FOMC Preview: "Boring" And "Uneventful" Dovish Hold

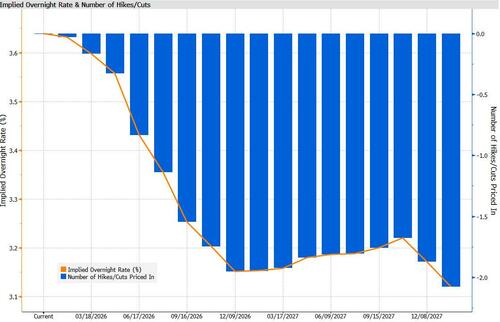

The Federal Reserve will leave the policy rate unchanged at 3.50-3.75% on Wednesday, with the latest BBG/Reuters polls showing unanimous expectations for no change at this meeting, while 58% of economists surveyed by Reuters also see rates staying on hold through the quarter. Money markets are pricing in around 45bps of cuts by year-end, with the first 25bps reduction seen by July.

With inflation sticky but not accelerating, the labor market cooling without collapsing, and fiscal stimulus set to support growth in early 2026, policy rates likely need to return to neutral, but not below, according to Seema Shah at Principal Asset Management. "With a leadership change approaching, the Fed is likely to place slightly more emphasis on the employment side of its dual mandate,” she said. “We expect two Fed cuts in 2026, taking rates close to neutral. Timing will be data-dependent, but a rising unemployment rate could prompt the cuts to be brought forward.”

This is a very “boring” Fed meeting during very interesting times, according to Christian Hoffmann at Thornburg Investment Management. “Looking at the playing field today two to three rate cuts seems very reasonable, but the picture and the backdrop can evolve very quickly,” said Hoffmann.

While Fed Chair Jerome Powell will likely emphasize a cautious, data-driven approach, key insights into the central bank’s outlook on growth and inflation will be closely watched, according to Kezia Samuel at AssetMark. “Amid fading tariff pressures, an ongoing drop in shelter inflation, and a sluggish labor market, we anticipate the Federal Reserve will resume its easing cycle in 2026, most likely by implementing one or two 25-basis-point interest rate cuts,” Samuel said.

Goldman Sachs said the meeting is likely to be "uneventful" (full Goldman note here), with no change to the Federal Funds Rate, only minor statement tweaks, and few clues on the future policy path. The bank expects Chair Powell to stress that the FOMC has already delivered three cuts to help stabilize the labor market and is well positioned to assess the impact. As in recent meetings, guidance is likely to matter more than the decision itself, particularly around how long policymakers intend to remain patient before easing eventually comes into view, according to Newsquawk,

How Hawkish A Hold? Morgan Stanley expects the Fed to keep its policy rate unchanged in January and deliver a "dovish hold": the recent stabilization in the labor market and solid activity data will be the main drivers behind the decision to pause rate cuts, while incoming data on inflation will keep the Fed confident enough about disinflation later this year to retain an easing bias. Powell's comments during the press conference will indicate that greater consensus has emerged within the committee regarding the outlook for the economy in 2026, and it will likely be favorable. That said, divisions about the appropriate policy path remain, with some seeing policy as already at neutral and others seeing room for further rate reductions should inflation move back toward the 2% target.

