Euphoria In Japan At Risk With Sky-High Valuations

By Hideyuki Sano, Bloomberg Markets Live reporter and strategist

Valuations in Japanese stocks are the highest in decades as a “Buy Japan” rally took off after Prime Minister Sanae Takaichi’s decisive election victory, leading investors to question how much upside remains.

The Topix now trades around 18 times expected earnings for the next 12 months. Notwithstanding times of extreme market stress, such as the pandemic, that’s the highest multiple since 2007 and well above its historical range of 12 to 16 times.

“The Topix has risen to a level that is explicable only if one factors in profit growth not just for fiscal 2026, but also for fiscal 2027,” Masatoshi Kikuchi, chief equity strategist at Mizuho Securities, said in a report.

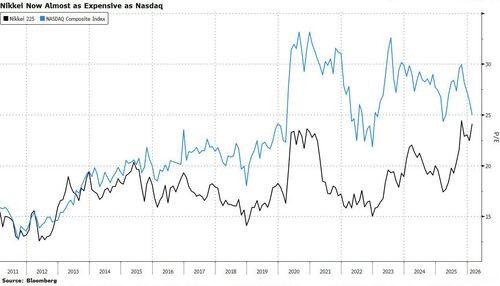

Even more striking is the valuation of the tech-heavy Nikkei 225 Stock Average. Its price to earnings ratio stands at 24.3 times its expected earnings per share, a whisker away from the Nasdaq Composite’s 24.9 multiple — one of the richest valuations among major global equity indexes.

Goldman Sachs Group Inc., Morgan Stanley and JPMorgan have upgraded their views on Japan in recent days. The sharp bullish upturn since the election has strategists pointing to the potential for renewed inflows from global investors seeking to diversify away from US-heavy portfolios.

“People have come up with various explanations to justify such a high premium,” said Teruhiko Nishimura, CEO of hedge fund RFM Corp. But “even if you price in the earnings growth in the next two years, the maximum you could expect in the Nikkei would be around 58,500,” he said.

That level represents just a 2.4% upside from the Nikkei’s close at 57,143.84 on Wednesday.

Goldman expects the Topix to trade as high as 18.9 times its forward earnings over the next six months, near its 2005 peak of 19 following former premier Junichiro Koizumi’s landslide victory.

Bulls argue that Japanese equities are no longer constrained by the old valuation regime, with the return of inflation making it easier for investors to anticipate steadier earnings growth.

Takaichi’s new super-majority has a “broadly equity market friendly agenda,” said analysts at Morgan Stanley, including Sho Nakazawa. “This will drive rising global and investor confidence in the long-run.”

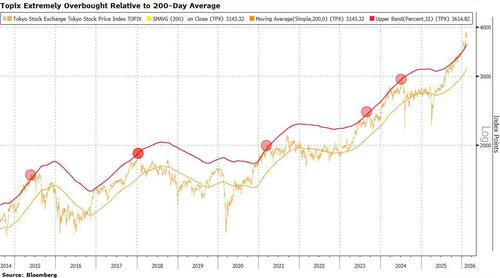

Still, the market looks overbought. The Topix is trading at 21% above its 200-day moving average, way above the 15% mark which often preceded pullbacks in the past.

The Topix reached a market value of over ¥1,300 trillion ($8.5 trillion) last week, almost double Japan’s nominal GDP of almost ¥670 trillion.

“We may have exceeded the speed limit,” said Masayuki Murata, general manager of balanced portfolio investment at Sumitomo Life Insurance Co.