Equity Bullishness Reaches YTD Highs; Gold's Still Shiny But AI Hype Fades For Goldman Clients

Climbing down from the uber-bullish views of the past few months, Goldman Sachs global head of content strategy, market analytics and data science, Oscar Ostlunnd, points out that investors' AI outlook seems much more balanced.

A healthy share of investors are now more circumspect of the ROI given the high costs and increasing competition.

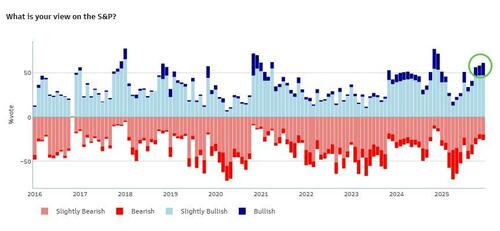

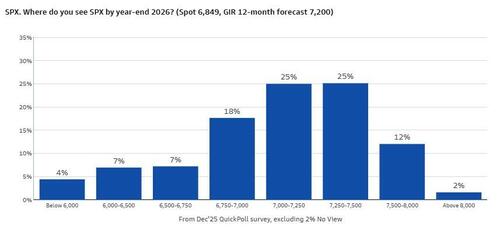

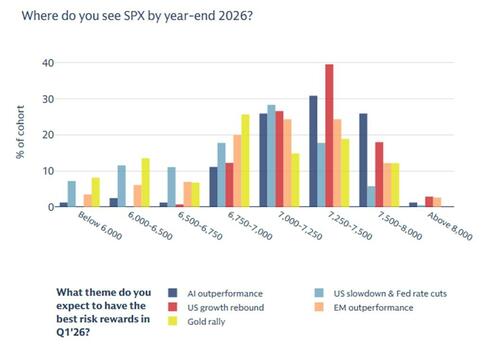

Yet, SPX sentiment hit a new high for the year!

Indeed, investors are increasingly comfortable with a jobless growth rebound in the US, pushing the Fed to continue easing in a non-recessionary environment: a historically-bullish setup.

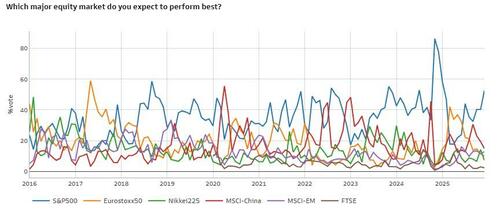

The positive sentiment is centered around the US - Europe and China equities saw a sharp drop in favorability.

1/ Santa Jay?

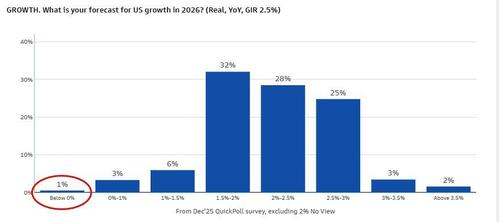

While investors' AI views have seemingly become more balanced, views on the US economy have been upgraded. With only 1% seeing a recession in 2026 and 10% expecting below 1.5% growth, the institutional investor base largely expects an easing cycle in a non-recessionary environment. This has historically been a very supportive environment for asset prices.

Few investors expect growth below 1.5% in 2026.

In addition, the December Fed is by now widely expected to be a hawkish cut, setting a high bar for Chair Powell to knock this market off kilter.

2/ Jobless Recovery

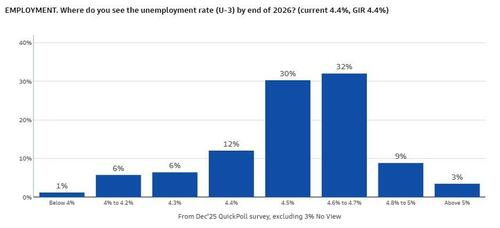

74% of investors expect continued moderate rise in unemployment. As companies cite AI-driven (real or hoped) efficiencies as the rationale for job cuts and slowed hiring, the US economy is expected to rebound into a "jobless recovery".

But the risk in the coming months is for unemployment to overshoot current expectations and trigger the "Sahm rule".

Despite the constructive growth view, the rise in unemployment is the biggest unknown.

"Our view has been that a faster rise in the unemployment rate that brings recession fear back into focus is still the key macro risk to the equity picture.

I think the window of peak risk is likely the next few months and the risk for 2026 will probably diminish if we haven't seen a crack in the jobs market by then.

I would put that risk higher than the 12pct who see a proper rise in the unemployment rate next year and I'm surprised only 3pct think the unemployment rate will be above 5pct. That reinforces my view that even though it's a tail, it's a good tail to hedge."

- Dominic Wilson, GIR's Senior Macro Advisor.

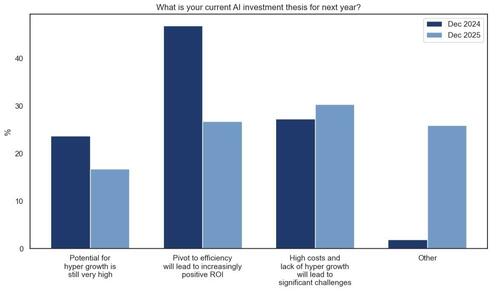

3/ More differentiation in a bullish AI setup

Investors continue to largely subscribe to the AI narrative, although they see increased risk factors leading to a more differentiation across the sector. We agree, as the AI infrastructure investment boom is indeed still going strong. And now with an added government support, we are still far from seeing the end of it.

