Dismal Data, Choppy Chipmakers, & A Fed Dove Send Bonds, Stocks, & Gold Higher

Disappointing data (all the macro you can eat is dovish), divergences in the AI leaders (TPUs >> GPUs?), and a (capital-D) Dove for Fed Chair sent rates lower, rate-cut odds higher, and stocks, gold, and crypto higher.

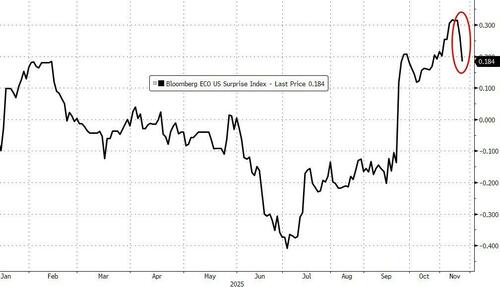

Dismal Data: US Macro was weak today as the shutdown release valve is opened. As Goldman's Chris Hussey notes, after weeks of very little data, markets are having to digest a bunch of 'catch-up' releases as the federal government agencies re-open and report on the economy again. The data we are getting today, however, is particularly dated. Two months into the 4Q, we are getting data today from the last month of the 3Q (the summer quarter) -- making it not particularly relevant for understanding how things are going today or, more importantly, how things might go tomorrow and into next year. Nevertheless, markets consume what they get...

Source: Bloomberg

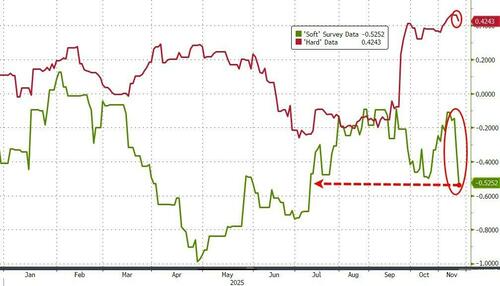

ADP weekly employment report was ugly (dovish), Retail sales disappointed (dovish), Core PPI cool (not hawkish), Home prices and sales slow (dovish), Richmond fed ugly (dovish), and consumer confidence really ugly (dovish); with soft data plunging to its weakest since July...

Source: Bloomberg

Goldman's economists lowered their 3Q25 GDP growth tracking estimate by 10bp to +3.7%, and bond markets reacted by pushing down yields on 10-year Treasuries. Slower growth indicators are clearly meeting increasing Fed funds rate-cut expectations which is helping to support risk assets here.

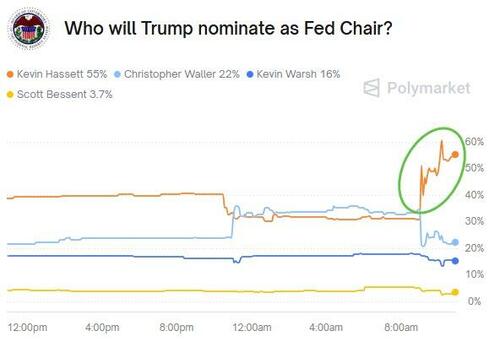

A Dove: The immediate market reaction to reports that Kevin Hassett is the frontrunner to become the next Fed Chair, sending his odds of being picked (via Polymarket) up to 55%...

...and prompted the front-end of the Treasury curve to outperform, re-steepening the 2s10s, and 5s30s spreads, and a rise in rate-cut odds...

Source: Bloomberg

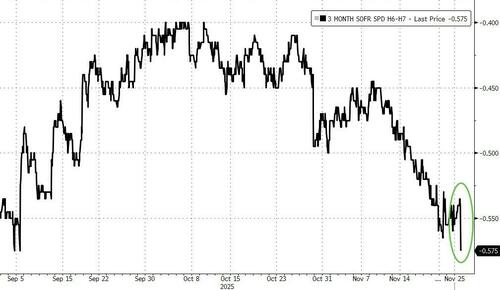

Additionally, spread sellers in SOFR have also emerged, with notable interest in the March 2026/March 2027 12-month spread, covering the year after Fed Chair Powell’s term ends...

Source: Bloomberg

And that also dragged down yields, led by the short-end...

Source: Bloomberg

... with 10Y yields back below 4.00% for the first time since Powel's hawkish comments in October...

Source: Bloomberg

Choppy Chipmakers: Nvidia and AMD drove the AI Semis basket lower {UBXXSEMA}, down 4.1%, amidst concerns of increased competitive pressures on GPU makers from the emerging success of ASICs, particularly Google's TPU...

Source: Bloomberg

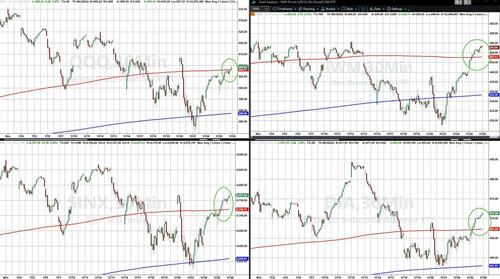

And while that weighed on Nasdaq overall (the laggard on the day), the rest of the US majors soared after an initial bot of selling at the cash open (led by Small Caps)...

All the US Majors broke back and closed above their 50DMAs...

Mag7 names underperformed on the day with the basket ending around unch while the S&P 493 rose strongly...

Source: Bloomberg

The rotation into healthcare from AI/Tech continues to gather pace...

Source: Bloomberg

Small Caps outperformed thanks to an ongoing squeeze in 'most shorted' stocks...

Source: Bloomberg

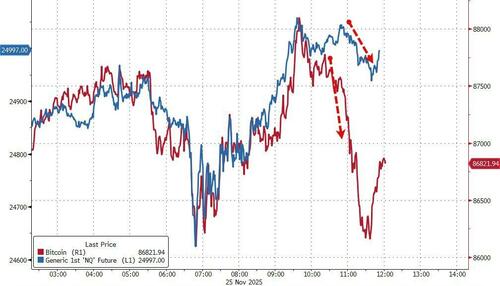

Bitcoin - once again as the fulcrum leverage vehicle - led the charge back lower in stocks in the afternoon...

Source: Bloomberg

The dollar dumped back to mid-last week's lows as rate-cut odds surged...

Source: Bloomberg

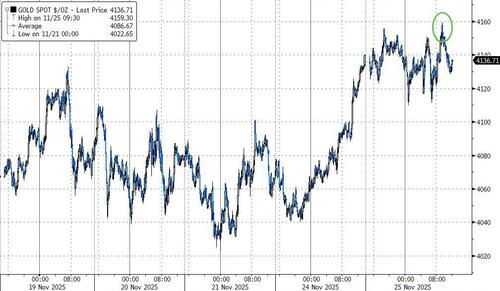

Despite the dollar's demise, Gold traded up to $4160 before falling back to unch...

Source: Bloomberg

Although the relationship between the buck and the barbarous relic has broken down recently to say the least...

Source: Bloomberg

Arguably, gold is well supported from a liquidity perspective...

Source: Bloomberg

But bitcoin for now has decoupled from global liquidity...

Source: Bloomberg

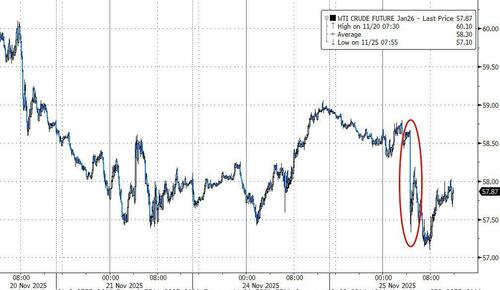

Oil prices plunged as headlines hit suggesting a Russia-Ukraine peace deal was imminent (we won't be holding our breadth)...

Source: Bloomberg

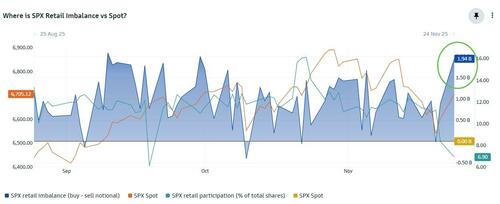

Finally, if you're looking for someone to blame for why the highest momentum names (and assets - bitcoin) has suddenly hit a soft patch, it's simple - all roads end at The Fed. As Goldman's Tony Pasquariello noted earlier, retail enthusiasm for stocks also peaked the exact week of Powell's hawkish narrative flip at The FOMC press conference...

Source: Goldman Sachs

It was The Fed that principally dented household risk appetite (from admittedly feverish levels). In the weeks that followed, as the market chopped lower, we saw a steady pattern of risk transfer from professional investors that gradually picked up speed (that supply reached a local apex last Thursday).

However, now that the doves have the upper hand at The Fed, guess who's back in buying!!??

Source: Goldman Sachs

Can the retail renaissance ignite momentum enough to un-rotate the AI-to-HCare flows from the pros? Tick tock, it's time for seasonals to come into play.