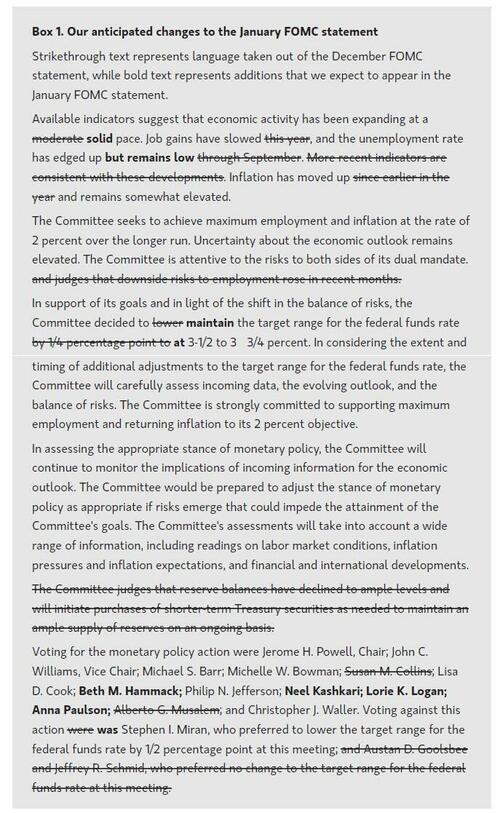

Fed statement: An upgrade to growth, less downside risk to employment, and a dovish hold: Morgan Stanley is looking for changes in several places in the January FOMC statement. In describing current economic conditions, the committee will upgrade its assessment of growth in economic activity from "moderate" to "solid". An argument can be made for using "strong" over "solid" given momentum in consumer spending, but some of the real GDP statistics are being propped up by volatility in trade and inventory data that may not be reflective of actual momentum. Either way, some upgrade to the growth assessment is warranted. Despite the unemployment rate falling in December, look for the statement to still say that the rate has "edged up" but "remains low." On inflation, recent FOMC statements have used the phrase "inflation has moved up since earlier in the year" to reflect tariff pressures. Recent inflation data have been muted and have not shown further firming in year-over-year rates of inflation, but enough of that signal has been muddied by the government shutdown to prevent any change of view. In addition, most commentary from Fed officials heading into the blackout period was consistent with inflation remaining elevated (e.g., above target). Inflation concerns appear more about inflation persistence than inflation rising further.

Morgan Stanley expects one key change to the committee's assessment of the balance of risks to the dual mandate. Prior to implementing risk management rate cuts in September, the statement said, "the committee is attentive to the risks to both sides of its dual mandate." In September, the Fed added "and judges that downside risks to employment have risen." In the January statement, the Fed will remove the reference to increased downside risk to employment. After all, if the Fed is pausing and sees monetary policy as better positioned to respond to evolving conditions, then that is consistent with seeing less downside risk to the labor market. Otherwise, if downside risks to employment have risen, the Fed should be cutting further

Regarding forward guidance about the policy rate path, the statement will maintain its current language – "in considering the extent and timing of additional adjustments to the target range" – which implies an easing bias in line with the median policy rate path in the Summary of Economic Projections. This would imply a "dovish hold" and signal the Fed would be prepared to reduce its policy rate further should inflation pressures subside. A "hawkish hold", which would imply a much longer pause, would be a return to the language of 2024 when policy rate guidance in the statement referenced "in considering any adjustments" to the target range. Elsewhere, expect the language describing the initiation of bill purchases to be removed and for the voter population to reflect the rotation of Reserve Bank voters in 2026 versus 2025. Finally, the statement will include a dissent from Governor Miran in favor of a 50bp rate cut.

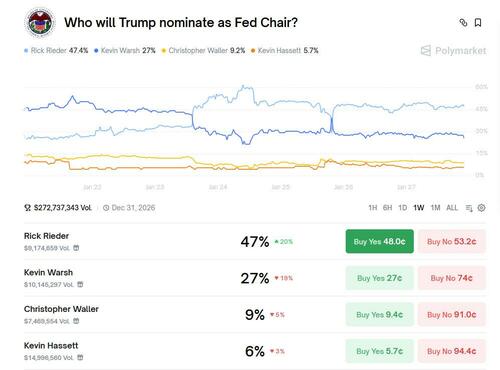

Fed Chair: Markets will scrutinize Chair Powellʼs press conference for signals on the policy path ahead, but there is added focus on uncertainty around his role and the central bankʼs independence. Investors will watch for any tonal shift amid growing political pressure on the central bank from those calling for lower rates. Public criticism from President Trump and ongoing legal scrutiny over the Fedʼs HQ renovation have raised questions about institutional independence, though officials are expected to avoid political comment. On his successor, an announcement is expected at any time, and BlackRock CIO Rick Rieder has emerged as the betting marketʼs favorite in recent days, followed by Warsh and Waller. Bloomberg, citing sources, said Wall Street credentials and openness to change at the Fed have boosted Riederʼs candidacy. On 13th January, Trump said the country has a bad Fed Chair and that a pick would come in the next few weeks, adding on 22nd January that he had finished interviews and had someone in mind.

