NS

NSEuropean equity futures continue to lag on market uncertainty, Trump to speak at Davos later - Newsquawk European Opening News

- US President Trump said Iran will be "wiped off the face of the Earth" if Iran attempts to carry out an assassination threat against him, NewsNation reported.

- US President Trump said having Greenland makes a much more effective golden dome, will probably be able to work something out with Europe at Davos.

- JGBs rebounded slightly, with the 40-year yield falling below 4% as Japan's Finance Minister called on investors to calm down; USD/JPY chopped around 158.

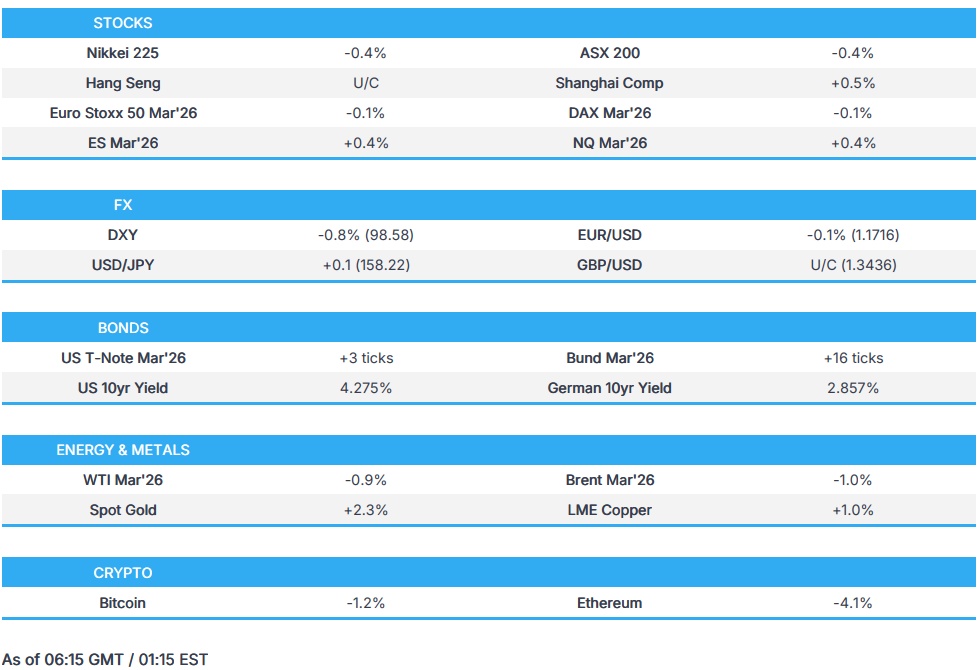

- European equity futures are indicative of a slightly weaker open with the Euro Stoxx 50 future down 0.1% after cash closed -0.5% on Tuesday.

- Looking ahead, highlights include UK CPI (Dec), US Atlanta Fed GDP, Japanese Trade Balance (Dec), IEA OMR, US Private Crude Inventory, SCOTUS US President Trump vs Fed's Cook. Speakers include ECB President Lagarde, Villeroy, Nagel; NVIDIA CEO Huang; US President Trump. Supply from the UK, Germany and the US. Earnings from Kinder Morgan, Johnson & Johnson, Ally Financial and Charles Schwab.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US indices saw losses as participants returned from the US market holiday, with sentiment hit by the growing EU-US tensions and Trump’s stance on Greenland.

- All sectors, aside from Staples, were in the red, with mega-cap sectors Tech, Discretionary and Communications the laggards, and all Mag-7 names lower.

- SPX -2.06% at 6,797, NDX -2.12% at 24,988, DJI -1.76% at 48,489, RUT -1.21% at 2,645.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump said tariff revenue replacing income tax is an option.

- South Korean President Lee said he is not worried about current talks on US chip tariffs and warned they could accelerate inflation in the US.

- USTR Greer and US Treasury Secretary Bessent are highly likely to meet their Chinese counterparts before April, Fox News reported.

- US President Trump said he gets along with the leaders of the UK and France; both countries have two problems: immigration and energy.

NOTABLE HEADLINES

- Air Force One carrying US President Trump turned back to Joint Base Andrews due to a 'minor electrical issue' on the aircraft, Axios reported; the report added that Trump will board another plane and continue towards Davos.

- US President Trump said he thinks it will be a successful trip to Davos.

