NS

NSDXY hit and US yields steeper amid continued Hassett focus; ADP and ISM ahead - Newsquawk US Market Open

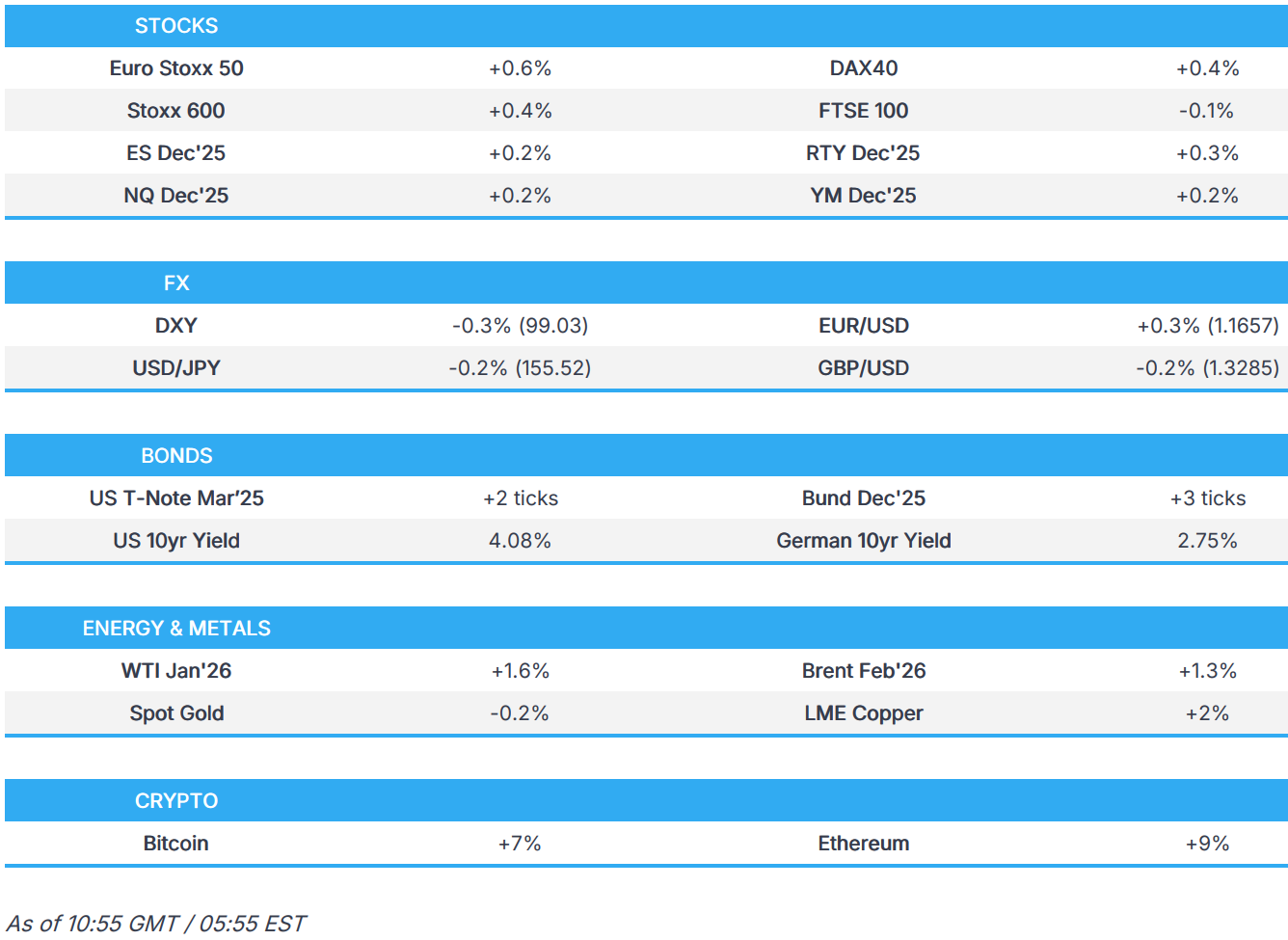

- European bourses are broadly firmer, alongside modest strength across US equity futures; Marvell (+10%) benefits following its upbeat outlook for data-centre growth.

