer, the labor market, and monetary policy.

ADP's weekly employment showed a positive signal for the labor market. After 4 weeks of losing jobs, it reported an average gain over the last month.

JOLTs was mixed with the number of quits plunging to 5 years low (good-ish), as hiring slide accelerates (bad), and layoffs in the U.S. rose to 1.85 million in October, the most since January 2023 (ugly).

All of which only deepens the Rorschach test already created by other labor market readings, leaving a market void of a clear picture.

So choose your own adventure in this "low hire, low fire... low quitting" economy.

Hassett chimed in and was notably more dovish than his comments yesterday:

-

*HASSETT: RATE CALLS WOULD BE MY JUDGMENT, WHICH TRUMP TRUSTS

-

*HASSETT: I WAS RIGHT TO QUESTION THOSE SAYING NO NEED TO CUT

-

*HASSETT: ASKED IF ROOM FOR MORE THAN 25 BPS: "THAT'S CORRECT"

-

*HASSETT REPEATS THAT LOT OF FED BEHAVIOR HAS LOOKED POLITICAL

And then, JPMorgan's Marianne Lake said that the "CONSUMER ENVIRONMENT LOOKS 'BIT MORE FRAGILE'" confirming fears of the K-Shaped economy broadening out.

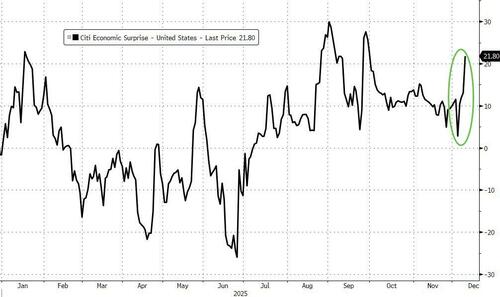

But at the end of the day, the macro data - on net - surprised to the upside...

Source: Bloomberg

The result of all that was a modest hawkish shift in rate-cut expectations (but tomorrow remains almost certainty)...

Source: Bloomberg

All told, the near-term tone for bonds remains bearish.

The yield on the 10-year broke above its 100-day moving average on Monday and pushed toward the top of the three-month range - yet the setup into the December FOMC still indicates yields are capped on signs the labor market is rolling over rather than reheating.

Source: Bloomberg

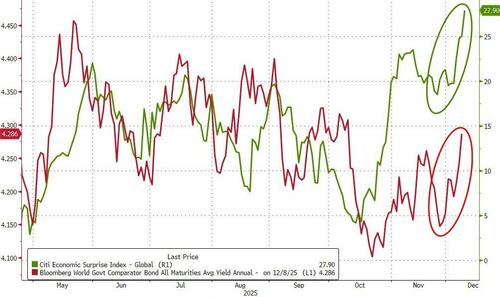

The US rates curve is caught between that uncertainty over domestic data and a global repricing that is pushing yields higher almost everywhere.

As Bloomberg's Michael Ball notes, the more interesting story, however, is that other central banks are looking done with rate cuts.

The assumption now is that the ECB, RBA, Riksbank, RBNZ, BoC and maybe SNB have finished their easing cycles. The Fed, BoE and Norges Bank are the only G10 central banks still expected to be cutting interest rates in 2026. As a result, global term premiums should rebuild on stronger nominal growth and heavy supply in places like Europe and Japan.

The result is a messy divergence. Global bear steepening should keep pressure on Treasuries at the margin. But US-specific growth and inflation risk, supply appetite, plus the politics around the independence of the Fed, will decide whether long-end yields break sustainably out of their recent range.

Global bond yields are tracking global economic data surprises higher...

Source: Bloomberg

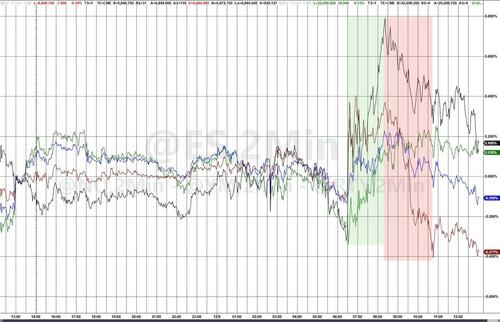

USTreasury yields were higher across the curve with the short-end underperforming (2Y +4bps, 30Y +1bp). As the chart below shows, yields were very choppy today...

Source: Bloomberg

Early gains in equity-land were erased as yields spiked again with The Dow the day's biggest loser. Small Caps managed to outperform most of the day once again but late-day selling pressure (as we also saw yesterday) pushed the S&P ended red (along with The Dow) and Nasdaq warbled around unchanged...

NVDA gave up its after-hours gains as China seemed dismissive over its demand for H200 chips...

Small Caps were once again supported by a significant short-squeeze - which again faded as the day wore on...

Source: Bloomberg

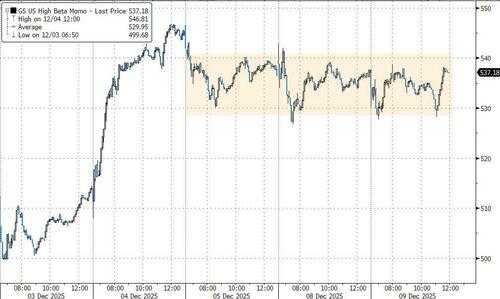

Momentum once again went nowhere - we suspect tomorrow will be 'different'...

Source: Bloomberg

Extending yesterday's pain, today's stronger dollar pushed crude oil prices lower (WTI back below $59, breaking below its 50DMA and to the bottom of its downward trend channel)...

Source: Bloomberg

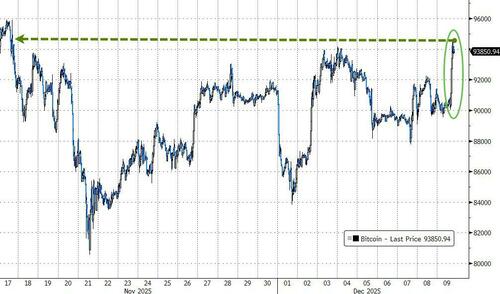

Bitcoin rallied strongly, bouncing off $90,000, back up near $4-week highs...

Source: Bloomberg

Ethereum soared over 7%, back up near $3400 and firmly rejecting $3000...

Source: Bloomberg

Ethereum closed above its 50DMA for the first time since October...

Source: Bloomberg

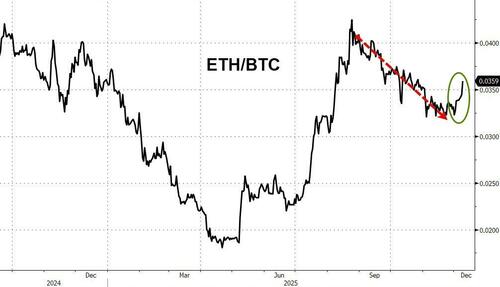

ETH has been outperfoming BTC for the last week

Source: Bloomberg

Nomura's Charlie McElligott notes that Kevin Hassett is of course viewed as POTUS “Rubber Stamp” on pro-growth ”Run-It-Hot” (yet still advocating “Weak Dollar”)–policy, alongside OBBB fiscal stim coming online and a recent broadening-out of Corp Earnings and Rev growth “Upside Surprises” versus estimates… where said aggregated tailwinds and “loose FCI” then of course risks embedding “Sticky Higher” inflation risks (Gold - not Bonds / Duration - as your Equities hedge when inflation > 3.50)... hence, removing that previously “deeper” Fed cuts path.

Gold gained on the day but remains in a range around $4200...

