NS

NSDownbeat sentiment with Dollar lower whilst USTs benefit, Alphabet results due - Newsquawk US Market Open

- US President Trump said it depends on China how soon tariffs can come down and they have spoken to 90 countries regarding tariffs already.

- US President Trump said if they don't have a deal, they will set tariffs and could set the tariff for China over the next two or three weeks, while he suggested that there is daily direct contact between US and China.

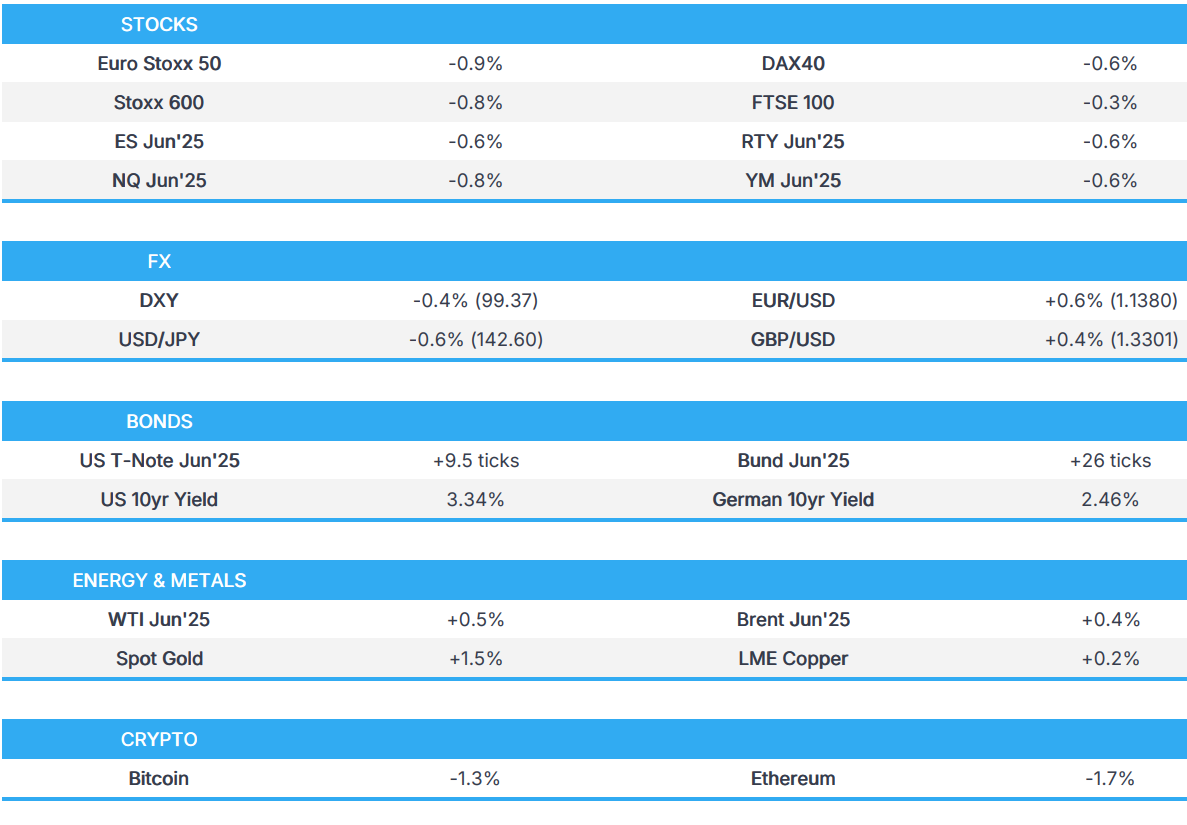

- European bourses are in the red amid the negative risk-tone; US futures also edge lower ahead of Alphabet results.

- USD is lower vs. all peers, EUR benefits from its liquidity premium.

- USTs and European paper benefit from the risk tone; Treasuries await a 7yr auction.

- Gold resumes upside amid ongoing trade uncertainty; crude modestly in the green following Wednesday's pronounced downside.

- Looking ahead, highlights include US Durable Goods, Jobless Claims, IMF/World Bank Spring Meeting. Speakers include ECB's Nagel, Simkus, Rehn, Lagarde & Lane, Fed's Kashkari, BoE's Lombardelli, Supply from the US.

- Earnings from Alphabet, Intel, American Airlines, Freeport, Southwest Airlines, PepsiCo, Dow Chemical, Merck, Valero, PG&E, T-Mobile, Vale.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TRADE

TARIFFS/TRADE

- China's Vice Premier He Lifeng said the nation must face up to the new situation of the US tariff increase on China; need to increase policy supply and solve practical problems.

- China's Foreign Ministry spokesperson, on US trade talks, said "As far as I know, China and the US have not consulted or negotiated on the issue of tariffs, let alone reached an agreement," via Global Times.

- China's MOFCOM said any content about China-US economic and trade talks is "groundless and has no factual basis" If US really wants to resolve the issue, it should life all unilateral tariff measures against China.

- China Foreign Ministry spokesperson Gou said China and the US are not yet in talks on tariffs; will fight tariff war "if we have to" Respect is condition for any talks to happen. Tariffs disrupt TWO rules, and harm people of all countries.

- China's MOFCOM held a meeting with foreign firms to discuss the impact of US tariff increases on the investment and operations of foreign enterprises in China; committed to further opening-up, with policies that are stable, consistent, and predictable.

- US President Trump said it depends on China how soon tariffs can come down and they have spoken to 90 countries regarding tariffs already. Trump said if they don't have a deal, they will set tariffs and could set the tariff for China over the next two or three weeks, while he suggested that there is daily direct contact between US and China. Furthermore, Trump commented that they don't want cars from Canada and that car tariffs from Canada could go up, as well as noted that they are working on a deal with Canada and will see what happens.

- It was earlier reported that US President Trump is to exempt carmakers from some US tariffs in which he was said to be planning to spare carmakers from some of his most onerous tariffs, in another trade war climbdown following intense lobbying by industry executives over recent weeks, according to FT.

- White House Economic Advisor Hassett said the USTR has 14 meetings scheduled this week with foreign trade ministers and there are 18 written offers from trade ministers, while he stated China is open to talks.

- PBoC Governor Pan said in Washington that there are no winners in trade wars and tariff wars, while he added that unilateralism and protectionism have no way out and are not in the interests of anyone. Furthermore, Pan said China will adhere to opening up and firmly supports free trade rules and the multilateral trading system.

- Chinese embassy in the US posted a statement from an official saying “Our doors are open, if the US wants to talk. If a negotiated solution is truly what the US wants, it should stop threatening and blackmailing China and seek dialogue based on equality, respect and mutual benefit. To keep asking for a deal while exerting extreme pressure is not the right way to deal with China and simply will not work."

- China Customs will no longer supervise goods and articles included in the management of drugs, veterinary drugs, and medical devices, while it will no longer supervise import and export of microbial agents for environmental protection with these goods to no longer be supervised as special items entering and leaving China.

- Japan Economic Minister Akazawa plans to visit the US for tariff talks from April 30th, while it was also reported that the US told Japan it cannot give special treatment regarding tariffs during talks held earlier this month, according to NHK citing multiple Japanese government sources.

- Taiwan's representative to the US said Taiwan is willing to increase purchases of weapons and energy from the US to reduce its trade deficit.

- White House said regarding the EU fine on Meta (META) and Apple (AAPL) that novel forms of economic extortion will not be tolerated.

- Swiss Economy Minister said he held a productive meeting with USTR Greer to discuss bilateral trade relations and is looking forward to future exchanges and continued collaboration.

- Chile’s President said the best way to respond to this trade war is not with high-sounding statements, while they are not going to respond with retaliation and are going to respond with greater integration. Furthermore, he said they must continue working hard to facilitate customs processes and promote investments to improve logistics.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.8%) opened with modest losses, but sentiment gradually deteriorated as the morning progressed, to display a clear negative bias.

- European sectors opened mixed but now display a bit more of a negative picture. Real Estate takes the top spot, alongside strength in Energy; although upside is very modest. Tech is the clear underperformer today, given the risk-tone and as traders digest the latest earnings from Dassault Systemes, which slumped after downgrading its 2025 margin outlook. The banking sector is pressured by post-earning losses in BNP Paribas, whilst the Luxury sector is hit after poor Kering results.

- US equity futures (ES -0.6% NQ -0.8% RTY -0.6%) are entirely in the red, in-fitting with the broader risk tone; the NQ lags, with sentiment in the Tech sector hit after IBM (-8% pre-market) results. Focus now turns to US Durable Goods, Jobless Claims and earnings from the likes of Alphabet and Intel.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

KEY EARNINGS SUMMARY:

- International Business Machines Corp (IBM) Q1 2025 (USD): Adj. EPS 1.60 (exp. 1.4), Revenue 14.5bln (exp. 14.35bln) Shares -7.7% pre-market

- Lam Research Corp (LRCX) Q3 2025 Adj. EPS 1.04 (exp. 1.00), Revenue 4.72bln (exp. 4.65bln). Shares +2.1% pre-market

- Texas Instruments Inc (TXN) Q1 2025 (USD): 1.28 EPS (exp. 1.05), Revenue 4.07bln (exp. 3.90bln) Shares +4.9% after-hours. Shares +3.1% pre-market

- Dassault Systemes (DSY FP), -7.5%, missed Q1 targets and cuts 2025 margin outlook.

- EssilorLuxottica (EL FP), -3.5%, in-line metrics but North American rev. was light.

- Kering (KER FP), -5.9%, reported 14% decline in Q1 sales and very poor Gucci metrics.

- STMicroelectronics (STMPA FP), +3%, Q1 results in-line, Q2 guidance topped.

- Roche (ROG SW), -0.5%, better-than-expected results and affirmed its outlook

- Nestle (NESN SW), -0.6%, beat on its Organic Revenue figure and highlighted CHF 0.7bln in cost savings for 2025.

FX

- DXY has pulled back with the USD lower vs. all peers after gaining yesterday on account of hopes on the trade front and more conciliatory language from President Trump re Fed Chair Powell. In terms of the latest state-of-play, Trump said it depends on China how soon tariffs can come down and they have spoken to 90 countries regarding tariffs already. Trump added that if they don't have a deal, they will set tariffs and could set the tariff for China over the next two or three weeks. Note, China this morning said they are not yet in trade talks with the US.

- EUR is firmer vs. the USD and the best performer across the majors with the EUR benefitting from its status as the most liquid alternative to the USD. On the trade front, not a great deal has changed for the EU with the Trump administration focusing more on the likes of India and China. Elsewhere, ECB speak has continued to lean towards suggesting that tariffs will weigh on inflation in the Eurozone. German IFO data exceeded expectations but failed to have any material sway on the EUR given the headwinds facing the nation. EUR/USD is currently stuck on a 1.13 handle and within yesterday's 1.1308-1.1440 range.

- USD/JPY pulled back from the 143.00 territory after rallying yesterday owing to the positive risk appetite and stronger buck, while recent data showed firmer Services PPI from Japan. On the trade front, Japanese Economic Minister Akazawa plans to visit the US for tariff talks from April 30th. USD/JPY has delved as low as 142.56 but is still some way clear of Wednesday's trough at 141.49.

- GBP is firmer vs. the USD but to a lesser extent than most peers. Newsflow out of the UK remains on the light side. However, on the trade front, UK Chancellor Reeves said the UK will not rush trade talks with the US and will not relax food standards to secure a deal. BoE's Lombardelli is both due later. Cable is currently stuck at the top end of a 1.32 handle and within Wednesday's 1.3234-1.3339 range.

- Antipodeans are both a touch firmer vs. the broadly weaker USD with little in the way of newsflow from Australia or New Zealand. As such, direction for both will likely be dictated by trade developments and the broader risk tone.

- Barclays said its passive month-end rebalancing model shows strong dollar buying against all majors.

- PBoC set USD/CNY mid-point at 7.2098 vs exp. 7.3111 (Prev. 7.2116).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- US paper is higher alongside downside in stocks and following a choppy session yesterday which saw T-notes ultimately settle lower. In terms of the latest state-of-play for trade, Trump said it depends on China how soon tariffs can come down and they have spoken to 90 countries regarding tariffs already. Trump added that if they don't have a deal, they will set tariffs and could set the tariff for China over the next two or three weeks. Note, China this morning said they are not yet in trade talks with the US. For today's docket, data releases include US durables and weekly claims figures, whilst Kashkari is due to deliver remarks - a 7yr note offering is also due. Jun'25 USTs currently sit towards the bottom-end of Wednesday's 110.18+ to 111.18+ range.

- Bunds are firmer on the session after a session of losses on Wednesday on account of the upbeat risk tone that was triggered by optimism on the trade front and Trump remarks re Powell. ECB speak has continued to lean towards suggesting that tariffs will weigh on inflation in the Eurozone, albeit there is a high level of uncertainty surrounding forecasts. ECB's Rehn has suggested that the GC should not rule out larger cuts than 25bps. German IFO data exceeded expectations but failed to have any material sway on prices given the headwinds facing the nation. Jun'25 Bunds are currently towards the middle of yesterday's 131.11-131.93 range with the 10yr yield @ 2.477% vs. yesterday's 2.454-2.518% range.

- UK paper is sitting just above the unchanged mark after a choppy session yesterday which saw initial gains (triggered by the UK DMO issuance adjustment and soft UK PMI data) reversed following the strong risk tone in the market. On the trade front, UK Chancellor Reeves said the UK will not rush trade talks with the US and will not relax food standards to secure a deal. A strong UK 2043 outing had little impact on Gilts, and currently trade within Wednesday's 92.34-93.29 range.

- Norwegian Sovereign Wealth Fund CEO said it has not gone massively to buy stocks but individual portfolio managers have been able to buy more "if they wanted to"; have not changed view on USTs.

- UK sells GBP 1.75bln 4.75% 2043 Gilt: b/c 3.38x (prev. 2.97x), average yield 5.155% (prev. 5.232%) & tail 0.3bps (prev. 0.5bps).

- Italy sells EUR 3bln vs exp. EUR 2.5-3.0bln 2.55% 2027 BTP: b/c 1.65x (prev. 1.55x) & gross yield 2% (prev. 2.38%).

- Click for a detailed summary

COMMODITIES

- A firmer session in the crude complex this morning following yesterday's slump in prices on account of the OPEC+ discord after Kazakhstan said it cannot lower oil output and prioritises domestic interest over the cartel's. WTI resides in a USD 62.11-63.00/bbl range while its Brent counterpart resides in a USD 65.95-66.81/bbl range.

- Once again a mixed picture across precious metals with spot gold now the gainer whilst spot silver and palladium falter. Little new to add aside from the ongoing theme of tariff uncertainty, with investors rushing back into the yellow metal following two days of heavy losses. Spot gold currently resides in a USD 3,305.37-3,367.69/oz parameter.

- Base metals are trading modestly firmer on the back of a softer Dollar but upside remains capped by lingering trade uncertainty. 3M LME copper resides in a USD 9,352.03-9,413.80/t range at the time of writing.

- Click for a detailed summary

NOTABLE DATA RECAP

- French Consumer Confidence (Apr) 92.0 vs. Exp. 91.0 (Prev. 92.0)

- German Ifo Expectations New (Apr) 87.4 vs. Exp. 85 (Prev. 87.7); Ifo Current Conditions New (Apr) 86.4 vs. Exp. 85.5 (Prev. 85.7); Ifo Business Climate New (Apr) 86.9 vs. Exp. 85.2 (Prev. 86.7)

NOTABLE EUROPEAN HEADLINES

- ECB's Rehn said should not rule out a larger rate cut; risks are beginning to materialise There are few good arguments to pause rate cuts. Defence outlays will not have much impact on medium-term inflation.

NOTABLE US HEADLINES

- BofA Institute Total Card Spending (Week-to-Apr-19th): +3.1% (Y/Y) (prev. 2.3%); said easter continues to be a major retail event for the US

- Fed's Hammack (2026 voter) said uncertainty is a big issue in the economy and is causing businesses to pause, while she added that an incredibly high bar exists for the Fed to step in and they have not seen the need for Fed market intervention. Hammack also commented that recent market troubles were a risk transfer and that markets were functioning, as well as noted it is not a good time to be pre-emptive amid policy uncertainty and reiterated now is a good time for monetary policy to take its time.

- US House Republicans will seek a USD 150bln Pentagon spending hike as part of their party-line mega bill, according to sources cited by Politico.

GEOPOLITICS

MIDDLE EAST

- Israel's army carries out a series of bombing operations in the city of Rafah in the southern Gaza Strip.

RUSSIA-UKRAINE

- Ukrainian air defence units were active around Kyiv and witnesses reported several explosions and drones in the air, while the second largest city of Kharkiv was also under missile attack with explosions heard.

- US Treasury Secretary Bessent met with Ukraine's PM Shmyhal and Finance Minister Marchenko, while he reaffirmed US dedication to secure peace and emphasised the need to conclude technical talks and sign an economic partnership between the US and Ukraine as soon as possible.

OTHER

- Russia said it may resume nuclear tests in response to similar measures from Washington, via Al Arabiya.

- China's Military said it monitored US warship's transit in Taiwan Strait on Apr 23.

CRYPTO

- Bitcoin is on the backfoot and trading just under USD 92k; Ethereum also lower and holds just above USD 1.7k.

APAC TRADE

- APAC stocks were ultimately mixed despite the positive handover from Wall Street - the risk momentum waned overnight as trade uncertainty lingered owing to the mixed signals from the US.

- ASX 200 was led higher by outperformance in mining stocks and tech, with gold producers buoyed by a rebound in the precious metal.

- Nikkei 225 advanced at the open but gradually pared most of the gains following firmer Services PPI data from Japan and after a report that the US told Japan it cannot give it special treatment regarding tariffs during talks held earlier this month.

- Hang Seng and Shanghai Comp were subdued following the mixed signals from the US as a report noted the White House was mulling cutting China tariffs by around half to de-escalate the trade war although officials declared they are not considering something unilaterally. Furthermore, President Trump stated it depends on China how soon tariffs can come down and if they don't have a deal, they will set the tariff but said they are having daily talks with China.

NOTABLE ASIA-PAC HEADLINES

- PBoC to sell CNY 600bln of 1yr medium-term lending facility (MLF) loans on Friday April 25th.

- China issued its new market access "Negative List" in which the number of items in the negative list was reduced to 106 from 117, while China's 2025 negative list for market access removed eight national access restrictions and partially liberalises eight national measures including for telecommunications services, TV production, pharmaceuticals, internet information services for drugs and medical devices, and forest seed imports.

- South Korea Information Protection Agency said DeepSeek transferred user information and prompts without permission, according to Yonhap.

DATA RECAP

- Japanese Services PPI (Mar) 3.10% (Prev. 3.00%, Rev. 3.20%)

- South Korea GDP QQ (Q1 A) -0.2% vs. Exp. 0.1% (Prev. 0.1%)

- South Korean GDP YY (Q1 A) -0.1% vs. Exp. 0.1% (Prev. 1.2%)