NS

NSEuropean equities look to open higher, boosted by LVMH/ASML earnings & Powell speak - Europe Marker Open

- APAC stocks were mostly higher as expectations for incoming Fed rate cuts helped the region shrug off the mixed lead from Wall St.

- Fed Chair Powell said downside risks to the US jobs market have risen and rising risks to the job market justified a September interest rate cut.

- US President Trump announced he is considering terminating business with China regarding cooking oil.

- European equity futures indicate a firm cash market open with EuroStoxx 50 future up 1.2% after the cash market closed with losses of 0.3% on Tuesday.

- DXY is softer and now basically flat on the week, AUD is attempting to atone for recent losses, EUR/USD sits on a 1.16 handle.

- Looking ahead, highlights include EZ Industrial Production (Aug), NY Fed Manufacturing (Oct), Cleveland Fed CPI (Sep), US Military Pay Date, Fed Beige Book, (Suspended Releases: US CPI), BoE’s Ramsden & Breeden, ECB’s de Guindos, Lane & Lagarde, Fed’s Miran, Bostic, Waller & Schmid, RBA’s Bullock & Kent, Supply from UK & Germany.

- Earnings from ASML, Bank of America, Morgan Stanley, Dollar Tree & Progressive.

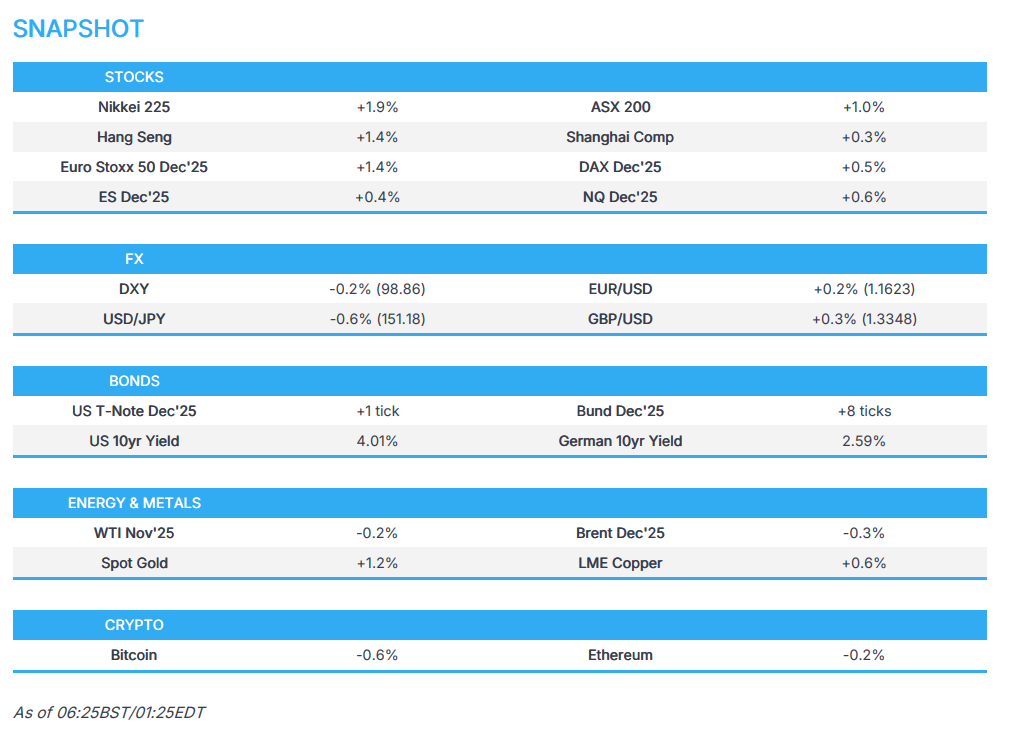

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy with early pressure amid the heightened US/China tensions and mixed US bank earnings, while indices then reversed through the majority of the US session, before once again falling near the close as Trump upped his rhetoric on China, in which he threatened to terminate business with China related to cooking oil. As such, sectors ended mixed with Tech and Consumer Discretionary the laggards, while Consumer Staples and Industrials outperformed.

- SPX -0.16% at 6,644, NDX -0.69% at 24,579, DJI +0.44% at 46,270, RUT +1.38% at 2,495.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said he is considering terminating business with China having to do with cooking oil, and other elements of trade, as retribution for purposefully not buying US soybeans.

- US President Trump earlier said they have to be careful with China and that he has a great relationship with President Xi, while he added that sometimes it gets testy, but stated they have a fair relationship with China. Furthermore, Trump said he is thinking about giving Spain trade punishment.

- USTR's Greer said they have had constructive talks with China over the past six months and that China's rare earths measures are disproportionate, while he thinks they will be able to work through issues with China over rare earth supply chains. Furthermore, he said the November 1st tariffs depend on what China does and that 100% US tariffs on China could come sooner.

NOTABLE HEADLINES

- Fed Chair Powell said the future path of monetary policy is driven by data and risk assessments, while data before the shutdown suggested growth may be better than expected. Powell said downside risks to the US jobs market have risen and rising risks to the job market justified a September interest rate cut, as well as noted that available data shows tariffs are pushing up price pressures. Furthermore, he said they may be approaching the end of balance sheet contraction in the coming months and that officials will be discussing the composition of the balance sheet.

- Fed's Collins (2025 voter) said even with some additional easing, monetary policy would remain "mildly restrictive" and it seems "prudent" to cut rates further given lower inflation risks and job market concerns. Collins stated that inflation should begin to ease as tariff impact wanes and downside risks to the job market have risen, but noted that favourable financial conditions will support households, and she expects more growth, a small climb in unemployment, and elevated inflation. Furthermore, she said inflation risks have become more contained, but tariffs will still push up prices, as well as stated that policy is not on a pre-set path and there are scenarios that would keep rates steady.

- Fed Discount Rate Minutes stated that Federal Reserve Bank directors generally reported stable economic conditions, but most also noted softening labour markets, weaker consumer demand, and continued uncertainty related to tariffs.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher as expectations for incoming Fed rate cuts helped the region shrug off the mixed lead from Wall St and the latest salvo in the US-China trade spat, in which President Trump announced he is considering terminating business with China regarding cooking oil.

- ASX 200 climbed higher with the advances led by healthcare, materials and financials, with the latter helped by gains in Westpac after Australian regulator APRA removed the remaining AUD 500mln capital add-on applied to Westpac.

- Nikkei 225 reclaimed the 47,000 status with the index unfazed by a firmer currency and political uncertainty in Japan.

- Hang Seng and Shanghai Comp conformed to the positive sentiment in the region, but with gains severely limited in the mainland following the recent mixed messages by the US regarding the trade dispute with China, while participants also digested the latest inflation data from China, which showed CPI was softer-than-expected, and that both consumer and factory gate prices remained in deflation.

- US equity futures (ES +0.4%, NQ +0.5%) treaded water following the prior day's mixed performance and after earnings season got underway.

- European equity futures indicate a firm cash market open with EuroStoxx 50 future up 1.2% after the cash market closed with losses of 0.3% on Tuesday.

FX

- DXY mildly softened with headwinds following the latest salvo in the US-China trade dispute, in which US President Trump said they are considering terminating business with China regarding cooking oil, and other elements of trade, as retribution for purposefully not buying US soybeans. Participants also reflected on the latest comments from Fed officials, with Fed Chair Powell the main highlight, in which he noted that downside risks to the US jobs market have risen and that they may be approaching the end of balance sheet contraction in the coming months, with officials to discuss the composition of the balance sheet.

- EUR/USD eked slight gains above the recently reclaimed 1.1600 level amid the softer buck and with France's socialist party providing PM Lecornu a lifeline, in which it announced it would not vote to oust him after he suspended pension reform, while there were several comments from ECB officials but had little impact.

- GBP/USD continued to recoup the prior day's initial losses that were triggered by disappointing UK jobs data, which BoE Governor Bailey said supports his view of a softening labour market, while it was reported that Chancellor Reeves is seeking to revive plans for an overhaul of tax-free ISAs in an effort to divert billions of savings from cash into domestic stocks.

- USD/JPY trickled lower to test the 151.00 level amid the pressure in the dollar and as longer-end yields in Japan softened.

- Antipodeans edged higher amid the mostly positive risk appetite and as CNH benefitted after the PBoC strengthened the USD/CNY fix to beneath the 7.10 handle.

FIXED INCOME

- 10yr UST futures kept afloat and took a breather after the previous day's positive, but choppy performance, in which prices ultimately gained amid US-China tensions and after Fed Chair Powell suggested they were nearing the end of the balance sheet drawdown.

- Bund futures held on to recent gains, albeit with further upside capped heading into today's Bund issuances.

- 10yr JGB futures struggled for direction with some slight curve flattening heading into the 20yr JGB auction which saw mixed results with a lower bid-to-cover ratio and higher accepted prices.

COMMODITIES

- Crude futures were lacklustre after declining yesterday amid US-China trade tensions and with IEA lowering its 2025 world oil demand growth forecast, while it also noted the world oil market faces a surplus of almost 4mln BPD next year as OPEC+ producers and non-OPEC rivals raise output and demand remains sluggish. Nonetheless, the downside was limited overnight amid the improved sentiment across the Asia-Pac region and with the weekly oil inventory data delayed for a day owing to the recent Columbus Day holiday.

- Spot gold extended on record highs amid the recent US-China frictions and anticipation of incoming Fed rate cuts.

- Copper futures traded rangebound following the prior day's declines and recent mixed messaging from the US regarding the trade tiff with China.

CRYPTO

- Bitcoin was choppy and traded on both sides of the USD 113k level before retreating to session lows.

NOTABLE ASIA-PAC HEADLINES

- Japan Parliamentary Committee failed to agree on holding an election to choose the next PM on October 21st.

- RBA Assistant Governor Hunter said recent data has been a little stronger than expected and inflation is likely to be stronger than forecast in Q3, while she added the labour market and economic conditions might be tighter than assumed. Furthermore, she stated that employment growth has slowed by more than expected and uncertainty about the global outlook remains elevated, as well as noted that the Board will adjust policy as appropriate as new information comes to hand.

- RBNZ Chief Economist Conway said they do not expect to use additional monetary policy (AMP) tools again anytime soon, while he added they will continue to update their approach to remain as prepared as possible to help New Zealand weather whatever economic storms come their way. Conway also announced that the RBNZ reviewed the frequency of its monetary policy decision announcements and acknowledged the perception that the gap between the November MPS and February MPS is too long, while they are to reduce that gap over the 2026/2027 period.

DATA RECAP

- Chinese CPI MM (Sep) 0.1% vs. Exp. 0.2% (Prev. 0.0%)

- Chinese CPI YY (Sep) -0.3% vs. Exp. -0.2% (Prev. -0.4%)

- Chinese PPI YY (Sep) -2.3% vs. Exp. -2.3% (Prev. -2.9%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said the job is not done regarding Israel/Hamas as the dead have not been returned, while he said phase two begins right now.

RUSSIA-UKRAINE

- US President Trump said he had a good relationship with Russian President Putin and that Putin doesn't want to end the war, while he added that Ukrainian President Zelensky is coming on Friday and that Zelensky would like to have Tomahawks.

OTHER

- US President Trump said he ordered a strike on a vessel affiliated with a designated terrorist organisation conducting narcotrafficking off the coast of Venezuela.

EU/UK

NOTABLE HEADLINES

- BoE Governor Bailey said the labour market data supports his view of a softening labour market, while he noted that UK businesses tell him they are delaying investment decisions due to uncertainty and are not seeing a lot of impact yet on prices from tariffs.

- UK Chancellor Reeves revives plans to overhaul cash ISAs with Reeves mulling halving the annual tax-free savings allowance to encourage wider investment in the UK stock market, according to FT.

- UK Chancellor Reeves says she is looking at both tax rises and spending cuts in the budget, via Sky News.

- ECB's Villeroy said the next rate move is more likely a cut than a hike, and the impact of US tariffs on Eurozone inflation should remain negligible.

- ECB's Makhlouf said the European economy is showing resilience, and inflation is where they want it to be.

- ECB's Kocher said a majority of stakeholders think banking rules have become too complex, and there is room for reducing the stock of regulation.

- French Socialist Leader Vallaud said they heard a signal that the government has listened and believes in debate in this chamber, while they will adopt the government's proposed budget and said suspension of pension reform is a victory. It was also reported that the French socialists will not vote for a no-confidence motion, according to BFM citing a lawmaker.