The End Of Panic, Powell's "Cut That Saved Christmas", & Not Your Grandparent's VIX

There are seventeen bells left in 2025.

"We’re almost there," says top Goldman Sachs trader Brian Garrett, noting that Jerome will most likely deliver the “cut that saved christmas” this week but investor conversation suggests it will come with hawkish rhetoric.

Garrett remarks further it's hard to believe the S&P 500 is +17% ytd as most conversations remain focused on how difficult this year has been

Rotation Continues

We’re now at five consecutive weeks of equity demand, but the rotation into higher quality continues.

Healthcare and financials continue to see buy tickets, at the expense of consumer and materials.

HF positioning in biotech is extreme - highest levels on a 5y lookback as biotech now composes 13% of our prime book total market value

CTAs Now A Tail-Wind with Systematics Green Sweep

It is not lost on those in the trenches that the whipsaw volatility in CTA expectations has been extreme (headwind / tailwind / back to headwind / repeat).

The CTA community had sold $40bn of equities in the 5 days preceding thanksgiving, and had sold $70bn of equities during the month of November.

Our data has them buying a lot of that back, with $35bn demand over the next week flat tape ($7bn a day is not small)

Precious Metals Demand

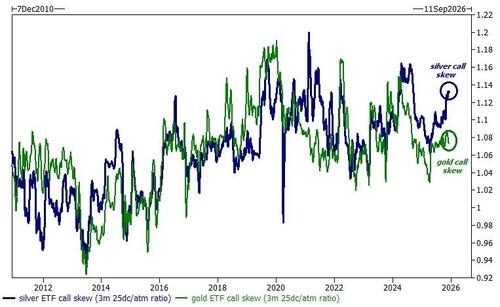

The futures desk highlights the demand for silver from the investing community.

Total ETF holdings is above the October high, futures open interest has continued to move higher, and call vols are extremely bid.

Silver and gold call skews have historically traded together as “precious metal” safe haven, recently the upside wing in Ag is decoupling vs Au (hat tip to periodic table knowledge, reminder i was pre-med for a semester, nbd)

There is a large commodity index rebalance in january, you should be aware and gs colleagues have done analysis (just ask)

Panic, What Panic?

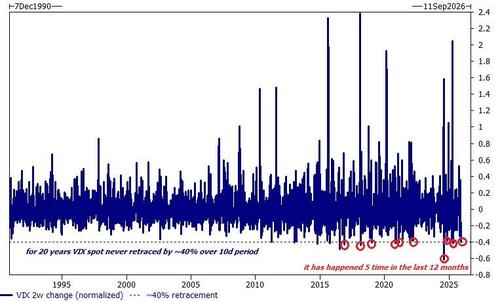

I am amazed at the speed by which fear gets priced in and priced out in the modern market (this isn’t your grandparent’s VIX).

Prior to 2011 the VIX index never retraced ~40% of spot in a two week period (ie, if vol went bid it stayed bid for a while).

What was once unheard of, highlight this dramatic retrace has already happened five times in the last twelve months (ie, market panics, vol goes bid, the risk is “sorted out” and vega/gamma supply takes over en masse)

Somebody “do something”

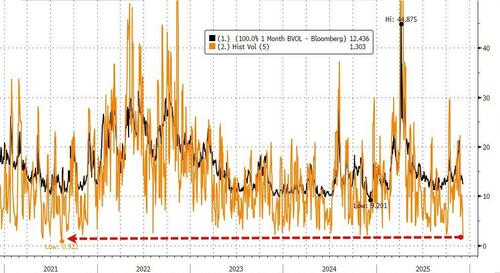

Last week saw one of the least volatile five day periods in history.

Bbg has S&P 500 five day realized vol at 1.3 as of Friday close...

This is the 0.2 percentile on a 10y lookback.

The S&P Friday straddle (including Jerome) is 1.3%.

Dispersion

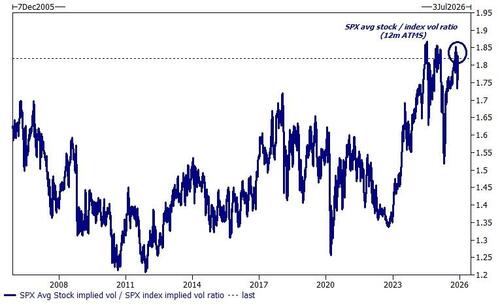

Increased dispersion is on a lot of 2026 market outlooks.

The market is already pricing this in.

The “avg stock” in the spx trades at almost double the implied vol of the index itself , one of the highest ratios in two decades

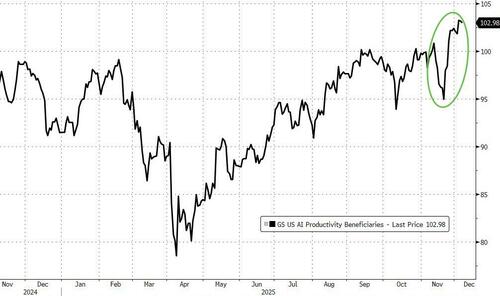

AI's Next Derivative

We launch the gs AI productivity basket this week which is comprised of non-Tech and non-AI companies that have mentioned plans to improve internal workflows / productivity.

GSXUPROD is the ticker … composed of banks, insurance co, retailers, warehouse logistics, transportation, healthcare services, and restaurants

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal