NS

NSEuropean equities hold steady amid quiet APAC session - Newsquawk EU Market Open

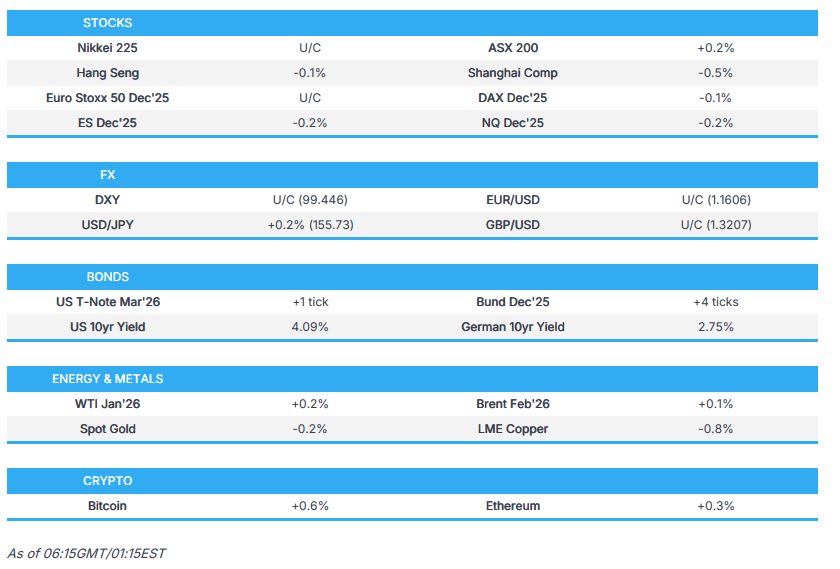

- APAC stocks were predominantly in the green as the region shrugged off the weak lead from Wall Street, but with the upside capped amid quiet macro catalysts and in the absence of any tier-1 data.

- White House said the administration is very optimistic about Ukraine and had very good talks with the Ukrainian delegation.

- White House confirmed a meeting on Monday between US President Trump and the national security team regarding Venezuela, while it stated that many options are on the table.

- UK PM spokesperson said PM Starmer has full confidence in Chancellor Reeves.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures U/C after the cash market closed flat on Monday.

- Looking ahead, highlights include EZ Flash CPI (Nov), Unemployment Rate, US RCM/TIPP Economic Optimism, BoE FSR, Supply from UK & Germany, Earnings from Marvell & CrowdStrike.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished the first session of December in the red following a choppy session with equity futures initially sold alongside caution in APAC trade in response to soft China PMIs, while pressure then continued once Europe arrived, with the DAX lagging amid a downward revision to the German manufacturing PMI. However, around the opening bell, the risk tone in equities started to improve throughout the afternoon, before fading into the closing bell.

- SPX -0.53% at 6,813, NDX -0.36% at 25,343, DJI -0.89% at 47,289, RUT -1.25% at 2,469.

- Click here for a detailed summary.

TARIFFS/TRADE

- Chinese rare-earth magnet companies are reportedly finding workarounds to their government’s export restrictions, as they seek to keep sales flowing to Western buyers, according to WSJ.

- EU dropped its complaint against Chinese trade curbs on Lithuania at the WTO.

- UK PM Starmer urged UK businesses to boost trade with China despite security threats, according to FT.

NOTABLE HEADLINES

- White House said US President Trump will hold a cabinet meeting on Tuesday and will make an announcement on the Trump Accounts, while President Trump's schedule noted he will host a Cabinet meeting on Tuesday at 11:30EST/16:30GMT and will make an announcement at 14:00EST/19:00GMT.

- Fed Vice Chair of Supervision Bowman said it is important to finish Basel III, while she added they are working on a G-SIB surcharge.

APAC TRADE

EQUITIES

- APAC stocks were predominantly in the green as the region shrugged off the weak lead from Wall Street, but with the upside capped amid quiet macro catalysts and in the absence of any tier-1 data.

- ASX 200 eked mild gains with the help of outperformance in energy, resources and mining, but with gains limited by underperformance in tech and utilities, while data was uninspiring with a larger-than-expected contraction in building approvals.

- Nikkei 225 nursed some of the prior day's losses but with the rebound contained amid risks of a BoJ December hike.

- Hang Seng and Shanghai Comp mostly traded mixed as participants reflected on a slew of monthly auto sales updates, while the mainland lagged after the PBoC's open market operations resulted in a net daily drain of CNY 146bln.

- US equity futures lacked direction with price action contained following yesterday's choppy performance.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures U/C after the cash market closed flat on Monday.

FX

- DXY struggled for direction after the prior day's flat performance amid a lack of major pertinent catalysts and following the recent ISM Manufacturing PMI report, which showed a surprise decline in the headline, indicating a worsening outlook for the sector amid further contractions in New Orders and Employment, although Prices Paid was firmer than expected.

