Trump Sparks Bullion Bid As Goldman Sees Dollar Demise 'Just Getting Going'; 'Gamma Wall' Gags Equity Gains

'Buy America' is back as tech leads the broad market higher (while healthcare hit hedgies hard), USTs were bid (at the short end), gold and silver rebounded from some overnight weakness, but crypto was puked again alongside the dollar.

President Trump dropped some late-day headlines sparking further weakness in the dollar and strength in precious metals saying that he did not think the value of the US dollar had declined too much, saying it was “doing great” and he expected currency values to fluctuate.

When asked if he was worried about losses in the dollar, Trump told reporters in Iowa on Tuesday:

“No, I think it’s great,”

“I think the value of the dollar — look at the business we’re doing. The dollar’s doing great.”

“I want it to be — just seek its own level, which is the fair thing to do,” Trump added.

Bloomberg reports that Trump suggested he could manipulate the strength of the dollar, saying “I could have it go up or go down like a yo yo.”

The dollar has not caught a bid in 6 days. Is free falling not floating and is getting slaughtered over the past year with Gold pricing in fiat risk.

— Matt Justice (@mattjustice13) January 27, 2026

Trump “dollar is doing great”pic.twitter.com/wIXh7yyXTq

But he cast that as an unfavorable outcome, likening it to hiring unneeded workers to juice employment numbers while criticizing Asian economies he said tried to devalue their currencies.

“If you look at China and Japan, I used to fight like hell with them, because they always wanted to devalue their yen.

You know that?

The yen and the yuan, and they’d always want to devalue it.

They devalue, devalue, devalue,” Trump said.

“And I said, not fair that you devalue, because it’s hard to compete when they devalue. But they always fought, no our dollar’s great,” he added.

A pretty clear signal of what he wants... and the result of all this was dollar uglierer and gold greener (gold snapped way before FX, raising question like - was the reporter's question leaked? Or was the question a setup?...

“Japan can’t fix the yen without risking domestic stress or global spillovers so the idea of coordination, a Plaza Accord II type of outcome, suddenly isn’t crazy to some,” said Anthony Doyle, chief investment strategist at Pinnacle Investment Management.

“When the US Treasury starts making calls, it’s usually a sign this has moved past a normal FX story.”

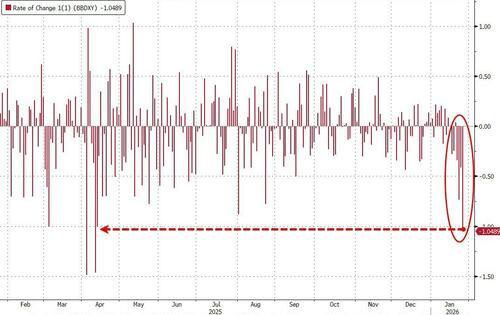

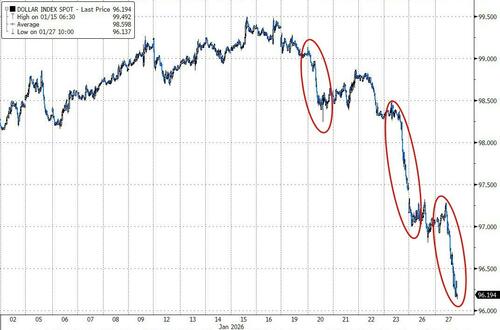

That was the worst day for the dollar index since April 2025 (Liberation Day)...

Source: Bloomberg

UBS traders noted a large block of gold‑linked equity (GLD) trading has gone through, coinciding with the sharp move higher in spot gold.

In over‑the‑counter equivalent terms, the customer is rolling 250k deltas out of an in‑the‑money 4,950/5,050 call spread, and into a Feb. 20 5,250/5,400 call spread, representing 1.1 mn ounces of gold exposure.

The client is paying roughly USD30 mn in net premium to implement the new structure.

But, before that malarkey, we had some macro today (before the massive micro incoming tomorrow from Mag7 EPS) with home prices accelerating faster than expected (so much for the affordability angle) but (Conference Board) consumer confidence crashing to 12 year lows (although we note that UMich saw sentiment improve.

This is happening as Atlanta Fed's GDPNOW is signaling magnificent economic growth (+5.4%) and US equities are hitting record highs...

Source: Bloomberg

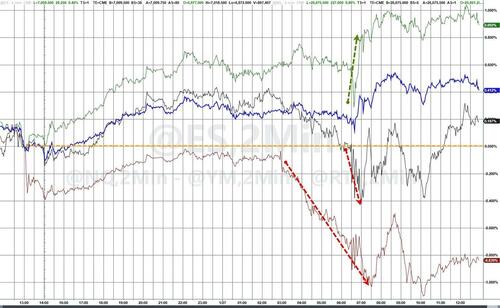

Nasdaq outperformed on the day with The Dow lagging notably (explained below)...

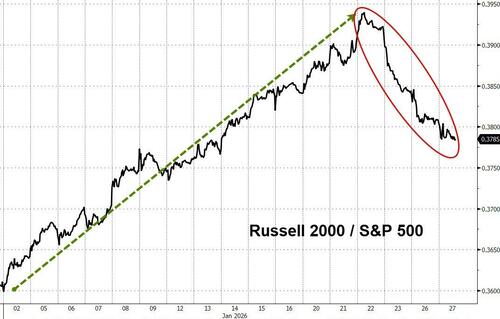

After 14 straight days of outperformance, RTY lagged SPX for the 3rd day in a row...

Source: Bloomberg

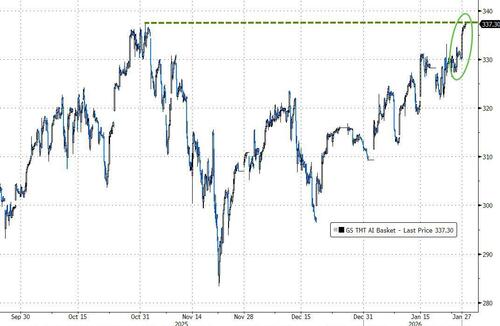

Mag7 and AI stocks outperformed despite the panic-mongering essay from Anthropic CEO with Goldman's AI basket back up near record highs (fueled by a few bullish headlines in the semis space in the last 48h (Micron additional $24bn to invest in fabs in Singapore, Samsung/Nvidia deal, SK Hynix/Microsoft)...

Source: Bloomberg

Momentum also pushed to a new record high today with both long and short legs working...

Source: Bloomberg

Goldman's trading desk notes that the squeezier pockets of the market also outperforming today with Non profitable tech GSXUNPTC +245 bps and most short rolling GSCBMSAL +160bps.

Source: Bloomberg

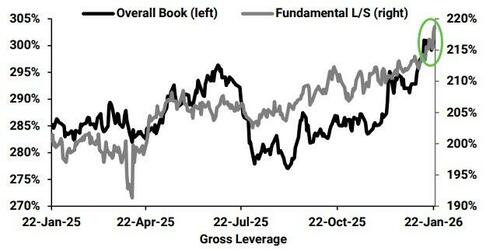

Remember from last week’s PB data: Our overall PB book (systematic + fundamental combined) shows gross exposure at 302% (100th percentile on 1, 3 and 5 yr look back).

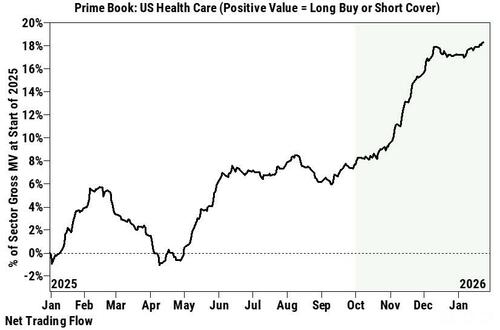

The Dow's dramatic underperformance was largely driven by the collapse in UNH (after ugly earnings and the government's Center for Medicare & Medicaid Services (CMS) announced that it is looking to hold Medicare Advantage (MA) rates flat in 2027, well below what the 4%-6% increase that markets had been expecting).

In response, shares of managed care bellwether UNH are down 20% today - and others in the group from HUM to CNC are seeing double digit losses as well.

Top Goldman Sachs trader, John Flood, describes the mayhem in that market today as hedgies got hammered, stuck 'long and wrong':

Per GSPB, Healthcare was by far the most $ net bought US sector on our Prime book during 4Q ’25, as HFs net bought the sector across all three months (led by biotech). In cumulative $ terms on a quarterly basis, the net buying US HC stocks in 4Q was the largest on our record (since 2016, +2.3 Z score on a 3-year lookback).

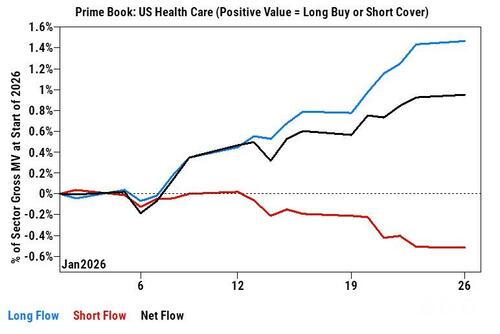

So far in 2026 (as of COB yesterday), Healthcare is the 2nd most $ net bought US sector (only behind Industrials), driven by long buys outpacing short sales ~3 to 1. Biotech is by far the most net bought subsector (again) followed by HC Providers & Svcs (led by buying in Managed Care names)....

