Evergrand-er: Chinese Property Market On Verge Of Fresh Collapse As Vanke Bonds Implode

China Vanke, the embattled Chinese real estate giant that rattled markets last week after it became the first state-backed property developer to request a delay on a bond payment, reigniting fears around the Chinese real estate sector’s financial health (which as we noted recently has been in a 5 year downturn with no hope of a bottom) has again shocked creditors with details of the plan.

Shenzhen-based Vanke, which after the spectacular implosion of Evergrande five years ago, became the nation’s largest builder by sales, told bondholders Monday that it was seeking a one-year delay to pay the 2 billion yuan ($283 million) note originally due Dec. 15, Bloomberg reported. The 3% interest would also only be paid after a year. The proposed changes would require at least 90% approval from holders, based on the note’s prospectus.

Several creditors had hoped for some upfront payments and for interest to be paid, but it appears that won't be happening. Many Chinese developers including giants such as Country Garden Holdings had previously offered installment payments amid delayed payments, though even with extensions some have struggled to meet the new terms.

"This proposal shatters the last illusion for investors,” said Yao Yu, founder of Shenzhen-based credit research firm RatingDog. “If this turns out to be the final plan for voting, market confidence will take another hit.”

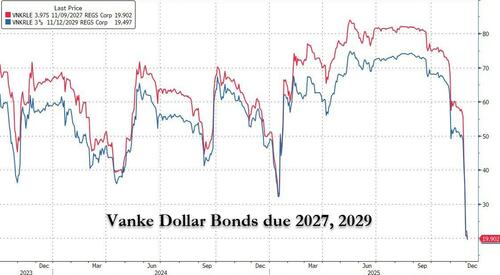

The price of the bond for which Vanke is seeking an extension has plunged to about 27 yuan from near par before the extension plan was announced last week. The builder’s dollar notes due in 2027 slid 2 cents Tuesday morning to the deeply distressed level of 20 cents, according to Bloomberg data. They were trading at a record high just a few months ago, and could be sold in the 50s just days earlier.

Vanke, which is technically state-backed but increasingly appears not to be, will hold a meeting with the yuan noteholders on Dec. 10 to review the extension proposal, according to a filing last week when it announced its request to delay the payment - the first of a 13.4 billion yuan wall of maturities stretching through mid-2026.

The move sent some of Vanke’s notes plunging to record lows, and led to declines in property shares amid broader concerns about Beijing’s commitment to support even its largest distressed developers.

Contrary to expectations of at least some handout to creditors, “the proposal is worse than our expectation with no upfront cash payment,” said Zerlina Zeng, head of Asia Strategy at Creditsights Singapore. She expects Vanke to extend onshore bonds maturing in 2026, which could pave the way for a comprehensive debt restructuring covering both onshore and offshore debt. A more pessimistic take sees Vanke following in the liquidation footsteps of its much more famous peer, Evegrande, whose collapse set off a chain reaction in China's property market which has led to trillions in losses for China's middle class.

Indeed, as Bloomberg notes, China’s multi-year property crisis has led to record defaults and liquidations or restructurings at real estate firms, including the nation’s biggest such as Country Garden and Evergrande. Vanke, one of the last major developers to have avoided defaulting and long regarded as a key gauge of government support for China’s property sector, has been grappling with severe liquidity pressures since late last year.

Over 30 billion yuan in shareholder loans from its largest state-owned backer, Shenzhen Metro Group, provided a critical lifeline, helping the cash-strapped builder avoid defaults this year. But the backing came under scrutiny in recent months after Shenzhen Metro signaled plans to tighten borrowing terms as a recovery from the seemingly endless property collapse has failed to materialize.

Vanke pledged its entire 57.16% stake in a Hong Kong-listed property management unit to Shenzhen Metro, handing over to the state shareholder one of its best assets as default concerns mount, according to an exchange filing late Friday. The pledge is part of a framework that allows Shenzhen Metro to demand collateral or pledges from Vanke in return for loan support.

While the market has long been wary of Vanke’s deteriorating credit outlook, few had expected the situation to deteriorate so quickly (see "Lehman moment" in bonds above).

On Friday, S&P Global Ratings warned that Vanke’s financial commitments are “unsustainable” given its weak liquidity and the risk of a distressed restructuring within the next six months has increased. Vanke was also rejected by at least two big local banks as it tried to secure a short-term loan to quell its liquidity challenges, Bloomberg News reported last week.

Meanwhile, China’s property malaise continues to bring more losses for investors in the sector, with dismal recovery rates for creditors in China’s distressed developer cases starting to come more into view and the picture is grim.

While each case is different and Vanke has yet to enter any restructuring, creditors are surely gameplanning potential scenarios. Those would reference peers like Country Garden and Evergrande, where some estimates put likely eventual recoveries in the range of 10% to 24% and just cents on the dollar, respectively.

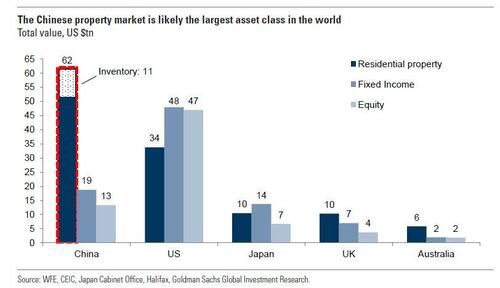

But while creditors are sure to suffer huge haircut, a far bigger concern is what Vanke's looming collapse means for the broader Chinese housing market, not that long ago the world's largest asset class as this graph from Goldman circa 2021 makes clear.

In an ominous sign, two of China’s private data agencies skipped releasing data on monthly home sales by the country’s top developers, after Vanke stirred market concerns with its bond extension bid.

China Real Estate Information and China Index Academy, which are among the country’s biggest private property data providers, did not disclose the combined sales of the nation’s 100 largest developers for November on Sunday (Nov 30). The two agencies, which usually release the data on the last day of every month, did not provide a reason.

The missing housing data “could increase uncertainty about the struggling sector’s condition”, Kristy Hung, a senior analyst on real estate at Bloomberg Intelligence, wrote in a Monday note. "The November data would likely show steeper declines", assuming it is ever published.

Global banks remain pessimistic on China’s property market, which has faced renewed sales weakness since the second quarter. UBS Group expects home prices to keep falling for at least two more years. Values of used homes have also dropped sharply, down more than a third from peak levels in major cities, according to UBS.

Fitch Ratings warned last month that new-home sales by area could decline another 15 to 20% before the sector stabilises. The bleak outlook suggests banks’ property-related bad debt will likely stay “elevated” next year, Fitch said.

It's a far worse signal for China's middle class whose assets are primarily "invested" in the country's real estate sector. Another 20% haircut there and not even Beijing will be able to preserve the illusion that China, which has been in one long recession for the past five years, is growing at the laughable 5%.