Former NY Fed Repo Guru: Powell Will Announce $45 Billion In Bill Purchases On Wednesday

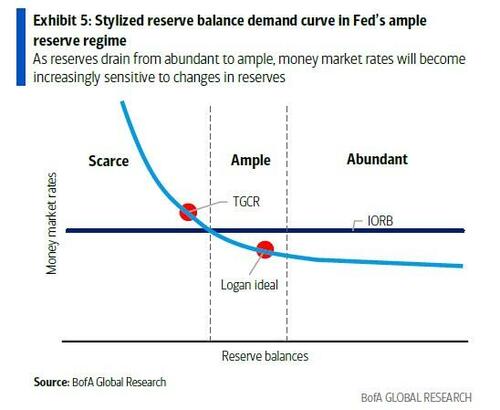

The last time we shared the thoughts of former NY Fed plumbing guru, and current BofA rates strategist - Mark Cabana - was about two months ago, when he validated our prior assessment that the ongoing tensions in the repo market would force the Fed to end its QT early (or at least earlier than the previous consensus call of "early 2026") doing so at the October FOMC. Specifically, in late-October when both SOFR and Tri-party GC rates were suddenly spiking every day, Cabana said that “money markets at current or higher levels should signal to the Fed that reserves are no longer ‘abundant',” adding that elevated repo rates and funding stress suggest the system is approaching reserve scarcity (something which we had previously warned about).

That's precisely what happened, and on Oct 29, Powell announced that the Fed would indeed end QT (a month later, on Dec 1) as a result of turmoil in the repo market. However, as we discussed next in "Repo Locking Up Again As Market Tries To Force Fed's "Reserve Management Purchases"", "Top JPM Trader: "Repo Stress Has Been Main Reason For The Market Reversal... And What Happens Next", and especially in "QT Ends Today Amid Repo Surge: What This Means For Overall Liquidity", the Fed has much more left to do.

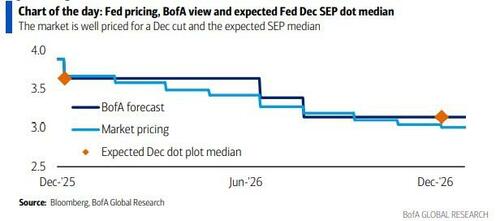

So with just a few days left until the Fed's Dec 10 rate cut, which is now 100% priced in, and with questions swirling what else the Fed may announce to lift risk assets, we once again go back to Cabana's latest must-read note, which tends to have an remarkably accurate predictive track record.

Which is good because according to Cabana, the rate cut is just the start, and the real fireworks will be in what else the Fed will announce in 4 days. Cutting to the chase, in his latest Global Rates Weekly note titled aptly Hasset-Backed Securities, Cabana writes that in addition to the 25bps rate cut - which is now a consensus call after John Williams's infamous Nov 21 dovish pivot, and where Cabana expects three dissents while we expect 4 or more - he also expects the Fed to announce RMPs (Reserve Management Purchases) and term repo operations.

Here are the details.

First, a few thoughts on rates: according to Cabana, the market is increasingly likely to see Powell as a lame duck Fed Chair after the Dec FOMC. The next Fed Chair is expected to be named by the Jan FOMC & the market now sees Kevin Hassett as the lead contender. Once the next Fed Chair is named the market will place greater weight on their guidance for the medium-term path of policy. Powell will still lead for the Jan / Mar / Apr ’26 FOMC meetings but the broader policy path will be guided by the Fed Chair in waiting. BofA suspects the market will price in a lower policy cutting trough based on the next Fed Chair guidance.

Besides the 25bps rate cut which is self-explanatory, Cabana also expects the Fed to announce reserve management purchases (RMPs) at next week's FOMC meeting for start in Jan at a pace of $45b per month. The BofA strategist admits that: "we are out of consensus early and in size", but being out of consensus has never stopped him before, especially since he was always contrarian and right.

The announcement will likely come in the implementation note with more detailed information on size and frequency provided in a link to the New York Fed's website. As part of the RMP notice, the Fed will provide open-ended guidance on the timing of Treasury bill purchases, which Cabana expects to see "at least until the end of the second quarter of next year" to maintain ample reserve balances "at or above" the level of reserves that prevailed prior to the recent episode of repo pressure, likely "early September 2025".

Below we excerpt from the full Cabana note, a must read for all Fed watchers out there:

Balance sheet: at the Dec FOMC we expect the Fed to announce:

- term repo operations

- reserve management purchases (RMPs) starting in Jan.

We see a low chance of an IOR cut but higher likelihood of a parallel reduction in IOR & SRF. Clients tell us we are out of consensus on RMPs. We think the market mis-reads Fed signals.