- DXY is softer and towards the round 99.00 mark as Trump referred to Hassett as the "potential" next Fed Chair, GBP top G10 performer, whilst CHF was briefly pressured post-CPI.

- Fixed benchmarks firmer but off highs as crude climbs. US yields steeper on Trump's Fed commentary.

- Crude grinds higher as traders digest the lack of progress from the Putin-Witkoff meeting; XAU trades rangebound; Copper extends to new ATHs.

- Looking ahead, US Services/Composite PMI Final (Nov), US ISM Services PMI (Nov), ADP National Employment (Nov), Import Prices (Sep), Industrial Production (Sep), NBP Policy Announcement, Speakers including BoE's Mann, ECB’s Lagarde, Earnings from Salesforce, Snowflake, Dollar Tree.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

TARIFFS/TRADE

- US President Trump said they will give refunds out of the tariffs and believes they won't have income tax to pay in the near future.

- US President Trump thanked Chinese President Xi for soybean purchases. It was separately reported that at least six shipments of US soybeans for China are to load at Gulf Coast terminals through mid-December, while the first US sorghum cargo to China since March is also loading at the Gulf Coast terminal, and a second cargo is due next week.

- US President Trump posted that he had a very productive call with Brazilian President Lula and "Among the things discussed were Trade, how our Countries could work together to stop Organized Crime, Sanctions imposed on various Brazilian dignitaries, Tariffs, and various other items." Trump added he believes "it set the stage for very good dialogue and agreement long into the future... Much good will come out of this newly formed partnership!"

- EU is said to be pushing for 70% of critical goods to be made in Europe, according to FT.

- Annual negotiations between Chinese copper smelters and Antofagasta (ANTO LN) have not progressed, as Chinese smelters remain determined to avoid negative fees, via Bloomberg citing sources

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.4%) opened with modest gains, following on from a positive session on Wall St. in Tuesday's session. Price action this morning has been mixed, with a few indices trading rangebound whilst others have gradually edged higher.

- European sectors are split down the middle. Retail leads the pile (buoyed by Inditex +8.50% post-earnings), whilst Energy and Tech complete the top three. Sentiment for the latter has been boosted after positive results from Marvell, which gains in pre-market trade. To the downside resides Insurance, and Optimised Personal Care.

- US equity futures (ES +0.2% NQ +0.2% RTY +0.3%) are incrementally firmer across the board, attempting to build on the upside seen in the prior session. Focus has been on the likes of Marvell (+9.3%) and CrowdStrike (-2%) post-earnings, with the former benefiting following its upbeat outlook for data-centre growth that exceeded analysts’ expectations.

- OpenAI has reported that ChatGPT is seeing elevated errors for business and enterprise use, via Bloomberg; OpenAI responded by saying it is not aware of any issues.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is softer today and trades towards the lower end of a 98.99 to 99.30 range. G10s are mostly stronger vs the Dollar, albeit to varying degrees. For the USD specifically, all focus has been on Fed developments, and in particular, President Trump hinting that White House NEC Director Hassett as the “potential” next Fed Chair. Moreover, it was reported in the WSJ that Trump aides have cancelled a number of Fed Chair interviews, after the POTUS said he had made up his mind. JD Vance was reportedly scheduled to meet with more candidates today, though those were cancelled, with the WSJ sources suggesting that it was currently unclear if they would be rescheduled. Odds of a Hassett chair nomination currently reside around 86% vs 75% earlier this week, on Kalshi. Ahead focus turns to US ADP National Employment and then ISM Services.

- EUR firmer and trades at the upper end of a 1.1622 to 1.1663 range. Benefiting from the weaker Dollar and softer energy prices. The single currency was little moved on EZ Final PMI metrics, which were revised slightly higher; the internal report said that the ECB will likely continue to communicate holding steady on rates. Most recently the EUR has notched fresh peaks, but without a clear catalyst; potentially a factor of a slight bounce in EUR/GBP, which gave the EUR/USD a bid.

- Elsewhere, GBP was initially gaining modestly vs the USD, before catching a recent bid, taking Cable to a fresh 1.3279 peak where it currently resides, lifting GBP/JPY closer to the key 207.20 mark and weighing on EUR/GBP. No catalyst for that upside. Thereafter, the GBP took another leg higher on the upwardly revised PMI metrics.

