"It's All About Positioning": The One Thing Goldman's Trading Desk Is Looking At Today

Today's selloff could not have come at a worse time for institutional investors.

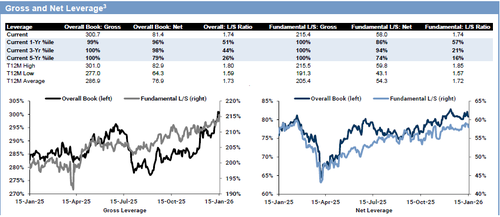

But first some background: echoing what JPMorgan said yesterday, this morning Goldman's Delta-One head, Rich Privorotsky, writes that despite a sudden surge in geopolitical fears, Greenland feels too politically unpopular domestically to end in anything other than a compromise (although it might get worse before it gets better). That's why according to Privo, he is less worried about geopolitics (still one eye on Iran) and more focused on positioning, which is running hot, with gross exposure at 5 year highs and net near 3 year highs.

Let's dig deeper:

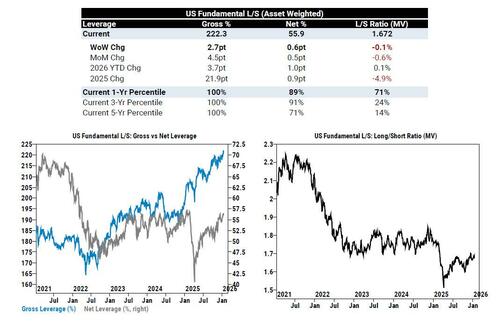

Per Goldman Prime Brokerage, US gross sits at 5y highs (+2.7 pts to 222.3%, or 100th percentile one-year), while Net leverage rose +0.6 pts to 55.9%, which is tied for a 3y high (89th percentile one-year). US Fundamental long/short ratio (MV) decreased slightly by -0.1% to 1.672 (71st percentile one-year).

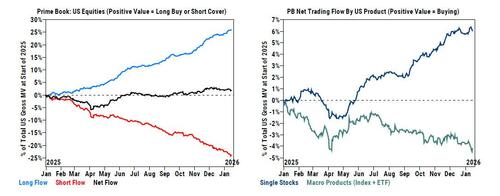

Taking a look at last week's trading flows (Jan 9th – Jan 15th), Goldman PB writes in its must read Weekly Rundown note (available to pro subs), that US equities were net sold this week (-0.6 SDs one-year), driven by short sales in Macro Products outpacing long buys in Single Stocks.

- Macro Products (Index and ETF combined) saw the largest net selling in 4 weeks (-1.1 SDs one-year), driven entirely by short sales. US-listed ETF shorts decreased -1.1% (still up +8.1% MoM), driven by covering in Large Cap Equity ETFs partially offset by shorting in Corporate Bond ETFs.

- Single Stocks collectively were slightly net bought (+0.2 SDs one-year), driven by risk-on flows with long buys modestly outpacing short sales (1.2 to 1).

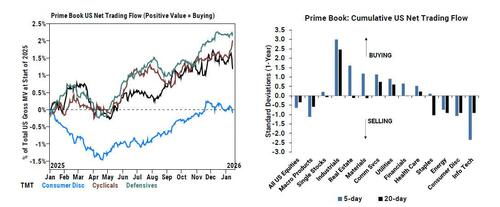

- 8 of 11 sectors were net bought, led in $ terms by Industrials, Comm Svcs, Health Care, Real Estate, and Financials, while Info Tech, Consumer Disc, and Energy were net sold.

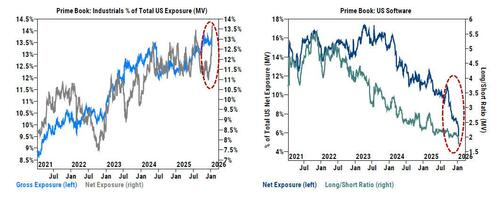

- Industrials, the top performing sector YTD, was by far the most $ net bought sector this week and the most net bought sector in SD terms for a second consecutive week (+3.0 SDs one-year), driven by long buys and to a much lesser extent short covers (6 to 1). Nearly all subsectors were net bought, led by Aerospace & Defense, Trading Companies & Distributors, and Electrical Equip. It’s worth noting that both gross and net exposures in Industrials (as % of total US Prime book) are now at the highest levels on our record (since 2016).

- On the other hand, Info Tech was by far the most net sold sector this week in both $ and SD terms (-2.3 SDs one-year), driven entirely by short sales. Software in particular was by far the most net sold subsector and net sold in 4 of the past 5 sessions – aggregate net exposure (as % of total US Prime book) and long/short ratio in US Software stocks both finished the week at the lowest levels on our record, suggesting a highly cautious stance by hedge funds.