Term repos: we expect the Fed to announce term repo operations (1-2 week) that span year end at SRF flat or SRF+5bp. Such an announcement will likely help cut the tail on year-end funding markets which trade at an implied rate of SRF+50bps. RMPs: we expect RMPs announced at Dec FOMC & start in Jan '26. RMPs in bills. In ’19, bill purchases were scheduled mid-month to mid-month. RMPs to offset Fed liability growth of ~$20b/m. We estimate $150b backfill needed to reset TGCR for Logan's preferred "money market rates near but slightly below IOR". Our base case sees RMPs of $45b/m, including $25b/m for 6m more than natural RMP run rate of $20b/m to offset Fed over-drain (Exhibit 2). Clients say we are out of consensus on how fast Fed will RMP.

Clients: “Fed has been so slow”. We say: “listen to recent guidance”. RMPs recent guidance: (1) NY Fed President Williams comment that "I expect that it will not be long before we reach ample reserves" (RMPs start after ample reached) (2) Dallas Fed President Logan comment that "I expect it will not be long before it is appropriate to resume balance sheet growth so that money market rates can average close to, but perhaps slightly below, IORB". "Will not be long" likely = Dec FOMC announcement. RMPs waiting till end Jan = too long, in our view.

Administered rates: clients ask: “why not just cut IOR?” We say: “IOR cut solves nothing”. IOR cut solves nothing because banks no longer have excess cash and a 5 or 10bps IOR reduction will not result in a material increase in bank repo lending. Banks are at their minimum preferred level of reserves due to a larger cash liquidity buffer build after SVB failure lessons; SVB lesson include: (1) shorter deposit life (2) supervisor guidance to be less reliant on FHLBs as liquidity source (3) underwater HQLA can’t be sold to raise cash. If the Fed wants to make an administered rate change, we think a 5bps parallel reduction in both SRF & IOR is most likely.

Putting it together, Cabana expects the Fed to announce (via the New York Fed's statement) $45 BN/month in bill purchases starting in Jan. In 2019 T-bill purchases started mid-month to account for MBS prepayments, and the schedule was announced on the 9th biz day of each month. These reserve management purchases will be on top of the Fed's ongoing reinvestment of MBS prepayments into Treasury bills.

The BofA strategist estimates that the Fed will need to buy at least $20b/m for natural balance sheet growth purposes and an additional $25b/m to reverse the reserve over drain, for at least the first 6 months. Furthermore, the Fed will likely want to maintain flexibility in future guidance on T-bill purchases to adjust for growth in Fed liabilities and demand for reserves over time.

Cabana also sees low chance of an IOR cut but see higher likelihood of a parallel reduction in IOR and SRF. The risk for Powell is that these measures could elicit additional dissents.

In terms of market reaction, Cabana looks for a limited rates market reaction to the policy communication but a larger reaction to balance sheet actions including term repos & RMPs, which as noted above, are not consensus. Administered rate adjustments seem less likely. Overall, to Cabana policy outcomes seem fairly-priced and balance sheet outcomes seem under-priced.

Incidentally, it's not just BofA that expects ~$40BN in Bill purchases, according to UBS' Sales and Trading desk, the Fed could buy $40BN a month in T-Bills starting early 2026, to wit:

The Fed is likely to buy as much as $40 bn of T-bills a month in early 2026. The short end of the US rates market is likely to be bumpy going into and through year end, as banks and dealers reduced balance sheet exposure, soaking up reserves in the system. The Fed will rely on its Standing Repo Facility and temporary Open Market Operations (OMO) to maintain market stability. Still, there’s likely to be a significant increase in SFR use, and effective funds rate and repo rates will likely spike well beyond the upper boundary of Fed Funds due to the reserve constraints.

After its Dec. 10 meeting, the Fed should provide some guidance on how it will proceed with balance sheet management over the longer run, though it’s not clear there’s a fully formed decision at this point. Most likely, the Fed will start net asset purchases in January or February, at around $40 bn a month (including MBS run-off proceeds) – half the pace of the original $80 bn a month rundown of the balance sheet, which stopped in October 2024. The Fed will probably buy mostly from the T-bill market as that would allow it to shorten the duration of its assets to better match the average duration of the Treasury market itself and hence remain as low-profile as possible. It’s also the pattern the Fed followed in late 2019 when it reached the same pinch point in bank reserves.

In short, Fed balance sheet expansion is back, i.e., direct liquidity injections, and whether one calls it RMP, QE, or anything else, what matters is the end goal which is simple: with just 5 months left until Powell's exit and Trump's takeover of the central bank, and with the the 2026 midterms looming, it doesn't take rocket surgery to guess which way the Fed's balance sheet - and risk assets - will move in the next 12 months.

Much more in the full must read Mark Cabana note available to pro subs.