Geopolitical Adventurism Has Impacted US Investors More

Authored by Simon White, Bloomberg macro strategist,

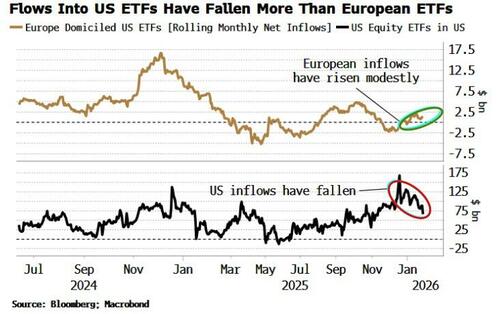

Net flows into US-domiciled US equity ETFs have fallen by more than European-domiciled ones over the last few weeks.

For all the European threats of capital withdrawal from the US in the wake of President Trump’s efforts to annex Greenland, there has been little sign of it, at least in ETF flows.

The chart below shows that net monthly flows into European-domiciled US equity ETFs have risen this year, and are now modestly positive.

These ETFs are more likely to be used by European investors to get exposure to the US market. Their net flows steadily fell through the first half of last year as the tariff war heated up, so they are a useful real-time gauge of foreign sentiment on US assets.

The chart above also shows that net flows into US-domiciled US equity ETFs has fallen in recent weeks, more so, both relatively and absolutely, than for the European ETFs. Perhaps domestic investor sentiment was hit more than that of foreigners after Trump’s interventions.

Either way, it looks like US retail traders (retail are often the main users of ETFs) are trimming risk as the S&P makes another new high, crossing 7000 for the first time Wednesday, before falling back rapidly on Thursday...

However, not seemingly getting cold feet, despite geopolitical uncertainty with Venezuela, Greenland and now Iran, are hedge funds.

The sensitivity of their returns to stock-market returns has picked up markedly this year, indicative of them increasing their exposure to equities.

Typically, the so-called smart money calls it right when itself and retail disagree on the market outlook.

European investors also seem unperturbed (and clearly not offended enough to start selling US assets).

Still, they could both be proven wrong, and it’s not impossible the US retail crowd’s uneasiness in stocks is justified.