Source: Bloomberg

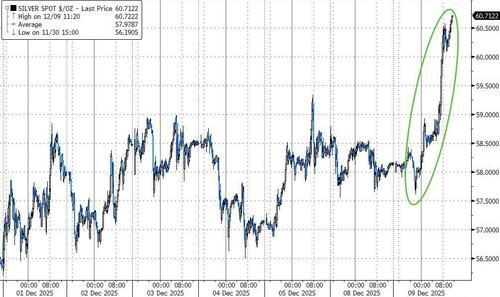

But, it was Silver that really ripped, surging above $60 - a new record high...

Source: Bloomberg

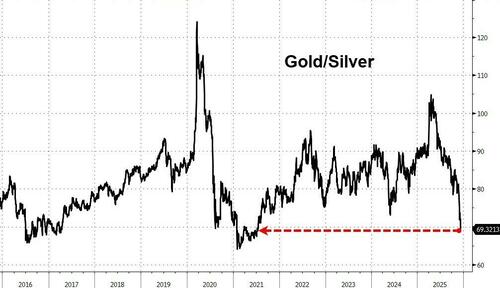

Silver's recent run has massively outperformed gold, dragging the Gold/Silver ratio down to below 70x for the first time since July 2021...

Source: Bloomberg

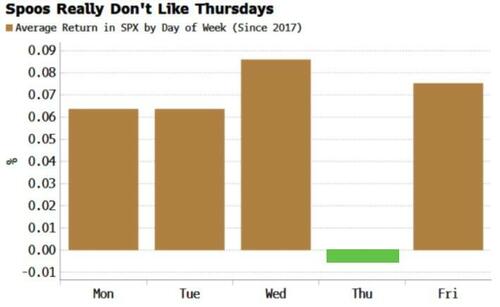

Finally, forget Mondays, it's Thursdays that you shouldn't like. Since 2017, it’s the only day that the S&P 500 is on average down.

Source: Bloomberg

In general, As Bloomberg's Simon White notes, Thursdays are a risk-off day. Bitcoin also has its worst - and only negative - day on average on that day, while gold and the yen post their best returns on Thursdays. Treasuries throw up even more interesting results, with Mondays seeing selloffs and Wednesdays rallies.

Of course, it's Wednesday this week that matters for most...

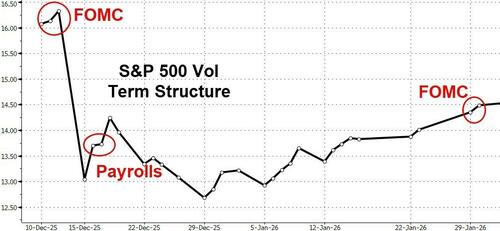

...as questions linger about whether Powell pours cold (hawkish) water on a rate-cut?

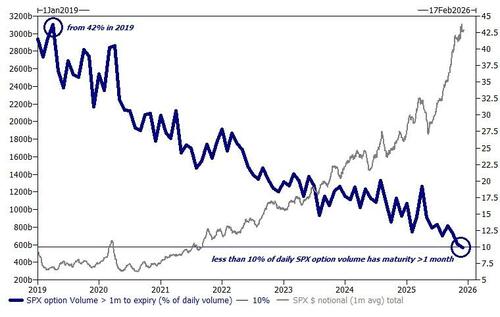

There are currently 250 expiry dates for SPX, with investors now having the ability to “trade and hedge with the precision of a hand surgeon” ... this creates opportunity

When top Goldman Sachs trader, Brian Garrett, started, the shortest tenor option one could trade was monthly … 12 expiries a year, nice orderly market

Since that day in summer 2007 … the number of option expiries has gone parabolic... Wednesday pm expiries came first, then Mondays, and then dailies (am and pm), with many contending its the retail footprint.

For the first time in history – the amount of real “vega” options (ie, those with a maturity of > 1 month) make up less than 10% of the avg daily volume – for those looking to trade in pockets of the market that are “not crowded,” longer dated convexity is an open lane ...

Goldman's trading desk contends that “despite the bid to longer dated vol over the last few weeks, implied correlation remains close to all-time lows (2y tenor) ... the lack of interest in vega for late cycle hedges is misplaced and like buying vol in the longer dated maturities.”