The managed care complex (UNH, HUM, ALHC, CVS, etc) is sharply lower this am, as the MA rate notice coming in well below street expectations suggests that this administration has little interest in bolstering the sector despite the volatility and the UNH guide paints a much slower margin recovery slope than even subdued street expectations.

The S&P 500 hit a new record high today (5th off the year)... but once again faded...

"...it feels like spx keeps failing at SPX 7,000..."

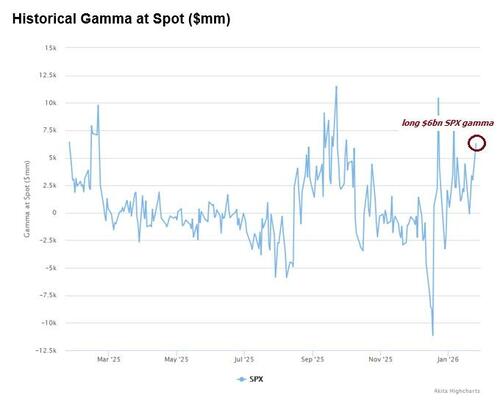

Top Goldman derivatives trader, Brian Garrett, sees a "Gamma Wall" holding stock back:

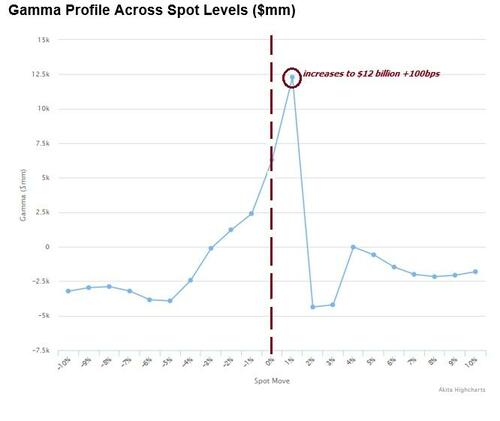

One reason is extreme SPX gamma positioning from market makers...

GS futures strats calculate $6bn of long gamma at spot, which increases to $12bn long gamma +100bps higher

In English, a 100bps rally in spx cash creates supply of ~35,000 e-minis from market makers

Goldman's vol desk desk believes the 7,000 strike is the peak concentration......beyond this level, the market doesn’t necessarily “flip short,” but the dynamic is much cleaner.

To take advantage of a potential upside break in this dynamic, Garrett notes that the cost of an SPX 2 week 102.5 call is trading at the lows...

...and if a fundamental catalyst is needed to rally thru the 7k level, megacap earnings this week could be what the market needs.

Treasuries were mixed on the day with the long-end lagging (30Y +3bps, 2Y -3bps) steepening the curve (note the entire curve dropped on the weak consumer confidence data). The long-end yield still higher (marginally) on the week...

Source: Bloomberg

The Dollar Index has plunged over 3% in the last 6 trading sessions (the biggest 6 day move lower since April 2025 - Liberation Day)...

Source: Bloomberg

Goldman Sachs FX traders think it's just getting going...

We have been cautious on the Dollar for the past ~6m but think all the pieces are lining up for the next leg lower.

Trump / Venezuela and potential read through for Greenland reignited the end-of US Exceptionalism narrative. Around that time, we saw more headlines out of Europe that certain pension funds would reduce exposure to US assets.

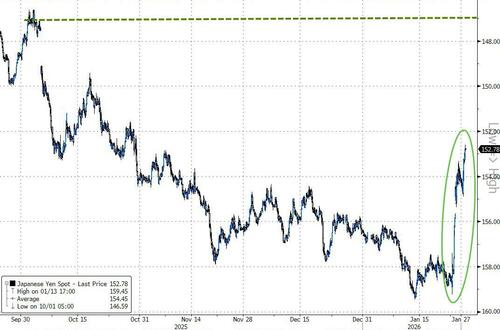

But the main driver since last Friday has been the reported USDJPY rate check by NY Fed on behalf of the UST. That sent USDJPY lower and has impacted the broader FX complex with the signal this time is even stronger than the rate checks in 2022 or 2024 because of the US participation.

Reason this has impacted the USD more broadly is

US administration is taking a more active approach to FX

JPY moves can have a knock-on effect across other key crosses like EUR + CNH which recently have also found macro sources of support

All 3 pillars of the USD (JPY, CNH, EUR) moving in the same direction for weaker-USD.

As this unfolds, concerns of unfriendly cross-asset correlations that could prompt an adjustment in FX hedge ratios if they persist has started to come back into focus. One theme that has been getting increasing airtime this week is Australia. In Australia, the super funds on average have historically low FX hedge ratio of around 20-30% (RBA). Last week, the second largest super fund, ART Super, said that they would look to increase FX hedge ratios (for USD denominated asset exposure that is sell USD / buy AUD).

