'Dollar Bears Should Take Pause': Citadel Macro Guru Sees Fed On Hold For Foreseeable Future

Authored by Nohshad Shah via Citadel Securities,

Kevin Warsh - You're Hired!!

THE FED IS LIKELY NOW ON HOLD FOR THE FORESEEABLE FUTURE...

...after acknowledging the reality of stronger economic growth and a shift in the balance of risks away from its employment mandate at last week’s meeting. The FOMC statement highlighted what regular readers of this note have known for some time…“economic activity has been expanding at a solid pace” (upgraded from “moderate” in December), and “the unemployment rate has shown some signs of stabilization” having “edged up” last month. Chair Powell’s press conference reflected the tone of a committee that broadly feels the policy rate is no longer in restrictive territory, having moved much closer to most estimates of neutral (~3.25%) following 75bps of insurance cuts last year. Downside risks to employment have improved more than upside risks to inflation. This makes sense…while there remain some concerns around the labour market, consumption and business investment are strong and corporate earnings robust.

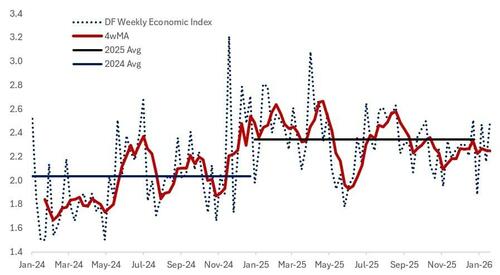

The Dallas Fed has Q4 GDP tracking at 2.49%, whilst The NY Fed’s Nowcast is at 2.74% despite the prolonged government shutdown, from which we can expect a bounce this quarter.

Source: Dallas Fed

The US economy has once again shown its resilience, rebounding strongly from last year’s tariff tantrum. With an almost unprecedented policy mix of easy financial conditions, loosening monetary policy, and incoming large fiscal stimulus from OBBA (with perhaps more to come in an election year), nominal GDP is likely to be in the 5–6% range this year.

With this backdrop, inflation risks may well move into the foreground in coming months…so I do not expect further rate cuts – certainly, from the Powell Fed – and perhaps for the entire year.

POWELL RE-ITERATED HIS FOCUS ON FED INDEPENDENCE DURING THE PRESS CONFERENCE...

...and it appears his strategy for managing pressure from the Trump Administration is working well.

The early reappointment of regional Fed presidents, the forceful and direct response to the DOJ’s subpoenas, and the immediate (and perhaps coordinated) pushback from powerful Senator Tillis – who stated he would block confirmation of new Fed Governors until the issue is resolved – suggest that the Administration’s strategy may have been counterproductive to its goal of exerting greater control over the Fed and, in turn, ushering in more dovish monetary policy. Indeed, one could argue that Kevin Warsh’s elevation as nominee for the next Fed Chair was at least partly a result of this dynamic.

Warsh is widely viewed as a more “establishment” candidate, popular with traditional Republican lawmakers, which should smooth his confirmation process.

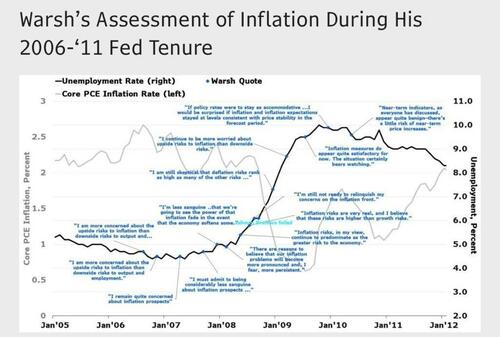

Source: Bloomberg, Anna Wong, Jan-26

WHAT DOES CHAIR WARSH MEAN FOR THE FED?

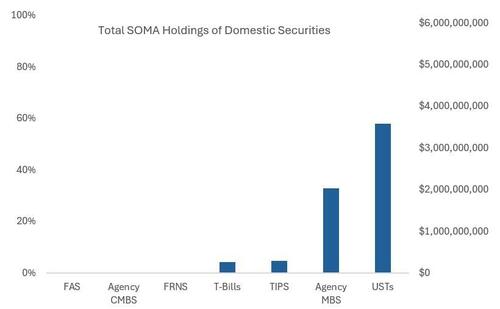

The historical track record suggests he is materially more hawkish than other contenders, consistently prioritising inflation control over employment considerations. He has also shown little tolerance for expanded monetary accommodation via unconventional tools, such as quantitative easing. Under his leadership, interest rate cuts would likely be implemented only when clearly justified by prevailing conditions, alongside continued balance sheet reduction (exactly how remains tbc). Warsh has been critical of what he views as mission creep during Powell’s tenure and favours a tighter focus on price stability rather than the broader objectives that have increasingly fallen under the Fed’s remit in recent years, echoing similar sentiments to Treasury Secretary Bessent’s critique on the Fed’s “gain-of-function”.

Whilst Warsh clearly supports Fed independence, past comments suggest an openness to closer coordination with the Treasury and the political establishment on broader economic strategy.

More recently, Warsh has been a proponent of AI-driven productivity gains and has used this argument to align himself with calls for lower rates.

But the Fed’s institutional structure means that staff, Governors, and regional Presidents would need to be aligned around a new balance-sheet or policy-rate path for it to be implemented.

Source: NY Fed

Given the President’s well-known preference for lower policy rates, Warsh is likely to face the challenge of threading the needle between his historical policy instincts and the political pressure to ease once he assumes the role later this year.

How successfully he navigates this tension remains to be seen, but for now markets may take some comfort in the sense that the Fed’s future appears less vulnerable to overt political interference than it might otherwise have been – a positive outcome for those who view central bank independence as critical to global financial stability.

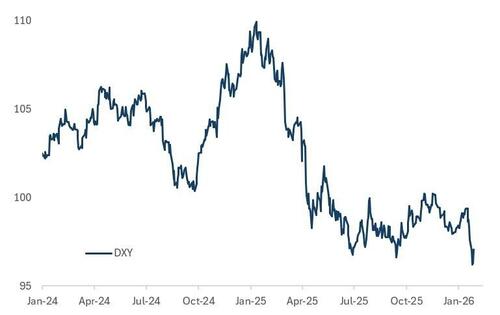

US DOLLAR WEAKNESS HAS BEEN THE DOMINANT MARKET THEME...

...driven by a confluence of related factors. The two-sided rate checks from both the Japanese Ministry of Finance and the Federal Reserve Bank of New York (acting in an agency capacity for the US Treasury) triggered a short squeeze in JPY but drove the dollar lower on a broad basis, as markets focused on the risk of a weak-dollar policy and speculation around a coordinated dollar devaluation.

In reality, it seems more likely that Secretary Bessent was simply willing to lend support to the MOF’s intervention threat to improve its effectiveness in curbing the rapid depreciation of the yen, rather than signalling a shift in US dollar policy. Nonetheless, the resulting dollar weakness was compounded by comments from President Trump – made in response to a specific question on the dollar – that implied he was comfortable with the currency’s valuation.

Broad-based dollar index (DXY)

This renewed push weaker presents a good opportunity to take profit on long-held US dollar shorts. The dollar has declined by around 11% over the past year, a substantial move.

With the Fed likely on hold for at least the next few months, a broadly accepted outlook of strong US economic growth, and the renewed emphasis on Fed independence discussed above, dollar bears should take pause at current valuations.