"The Fed/Treasury Merger Is Underway": The Market Will Never Again Signal That The Government Is Spending Too Much

The big shock in last week's FOMC was not that the Fed would cut - after John Wiliams' Nov 20th speech, that was common knowledge. The shock is that the Fed launched QE Lite (aka reserve management purchases), just as we said they would simply by following the clogs in the repo plumbing, yet virtually nobody else echoed our expectation (we were right). What is just as remarkable is that the Fed was expected to start growing its balance sheet some time in late Q1/early Q2 2026, but certainly not this Friday.

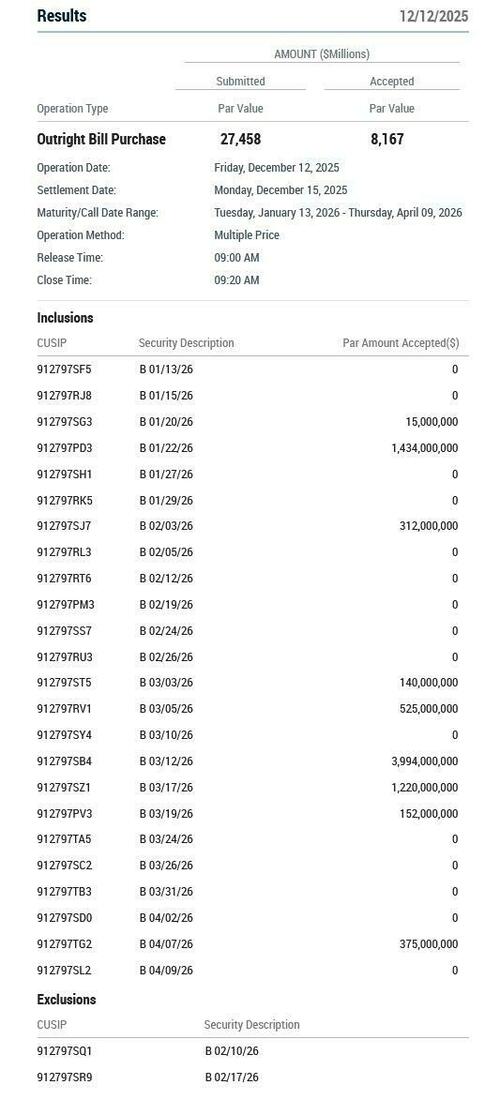

The Fed's cover story, as TS Lombard's Steven Blitz notes, is that the TGA account swells in April, so they need to start buying bills now ($40bn in Jan, more in Feb). As we noted yesterday, BofA's rates guru - who was the only other voice to call for an early start to QE lite - predicted that $40bn is just the start, and it is likely that the Fed will end up buying much more (and veer outside of pure Bill territory, adding 2Y and 3Y notes as well). Here is Cabana's full forecast:

- There is risk of maintaining higher pace of purchases for longer as RMPs will only add back $80 billion of cash above natural liability growth by mid-April while BofA expects the Fed will need to add back $150 billion to achieve ideal outcome. This means the the next 4-5 months could see as much as double the pace of QE as previewed by the Fed.

- Fed will shift to UST coupons out to three years if they perceive bill investors are “being adversely affected” to limit their displacement (It will be very difficult for the pro-Fed commentariat to pretend this is NOT QE (again)).

The press conference message from Powell was that they are once again buying securities because the Fed wants money market rates set by policy, not managed through open market operations (SRF these days). In truth, Blitz admits, the return signals that the Fed is ensuring that Treasury spending will be financed without any rate hiccups. The Fed will smooth out the volatility and keep rates tied to the funds rate, or as the TS Lombard strategist notes, "You can forget market signalling to the government that it is spending more than the market can absorb."

That, dear readers, is the first official step toward Yield Curve Control and is precisely what soaring gold and silver are sniffing out.

Here Blitz cautions that while Hasset et al lean hard against that view from a philosophic standpoint , the will eventually yield to politics and practicalities (i.e. they will CTRL-P the moment Trump calls). That's because of returning volatility to the short end of the market, something we discussed extensively in October and November, making market signals matter again, was recently espoused by Dallas Fed Pres. Logan and Fed Vice Chair Bowman. One further note: there are no votes on this bill-buying turn coming out of the Dec FOMC meeting, perhaps the FOMC minutes in a few weeks will give us a sense of its unanimity or not (Miran standing in for Hasset).

Yet philosophy is one thing, but financing the government is another, and once Hasset is confirmed, Bessent will be his boss. A “direct” reporting line, day-to-day communication (coordination) with the WH running through Bessent (the unitary theory of the presidency in action).

Of course, what is happened is hardly shocking: the seeds of the monetary destruction were planted in 2008, when QE obliterated the Treasury/Fed accord which separated the Fed and Treasury in the early 1950s. But as a result of Fed market interventions, the Fed and Treasury balance sheets are essentially one and Bessent will have his say (especially because he managed the selection process that got Hasset over the finish line).

And in case there is any confusion, Blitz lays it out: what Bessent/Trump want is cheap funding – flood the short end and starve the long end of issuance. And on Friday, the Fed started to buy the short end, monetizing $9.4 billion in Bills. Or as Blitz puts it, "Put this one in the column for why inflation will be higher in 2026."

Away from the RMP, Blitz notes that there was an interesting shift in the SEPs on the funds rate, but it is as meaningless as Powell’s Jackson Hole Speech on the Fed’s new framework - that's because Powell is now a lame duck and new management takes over in May. Here's the peculiarity: the median view on growth in GDP in 2026 is higher (2.3% vs 1.8%), unemployment is the same (4.4%), but core inflation is lower (2.5% vs 2.6%), so the real funds rate is 90bp vs 80bp in Sep.

Against this median backdrop, look into the dot plots for the median funds rate in a year’s time (if we knew Powell’s, we could toss it out). Compared with September, the number of FOMC members seeing the funds rate below 3.5% in 12 months jumped from 11 to 16. Because there is one less seeing the rate below 3%, the median of this subset is still 3.00%-3.25% -- where the market is priced (3.10%) with smidge of a bias to a little less. Call it the Trump discount.

As for the economy, Powell’s press conference suggested more weakness than he is headlining. We heard the Fed's downward adjustment of 60,000 to monthly payrolls -- 40,000 is a 20,000 decline. This is why they are cutting – several months of negative payrolls always leads to cuts (payrolls lead the economy and the Fed reaction function, not the unemployment rate). We also heard that if they abstract the inflation data from the tariffs, inflation is really running below 2%. If the coming data confirm this, and the Fed seems to think so without saying so, there may be more cuts than the market is pricing, or the funds rate drops to 3.00%-3.25% sooner. Put this one also in the inflation lower column for 2026.

In sum, everything the Fed announced is inflationary (and gold reactive as it should), unless the economy proves to start the year weaker than currently believed. There is a leaning within the Fed, as hinted by Powell, that this may be the case. If true, then the normal lead/lags of growth, employment, and inflation do generate the median outcome – without having to account for the AI productivity story (which is likely very oversold).

The silver lining is that with the coming boost from fiscal policy, any downturn would be limited, but the inflation story nevertheless takes hold later in 2026, or in 2027 (inflation lags real growth by about a year). Any forecast, necessarily built around norms of fiscal and, more critically, monetary policy, is tenuous at best, and most likely plain dead wrong.

As Blitz concludes: "the great disruption is coming to the Fed and banking more broadly. I hope I am wrong, but hope is never a strategy."

Much more in the full note for professional subscribers.