The DXY is close to breaking to a ~4y low. Praneet Shah (Head of G10 Options EMEA) sees this move as opening up a potential move down to 92.75 (approx. 4% lower) over the next few months.

Source: Bloomberg

This is equivalent to approx. 1.2450 for EURUSD (a level consistent with Trump's first term). We are also targeting 147 for USDJPY but acknowledge it will be noisier into 8Feb election - long EURUSD should offer better vol adjusted returns.

Source: Bloomberg

But it's not just the yen, Cable soared to its highest since Oct 2021 today...

Source: Bloomberg

Of course, aside from the dollar, precious metals once again stole all the headlines with gold bouncing back from overnight weakness to test $5100 numerous times before breaking out above it late in the day to $5175 on the Trump comments...

Source: Bloomberg

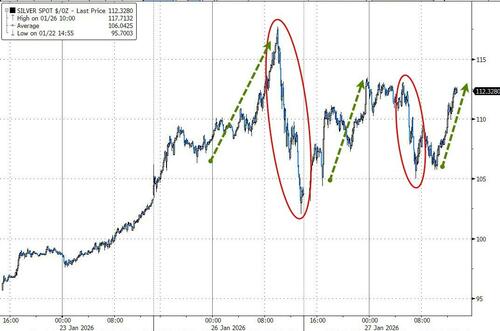

Silver was - as expected - even more volatile, plunging 13% from its yesterday's highs but bouncing back into the green today, finding $105 as support for now and breaking back above $112 late in the day on the Trump comments...

Source: Bloomberg

While gold and silver ended green, platinum and copper ended red on the day...

Source: Bloomberg

Pulling that together, we note that the last time Gold vol was this high relative to bond vol... it was Lehman!!

Source: Bloomberg

Crypto was a chaotic mess again, oscillating around $88,000 (following a similar path to yesterday), but breaking out above $89k by the close of the cash equity market...

Source: Bloomberg

Crude oil prices rose as President Trump touted a growing US military presence near Iran, while traders monitored the fallout from a sweeping winter storm and a weaker dollar boosted the appeal of commodities

Source: Bloomberg

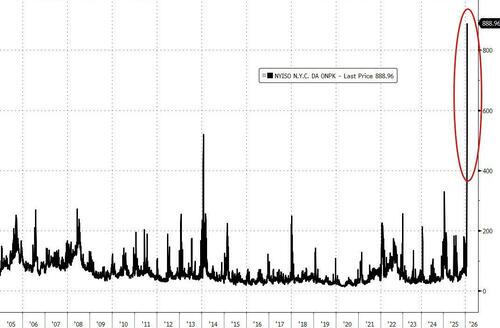

NatGas futures were highly volatile again, but bounced late on back into the green (after falling over 22% from yesterday' highs)...

Source: Bloomberg

...as NYC day-ahead power new all-time high of $889/MWh for tomorrow, shattering the 2014 Polar Vortex record.

Source: Bloomberg

Classic winter grid squeeze. Priority goes to heating homes -> nat gas supply chokes ->generation costs go vertical.

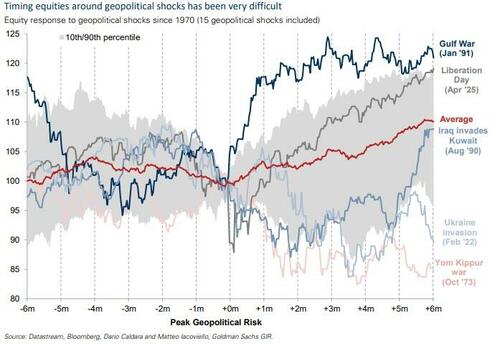

Finally, Geopolitical risk has returned to the forefront following the recent developments around Venezuela, Iran, and Greenland, and is likely to remain there for some time as the US continues to reshape its geopolitical and economic relationships with the world. Goldman's Christian Mueller-Glissmann points out that this has raised questions about how investors can protect themselves from geopolitical shocks, which can have material impacts on global growth, inflation, and sentiment, especially as the linkages between economies and markets have become increasingly complex. Rather than try to time geopolitical shocks, which can be difficult, Goldman thinks robust portfolio construction and diversification should be investors’ first line of defense.

So, for investors looking for ways to protect their portfolios from geopolitical shocks, Goldman's message is: diversify, don’t time. Specifically, they recommend more regional, sector, and style diversification relative to global benchmarks and like safe assets such as gold and selectively hedging Dollar risk. With the volatility reset, we also like shorter-dated rates receivers as a hedge for major growth shocks, credit payer spreads/VIX call spreads to hedge corrections, and longer-dated calls to maintain overweight equity allocations despite the potential for more geopolitical shocks.