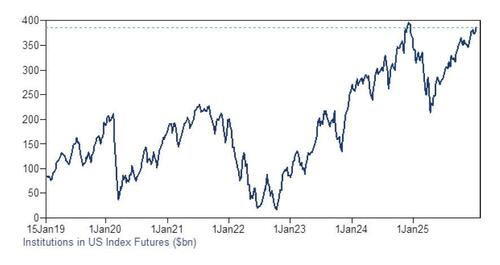

It's not just the prime brokerage where everyone is bulled up: according to Goldman's Futures S&T desk, S&P futures positioning is also at 5y highs, while CTAs are 8 out of 10 long. Some more details below:

- Institutional US equity length is near the highs nominally and near its 90th percentile on a normalized basis.

- The systematic/CTA cohort is also comfortably long.

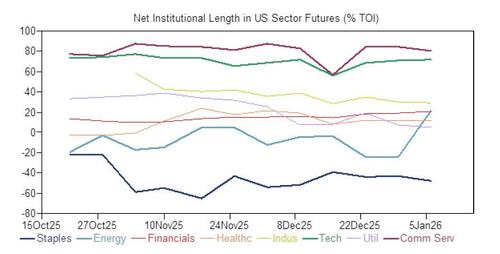

- Separately in US Sector Select Futures, a growing market segment, institutions are longest in Tech and Comm Services, shortest in Staples, and have increased most in Energy and Fins the last 1 month, particularly Energy where the short base has recently collapsed nearly 75%.

Extreme positioning is also the biggest risk according to Goldman's head of ETF and custom baskets volatility trading, Shawn Tuteja, who writes that "Discretionary client positioning is very long equities, as the playbook heading into 2026 was consistent across different client types." The Goldman trader further notes that once the December FOMC press conference was taken as dovish and the following week’s inflation data was benign, we saw clients quickly add length into year-end and the beginning of this year across a variety of themes including

- 1) AI productivity (GSXUPROD +6.1% to start the year)

- 2) consumer equities (GSXUMIDC +8.14% YTD) and

- 3) depressed cyclicals (GSCBCYDP +7.4% YTD).

If there’s any doubt as to whether clients are carrying a lot of equity risk, Tuteja points too the chart below – which is the latest PB data– shows where risk sits on Goldman's prime book: "Clearly, when you combine this with the systematic length, it paints a picture of an equity market that is well-subscribed."

Coming into this week, the overwhelming sentiment from client conversations continues to be a strong desire to own risk into 1H 2026 for several reasons: 1) belief in 10-12% EPS growth YoY 2) a dovish December FOMC that likely decays into an even more dovish committee as we get closer to May 3) a jobs outlook that isn’t rapidly declining as some had feared in October / November 4) economic reacceleration (GDP printing 3%) 5) tax refunds to the consumer and 6) potential reduction in the average effective tariff rate from the Supreme Court’s IEEPA ruling.

Yet when it comes to the pain trade, it isn't stocks that are the big risk, but rather bonds.

As Privorostky concludes, bonds are the focus as they are the most logical thing to spoil the pro fiscal growth policy. What he means is that if bonds back up enough to tighten financial conditions, growth expectations get downgraded, and crowded cyclical exposure sells off.

That said, not even today's modest selling is enough to push the Goldman trader into a bearish mindset: as he explains, the big picture is one where "it is hard not to remain constructive when Gold and anything precious/real inflating away," and "equities are the ultimate store of real value but locally think can correct more. Watch bonds..." and especially Japanese bonds, which brings us to something we pointed out earlier: Japan could either be nearing the end of its doomed monetary experiment... or is about to massively kick the can by launching the next QE/Yield Curve Control episode. This is how Privorotsky put it:

The question I keep coming back to is when the correlation between rates and equities finally flips (bond yields up and Japan banks down). Up to now, fiscal expansion has pushed yields modestly higher while rewarding equities in a pro-growth, mildly inflationary backdrop. There has been no real constraint on spending. If we are approaching the theoretical upper limit of Japan’s fiscal capacity, one of two things has to give. Either Japan materially scales back its spending ambitions… politically toxic, especially for Takaichi and her hopes of a fiscally unified election platform (who wants to pay taxes on food?) or the BOJ is forced back into YCC. The former looks unpalatable. The latter risks a risk to the fx but feels like the logical endgame. The historical analogue is familiar. In episodes of fiscal dominance, governments often lean on inflation while central banks cap nominal rates, generating persistently low real rates and a structurally weaker FX.

So YCC it is. If only someone could tell the crypto algos...

More in the full Goldman Weekly Rundown note and the latest report from the Goldman Delta One trader available to pro subs.