'The Finish Line Is Visible': Top Goldman Macro Trader Ruminates On The Rest Of The Year

The final straight is here, December the 2nd and the finish line is visible.

That being said, top Goldman macro trader, Bobby Molavi, notes that the last two weeks reflected both sides of the 'market debate'.

Some of the growing fragility around themes like Ai, Ai capex, Ai related debt, Private credit, Fed December decision, retail length as well as the structural resilience from buy the dip, US technological supremacy, Ai netting benefits (if Nvidia falters Google offsets) and structural vol suppression.

Two weeks ago... a combination of Ai worries, Crypto correction, retail anxiety, hawkish fed commentary and labour market data triggering a risk off move. Strong earnings from Nvidia and Walmart helped stem the supply…but after an initial relief bounce post Nvidia…we saw another wave of supply before an end of week relief bounce. Within that mix we saw plenty of meme and retail favourites coming under a great deal of pressure….non profitable the, ai winners, rare earths, quantum, robotics etc. Last week saw a material bounce back with risk on moves in most places at headline level.

Perhaps less Ai everywhere but rather Ai in some places (Broadcom, Google), we saw another bout of retail buy the dip (Bitcoin and Nasdaq bounce back) as the Hawkish tone from the Fed flipped at the margin with Williams comments putting a dec cut back in play.

The headline stats for November mask the journey of the month. Nasdaq down only 1.6% the headline….but beneath the surface we saw a peak 8% drawdown as the Ai trade and the mega caps (Nvidia) faltered. We couple that with macro uncertainty around rate cuts, jobs and economy and a technical and factor driven risk off move (momentum, CTA and retail supply) and it was a tricky month to navigate across gross, net, factor, theme and meme….but with headline stats that point to a ‘healthy’ digestion of some of the higher octane moves since the April lows and some investors.

As has been the case all year….too many cross currents to unpack in email.

On one hand a growing sense of end of year ‘pnl’ sensitivity in reactions to moves and performance protection.

I’m seeing a growing amount of focus on Technicals – CTA supply, retail activity, 50 day moving averages, crowding, hedge fund gross and net exposures.

A continued shift towards diversification (Asia and defensive/value tilt away from US).

We see one eye on the tail winds from bank de-reg that come in Q1.

We see focus on growing impetus for corporate strategic M&A (D Boerse for Allfunds the latest example).

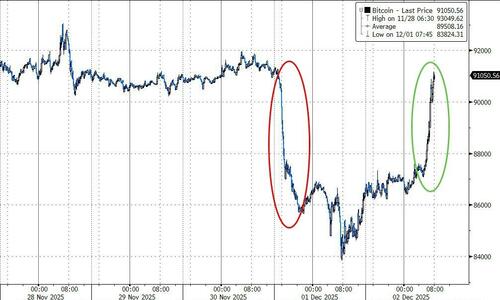

The start of this week sees Bitcoin once again having a wobble. Down ~8% to start the week before a ~4% rally from the lows. Will it once again be a lead indicator for Equities (a weaker start yday) or another example of noise over signal and more buy all dip mentality (seems to be the case today!).

[ZH: BTFD indeed]

Elsewhere, the Japan/JGBs move and Hawkish rhetoric driving a breakout in 10 year and 30 year to levels not seen in 2 decades.

We await US data to give us a leading indicator of the Fed December decision and tone of the decision if it is a cut (hawkish cut?).

Bulls vs Bears.

In the bull corner…we have a new transformational technology.

We have $600bn of Mag 7 Capex flowing through the economy.

President Trump talking up the market…as well as talto Income tax cuts and $2000 stimulus cheques.

We have the end of QT. We have continued US deficit spending.

We have $1.2 trillion of buy back authorisations for 2026.

We continue to see retail deploy and buy the dip.

We have bank de-regulation and capital easing in 2026.

In the bear corner…we are starting to run out of catalysts and with a narrow and crowded market extremely geared to one theme (Ai and Ai capex).

Valuations are no longer cheap.

We see more and more Ai circularity as well ad debt related financing of the theme.

We see more concern around a K shaped economy.

We see more employment pressure (graduates and Ai affected roles).

We see stress in the lower earning segments of the market (consumption and defaults).

We see concern around private credit and the credit cycle.

Var and vol.

In a market where narrowness, crowding and concentration have evolved into a feature rather than a bug….and where volatility spikes are rare and then reset fast…it was quite informative to look at the market cap moves on higher volatility in recent weeks. Given the ‘precious few’ drive the market more and more…and that a handful of companies live at $1 trillion or more (Eli lilly joining that club recently) and most of these companies are Tech and Ai or Ai adjacent plays….it is telling that Nvidia (the largest of them all) was having $500bn intraday market ca.. The value of AI-related companies had risen by over $19tn since the introduction of Chat GPT…and 40 or so companies account for 80% plus of that value creation.

As positioning (active and passive) increasingly anchors to this few….embedded var and vol could/should/might tick higher…..especially if and when we see regime or momentum shift for real.

This is the 1-month realized vol of our flagship momentum basket (there are many to choose from). As you can see clearly, since the cycle lows of late 2022, the recent patch was in fact more volatile than the regional banking scare of 2023 or Liberation Day...

AI Dispersion.

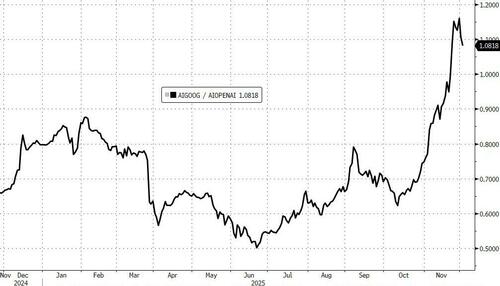

The last few weeks have seen a shift from all things Ai related winning together to more dispersion within the Ai theme. Nvidia handing off the baton to Google or the draw downs and concerns around Micro strategy, Oracle and Softbank vs the resurgence and performance of Broadcom and Meta. Highlighting two things arguably…not everyone will win…and even when one falters…there is often an offset that can maintain the momentum. Also that levered plays to a theme win big when all going well….but the opposite is also true.

As Google’s Gemini showed a potential step-change improvement vs ChatGPT, the market has found itself mis-aligned and mis-priced for that...

The vicious rotation of Google supply chain over OpenAI's is even more evident in the ratio (Google AI Ecosystem is AVGO, CLS, GOOGL, LITE, and TTMI; OpenAI's is Softbank, AMD, CRWV, MSFT, NVDA, and ORCL):

AI Debt.

In the aggregate, it’s not yet time to worry about the inability of these companies to access capital.

To be sure, our work suggests the core hyperscalers can add around $700bn of financing before their net debt load is > 1x 2026 EBITDA.

Politics.

What does Mamdani win mean in terms of momentum shifts in US politics? Are we moving towards a Democratic and/or ‘Left’ rebound? And could that rebound come with an overextension that impacts risk, multiples and or animal spirits?

All of this at a time where the MAGA Republican base seems to be seeing some signs of infighting (eg Marjorie Taylor Greene), divisions around foreign policy vs domestic policy.

So what? Well….for starters does the above mean higher likelihood on shifts to broker peace (eg US/China détente post Korea summit or this weekend Ukraine peace deal spec), could it result in some fiscal spending to support supporter base (eg $2000 cheques spec) or could it result in more policy volatility and reflexivity that may result in $ and/or US risk issues? (eg Liberation day).

Worth watching in my view.

US supremacy.

Much was made of a rotation away from US earlier in the year.

Looking at US market rebound since liberation day is one proof point that the US ‘demise’ was greatly exaggerated….but also the fact that foreign investors are buying US equities at a record clip.

