NS

NSGlobal equities mixed; markets await ECB and BoE rate announcements - Newsquawk US Market Open

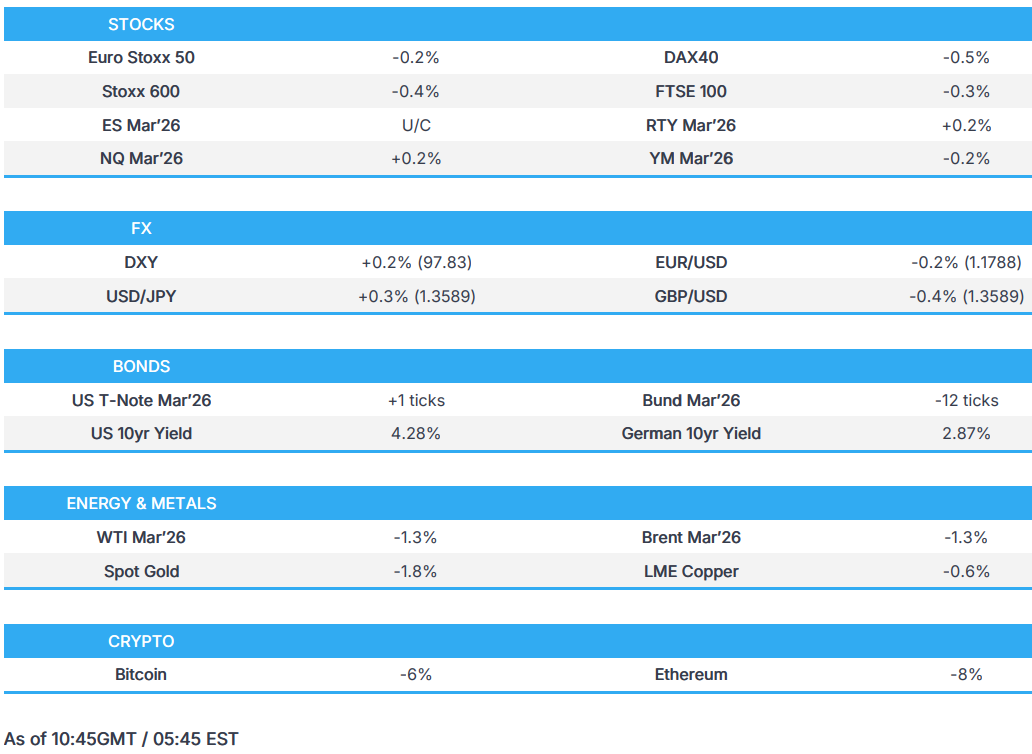

- European bourses are broadly on the backfoot; US equity futures mixed, but the NQ outperforms, as chip names benefit from Alphabet boosting AI spending.

- DXY is mildly firmer, with G10s lower to varying degrees; Aussie hampered by pressure in metals, GBP lags into BoE.

- Fixed income benchmarks are mixed; USTs incrementally firmer, whilst Gilts underperform on political woes.

- Crude benchmarks slip with US-Iran meeting confirmed, Spot gold moves lower, silver -10.5%.

- Looking ahead, highlights include US Challenger (Jan), Weekly/Continuing Jobless Claims, Revelio PLS, ECB Announcement, BoE Announcement & MPR, Banxico Announcement, CNB Announcement. Speakers include BoE’s Bailey, ECB’s Lagarde, Fed’s Bostic, BoC’s Macklem & RBA's Bullock.

- Earnings from Amazon, Strategy, Roblox, Reddit, Bloom Energy, ConocoPhillips, Bristol Myers Squibb and Barrick Mining.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -0.6%) are broadly lower, though the AEX is mildly firmer, boosted by strength in ASML (+1.1%). The chip giant has been boosted after Google noted it would boost AI spending.

- European sectors hold a negative bias. Basic Resources underperforms given the pressure in the metals complex, whilst Shell (-2%, Q4 metrics light) weighs on the Energy sector. Other key movers include Volvo Car (-22%) after poor results and a dire outlook.

- US equity futures (ES U/C, NQ +0.2% RTY +0.2%) are mixed, with very mild outperformance in the tech-heavy NQ. Key names are losing in pre-market trade (Google -2.4%, Arm -6.7%, Qualcomm -10.5%), but focus has been on Google’s decision to double AI spending – a factor which has boosted chip names.

- Alphabet Inc. (GOOGL) Q4 2025 (USD): EPS 2.82 (exp. 2.64), Revenue 113.8bln (exp. 111.29bln) Shares -2.4% pre-market

- ARM (ARM) Q3 2026 (USD): Adj. EPS 0.43 (exp. 0.41), Revenue 1.24bln (exp. 1.23bln) Shares -6.2% pre-market

- QUALCOMM (QCOM) Q1 2026 (USD) Adj. EPS 3.50 (exp. 3.39), Revenue 12.25bln (exp. 12.21bln) Shares -11.1% pre-market

- Maersk (MAERSKB DC) Q4 (USD) EBITDA 1.8bln (exp. 1.84bln), Revenue 13.3bln (exp. 12.9bln).

- Shell (SHEL LN) Q4 (USD): Adj. Profit 3.26bln (exp. 3.51bln), EPS 0.57 (exp. 0.63), Adj. EBITDA 12.79bln (prev. 14.77bln Y/Y), announces USD 3.5bln share buyback programme.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is kept afloat as it continues to claw back losses seen towards the end of January. That being said, the upside is limited following mixed data releases stateside and with plenty of focus on geopolitics amid reports that US-Iran talks scheduled for Friday were off, and on again. DXY has topped resistance seen around the 97.70-97.75 area to reach a current high of 97.83, still some way off the 23rd Jan high at 98.481.

- GBP/USD is among the laggards heading into the BoE, but likely more on political factors at the moment, with UK PM Starmer's premiership coming under scrutiny for his decision to appoint Peter Mandelson as the US ambassador despite links to Epstein. Back to the BoE, the Bank Rate is expected to be maintained at 3.75%, with some mixed views on the vote split. GBP/USD resides towards the bottom end of a 1.3576-1.3664 range.

- EUR/USD resides in a narrow 1.1783-1.1809 range ahead of the ECB announcement and presser. The ECB is expected to keep its rates on hold, a view held by the likes of Goldman Sachs and Morgan Stanley. Data developments play in favour of keeping rates steady; inflation dipped below the Bank’s target in January, but largely due to base effects. Focus this meeting will be on any commentary surrounding the stronger EUR, trade/geopolitical uncertainty and higher gas prices.

- USD/JPY continues rising amid the firmer USD, with the pair back above 157.00, with yen weakness persisting throughout the week ahead of the snap elections on Sunday. Elsewhere, Antipodeans are softer with AUD the G10 laggard amid headwinds from the subdued risk appetite and selling pressure in commodities.

FIXED INCOME

- USTs are currently firmer by a couple of ticks and trade within a narrow 111-18+ to 111-24 range. Not much driving things for the benchmark this morning, but the focus has been on geopolitics. On Wednesday, it was reported that the US-Iran talks were cancelled, but are now back on and set to happen on Friday. Back to the US, the BLS provided an updated data schedule following the recent partial shutdown. JOLTS is set to be released today; NFP on Feb 11 and CPI on Feb 13. That aside, Jobless Claims is due today, with traders looking to see if the labour market remains in its recent “low hiring – low firing” environment.

- Bunds trade steady and in a narrow 127.88-128.07 range. Really not much driving things for the benchmark this morning aside from EZ Construction PMIs and Retail sales, which had a limited impact on price action. Ahead, the ECB is set to keep its deposit rate at 2.00% and is likely to reiterate that the Bank is in a good place. Focus will be on the recent strength of the EUR and any comments related to potentially undershooting inflation.

- Gilts are underperforming this morning, currently lower by around 40 ticks. Initially gapped lower by around 19 ticks, and then extended lower to make a trough of 90.13. The underperformance in Gilts today can be attributed to the increased pressure that PM Starmer is facing for his decision to appoint Peter Mandelson as the US ambassador, despite knowing about his links to Epstein. As it stands, several MPs are calling for Starmer to resign whilst others are calling for the sacking of Chief of Staff McSweeney; MP Turner said if he does not sack him, then his own back will be “up against the wall… soon” – nonetheless, the did suggest that there is still support for the PM adding that MPs do not want him to go. As it stands, Polymarket odds of Starmer to be out the door by June 30th have risen to 47% (vs 23% yesterday).

- France sold EUR 13.5bln vs exp. EUR 11.5-13.5bln 3.20% 2035, 3.50% 2035, 3.60% 2042 and 3.00% 2049 OAT.

- Spain sold EUR 5.838bln vs exp. EUR 5-6bln 2.35% 2029, 3.00% 2033, 3.20% 2035 Bono and EUR 0.646bln vs exp. EUR 0.25-0.75bln 0.70% 2033 IL.

- Japan sold JPY 525bln 30-yr JGBs; b/c 3.64x (prev. 3.14x), and average yield 3.615% (prev. 3.447%).

COMMODITIES

- Crude benchmarks continued to trade with a lack of clear direction. The pressure seen at the start of the week (following plans of US-Iran talks) was completely reversed in Wednesday's session over reports that the talks have been cancelled due to Tehran's demands to change the location and talk format. Late in Wednesday's session, Iran's Foreign Minister reconfirmed that talks are back on in Oman for Friday. Prices dropped at the end of the US session. As the European session got underway, benchmarks reversed overnight losses, with Brent returning above USD 68.50/bbl. Today is the expiration day of the New START Treaty. This outcome was expected amid a lack of effort from both sides to renew the agreement.

- Spot gold ended Wednesday's session below the USD 5,000/oz handle but attempted to regain above the level at the start of the APAC session, but failed to do so. The yellow metal fell to a low of USD 4,790/oz, weighed on by the plunge in silver prices, before slightly paring back losses as European trade gets underway.

- Spot silver wiped out the entirety of the two-day recovery the metal attempted to stage as trade at the Shanghai Metals Exchange got underway. The metal kissed USD 90/oz before slipping to a trough of USD 73.55/oz, with losses seen as much as 16%. Dip-buyers took advantage of the lower prices, with silver prices currently trading around USD 80/oz.

- China gold consumption reportedly fell by 3.6% to 950 tons in 2025 and total gold production rose 3.35% Y/Y to 552 tons.

- 3M LME Copper continued the selloff seen throughout the US session, with the red metal dipping below USD 13k/t to a trough of USD 12.86k/t. This comes following continued worries that AI will become a bigger factor within business models. The tech sector has been weighed on in recent sessions, as in turn, dragged copper prices lower.

TRADE/TARIFFS

- India's Foreign Ministry said they are looking to explore commercial merits of any crude supply, including from Venezuela.

- India's Trade Ministry Officials said that India will need to import USD 300bln annual worth of goods and the US will be one of the key suppliers of energy, aircraft and chips.

- Indian Trade Minister said we will announce the first tranche of a trade deal agreed with the US.

- China's Foreign Ministry said we oppose any country forming small groups to disrupt international economic and trade order.

NOTABLE EUROPEAN DATA RECAP

- EU Retail Sales MoM (Dec) M/M -0.5% vs. Exp. -0.2% (Prev. 0.1%, Rev. From 0.2%, Low. -0.4%, High. 0.2%).

- EU Retail Sales YoY (Dec) Y/Y 1.3% vs. Exp. 1.6% (Prev. 2.4%, Rev. From 2.3%).

- EU HCOB Construction PMI (Jan) 45.3 (Prev. 47.4).

- UK S&P Global Construction PMI (Jan) 46.4 vs. Exp. 42 (Prev. 40.1).

- UK New Car Sales YoY (Jan) Y/Y 3.4% (Prev. 3.9%).

- Italian Retail Sales MoM (Dec) M/M -0.8% vs. Exp. 0.4% (Prev. 0.5%).

- Italian Retail Sales YoY (Dec) Y/Y 0.9% (Prev. 1.3%).

- Italian HCOB Construction PMI (Jan) 47.7 (Prev. 47.9).

- German HCOB Construction PMI (Jan) 44.7 (Prev. 50.3).

- German Factory Orders MoM (Dec) M/M 7.8% vs. Exp. -2.2% (Prev. 5.6%, Low. -5%, High. 3%).

- French HCOB Construction PMI (Jan) 43.5 (Prev. 43.4).

- French Industrial Production MoM (Dec) M/M -0.7% vs. Exp. 0.2% (Prev. 0.1%, Rev. From -0.1%).

CENTRAL BANKS

- Fed's Cook (voter) said she will continue to carry out duties at the Fed and she looks forward to getting to know Warsh. said:Hopes that goods inflation will dissipate quickly, and once they do, should be back on the disinflation path.

- Fed's Cook (voter) said she is focused on inflation risks and noted that when considering the proper stance of monetary policy, she sees risks to both sides of the dual mandate. said:. Progress on inflation has stalled, while such a plateau is frustrating after seeing significant disinflation in the preceding few years. It is essential we maintain credibility by returning to a disinflationary path.

- Federal Reserve finalizes big bank stress test criteria, votes to keep current capital buffer; Bowman said freezing bank capital levels allows Fed to correct any "deficiencies" in stress test models.

- Westpac's Ellis said can't rule out the RBA raising interest rates for a second consecutive time in March, according to Bloomberg.

- China Securities Daily reported that analysts now expect PBoC RRR 'cuts' in Q2.

NOTABLE US HEADLINES

- Republican Senator Hawley is circulating a bill around Congress that would ensure the costs of data centre's energy use is not passed onto consumers, Axios reported citing a bill summary.

- US President Trump commented that Fed is in theory an independent body, adds looking at tariff rebate checks very seriously, but haven't committed to tariff rebate checks yet, while he discussed expanding immigration operations to five cities.

- White House said President Trump is to make an 'announcement' on Thursday at 19:00 Eastern Time (00:00GMT).

GEOPOLITICS

RUSSIA-UKRAINE

- US Envoy Witkoff said that discussion between US, Ukraine and Russia were productive but "significant work remains"; talks will continue, with additional progress anticipated in the coming weeks; Ukraine and Russia agreed to exchange 314 prisoners.

- Russia's Kremlin spokesperson confirms the New START Treaty ends today.

- Russian Envoy Dmitriev said Russia-US meetings in Abu Dhabi are positive; progress on a peace deal despite pressure from the EU and UK; active work ongoing to restore Russia-US relations.

MIDDLE EAST

- Israeli security assessments note Houthis may attack Israel if Washington launches a strike against Iran, according to Sky News Arabia.

- Palestinian media reported Israeli artillery shelling targeting the Al-Bureij camp in the central Gaza Strip.

CRYPTO

- Bitcoin is on the backfoot and trades around USD 71.5k; Ethereum is also posting losses, down to USD 2.1k.

APAC TRADE

- APAC stocks were mostly lower following the continued tech selling stateside and flip-flopping regarding US-Iran talks, while commodities were pressured overnight with silver prices dropping by a double-digit percentage.

- ASX 200 was dragged lower by weakness in mining and resources stocks after underlying commodities prices took a hit, but with the losses in the index stemmed by resilience in financials and consumer stocks.

- Nikkei 225 saw early indecision but eventually slipped below the 54,000 level alongside the downbeat mood in the region.

- Hang Seng and Shanghai Comp declined with notable weakness in miners, property names and insurers, while an increased liquidity effort by the PBoC and reports of an 'excellent' call between Trump and Xi failed to spur risk appetite.

NOTABLE ASIA-PAC HEADLINES

- Chinese provinces set lower growth targets for 2026, according to FT.

- China is said to pause Panama deals after CK Hutchinson's (1 HK) port operations were nullified.

NOTABLE APAC DATA RECAP

- Australian Balance of Trade (Dec) 3.37B vs. Exp. 3.325B (Prev. 2.94B, Low. 2.6B, High. 4.0B).

- Australian Imports MoM (Dec) M/M -0.8% (Prev. 0.2%).

- Australian Exports MoM (Dec) M/M 1.0% (Prev. -2.9%).

- Japanese Foreign Bond Investment (Jan/31) 713.7 (Prev. 190.4, Rev. From 177.6).

- Japanese Stock Investment by Foreigners (Jan/31) 494.6 (Prev. 329.5, Rev. From 328.1).

NOTABLE APAC EQUITY HEADLINES

- Foxconn (2317 TT) January revenue TWD 730bln, +35.5% Y/Y (prev. +31.8% Y/Y); expects seasonal performance for the current quarter to be better than the past five-year range. Cloud networking products sales grew strongly Y/Y in January.

- Sony (6758 JT) 9-month (JPY) net loss 409.7bln, oper. profit 1.28tln (prev. 1.06tln Y/Y), rev. 9.44tln (prev. 9.23tln Y/Y), raises share buyback to JPY 150bln from JPY 100bln. Co. raises FY26 oper. profit guidance to 1.54tln from 1.43tln and rev. guidance to 12.3tln from 12.0tln.