December CPI Preview: Snapback From Govt Shutdown Distortions

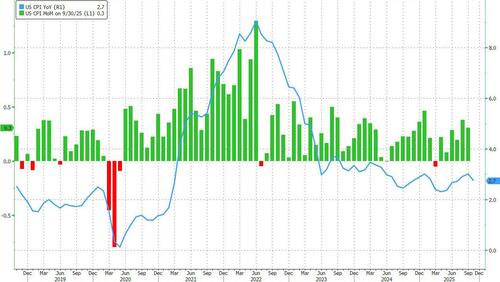

Economists expect Tuesday's US CPI to snap back in December after Novemberʼs unusually soft reading which was curbed by the government shutdown, with headline CPI seen rising 0.3% M/M, same as core CPI 0.3% M/M. Annual rates are expected to hold at 2.7% Y/Y for both headline and core, remaining below September levels and signalling a continued disinflationary trend.

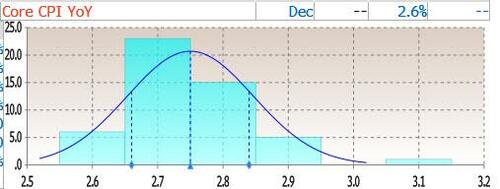

Core CPI expectations have a right-tail distribution, with most analysts expecting a 2.6% and 2.7% number, although a number see annual inflation spiking as high as 2.9%-3.1%.

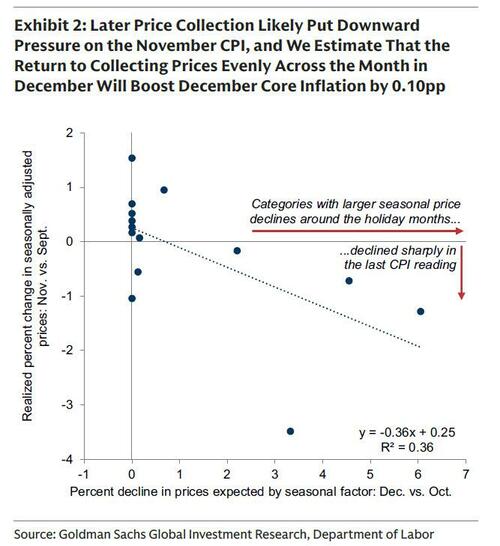

The December pickup largely reflects the unwinding of distortions from data-collection disruptions during the government shutdown, which amplified seasonal discounting in November. Goods prices are expected to rebound more sharply than services on holiday discount payback, while tariff pass-through appears to be moderating. Services inflation should also firm, notably in travel-related categories, while shelter inflation is seen following its pre-shutdown trend. Statistical quirks persist, particularly in housing, where CPI sampling rotations mean shutdown-related softness in shelter inflation may linger until April. Health and motor vehicle insurance prices are also expected to restrain CPI in the coming months.

Goldman's forecast (0.35% core/0.37% headline MoM; 2.78% YoY core/2.74% headline) reflects a 0.17% boost from two channels related to missed or delayed data collection as a result of the government shutdown.

- First, GS expects an unwinding of the negative impact of delayed data collection on the price level in categories that typically experience steep discounting in late November (such as apparel: GS forecast +1.6%; airfares: +5%; and hotels: +3%) worth +0.10pp.

- Second, the bank expects an unwinding of the negative impact of missed data collection in October from metros where prices are only collected every other month and were due to be collected in October (impacting most categories outside of housing and autos) worth +0.07pp.

- There was a third distortion in the prior report that led shelter inflation to be understated across October and November, but Goldman does not expect an unwind of that negative bias until the April report. Until then, year-over-year core CPI inflation will be understated by about 0.1pp.

Goldman also highlights four key component-level trends that it expects to see in this week’s report:

- 1. Shelter. the bank expects a rebound in shelter inflation to slightly below the average monthly pace of Q3 (GS forecast for OER: +0.25%, primary rents: +0.24%), after a methodological feature to assume no inflation in October—when data could not be collected—led shelter inflation to be understated across October and November in the prior report. Goldman does not expect an unwind until April 2026, when the units that were supposed to be surveyed in October are sampled again, and therefore estimate that the core CPI will be understated by 0.1% until then.

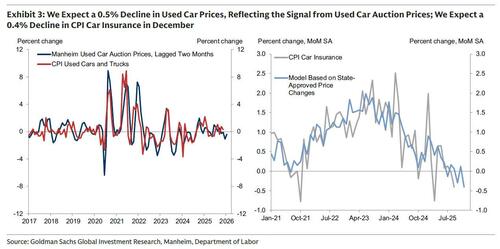

- 2. Autos. The bank expects a 0.5% decline in used car prices in December, reflecting the signal from used car auction prices, a slight increase in new car prices (+0.1%), and a decline in the car insurance category (-0.4%), reflecting a decrease in premiums indicated by the online dataset.

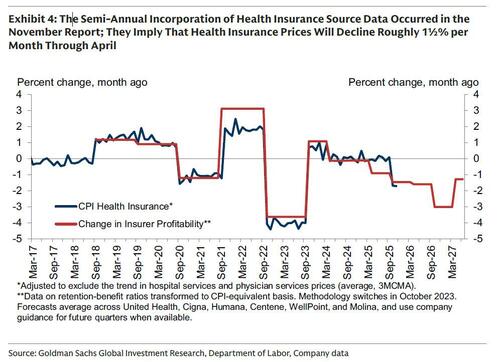

- 3. Healthcare services. Goldman expects a modest 0.1% increase in medical services prices, reflecting a continued decline in medical insurance prices (-1.4%) following the semiannual source data update in last month’s report and downward pressure from potential seasonal distortions in other medical care services categories.

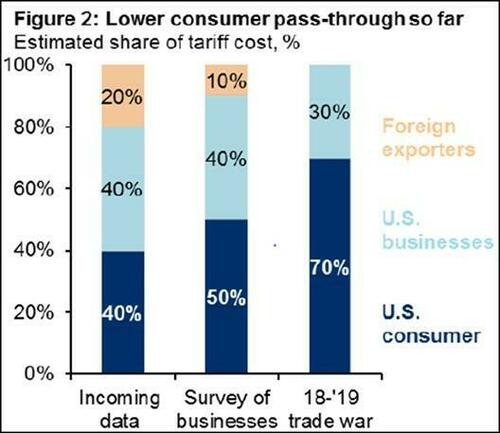

- 4. Tariffs. Goldman expects upward pressure from tariffs on categories that are particularly exposed, worth +0.07pp on core inflation in December. We see scope for boosts from tariffs on household furnishings (GS forecast: +0.5%), recreation (+0.8%), and communication (flat) prices.

Among other inflation gauges, the New York Fedʼs monthly survey of consumer expectations rose in December, with consumers expecting 3.4% price growth over the next year, up from 3.2% in November, while longer-term expectations were steady. In December, ISM data, manufacturing prices remained in expansion, matching November, while the services prices index fell to its lowest since March 2025, though it has still exceeded 60 for 13 straight months.

Looking ahead, most banks see inflation continuing to ease, supporting a patient Fed stance. Goldman expects a modest boost to the January reading from outsized start of the year price increases (i.e., the “January effect”) and forecast monthly core CPI of 0.3%. Over the rest of this year, Goldman expects underlying trend inflation to fall further, reflecting shrinking contributions from the housing rental and labor markets, and the impact of tariffs on monthly inflation to moderate. Goldman forecasts year-over-year core CPI of +2.0% and core PCE inflation of +2.1% in December 2026.

A slightly less sanguine view comes from JPM chief economist Michael Feroli who expects "a significant increase in the December consumer price index as prices that were effectively held fixed for October following the federal government shutdown are reset." Below we excerpt from the report:

We forecast that these adjustments should have led to a 0.38% rise in headline CPI last month, and a 0.41% rise in the core (ex. food and energy) CPI. Even though seasonally adjusted gasoline prices likely fell 0.6% on the month to reflect a slide in the average price at the pump throughout December, we look for increases in both electricity and gas service prices to have pushed up the December energy CPI on net. Food CPI also should have risen modestly last month. If our forecast is realized, headline CPI should have remained at 2.7% over-year-ago while core CPI inflation should have firmed modestly to 2.8%oya in December.

Vehicle prices were among the few that were collected in October despite the shutdown, as they rely on non-survey-based price collection. The industry prices that we track to forecast new vehicle prices suggest a firm 0.6% rise in December. By contrast, prior declines in wholesale prices for used cars and trucks should imply a 1.0% decline (seasonally adjusted) in December. Most other prices are likely to be impacted by the cessation of data collection during October and earlier November, as a sizable portion of prices are collected on a bimonthly basis – which means some prices have effectively not been updated to reflect true individual level price changes since August. This effect will boost prices for both goods and services – for example, for medical care.In addition, the fact that data collection resumed later in the month of November likely meant that seasonal holiday sales were oversampled relative to past years. This distortion likely biased lower prices for a number of goods that typically see holiday sales, including apparel, home furnishings, and consumer electronics. We expect a material further bounce back in the December prices across these various categories.

Shelter prices behave slightly differently as a result of the shutdown, owing to the fact that they are collected once every six months in a rotating panel. As October prices were treated as unchanged by the BLS, that means the change from cumulative two-month change from September to November more accurately reflects the monthly change for November, and computing the growth rates from interpolated index data should produce a November figure that is roughly half as large as it should be. The impact of skipping the October data collection should continue to bias down the index levels for both owners’ equivalent rent and tenants’ rent until the panel that was supposed to be updated in October gets refreshed next April. We look for the December OER and rent price indexes to more accurately reflect the underlying trend of growth, which is likely to be roughly twice as large as November. In fact, while we presume that the gradual cooling trend continues, they appear overdue to show monthly growth rates similar to what had been seen in late summer, after running below that trend in recent months.

JPMorgan's Market Intel team writes that while this may not be a ‘clean’ CPI print print for reasons that Feroli mentioned, the setup is one where markets are bulled up, but the data suggest that a hawkish print is more likely than a dovish print; but, the market outcomes are skewed bullishly. That is why the probability distribution is not symmetrical and neither are the SPX outcomes, e.g., since Oct 1, 2025 the SPX has had 5x up-one-percent moves and 7x down-one-percent moves. Commentary from businesses surveyed in ISM / PMIs over the last few months point to still increasing input prices but a desire, prior to December, to maintain selling prices static due to concerns around the health of the consumers and the economy, thus a desire to maintain market share, something we have said would be the case all along.

Given the recent GDP data, it appears that more companies are seeking to pass costs along to their customer base. This summer, our colleagues in JPM Private Bank estimated that tariff pass-through was ~45% vs. 70% pass-through under Trump 1.0.

Another inflation peak represents one of the higher probability risks for Equities in 26H1. While this print cannot confirm that hypothesis, it can, in combination with Friday’s NFP, push Fed cut expectations farther out into the future. Feroli sees the Fed as taking no action in FY26.

Market Reaction

According to JPM's Market Intel team, this is the market reaction matrix, and probability:

- Core MoM prints above 0.45%. SPX loses 1.25% - 2.5%: Probability 5.0%

- Core MoM prints between 0.40% - 0.45%. SPX gains 0.25% to loses 75bps: Probability 32.5%

- Core MoM prints between 0.35% - 0.40%. SPX gains 0.25% to 0.75%: Probability 40.0%

- Core MoM prints between 0.30% - 0.35%. SPX gains 1% - 1.5%: Probability 20.0%

- Core MoM prints below 0.30%. SPX gains 1.25% - 1.75%: Probability 2.5%

Finally, options that expire on Tuesday are pricing a 0.6% move based on Friday’s (Jan 9) closing prices.

More available to pro subscribers in the usual place.