NS

NSEquities mixed but mostly stabilised following further tech-led selloff stateside - Newsquawk EU Market Open

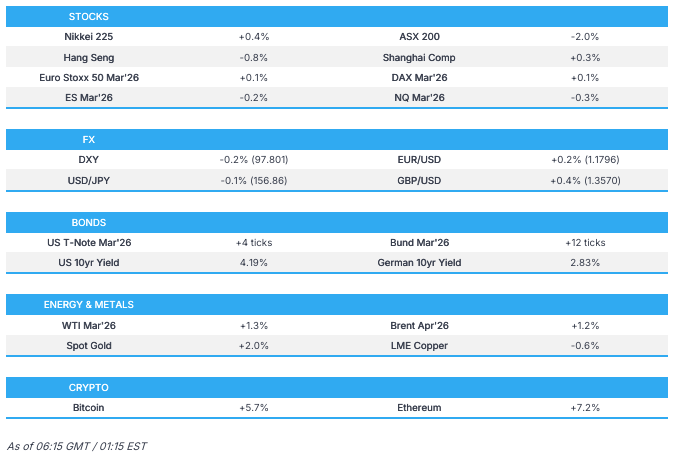

- APAC stocks were ultimately mixed after the global market rout rolled over into the region following the continued tech woes stateside and weak US labour market data.

- US equity futures were lower but off worst levels with headwinds seen after Amazon shares dropped 10% post-earnings.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with losses of 0.8% on Thursday.

- RBI maintained its Repurchase Rate at 5.25%, as expected, via a unanimous decision and voted to maintain its neutral policy stance; Banxico held rates at 7.00%, as expected, in a unanimous decision.

- Looking ahead, highlights include German Trade Balance (Dec), Swedish CPIF prelim. (Jan), Swiss Unemployment (Jan), Canadian Jobs Report (Jan), US Prelim. Michigan (Feb), ECB Survey of Professional Forecasters. Speakers include ECB’s Cipollone, BoE’s Pill & Fed's Jefferson.

- Earnings from Biogen, Under Armour, Carlyle Group and Philip Morris International.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were sold on Thursday with the majority of sectors red, primarily led by consumer discretionary, materials and technology. Big tech valuations remain a key concern this earnings season, with Amazon (AMZN) pressured heading into its earnings after-hours, while Google (GOOGL) was sold after boosting its CapEx view, albeit the stock did close well off its earlier lows.

- Furthermore, Microsoft (MSFT) slumped after a downgrade at Stifel, and software names continued to decline after Anthropic announced the Claude Opus 4.6 AI model, adding more pressure to the recently beaten-up sector. Aside from tech woes, risk sentiment was also weighed on by weak labour market data in the US.

- SPX -1.23% at 6,798, NDX -1.38% at 24,549, DJI -1.20% at 48,909, RUT -1.79% at 2,578.

- Click here for a detailed summary.

TARIFFS/TRADE

- US is to scrap reciprocal tariffs on 1,675 Argentine products.

- White House Press Secretary said she does not have a timeline regarding South Korea tariffs. In relevant news, South Korea's Foreign Minister said South Korea is not intentionally delaying US investment, while a South Korean official said the US is taking necessary steps regarding the issue of South Korea being on sensitive country lists.

- South Africa's Trade Minister said they signed a framework economic partnership with China, while the agreement will be followed by an early harvest agreement by the end of March 2026, which will then see China provide duty-free access to South African exports.

NOTABLE HEADLINES

- Fed's Bostic said inflation is too high for too long, and it is important to keep policy moderately restrictive. Bostic added that if the Fed is going to do its job well, it has to think about issues over the long run and that other officials, such as those in Congress, have shorter horizons.

- US President Trump announced the launch of the TrumpRx.gov website and said prescription drugs will be available tonight on the website, while he added that 16 of the 17 largest pharmaceutical companies have signed agreements.

- White House Press Secretary said regarding the DHS, that they are willing to discuss some of the Democrats' demands.

NOTABLE US EARNINGS

- Amazon (AMZN) Q4 2025 (USD): EPS 1.95 (exp. 1.96), Revenue 213.4bln (exp. 211.42bln). Q1 operating income 16.5-21.5bln (exp. 22.2bln). 2026 capex about 200bln (exp. 146.11bln). Shares fell 10%.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed after the global market rout rolled over into the region following the continued tech woes stateside and weak US labour market data. Nonetheless, most of the regional benchmark indices are well off their worst levels, as the early sell-off gradually stabilised.

- ASX 200 was among the underperformers with the index dragged lower by heavy tech losses, and with sentiment also not helped by M&A-related disappointment after the proposed Rio Tinto-Glencore merger fell through, while there were comments from RBA Governor Bullock, who noted the RBA board is not happy with inflation and the prospects of getting it down.

- Nikkei 225 initially declined amid the broad risk-off mood and disappointing Household Spending data, but then recovered as sentiment improved and with participants awaiting the snap election on Sunday, where the ruling bloc is widely anticipated to achieve a landslide victory.

- Hang Seng and Shanghai Comp were mixed amid a lack of fresh pertinent catalysts and with the mainland clawing back all of its early losses following another two-pronged liquidity operation by the PBoC utilising both 7-day and 14-day reverse repos.

- US equity futures were lower but off worst levels with headwinds seen after Amazon shares dropped 10% post-earnings.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with losses of 0.8% on Thursday.

FX

- DXY marginally pulled back after gaining against its peers yesterday amid haven appeal and as the buck continued to nurse some of its YTD weakness, with momentum following the Warsh Fed Chair nomination remaining intact yesterday, despite the slew of weaker-than-expected labour market metrics.

- EUR/USD eked slight gains and retested the 1.1800 level, albeit with price action contained following the uneventful ECB policy announcement in which the central bank maintained rates, as expected, and reiterated it is not pre-committing to a particular rate path with policy to remain data-dependent and meeting-by-meeting.

- GBP/USD regained some composure after the prior day's underperformance, which was caused by the BoE's dovish vote split.

- USD/JPY ultimately declined, but with price action choppy ahead of the election on Sunday and following disappointing Household Spending data from Japan, while BoJ's Masu reiterated that the central bank will raise rates if the economy and prices are in line with the BoJ's outlook.

- Antipodeans rebounded from a weekly trough as the early sell-off in metals and stocks gradually stabilised.

- PBoC set USD/CNY mid-point at 6.9590 vs exp. 6.9517 (Prev. 6.9570).

- Banxico held rates at 7.00%, as expected, in a unanimous decision. Governing Board deemed it appropriate on this occasion to pause the rate-cutting cycle, consistent with the assessment of the current inflationary outlook. Looking ahead, the Board will evaluate additional reference rate adjustments (prev. Looking ahead, the Board will evaluate the timing for additional reference rate adjustments).

FIXED INCOME

- 10yr UST futures held on to gains after bull steepening in the wake of soft labour market metrics, in which Challenger Layoffs, Initial Jobless Claims, JOLTS Job Openings, and the Revelio Labs US Jan Non-farm Jobs numbers all showed a deterioration.

- Bund futures remained afloat after the prior day's advances but with further upside capped following a lack of fireworks at the recent ECB meeting and with German trade data scheduled later.

- 10yr JGB futures were indecisive and traded on both sides of the 132.00 level following weaker-than-expected Household Spending data and ahead of the Japanese election, while there were also comments from BoJ's Masu, who stated that an appropriate and timely rate hike is needed.

COMMODITIES

- Crude futures were initially lacklustre after retreating yesterday alongside the sell-off in risk assets and with participants looking ahead to US-Iran talks scheduled in Oman, but then gradually edged higher as sentiment gradually recovered.

- Saudi Arabia cut the price of its Arab Light grade to Asia by 30 cents a barrel to parity with Oman/Dubai for March, while it set the OSP to NW Europe at minus USD 0.65/bbl to Ice Brent settlement and set the OSP to US at plus USD 2.10/bbl vs ASCI.

- Mexico is reportedly evaluating how to send fuel to Cuba while avoiding US tariffs

- Spot gold declined in early Asia-Pac trade alongside a 9% slump in silver prices, but then staged a recovery with the precious metals ultimately higher on the day.

- Copper futures remained subdued following a 2-day losing streak and temperamental risk tone.

CRYPTO

- Bitcoin saw two-way price action in which prices initially dipped to below the USD 61,000 level amid early pressure across risk assets, but then recovered as sentiment gradually improved with prices returning to north of USD 64,000.

NOTABLE ASIA-PAC HEADLINES

- China's Ministry of Agriculture issued an implementation plan to advance rural revitalisation and agricultural modernisation.

- BoJ board member Masu said the central bank is closely watching FX market moves and their impact on the economy and prices, while he noted that an appropriate and timely rate hike is needed. Furthermore, he said the BoJ will raise rates if the economy and prices are in line with the BoJ's outlook, and noted that the real interest rate remains at a significantly negative level in Japan. He is convinced that continuing with further policy interest rate hikes will be needed to complete the normalisation of monetary policy in Japan.

- RBA Governor Bullock said much of the recent increase in inflation is judged to be temporary, but some of it seems to be persistent, while she added that the board will be monitoring closely the extent to which the strong inflation we have observed is persistent or temporary. Bullock also stated that the labour market is still doing very well, but noted that the RBA board is not happy with inflation and the prospects of getting it down.

- RBI maintained its Repurchase Rate at 5.25%, as expected, via a unanimous decision and voted to maintain its neutral policy stance. RBI stated that the current policy rate is appropriate, and underlying inflation remains low, while the Indian economy is on a steady and improving trajectory, but noted that external headwinds intensified since the last meeting. Furthermore, Governor Malhotra stated that net external demand remains a drag, rural demand remains steady, and the recovery in urban consumption is to strengthen, while the central bank lifted its FY26 CPI inflation forecast to 2.1% from 2.0%.

DATA RECAP

- Japanese Household Spending MoM (Dec) M/M -2.9% vs. Exp. -1.3% (Prev. 6.2%)

- Japanese Household Spending YoY (Dec) Y/Y -2.6% vs. Exp. 0% (Prev. 2.9%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said in closed sessions of the Knesset that political, military and economic factors brought Iran closer to a critical point, although he did not consider the fall of the government to be certain, while he warned that any Iranian attack would be met with a "strong response".

- White House Press Secretary said diplomacy will be the focus in talks with Iran, and that Trump wants to see if a deal can be struck, although the US also reminded the Iranian regime that President Trump has many options besides diplomacy.

- Iranian Foreign Ministry spokesman Baghaei hopes the US side would also take part with responsibility, realism and seriousness, while he added that they have a responsibility not to miss any opportunity to use diplomacy to secure Iran's national interests and regional peace and stability.

- Iran deployed an advanced long-range ballistic missile, Khorramshahr 4, at an underground facility, while the missile has a range of 2,000km and is capable of carrying a 1,500kg warhead, according to Iranian press.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said the next round of talks on Ukrainian settlement is likely to take place in the US.

- US envoy Witkoff said Ukraine discussions were constructive and focused on how to create the conditions for a durable peace, while delegations agreed to report back to their respective capitals to continue trilateral discussions in the coming weeks. Witkoff stated they had a wide range of discussions on the remaining issues, including methods to implement a ceasefire and monitor the cessation of military activities, and noted Russia and Ukraine will exchange 157 PoWs.

- US Treasury Secretary Bessent said he continues to believe that Russian President Putin is a war criminal and stated that further Russian sanctions depend on the peace talks.

- US President Trump posted "Rather than extend “NEW START” (A badly negotiated deal by the United States that, aside from everything else, is being grossly violated), we should have our Nuclear Experts work on a new, improved, and modernized Treaty".