- Uneventful trade for USD/JPY this morning, and ultimately moving at the whim of the Dollar. Currently trading at the lower end of a relatively narrow 155.52 to 155.90 range, awaiting key US data later.

- Earlier, CHF was pressured after a cooler-than-expected inflation report which saw Y/Y printed below expected at 0.0% whilst the M/M printed in-line. In an immediate reaction, EUR/CHF lifted from 0.9332 to 0.9339; the upside was ultimately fairly muted given there were a number of analysts also expecting a 0.0% Y/Y print (which would be in-line). Moreover, traders will look towards the SNB meeting next week; policymakers have significantly raised the bar for a sub-0% policy rate, and while today’s outturn factors on the dovish side, it is unlikely to warrant a return to NIRP, focus instead on inflation forecast adjustments and FX language. Though, a move back to NIRP cannot be ruled out.

- Click for NY OpEx Details

FIXED INCOME

- For the most part, a session of modest gains for fixed benchmarks, ranges limited, awaiting newsflow later in the session. More recently, benchmarks have reverted back to lows and are threatening a move into the red, potentially amid yield upside on continued Crude gains.

- USTs got to a 113-01+ peak, firmer by just under five ticks at best. Yields lower across the curve at first, but the long end moving higher as the morning continues and the steepening bias extends. The main driver being the WSJ reporting that the final Fed Chair interviews have been cancelled and Trump announcing that he will make an announcement early-2026, steepening began as Trump referred to Hassett as the "potential" next Fed Chair.

- Bunds off best in a 128.25-41 band. The benchmark has been firmer for the entire morning, saw some fleeting pressure on upwardly-revised Final PMIs, but for the most part has been choppy and directionless in the mentioned band, before succumbing to what appears to be energy-induced pressure in recent trade.

- A similar story for Gilts. No move to the region's own PMIs, revised higher. Internal commentary was downbeat, though we wait to see how this shakes out in the post-Budget metrics. Commentary also pointed to wage pressure, a point that factors against BoE easing in December, though a cut appears increasingly likely barring a shock in the November CPI print due just before the December announcement. Off highs but firmer by around 10 ticks in a 91.22-50 band.

- UK sells GBP 4.75bln 4.00% 2029 Gilt: b/c 3.10x (prev. 3.06x), avg. yield 3.855% (prev. 3.845%), tail 0.4bps (prev. 0.4bps)

COMMODITIES

- WTI and Brent dipped to a low of USD 58.38/bbl and USD 62.19/bbl, respectively, in the early hours of the APAC session. They have gradually trended higher throughout the European session thus far, as traders react to the lack of significant progress from the Putin-Witkoff meeting in Moscow. Benchmarks have steadily bid c. USD 1.00/bbl from its session lows and are currently trading back above USD 59/bbl and USD 63/bbl. Brent Feb'26 currently trading at the upper end of a USD 62.18-63.37/bbl range.

- Dutch TTF has failed to bid higher following the reports that the EU have reached a deal on phasing out Russian gas imports by 2027. The deal is caveated with a possible extension to the ban implementation in case of difficulty filling gas storage. After opening the session at EUR 28.15/MWh, Dutch TTF has fallen lower and is currently trading near session lows at EUR 27.74/MWh.

- Spot XAU has traded on both sides of the unchanged mark, as the yellow metal struggled to find direction at the start of the European session. XAU followed on from the bid higher in Tuesday's US session and peaked at USD 4229/oz in the early hours of APAC trade. As the European session got underway, the yellow metal dipped back below USD 4200/oz as the market continues to digest the possibility of Kevin Hassett as the new Fed Chair.

- 3M LME Copper has started the European session on the frontfoot and is currently trading at USD 11.41k/t, extending to fresh ATHs. This comes as demand for the red metal continues to grow, shown by the spike in requests to withdraw inventories from LME warehouses. Supply disruptions and front-running of possible import tariffs into the US have been the theme in 2025 that has driven Copper to record highs.

- Ukraine has hit Russia's Druzhba oil pipeline in the Tambov region, according to Reuters sources.

NOTABLE DATA RECAP

- EU HCOB Services Final PMI (Nov) 53.6 vs. Exp. 53.1 (Prev. 53.1); Composite Final PMI (Nov) 52.8 vs. Exp. 52.4 (Prev. 52.4)

- EU Producer Prices MM (Oct) 0.1% vs. Exp. 0.1% (Prev. -0.1%); Producer Prices YY (Oct) -0.5% vs. Exp. -0.4% (Prev. -0.2%)

- UK S&P Global Services PMI (Nov) 51.3 vs. Exp. 50.5 (Prev. 50.5); Composite Output (Nov) 51.2 vs. Exp. 50.5 (Prev. 50.5)

- Swiss CPI YY (Nov) 0.0% vs. Exp. 0.1% (Prev. 0.1%); CPI MM (Nov) -0.2% vs. Exp. -0.2% (Prev. -0.3%)

- Spanish Services PMI (Nov) 55.6 vs. Exp. 56.1 (Prev. 56.6)

- French HCOB Services PMI (Nov) 51.4 vs. Exp. 50.8 (Prev. 50.8); Composite PMI (Nov) 50.4 vs. Exp. 49.9 (Prev. 49.9)

- Italian HCOB Composite PMI (Nov) 53.8 vs. Exp. 53.2 (Prev. 53.1); Services PMI (Nov) 55.0 vs. Exp. 54 (Prev. 54)

- German HCOB Composite Final PMI (Nov) 52.4 vs. Exp. 52.1 (Prev. 52.1); Services PMI (Nov) 53.1 vs. Exp. 52.7 (Prev. 52.7)

- Turkish CPI YY (Nov) 31.07% vs. Exp. 31.6% (Prev. 32.87%); CPI MM (Nov) 0.87% vs. Exp. 1.25% (Prev. 2.55%)

NOTABLE EUROPEAN HEADLINES

- French Parliamentary debate on the increases to the General Social Contribution on capital income, part of the Social Security Financing Bill (PLFSS), will be discussed later this week after the revenue component, Politico reports.

- ECB's Lane says they have a clear orientation for monetary policy conduct. On inflation "...a sufficiently large and persistent deviation from the target requires a monetary policy response, regardless of its origin". "In summary, this discussion has emphasised that the appropriate monetary policy response to an inflation deviation from the target is context specific and requires a careful analysis of a broad set of considerations. Of course, the capacity to consider “looking through” some types of inflation deviations depends on a strong institutional commitment to delivering the symmetric inflation target over the medium term, underpinning firmly-anchored medium-term inflation expectations".

NOTABLE US HEADLINES

- US President Trump posted that "Any and all Documents, Proclamations, Executive Orders, Memorandums, or Contracts, signed by Order of the now infamous and unauthorized “AUTOPEN,” within the Administration of Joseph R. Biden Jr., are hereby null, void, and of no further force or effect. Anyone receiving “Pardons,” “Commutations,” or any other Legal Document so signed, please be advised that said Document has been fully and completely terminated."

- US judge blocked the Trump admin from enforcing a law depriving Planned Parenthood of Medicaid funding in 22 states.

- US paused all immigration applications filed by immigrants from 19 countries it restricted from travel to the US earlier this year, according to NYT.

- BofA Total Card Spending (w/e Nov 29th) +0.2% (prev. +2.4% avg. in October); highlights that the slowdown was broad based and higher core goods inflation meant real spending was ever weaker.

GEOPOLITICS

MIDDLE EAST

- Israel's COGAT says the Rafah crossing will open in the coming days for Palestinians to exit from Gaza to Egypt.

- Russia's Kremlin says it would be wrong to say that President Putin rejected the US' peace plan, adds that Russia highly values US President Trump's political will and are trying to find a resolution.

RUSSIA-UKRAINE

- Russian President Putin's envoy Dmitriev described talks with the US in Moscow as productive after Russian President Putin's meeting with US Special Envoy Witkoff and Jared Kushner lasted for five hours.

- Russian Kremlin aide Ushakov said the conversation between Russian President Putin and US Special Envoy Witkoff was useful, constructive and meaningful and that they discussed several options for Ukraine's settlement plan, although he stated that they are no closer to resolving the crisis in Ukraine, and there is much work to be done. Ushakov said Putin asked to convey a number of important political signals to Trump and they agreed with their American colleagues not to disclose the substance of the negotiations that took place with the discussion confidential. Furthermore, he said American representatives will return to the US, present their findings to President Trump and contact the Russian side, while they also discussed prospects for economic cooperation between Russia and the US.

- European Commission is to make a legal proposal this week to use Russia's frozen assets for a Ukraine loan, according to sources cited by Reuters.

- German Foreign Minister Wadephul says they are to procure an additional USD 200mln worth of military equipment for Ukraine across two packages

- EU Ambassadors meeting has been moved forward to 13:30GMT (prev. 17:45GMT), regarding the use of frozen Russian assets for a Ukraine reparation loan, via Politico. Diplomats cited say that Commission President von der Leyen intends to use Article 122, "solidarity in economic emergencies"; elaborating that this means the clause could be deployed to extend the sanctions renewal period from six months to three years, potentially bypassing the unanimity requirement.

- Belgium Foreign Minister says, re. the use of frozen Russian assets, "the texts the Commission will table today do not address our concerns in a satisfactory manner. It is not acceptable to use the money and leave us alone facing the risks".

OTHER

- US President Trump signed into law a measure forcing the State Department to review guidelines for the country’s engagement with Taiwan, according to the White House.

- South Korean President Lee said communication is completely cut off between South Korea and North Korea, while he added that North Korea keeps refusing our efforts to talk. Lee also commented that South Korea can look into the issue of joint exercises with the US to help create grounds for dialogue between the US and North Korea, as well as stated that they will not veer off the road towards denuclearisation of the Korean peninsula.

CRYPTO

- Bitcoin is on a strong footing today, after having surged beyond USD 93K; Ethereum now back above USD 3k.

APAC TRADE

- APAC stocks were mixed, with the region only partially sustaining the positive momentum from Wall St, where tech and crypto rebounded.

- ASX 200 traded marginally higher but with gains limited as participants also reflected on disappointing Australian GDP data.

- Nikkei 225 rallied to back above the 50k level as it benefitted from tech-related momentum.

- Hang Seng and Shanghai Comp declined after the Chinese tech giants failed to join in the spoils seen in global peers and after the PBoC continued to drain liquidity through its daily open market operations, while participants also digested the latest Chinese RatingDog Services and Composite PMI data, which continued to show an expansion in activity, albeit at a slower-than-previous pace.

NOTABLE ASIA-PAC HEADLINES

- China was reported to unveil a plan to boost tourism and aviation sectors and will strengthen inbound tourism air routes, while it will continue to ease entry and travel for foreign tourists and will boost tourism through coordinated consumption policies.

- DigiTimes reports that memory spot prices surged in November, despite Samsung Electronics' (005930 KS) RDIMM release marginally easing shortages, as suppliers hiked contract prices significantly. "Some industry insiders reveal that after Samsung halted pricing quotes in October, it resumed DRAM chip quotations mid-November with average contract price increases of 30-40%." "Sources indicate US-based NAND giants raised prices repeatedly, with November quotes 100-150% above October." "Expectations point to even steeper hikes in the first quarter of 2026."

- "Samsung Electronics' (005930 KS) final HBM4 samples are scheduled to undergo 2.5D packaging and finished product testing starting this month," via zdnet citing sources

- China is reportedly likely to maintain the annual growth target of around 5% in 2026, via Reuters citing sources; some advisors cited proposed a 4.5-5.0% target

- India's Chief Economic Adviser says he's not losing sleep over the INR weakening

DATA RECAP

- Chinese RatingDog Services PMI (Nov) 52.1 vs. Exp. 52.1 (Prev. 52.6)

- Chinese RatingDog Composite PMI (Nov) 51.2 (Prev. 51.8)

- Australian Real GDP QQ SA (Q3) 0.4% vs. Exp. 0.7% (Prev. 0.6%)

- Australian Real GDP YY SA (Q3) 2.1% vs. Exp. 2.2% (Prev. 1.8%)

- China Preliminary Retail Passenger Vehicle Sales for November +1% (prev. -0.1%), +7% Y/Y (prev. -0.1%), via PCA.