Private foreign investors over a 12 month period ending Sept 2025 bought ~$648bn of US equities….a record amount over any 12 month rolling period. Worth also noting the cadence has doubled since the start of the year…and the total is now above the $390bn previous high seen in 2021.

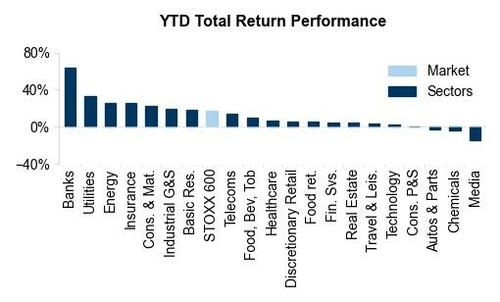

Europe - A Safe Haven?

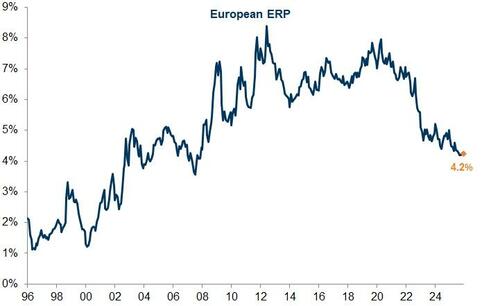

The Equity Risk Premium (ERP) in Europe has dropped to 4.2% compared with an average of 6.7% between 2009 and 2021 – so back to GFC levels in spite of growth having troughed...

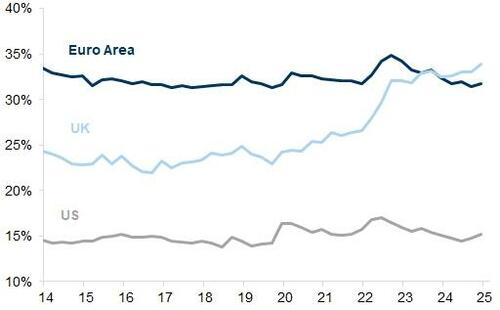

European households have generally preferred currency and deposits over equities highliughting the defensive nature of European savings...

Currency and deposits as a share of household financial assets (%)

It is telling that Tech is well below the average and at the margin surprising that the top 5 are old economy, non ai (ex power) and very much value skewed...

Credit cycles.

There have been 9 chapter 7 bankruptcy filings for companies with $100m of liabilities or greater in 2025.

This is a far more punitive form of bankruptcy vs Chapter 11. This is the 4th highest reading ever. Just saying.

Market-timers vs market-owners.

The worries about US deficit are not new...the consensus long/overweight around the $ has been structural...the arguments of alternative stores of value have been thrown around for a while.

Yet if you look at Gold as perhaps a rational beneficiary of these debates...nothing happened between December 2020 and December 2023....with gold trading in a fairly narrow range.

So anyone who put that trade on for those arguments effectively was 'early' or 'wrong' or both as they are basically the same. Then last year...we start to see some of the same debates getting traction....then those same debates get catalysts (conflict, liberation day, debasement, diversification).

Then what happened.....Gold goes from 1800 to 2200....then 2550.....then 3450....then 4400...all in the space of 14 months.

Benchmarks.

With 7 stocks now accounting for ~35% of the market….benchmarks are an institutional problem and a construction problem. Alongside that… perspectives and perceptions are equally a problem. As the market focusses on an every narrower universe…and when beating ones ‘benchmark’ revolves around getting bets right around the largest stocks (Nvidia and Google over Tesla and Mata) our frame of reference is being skewed away from return per $ towards total return in an indexed and correlated environment.

Take the general….Nvidia. It has lost $1 trillion of market cap at one point in a draw down earlier this year….only for to rebound, and in spite of recent wobbles, now being up 30% on the year making back that drawdown and then some. Equally we conflate contribution with performance in an increasingly benchmarked world. To iterate the point…..coming into November Nvidia was the biggest contributor to S&P gains in $/mkt cap terms and the best performing stock of the Mag7…but…. it might surprise you that 46 stocks in S&P had outperformed it.

In fact…..there are roughly 630 stocks in Nasdaq that had, at that time, out performed Nvidia! So for contribution to the S&P…likes of Nvidia, Alphabet, Meta and Microsoft stand alone…and not owning enough means you are underperforming your ‘benchmark’ yet…from a performance basis in ‘percentages’ then a different world exists where the likes of Micron, Palantir, AMD, Intel, Applovin have all delivered ‘more’ per $100 of investment.

More buyers than sellers.

A throwaway slogan – somewhat reductive – often used by traders across desks everywhere as a quick witted response to the question why are markets up. I used to think that this made no sense. Now I think even less so.

As the market structure evolved…and passive becomes the majority of equity aum while the remaining ~50% becomes a mix of active, hedge fund, prop and systematic quant….there are other ways that a trade means less (or different) that it once did.

I used to think that a trade takes place when there is a disagreement on value but an agreement on price. Or put another way...a point in time where a buyer has a view on fundamental value and a seller , generally, had a contrarian view.

Now the time frames under which most trades take place can be built around returns over 1 minute, 1 hour, 1 day, 1 year out to 10 years….with a median duration that is likely getting shorter on average.

At the same time..as signal and impact becomes an alpha source in and of itself…the ‘basis’ for the trade is also shifting. The problem now is...that one leg of that trade might exist solely with the goal of ascertaining that the other leg of the trade exists. No view...no thesis...just a form of liquidity provision as a method of signal discovery or signal confirmation.

At that point....the 'seller', if there for signal reasons, then can...and often does....use that information as an input into what they do next.

Muscle memory.

Sentiment at extremes serves as a contrarian indicator. Then Sentiment when it is positive can last a long time...and defended as it is in everyone’s self interest to hold onto hope and believe in the dream. We saw with the last Tech bubble and Greenspan ‘irrational exuberance’ comment....in 1996 no less….which while prescient…was early by 3 to 4 years and therefor ‘wrong’ for quite some time. The smoke signals were visible..but didn’t catch fire until 1999/2000. The last decade has all been.....Momo, Buy the dip, FOMO.

The speed of correction retracement has been short and seemingly getting shorter. Covid…5 weeks for market and 2 months for economy…Liberation day felt like days and weeks rather than weeks and months. Underpinning this is the evolution of the nature of the 'investor' and who the 'buyer' is. In reality the key buyers in 2025 have been a combination of corporates (buybacks likely to breach $1 trillion this year), corporates and PE (in the form of P2P and strategic M&A coming back to life) and then finally ….retail…net buyers of $500bn year to date…sticky, vol supressing, employed and believers of buy the dip.

The ticker tape keeps 'proving' that emotions/fear/anxiey are irrelevant as an indicators most of the time…at least in moments in time….and especially in a momentum driven market. That the fear gauges may be broken...and that while the trend holds....the trend holds. Like other soundbites.... like don’t fight the fed...or tankers are slow to turn...the trend is set (and is your friend)...and it will take something big to shift it...and how we feel...and our anxiety isn't going to be that thing. That being said….the fear….like in 1996….may just be early.

Recency bias.

Most of today's ‘players’ have only seen one market.

Limited experience of a sustained drawdown and correction for which there is no floor to the dip. No real credit cycle and/or liquidity crunch.. the last 15 years have witnessed an unprecedented bull market with buy the dip paying over and over again.

With ignoring smoke signals and left tails over and over again.

And where the primary beneficiaries are those that have run and added throughout the ride irrespective of the noise. On one hand…nothing lasts forever…on the other this has lasted much longer than anyone thought and anyone who held on throughout…was paid handsomely. I suspect those who will be paid/rewarded in navigating a real correction will be an audience who have seen this before.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal