Global Reflections: Top Goldman Trader Asks The 'Two Trillion Dollar Question'

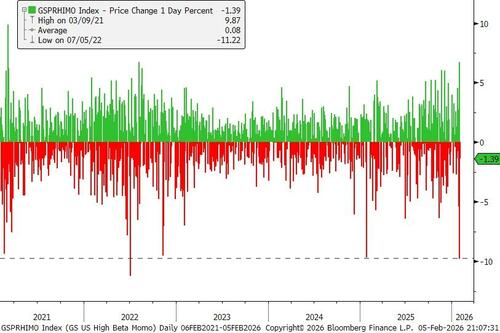

The unwind in Gold/Silver last Friday was a precursor to dramatic thematic and factor vol this week, reminiscent to the aftermath of the crypto liquidation in October that led to big unwinds in Mid-October through November.

Similar to then, top Goldman Sachs trader Louis Miller notes that momentum wobbled, but didn’t break.

Given the positive earnings revisions of the long-leg of momentum, meaningful dips should be bought, while respecting vol.

The var shock has indeed left a mark.

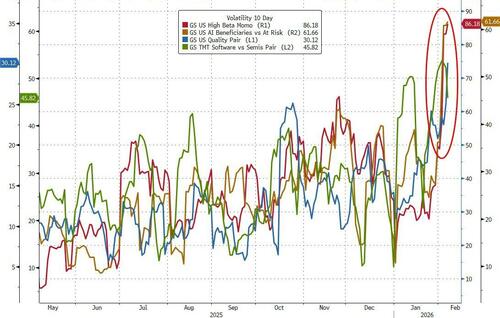

Currently, the 10 day realized vol of many themes are in the 99th percentile going back to 2010 including: High beta momentum (GSPRHIMO Index), AI Winners vs At Risk (GSPUARTI Index), Quality (GSPUQUAL Index), and many others aren’t far behind: Software versus Semis (GSPUSOSE Index, 97th percentile), Cyclicals vs Defensives (GSPUCYDE Index, 94th percentile), L/S Beta (GSPUBETA Index, 96th percentile).

Given the current volatile backdrop, it is a bit easier to take risk in real economy themes.

-

Regional banks screen well on steeper yield curve, de-regulation, M&A, short momentum factor;

-

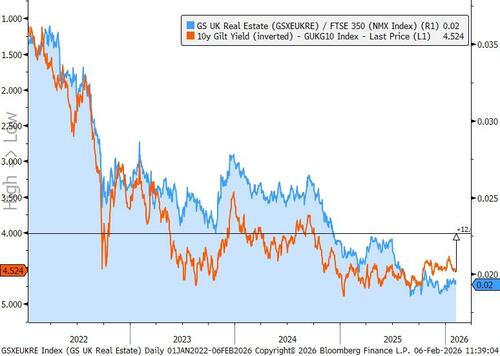

while colleagues in London/Paris quite like UK Real Estate (GSXEUKRE Index) ahead of a potential rate cut in March.

-

In a similar vein, industrial policy aligned themes feel very strong here. See Point 3 for more on 1) onshoring, 2) Japan economic security and 3) German fiscal.

-

Also, the CHEERS Chinese New Year trade has nothing to do with the unwind we are seeing in software versus semis or metals, and the seasonality pattern is quite strong. The market closes for Lunar New Year soon, so worth considering Sunday night.

The $2 trillion dollar question is what to do with software...

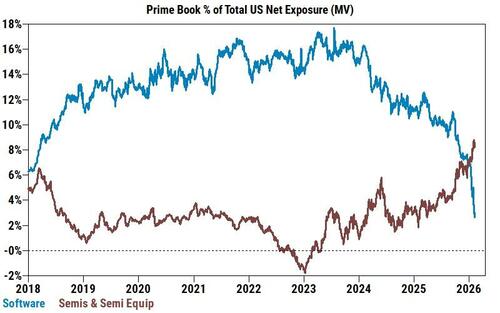

From a flow perspective YTD and in the past week, Software is by far the most net sold AND shorted subsector on the PB book...our US Software single stock short book is +19% WoW and +55% YTD.

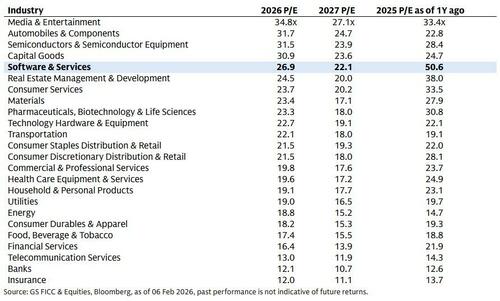

If we consider software to be valued on a P/E instead of a EV/EBITDA basis, it is fair to say that the software industry has definitely de-rated to a level more comparable to the rest of the market (27x today, 51x 1 yr ago), our work would suggest it still looks 4x expensive to other industries based on EPS growth, but superior sales growth and margins would argue things are more fair.

Source: Goldman Sachs

The key thing will be terminal value, pace of disruption, and stocks like MSFT at/near mkt multiples certainly will get your attention.

When software becomes a beachball in the ocean as opposed to a falling knife is an important calibration exercise because it affects the vol and investability of the long leg of momentum (ie Memory).

With 10+ AI model updates and tools expected to launch in the next month, volatility in areas perceived to be at risk of AI disruption will likely remain high.

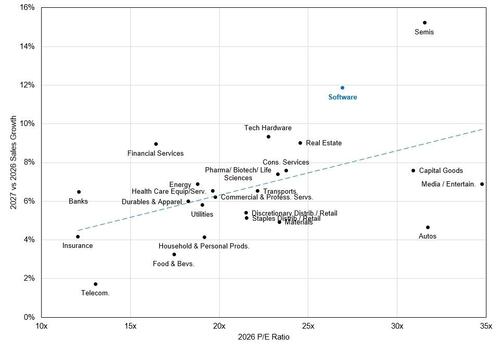

From a Sales growth perspective, Software still stands out significantly relative to the rest of the equity market.

Source: Goldman Sachs

1. AI Disruption Risk & How to Hedge the ‘Sell Now, Ask Later’ Panic?

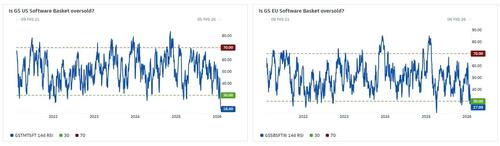

US Software (GSTMTSFT) has lost ~$2tn of value from the highs, posting its worst weekly performance (-6.7%) in almost four years following the launch of Anthropic’s latest AI tools. EU Software (GSSBSFTW) is similarly under pressure (-3.5%) as the market re-evaluates valuations against mounting EPS challenges. While these pockets now trade in ‘oversold’ territory, we are yet to see buyers meaningfully step in and defend valuations at current levels. As GS research points out, US Software’s forward P/E has declined from 35x in late 2025 to 20x currently, and EU Software now trades on 17x vs. 25x, but with profit margins still at the highs, the decline in valuations implicitly indicates these estimates will also decline. With 10+ AI model updates and tools expected to launch in the next month, volatility in areas perceived to be at risk of AI disruption will likely remain high.

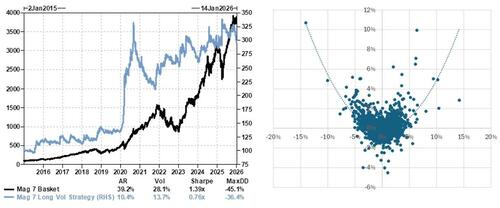

A pick-up in micro news-flow is also driving higher vol across the Mag 7, which until last week was screening surprising low. Our traders have observed increasing dispersion driven by divergent AI strategies and monetization timelines (GOOGL +3.2% vs. MSFT -17% YTD). We see compelling opportunities to trade volatility on individual names, particularly around earnings, with NVDA reporting on Feb 25th. We recommend going long our Mag 7 Vol strategy (ticker: GSVIM7V1) to mitigate concentration risk and potentially monetize dislocations in Mag 7 volatility.

Source: Goldman Sachs

Worth mentioning we are launching an S&P 500 ex AI index with S&P next week (SPXXAI Index), stay tuned for more.

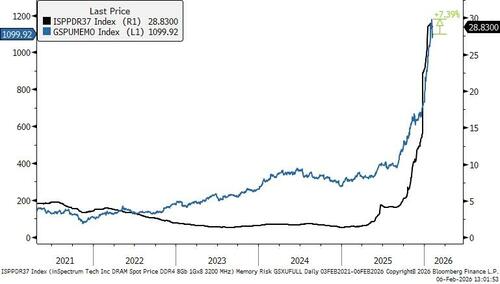

The pair of going long Memory Beneficiaries vs short Memory Input Cost Exposed Equities (GSPUMEMO = GSTMTMEM vs GSXUFULL) unwound this week with momentum and now has over 7% upside to memory prices. While the TAM of software and other parts of the market were under scrutiny, nothing fundamentally changed for the memory market and, if anything, increased proliferation of AI should further increase demand unless there is a meaningful cap ex deceleration. While the pair has a momentum bias, the fundamental story remains strong. Notably, expected earning of memory names have more than tripled while Memory Input Cost earnings have lagged the broader index.

RSI implies US & EU software is oversold...

Source: Goldman Sachs

...but flows remain skewed with no buyers stepping in

Source: Goldman Sachs

Our Mag 7 Long Vol Strategy (GSVIM7V1) has historically reacted quickly in risk-off regimes, with strong convexity to Mag 7 drawdowns

Source: Goldman Sachs

Pair Trade of Going Long Memory Beneficiaries vs Memory Input Cost Exposed has tracked memory prices (as tracked by specific SKU)

Source: Goldman Sachs

2. Momo Vol Here to Stay

For all the talk about momentum unwind this week, the factor, and notably the long leg, are both essentially flat vs when we left the office last Friday.

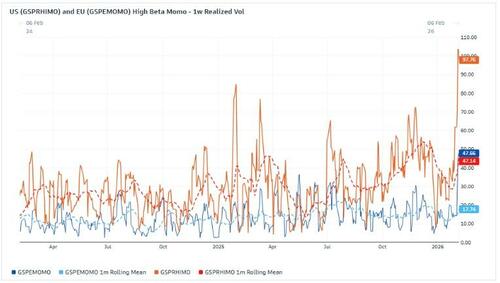

Broadening AI disruption risk and stretched technicals are driving much higher factor and thematic vol of late. Momentum factor volatility is currently in the 95th percentile of the last 5Y, with the factor delivering +3-4 SD moves in the last few days. The most recent sell-off has been driven by strong underperformance of the long-leg (i.e past winners GSXUHMOM, GSXEHMOM) which is skewed towards cyclical high beta themes in both the US & Europe.

Historically, buying the momo dip has paid off in the medium-term, but we are yet to see major signs of capitulation.

EU Momo: GSXELMOM Mar 105% Call costs 1.1% / 22d & GSXEHMOM Mar 95% Put costs 1.3% / 23d

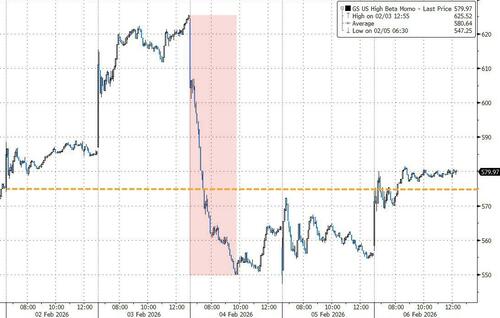

US High Beta Momo (GSPRHIMO) had its worst day since the Deep-Seek sell-off (Jan 2025) this week, amidst stretched short-term technicals and volatility around the AI disruption narrative

Source: Goldman Sachs

Momo Vol has spiked above levels seen in the last 2 years, supporting our view of the value in short-term hedging

Source: Goldman Sachs

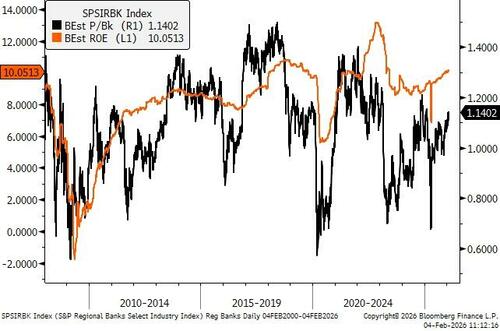

3. Real Economy Trades That Make Sense

US Regional Banks - Against this backdrop, real economy trades that are not exposed to the momentum factor make sense. One trade very aligned with policy and strong growth is US regional banks. We like our Liquid Regional Banks Basket (GSCBRGBK) for exposure to a steeper yield curve, improving loan growth, and deregulation. Our Regional Bank M&A basket (GSFINRMA) has the added kicker of potential consolidation and this week’s Santander/Webster Bank announcement points to a pick-up in activity. With focus on deregulation and improving fundamentals, Regional Bank (GSCBRGBK) and Regional Bank M&A (GSFINRMA) exposed earnings have been moving higher while broader Financials (GSXUFINA) earnings have turned lower. The ROE for regional banks also seems to justify above average valuations and positioning looks favorable.

The ROE of US regional banks seems to justify above average valuations

Source: Goldman Sachs

UK Real Estate - While UK growth is less robust than the US, we see an opportunity to step into a real asset trade (UK Real Estate = GSXEUKRE) that screens cheap on valuation, where earnings momentum has been positive, and where there is a clear alignment with one key macro variable: Gilt yields. Despite holding rates steady, the BoE has turned decisively dovish this week (vote split, forward guidance). The market was quick to reprice probability of a March rate cut (from 18% to 70%) but GS is still notably below market pricing on the terminal rate. Long duration assets like Real Estate display high negative correlation with UK yields. Last year’s underperformance vs. FTSE 350 offers an attractive opportunity to go long ahead of the March BoE meeting and improving EPS momentum (better housing affordability, rent growth in office given strong S/D). Valuations offer some re-rating potential, with UK P/NTA at -32% vs. a historical average of -19%, and we note SMID-cap M&A picking up (e.g. Assura, Warehouse REIT, Empiric). GSXEUKRE Mar 105%/115% Call spread costs 1.4%, 23d, 7x payout.

Relative performance of our UK Real Estate basket (GSXEUKRE) is highly correlated with long-term Gilt yields

Source: Goldman Sachs

4. A Global Theme That Warrants Focus

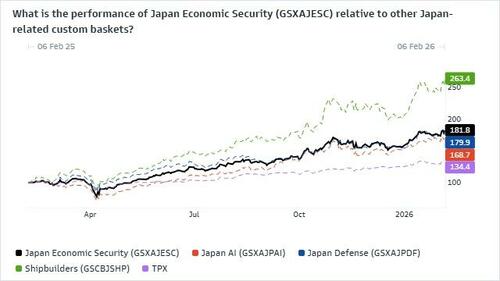

Another angle to the AI insulated trade is the onshoring & national security theme, not just in the US (GSXUSHOR, GSXUNATL), but also in Germany (GSXEGFSC) and Japan (GSXAJESC). We like this trade given a structural shift in geopolitics driving re-industrialization in the old economy to bolster national reserves across strategic sectors. Not only does higher fiscal spend support a robust earnings outlook, but these sectors also benefit from being relatively high-beta, pro-cyclical and high FCF generating – something investors are likely to reward amid AI disruption related credit concerns.

-

The nearest catalyst is for our Japan Economic Security basket (GSXAJESC) with snap elections this weekend. Latest surveys indicate a strong majority for the ruling coalition, which would cement PM Takaichi’s campaign to strengthen economic and defense policy.

Source: Goldman Sachs

-

In Germany, worth noting a significant positive surprise in manufacturing order and continued strong momentum in deployment of the fiscal package, supporting positive momentum in GSXEGFSC earnings.

A sharp uptick in German domestic manufacturing activity supports positive momentum in our German Fiscal Infra Beneficiaries (GSXEGFSC)

Source: Goldman Sachs

-

The US baskets (GSXUSHOR, GSXUNATL) should benefit from increased investor allocation to real economy trades in the near-term, while the macro backdrop of policy support (bonus depreciation) and positive GDP growth also disproportionately favour these industrial companies.

US Onshoring Beneficiaries have historically tracked broader Cyclicals, but are now breaking away as focus on domestic industries ramps

Source: Goldman Sachs

5. Last Chance on CHEERS – The Horse is Leaving the Barn

To capture the Chinese New Year seasonality effect, Wolfe suggests opening ASAP.

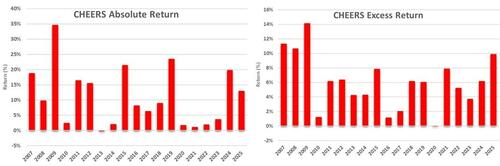

As always we are on the lookout for logical trades that make sense to express risk on views in China. One trade we especially like is this seasonality trade around Chinese New Year. Wolfe’s analysis suggests that investors are more likely to embrace risk around the Chinese New Year season, driving Chinese equities higher in the short term. During this season, the Chinese equity market produced positive returns in 18 out of the past 25 years. In fact, the risk adjusted performance or Sharpe Ratio during this period is 10x higher than an average month.

While index implementations do capture some of this dynamic, Wolfe’s CHEERS Strategy is optimized to capture this seasonality benefit through large- and mid-cap stocks listed in mainland China. The CHEERS portfolio has outperformed the benchmark MSCI China A Onshore index almost every year in the past 19 years and the last 6 years since going live (including years where China is up in Jan), with an average excess return of approximately 6% and an Information Ratio of 5.1x over the 5-week period.

Wolfe suggests a target opening date on Friday, Feb 6th and closing date on March 16th

Source: Wolfe as of January 2026. Past performance is not indicative of future results.

CHEERS Returns in Previous Years

Source: Wolfe as of January 2026. Past performance is not indicative of future results.

6. Upcoming Catalysts

Macro datapoints include small business optimism, NFP, CPI, and a slew of Fed Speakers.

Eyes will be on NFP after a large number of layoffs expected in January and focus on the jobs vs AI conversation this week.

Micro will continue to be in focus with earnings season in full swing.

However, the market has been focused on the top down thematic trades in spite of many of the granular data points coming out this week, and that is likely to continue next week.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal