Do The Fundamentals Matter? Top Citadel Macro Mind Says 'Stay Short The US Dollar'

Authored by Nohshad Shah via Citadel Securities,

THIS WEEK’S LABOUR MARKET DATA CONFIRMED THAT THE JOB MARKET HAS BEEN COOLING…

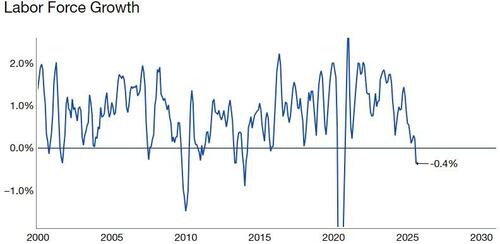

With Nonfarm Payrolls at 22k and further revisions to prior months’ data now totalling a whopping -285k. The all-important unemployment rate also rose to 4.3%, the highest since 2021. I don’t think this is enough to warrant a 50bp cut later this month…but it does increase the probability of the Fed delivering some insurance rate cuts. It’s worth remembering that with a 3m NFP avg. of 29k, one would’ve expected a sharper rise in the u/e rate, which confirms in my view that the breakeven level of payroll growth is somewhere around 50k (though this is a moving target). As a reminder, this is due to significant changes to immigration policies under President Trump’s Administration, which are estimated to bring net migration down from an average of +1.3mio/year in 2022-2024 to +115k/-525k. The broader implications of this are interesting…growth of the labour force has slowed to below 0% YoY (chart below).

If we hold productivity constant (at long-term estimates of 1%), we can create a back-of-the-envelope real-time estimate of potential GDP for the US economy…which has fallen from ~2.5% to 0.6% in the last year (chart below).

Source: Haver

This makes sense…a large supply-side shock of this magnitude will almost certainly reduce trend GDP, other things being equal (which we’ll come onto).

AT THE SAME TIME, THE FORWARD OUTLOOK FOR GROWTH CONTINUES TO IMPROVE…

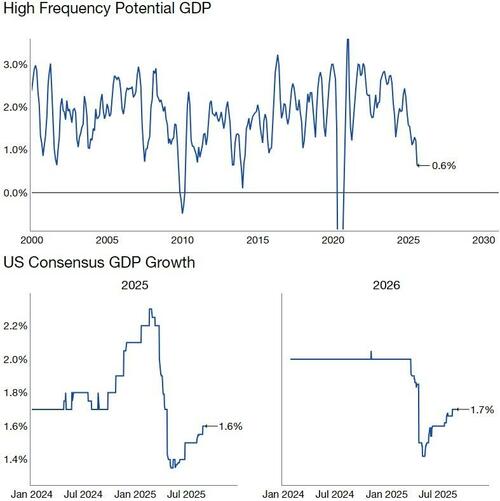

Consensus estimates of 2026 GDP growth are being revised up (~1.7%) and I expect this to continue given the current backdrop of easy FCI, positive PMIs, strong signals in New Orders from the regional surveys and ISM, as well as beige book sentiment…plus incoming fiscal stimulus…and an FOMC which is about to cut rates. Indeed, when looking in aggregate using the Bloomberg Growth Surprise Index (67 economic data releases), we can see a clear uptrend since the lows of late Jun/early July (chart below).

Bloomberg Economics Growth Data Surprise

And this is precisely the point…whilst the spot payroll data points to a weak labour market over the summer, one must remember that this remains a lagging indicator for the health of the US economy. NFP is important in so much as it implies a gathering pace of layoffs, leading to broad-based unemployment, with substantial second round effects for consumption and therefore economic growth. I just don’t think we’re there yet…instead the balance of risks in my view is that the conditions outlined above mean that realised economic growth exceeds trend growth in 2026.

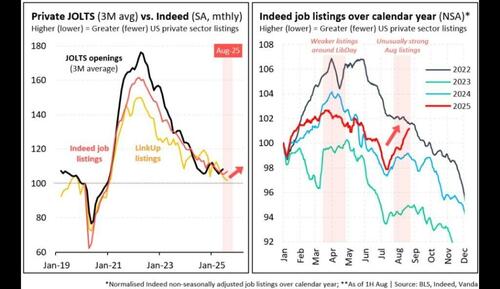

Even in the near-term, looking at high-frequency data like Indeed Job listings, we observe a strong uptick in August (see below)…and seasonality for payrolls for the month of August suggest revisions could be as much as +70k. Time will tell.

IF REALISED GROWTH EXCEEDS TREND IN 2026, THE IMPLICATIONS ARE CLEAR – INFLATION.

Injecting both fiscal and monetary policy stimulus into an economy that is broadly healthy carries significant inflation risks. That’s without considering the uncertainty around the full passthrough from tariffs…whilst the actual average tariff rate is hovering around 11% for the last couple of months, this is meaningfully lower than the ~18% statutory tariff rates. According to Yale’s budget lab, this gap is due to several potential factors – timing of short-run purchases to minimize impact; policy changes rarely applying to goods already in transit with shipping taking a few months and importers delaying payments for up to six weeks; the lag to remit tariff revenues to Treasury from Customs & Border Protection; and broader tariff avoidance and evasion. One would expect this gap to narrow over time with the actual average rate converging towards the statutory rate. The implications are starting to play out in Durable Goods, where prices have broken with their prior behaviour rising 1.7% over the course of 1H25 versus -0.6% in 1H24 (details here). And we know from the last CPI report that Core Services inflation is creeping back up at 0.4% MoM.

Next week we learn more, but goods prices that are yet to fully reflect tariff passthrough plus services that are inflecting upwards is a concerning backdrop.

DO THE FUNDAMENTALS MATTER?

This is an important question given political pressure on the central bank’s independence. Treasury Secretary Bessent’s Op Ed in the WSJ was direct: “The Fed’s growing footprint has profound implications for independence. By extending its remit into areas traditionally reserved for fiscal authorities, the Fed has blurred the lines between monetary and fiscal policy”. He also cited “regulatory overreach” in what was a strongly worded accusation of failure of Fed policy over recent decades. These statements reflect real intent on the part of this Administration to exert greater control of the Federal Reserve and its mandates. Why is exerting control over monetary policy so important for President Trump? Beyond the desire to control all policy levers (unitary executive theory), one must assume that Secretary Bessent and the broader economic team have a vision mind.

My sense is that this is one where both monetary and fiscal policy are used to stimulate growth in demand, whilst supply side expansion is generated from a mix of tax incentives, deregulation and boosting energy infrastructure. In addition, policies designed to ensure that America wins the AI race lead ultimately to substantial productivity gains thereby boosting trend growth, dampening the inflationary impact for the economy.

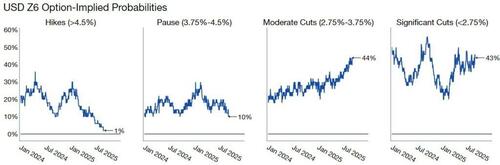

Whilst I don’t necessarily disagree, my timeline would suggest that the upgrade to growth (driven by the capex investment boom) comes meaningfully earlier than productivity gains, implying an economy and inflation that runs hot for some time. For now, the combination of weaker labour market data and persistent pressure on the Fed to ease monetary policy has meant that end 2026 (SFRZ6 contract) rates are priced for a return of policy rates to sub 3%, with implied probabilities reflecting a 43% chance of going below 2.75%, what most would consider neutral (see below).

I don’t see that changing soon, given current pressures, regardless of the economic landscape. So…if I’m right about the forward outlook for growth…yet we still get the expected stimulus from both rate cuts and fiscal policy, then the asset market implications remain the same: focus on real assets that benefit from financial repression…equities (with the right exposure)…precious metals…real yields…digital assets and real estate.

Stay short the US dollar…

This has become the only escape valve whilst 10y Treasury yields remain range-bound (though they look rich to me at sub 4.10%).

Excess savings and liquidity in the global financial system buoyed by policy easing (either monetary, fiscal or both) have conspired to drive asset prices higher for much of the last two decades.

This has been THE trade…and it continues to be for now. Fundamentals will have to wait.