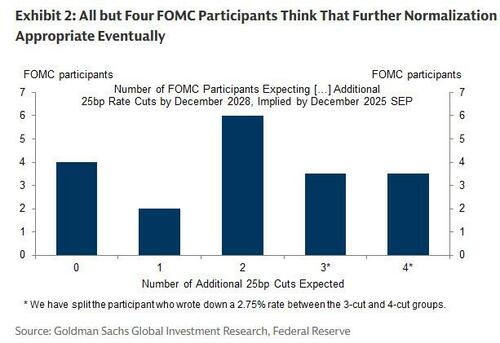

Dots: The December dots - where 15 of the 19 FOMC participants projected that one to four more 25bp rate cuts will be appropriate -suggested that the Committee is quite likely to resume cuts eventually. But if the next cut is less urgent, aimed at normalization rather than addressing an immediate risk, then the leadership will likely want it to be backed by a stronger consensus than the December cut was.

Path Ahead And Next Rate Cut: Analysts said the balance of risks still points to rates remaining on hold through Q1, with cuts more likely later in the year if inflation shows clearer signs of easing. Further hikes are seen as very unlikely, but strong growth and expansionary fiscal policy suggest any easing cycle is likely to be gradual. Few surprises are expected from the meeting, keeping markets focused on Powellʼs assessment of inflation persistence, labor market tightness and financial conditions. Goldman Sachs said that if the labor market stabilizes this year, as it and the FOMC expect, further cuts would be less urgent. Goldman has penciled in the next 25bps cut in June, followed by a final cut to 3.00-3.25% in September. It sees risks over the next year or two tilted to the downside, with hikes unlikely but scope for additional cuts, leaving its probability-weighted Fed forecast slightly below both its baseline and market pricing.

Fed Independence: Powell is likely to be questioned on a number of topics, including risks to Fed independence following the receipt of the DOJ subpoena, housing affordability, the purpose of bill purchases, productivity, AI's effects on the labor market, and data quality issues. On productivity, Powell has been generally optimistic during recent meetings about the productivity backdrop, and recent economic data are likely to reinforce that view. He could say that recent data could mean upside risk to growth and are a factor that would increase his confidence about disinflation. That said, Morgan Stanley thinks the Fed has not come to a conclusion about whether the recent improvement in productivity is coming from post-pandemic cost-offsetting automation, cost pressure-driven efficiencies (which could have emerged from restrictive trade policies), or an emerging AI wave. On the labor market effects of increased AI spending, Powell will say business contacts mainly pointed to slower hiring as firms reassess staffing needs as opposed to increased layoffs.

Recent Fed Commentary: The committee remains divided, with no clear consensus on the policy path. While rates are widely expected to be left unchanged, this is likely to be the fifth consecutive meeting with dissent. Governor Miran is seen as almost certain to vote for a cut, though the size remains unclear. In recent remarks, the dove said he sees 150bps of cuts this year and noted that, given moves so far, the need to dissent with a 50bps cut has become somewhat less. Governor Miranʼs term expires in January 2026, but his future remains uncertain; he has said he does not know what will happen, and will do what Trump thinks is best. Treasury Secretary Bessent has suggested Miran will likely return to the Council of Economic Advisors in February or March. The Fedʼs Vice Chair for Supervision Bowman is also expected to dissent, having said the Fed should be ready to cut again amid job market risks, and should not signal a pause in the easing campaign. By contrast, NY Fed President Williams said monetary policy is well positioned amid a favourable outlook and closer to neutral ahead of the January decision. Philly Fedʼs Paulson, a 2026 voter, is comfortable holding rates steady. Minneapolis Fedʼs Kashkari, also a 2026 voter, sees no impetus to cut in January, while Kansas City Fedʼs Schmid, a 2028 voter, sees little reason to ease.

Dissents: Goldman expects that only Governor Miran will dissent this week in favor of a cut, a sharp contrast to the three dissents in the statement and the record seven soft dissents in the dots at the December meeting.

Recent Data: Recent data continue to point to resilient US growth and sticky inflation, arguing against any urgency to cut rates. The economy expanded strongly in the second half of 2025, while inflation remains above target, reinforcing the Fedʼs preference for patience. Policymakers are therefore likely to repeat their data-dependent message and avoid signalling that easing is imminent.

More FOMC previews available to pro subs.