While US stocks are likely to maintain an upward trajectory, AI-bullishness is no longer expected to be the sole driver.

"The results show the underlying conflict that clients have had for the past few months.

At the end of October, most of our client base wanted to position for a year-end rally given 4 key factors:

1) the Fed was dovish / cutting into an ok growth outlook

2) the 2026 EPS story was intact

3) the AI story was intact and

4) year-end seasonals were positive.

Here we are at the beginning of December and after the events of November, it feels that clients have a more cautious posture.

While most people still believe that SPX will be higher next year, the price targets are much more conservative (a month ago, people thought 7200 by this year-end!).

There is also growing belief that upside will broaden to non-AI sectors, as there is concern in our conversations about the ROI and capex picture of the AI story.

We think clients are still overweight AI and need to see confirmation of a reaccelerating economy before fully rotating into cyclicals."

- Shawn Tuteja, Head of ETF and Custom Baskets Vol Trading.

4/ Not over their skis (yet)

We've highlighted over the past few months how FOMO drove investors into the AI complex, turning into a strong tailwind for the US stock market.

It also meant that investors were less likely to cut risk in a hurry.

The November wobbles confirmed that investors are by no means stretched here.

The recent correction was so small, it did not even make it into the top 15 of the largest SPX corrections of the last 10 years.

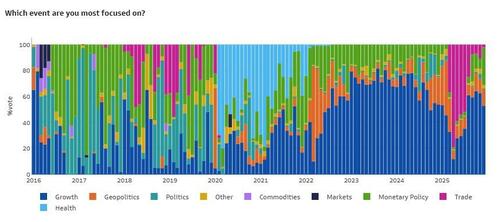

5/ Return of monetary policy

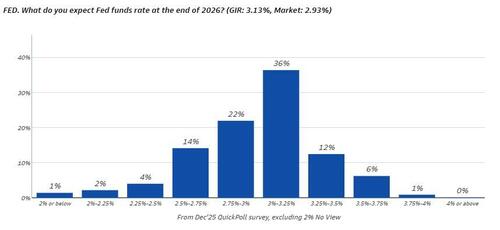

With the Fed at a pivot point again, focus on monetary policy reached a three-year high this month. Investors are weighing the upcoming FOMC decision and the impending change in Fed's leadership next year.

Our UST sales desk points out the rates market has steadily put in premium for a more dovish Fed Chair for the past couple of weeks.

"Our working assumption is that the FOMC slows the pace of easing in 2026H1, pausing in January but still delivering two more cuts in March and June which push the funds rate down to a terminal level of 3-3.25%."

- Jan Hatzius, Chief US Economist

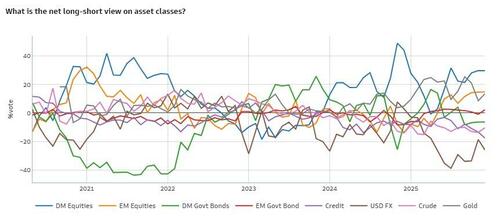

6/ From fiscal to credit expansion

The market is gearing up for a paradigm shift in the growth cycle, from fiscal expansion to credit expansion.

This is mostly seen in the growing short credit conviction which reached an all-time high in our poll's history.

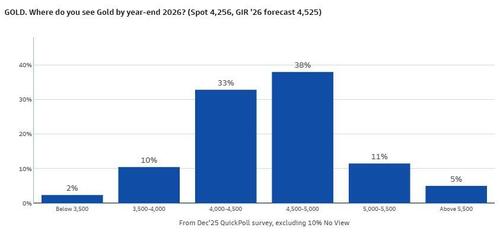

7/ Gold's still shiny, just not as sparkly

Investors expect Gold to continue to climb next year, although at a slower pace (only 16% see it above $5,000 at yearend 2026).

While bullishness seems relatively intact, conviction has fallen. Many investors see better opportunities in DM and EM equities.

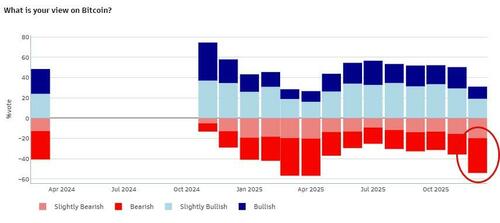

8/ Crypto washout

A familiar story is playing out in crypto markets where the rapid drop is revealing the weaker hands in the market.

The bearish turn in sentiment most likely lead to institutional investors sitting out the market until we've seen signs of capitulation.

9/ EM & Carry

Easier monetary policy, firm growth and low volatility is the dream environment for carry traders.

EMFX is where we expect USD weakness to concentrate and EM Equities to continue to have strong sponsorship in the survey (worth noting the stellar performance of MSCI EM this year).

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal