A Global Boom Is America's Gift To The World

Authored by Simon white, Bloomberg macro strategist,

Government spending in the US is driving a global expansion, weighing on the dollar and underwriting the outperformance of equities around the world.

In the process of writing this column twice weekly I review lots of data and hundreds of indicators.

It can be a fruitless task but, just sometimes, seemingly disparate charts jump out and together join the dots in a bigger story. That’s the case today.

Before I get to that, an important point on charts. This column focuses so heavily on them as too often in markets analysis the difference is blurred between deductive reasoning, based on logical assertions or commonly accepted narratives, and inductive reasoning, using what happened before to gauge what happens next.

Both types are necessary, but often logical assertions are made that sound intuitive yet are not backed up empirically.

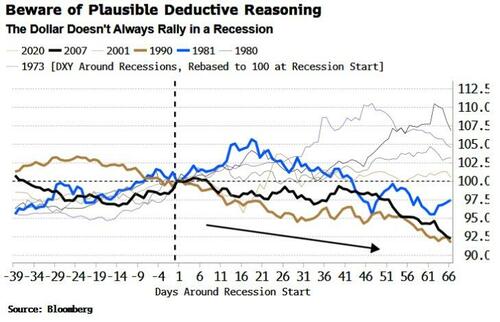

A statement about markets, such as “the dollar is risk-off therefore it always rallies in a recession,” is almost always implicitly about a time series – ie it can be shown in a chart.

Deductively an assertion can sound plausible, but inductively, illustrated through a chart, it may not be the case (the dollar has only rallied through about half of recessions since the 1970s).

So with that in mind, let’s return to today.

The charts are telling a compelling story of the massive US fiscal deficit galvanizing the domestic economy and driving near-term recession risk to very low levels, catalyzing a weaker dollar and supporting global excess liquidity.

Stock markets around the world are surging higher as the global economy benefits from a cyclical upswing.

The US is fueling this move. But there are risks investors should pay heed to. Several overseas markets are looking very overbought, while almost all types of holder of American stocks are historically very overweight US equities, from households to foreigners to financial firms.

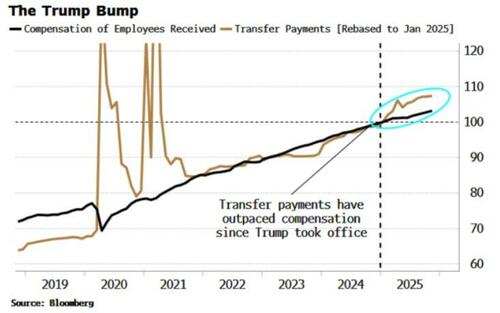

Enough words. The first chart that jumped out was on government transfer payments (benefits, etc). It’s no surprise they have been rising given the deficit, by $400 billion since Trump’s second term started, but they have in fact been outpacing employee compensation since that time.

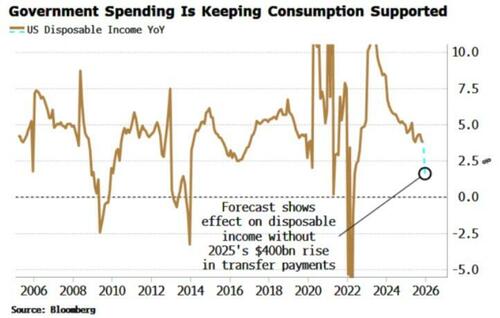

Transfer payments have been the only significant driver of rising disposable income this past year, and without that boost income would be growing at its lowest rate for over 10 years, at less than 2% annually and negatively in real terms.

Consumption has also been supported by the compression of mortgage spreads as bond vol has fallen and the yield curve has steepened, and by banks more willing to make consumer loans. December’s weak retail sales report looks too negative given the supportive backdrop.

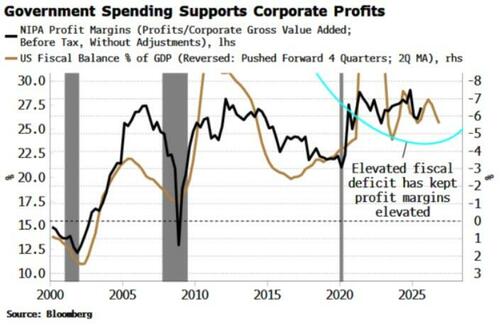

Fiscal spending is also the main reason why profit margins have remained elevated. The deficit supports private spending directly, via transfer payments as above, and indirectly through tax cuts, government consumption and the wages of public workers. This flows down to corporates’ bottom line.

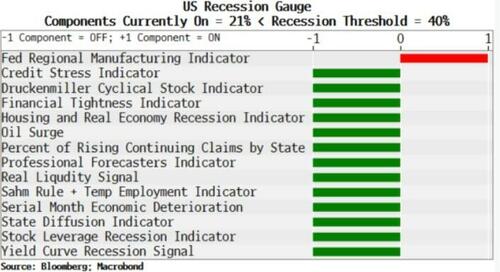

It’s no wonder recession risk keeps dropping. My Recession Gauge consists of 14 submodels, based on a wide range of market, economic and sentiment data. The gauge triggers when at least six of the submodels are activated. Only one remains active today, the least since exiting the 2020 recession.

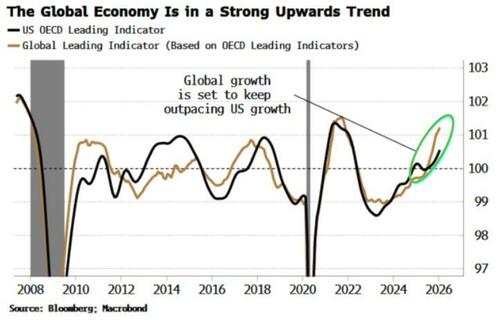

The US economy has remained on an even keel and is now showing signs of reaccelerating. This is good for growth across the world, which is on the cusp of also accelerating higher, and further outpacing US growth, based on OECD leading indicators.

If there are any doubts a global upswing is in play, the following chart should allay them. The rapid rise in exports from small, open and highly cyclical markets such as Taiwan and South Korea is pointing to an upswell in global earnings. The massive rise in AI capex spending should be felt widely.

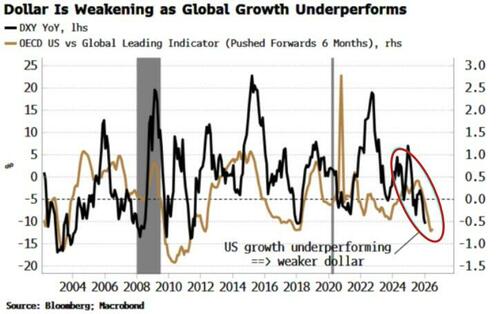

Paradoxically, an accelerating US is negative for the dollar: strong US growth has a geared impact on the global economy, driving foreign currencies higher against the dollar.

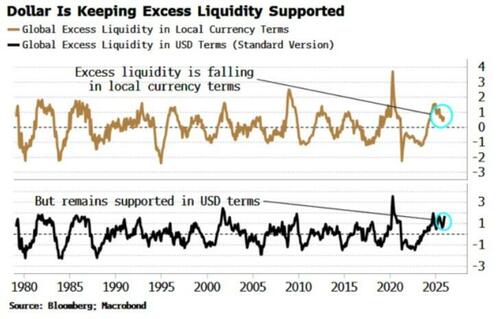

The weak dollar is almost single-handedly keeping G10 excess liquidity supported. As a reminder, this is real money growth versus economic growth for the G10 in dollar terms. In local currency terms, excess liquidity is getting squeezed, but a lower dollar is acting like a stimulant, undergirding the USD value of non-US money.

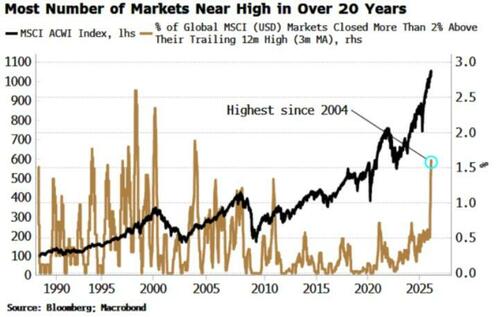

It is also therefore no wonder that stock markets around the world are surging higher in dollar terms, catapulted there by excess liquidity and stronger domestic currencies. The number of dollar-denominated MSCI country indexes that are more than 2% above their one-year peak has jumped to its highest level since 2004.

One of the in-vogue trades recently has been buying the equities of the rest of the world versus the US. The latter has outperformed almost every year since the GFC, but since late 2025 US stocks have badly lagged their global counterparts.

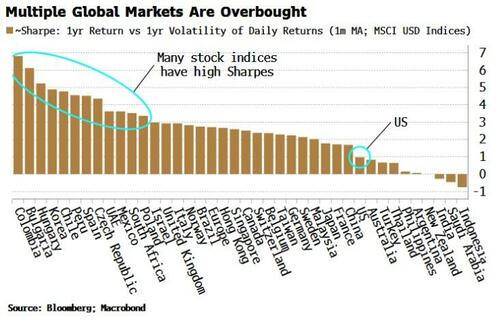

That’s expected to continue, but many markets are already looking overbought. About three-quarters of major dollar-denominated MSCI EM and DM country indexes have a Sharpe ratio of more than two (approximating the ratio by annual return divided by annual vol); for a quarter of them it’s more than four.

Excessively high risk-adjusted returns are often the harbinger of market downturns. There could then be a reappraisal of the US – now with a very low Sharpe ratio – especially as it is holding up remarkably well given the travails of the hyperscalers and software firms.

The risks investors need to look out for are sudden rises in recession likelihood, strong counter-trend rallies in the dollar and contractions in liquidity or, as usual, geopolitical flare-ups.

Otherwise, the story told from the charts above is of a resilient US economy helping to fuel a global upswing and bolster liquidity through a weaker dollar. Far from withdrawing from the world in a haze of “America First” ideology, the US is still highly influential to the fate of the global economy and its markets.