- EUR/USD traded sideways overnight after recent swings and as ECB rhetoric continued to underscore the unlikelihood of any near-term policy adjustments, while participants look ahead to flash CPI data from the bloc.

- GBP/USD lingered near Monday's trough after recent whipsawing and despite the UK and US agreeing to a zero-tariff pharma deal, although the deal called for the NHS to increase the net price it pays for new medicines by 25%.

- USD/JPY gradually clawed back most of yesterday's losses and regained a firm footing at the 155.00 handle.

- Antipodeans conformed to the uneventful picture across the FX space in the absence of tier-1 data, although AUD/USD gradually edged higher amid the mostly constructive mood.

- PBoC set USD/CNY mid-point at 7.0794 vs exp. 7.0746 (Prev. 7.0759)

FIXED INCOME

- 10yr UST futures saw some slight reprieve from the prior day's selling after pressure was seen across the curve yesterday, with global fixed income weighed on by the recent comments from BoJ Governor Ueda, who hinted about a December rate hike, while Treasuries were also not helped by a slew of corporate issuances and as rising crude prices bolstered inflation expectations.

- Bund futures languished at yesterday's trough after suffering from the global bond selling.

- 10yr JGB futures nursed some on the recent losses with mild support seen in the aftermath of the latest 10yr JGB auction, which attracted higher demand but resulted in lower accepted prices.

COMMODITIES

- Crude futures took a breather after gaining yesterday, following the OPEC+ decision to maintain output throughout Q1 2026 and continued Ukrainian attacks on Russian oil refineries. Also on the geopolitical front, President Trump was reported to hold a meeting with the national security team on Venezuela in which many options were said to be on the table.

- Spot gold mildly retreated and briefly tested the USD 4,200/oz level to the downside with headwinds seen as copper and silver prices pulled back from recent peaks.

- Copper futures trickled lower with LME prices on a comedown from record highs, despite the mostly positive risk tone.

CRYPTO

- Bitcoin clawed back some of its recent losses, albeit in a choppy fashion and returned to above the USD 87,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBNZ Governor Breman said she will discuss with the MPC the possibility of being more transparent with how members vote, while she added that the mandate is very clear that we should focus on keeping inflation low and stable. Breman said that they aim to support a healthy, strong and growing economy, but keep inflation low and stable. It was separately reported that the RBNZ is to begin weekly open-market operations from December 4th and will update changes to the format in Q1 2026.

DATA RECAP

- Australian Current Account Balance (AUD)(Q3) -16.6B vs. Exp. -13.3B (Prev. -13.7B)

- Australian Net Exports Contribution (Q3) -0.1% vs. Exp. -0.1% (Prev. 0.1%)

- Australian Building Approvals (Oct) -6.4% vs. Exp. -4.5% (Prev. 12.0%, Rev. 11.1%)

GEOPOLITICS

MIDDLE EAST

- US President Trump held a phone call with Israeli PM Netanyahu and invited him to the White House in the near future.

- Arab media reported new Israeli attacks in Khan Yunis and Rafah, according to Iran International.

RUSSIA-UKRAINE

- White House said the administration is very optimistic about Ukraine and had very good talks with the Ukrainian delegation.

- French President Macron discussed the situation in Ukraine with US President Trump and emphasised the central importance of the security guarantees needed for Ukraine.

- European Commission President von der Leyen said the situation at the border with Belarus is worsening, and the EU is preparing further measures under its sanctions regime.

- Russian Foreign Minister Lavrov is to meet with Chinese Foreign Minister Wang Yi on Tuesday.

OTHER

- White House confirmed a meeting on Monday between US President Trump and the national security team regarding Venezuela, while it stated that many options are on the table and that War Secretary Hegseth spoke with members of Congress over the weekend regarding Venezuelan strikes.

- Venezuelan President Maduro reportedly asked for sanction removal for more than 100 officials during a previous call with US President Trump. Furthermore, Trump gave Maduro a Friday deadline to leave Venezuela with his family, while the failure to meet the Friday deadline prompted Trump's comments on Saturday about the closure of airspace, according to sources cited by Reuters.

- US Treasury Secretary Bessent said the Treasury is investigating allegations that Minnesota tax dollars may have been diverted to Al-Shabaab.

- China's Coast Guard said it expelled a Japanese vessel in the waters of the Senkaku Islands on Tuesday.

EU/UK

NOTABLE HEADLINES

- UK PM spokesperson said PM Starmer has full confidence in Chancellor Reeves.

- UK OBR Chair Hughes has written to submit resignation following the Budget day publishing error.

- Confederation of British Industry said Britain's private sector expects output to decline during the next three months in the gloomiest outlook since May as cautious consumer spending and cost pressures continue to weigh on businesses.

- ECB's Kocher said slight deviations above or below the 2% target should not trigger any need for action on rates now, while Kocher added that they should keep enough powder dry to be able to react quickly if necessary, according to the Kurier newspaper.

DATA RECAP

- UK BRC Shop Price Index YY (Nov) 0.6% (Prev. 1.0%)