- The White House released President Trump's executive order to restrict Wall Street firms from buying single-family homes.

CENTRAL BANKS

- Two Democratic senators are demanding that Trump administration officials turn over records related to the DoJ's criminal probe of Fed Chair Powell, WSJ reported.

- ECB's Nagel said the German government was right to launch a large fiscal package and that it is close to the price stability target.

NOTABLE US EQUITY HEADLINES

- OpenAI has started to offer its new chatbot ads to dozens of advertisers and will charge based on ad views, The Information reported.

- Netflix (NFLX) Q4 2025 (USD): EPS 0.56 (exp. 0.55), Revenue 12.05bln (exp. 11.97bln); to pause buybacks to fund pending Warner Bros. (WBD) deal. Key Metrics: FCF 1.87bln (exp. 1.46bln). Q1 Guidance: Revenue 12.16bln (exp. 12.17bln). EPS 0.76 (exp. 0.81). Op. income 3.91bln (exp. 4.18bln). Op. margin 32.1% (exp. 34.4%). FY26 Guidance: Revenue 50.7-51.7bln (exp. 50.96bln). Op. margin 31.5% (exp. 32.4%). FCF 11bln (exp. 11.93bln). Commentary: H2 '26 op. income growth to exceed H1. Sees '26 ad revenue about doubling vs. '25.

- United Airlines (UAL) Q4 2025 (USD): Adj. EPS 3.10 (exp. 2.93), Revenue 15.4bln (exp. 15.37bln). Guidance: 2026 adj. EPS 12-14 (exp. 13.04).

- Interactive Brokers Group Inc. Class A (IBKR) Q4 2025: EPS 0.63 (exp. 0.59), Revenue 1.64bln (exp. 1.64bln).

APAC TRADE

EQUITIES

- Asia-Pac stocks traded mixed, with initial downside paring back as the session continued.

- ASX 200 held onto earlier losses, with downside in IT and Financials counteracting the gains seen in miners following the rise in metals.

- Nikkei 225 continued its recent weakness for a fifth straight session, weighed on by banks and exporters, as worries over Japan’s fiscal sustainability hit Japanese markets.

- KOSPI chopped throughout the session, as the South Korean market traded on either side of the unchanged mark.

- Hang Seng and Shanghai Comp. traded with slight gains, albeit very modestly, but limited with a lack of catalysts.

- US equity futures slightly rebounded from Tuesday’s selloff (ES +0.3%, NQ +0.3%), as tech aided the modest upside.

- European equity futures are indicative of a slightly weaker open with the Euro Stoxx 50 future down 0.2% after cash closed -0.5% on Tuesday.

FX

- DXY initially sold off at the start of the APAC session but rebounded back above 98.50 as EU-US tensions remain at the forefront of traders' minds.

- EUR/USD fluctuated in a tight range following its outperformance in Tuesday’s session, despite a lack of drivers for the Euro overnight.

- GBP/USD oscillated around 1.3440 ahead of the UK inflation report. The ONS released its employment report in Tuesday’s session, which saw the initial upside in cable unwind throughout the session.

- USD/JPY chopped around the 158.00 handle as the recent turmoil in JGBs briefly calmed.

- Antipodeans were muted, as the Kiwi consolidates following recent gains.

- CNH weakened.

FIXED INCOME

- 10yr UST futures rebounded slightly following Tuesday’s selloff, which was led primarily by JGBs as worries over fiscal sustainability grew. Despite the worries of risk, the US 10-year yield remained below 4.3%.

- Bund futures returned above the 128 handle as global markets calmed following the turmoil in JGBs.

- 10yr JGB futures clawed back some losses following the recent selloff that saw 40-year yields reach levels not seen since their debut. Japan’s Finance Minister Katayama called on investors to calm down, stating that the fiscal policy has been responsible and sustainable, not expansionary. US Treasury Secretary Bessent also commented on the recent JGB slump, as USTs were also hit as a result.

- Japan's SMFG (8316 JT) plans big JGB purchases after selloff, Bloomberg reports.

- Fitch Ratings said the US credit outlook is broadly benign entering 2026, supported by AI-led capex, easing monetary policy and strong fiscal support.

COMMODITIES

- Crude futures ground higher, but remained far from Tuesday’s settlement price, amid a lack of geopolitical updates.

- Spot gold continued to reach new heights, with the yellow metal extending to an ATH of USD 4878/oz as geopolitics and fiscal worries support the metals complex.

- Copper futures rose in the early hours of the APAC session, as 3M LME copper rebounded from Tuesday’s trough of USD 12.69k/t.

- US Southern Command announced and published footage of its seventh boarding and seizure of a sanctioned crude oil tanker, reportedly the Liberian-flagged, in the Caribbean Sea.

- Venezuelan Assembly is likely to discuss the oil law on Thursday.

CRYPTO

- Bitcoin fell below 90k as risk sentiment continued to wane.

NOTABLE ASIA-PAC HEADLINES

- Japan's Rengo labour union chair sees favourable environment for upcoming wage negotiations; closely monitoring foreign exchange moves; weak JPY contributes to rising inflation in Japan.

- China's MIIT official said they aim for tech breakthrough in chips for AI training.

- Japan's DPP Leader Tamaki said the BoJ should hike rates if SMEs sustain wage growth of around 5%; shouldn't rule out FX intervention if Gov't measures to limit long-term rates lead to weakening JPY. Government should consider bond buybacks, reducing 40-year JGB issuance, while BoJ slows tapering pace.

- South Korean President Lee said the USD-KRW is showing alignment with JPY movement, will work to stabilise the FX market, sees USD/KRW near 1400 in 1-2 months.

- South Korea's PM will visit the US from January 22nd.

- New Zealand's PM Luxon called for the General Election to be held on November 7th.

DATA RECAP

- Australian Westpac Leading Index MoM (Dec) M/M 0.1% (Prev. 0%).

- South Korean Imports YoY (Jan) 4.2% (prev. 0.7%).

- South Korean Exports YoY (Jan) 14.9% (prev. 6.8%).

NOTABLE APAC EQUITY HEADLINES

- Toyoto Motor (7203 JT) is to raise prices for parts suppliers, Kyodo reports.

- Alibaba (9988 HK/BABA) has set up a CNY 250mln JV with China National Nuclear Power (601985 CN) to help secure the power needed to run AI data centres.

- Mitsubishi Motor (7211 JT) President Kato is to become CEO, effective April 1st, Nikkei reported.

- China Vanke (2202 HK) plans to publicly issue special corporate bonds for housing leasing.

GEOPOLITICS

RUSSIA-UKRAINE

- A planned announcement of an USD 800bln 'prosperity plan' between Ukraine, Europe and the US has been delayed due to Europe's opposition from President Trump to acquire Greenland, the FT reports citing officials.

- US President Trump, on the Ukraine-Russia war, said when Ukraine is ready, Russia is not; when Russia is ready, Ukraine is not.

- Russian envoy Dmitriev said dialogue was constructive with US envoys, and more and more people understand the fairness of the Russian position.

- US Envoy Witkoff said talks with Russian Envoy Dmitriev were "very positive", RIA Novosti reported.

- Envoys for US President Trump and Russian President Putin enter the "USA House" at Davos.

MIDDLE EAST

- Iran's Foreign Minister warns Washington that any all-out confrontation with Iran would be fierce and engulf the entire region, Sky News Arabia reports.

- US President Trump said Iran will be "wiped off the face of the Earth" if Iran attempts to carry out an assassination threat against him, NewsNation reported.

- US President Trump is still pressing aides for "decisive" military options on Iran, WSJ reported citing officials.

OTHERS

- The French Presidency announces it has requested NATO exercise in Greenland and says it is ready to participate.

- US President Trump said having Greenland makes a much more effective golden dome, will probably be able to work something out with Europe at Davos.

- The US is to pull 200 military personnel from NATO and its advisory groups amid escalating EU-US tensions, the FT reported citing sources.

- US Interior Secretary Burgum said that markets have it wrong today about Greenland; the US would build up Greenland in a similar fashion to Alaska if it was owned.

- US President Trump said we have lot of meetings scheduled on Greenland; thinks it will work out well; on EU-Greenland tariffs, doubts EU investments are at risk. Wouldn't go to G7 meeting in Paris. Thinks NATO will be very happy with the Greenland outcome. If NATO doesn't have the US, NATO is not very strong.

- US President Trump, when asked how far he is willing to go to acquire Greenland, said "you'll find out".

- US President Trump said going to be very shortly hitting drugs coming in by land.