Gold Jumps, Crypto Dumps As Trump Tensions & Tokyo Tumult Spark Global Bond Rout

The optics suggest a 'sell America' trade re-emerged today (Gold up, Oil up, everything else down)...

Source: Bloomberg

...as Trump re-ignited tariff tensions over Greenland (US to impose a 10% tariff on imports from eight European countries - Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland - starting Feb-1) prompting threats of escalation and retaliation.

...but as Goldman Sachs noted - this was not about geopolitics, this was about Positioning and Japanic.

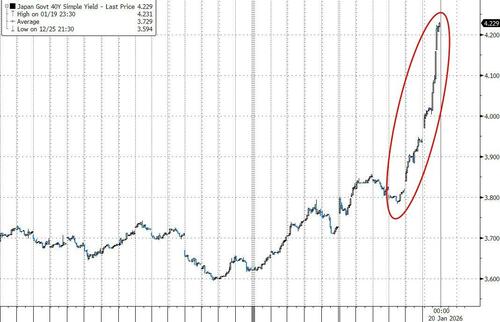

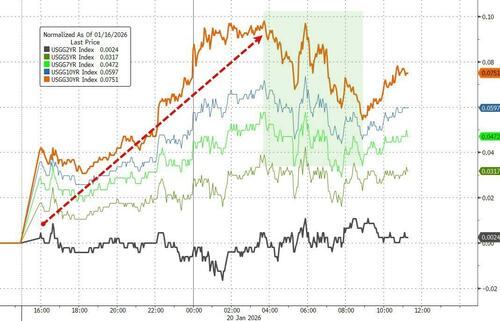

On the latter, "trading action was crazy" in Japanese bond markets as yields on the long-end of the JGB curve exploded higher...

Source: Bloomberg

...with three factors compounding the selloff...

-

First is worries around the snap election and prospect of “muscular fiscal stimulus”

-

Second is data showing life insurers were big net sellers of JGBs in December

-

Third was lackluster 20-year JGB auction

The bottom line on the Japanese bond market chaos is that: “this is basically the market pricing in a Liz Truss moment in Japan,” said Masahiko Loo, senior fixed-income strategist at State Street Investment Management (referring to the former British Prime Minister, who left office in 2022 following a vicious bond selloff in response to her plans to push through a package of unfunded tax cuts).

Although as UBS notes, while today's moves could be largely attributed to PM Takaichi's fiscal expansion story, we observe the biggest drivers may be market demand-supply dynamics.

-

JGB markets are fragile with very skewed demand/supply dynamics.

-

This not a new phenomenon.

-

Rather a multi-year market trend that is difficult to reverse and only exacerbated on headlines like today.

The 40-year yield rocketed past 4%, a first for any JGB maturity in more than three decades and adding to the selling pressure in US Treasuries.

Source: Bloomberg

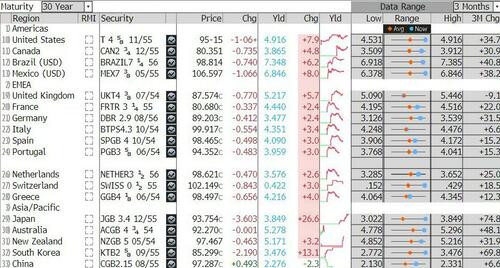

Japan's pain spread to the rest of the world (apart from China) with long bonds a sea of red...

Source: Bloomberg

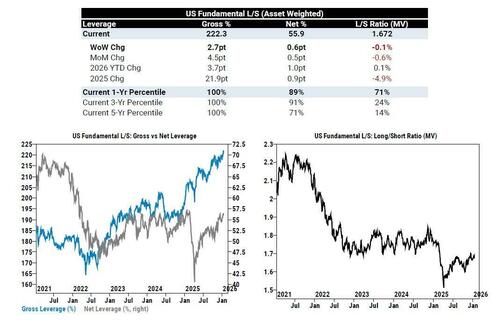

With regard to the former - Positioning - No 'TACO Tuesday' flip-flop from the US President (on EU tariff threats etc) did exacerbate overnight bond weakness in Japan, but with gross exposure at 5 year highs and net near 3 year highs, today's selloff could not have come at a worse time for institutional investors...

Source: Goldman Sachs

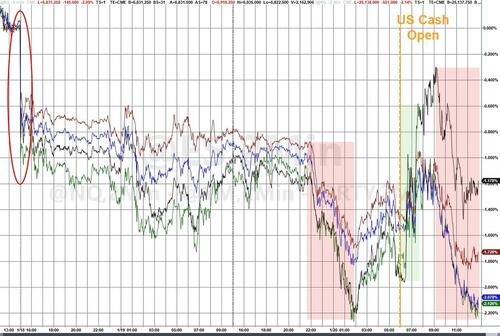

All the US Majors were deeply red today with Nasdaq and S&P leading the charge lower (despite a decent to BTFD at the cash open)...

...as Tech was wrecked with Mega-Cap stocks now at their lowest since Thanksgiving...

Source: Bloomberg

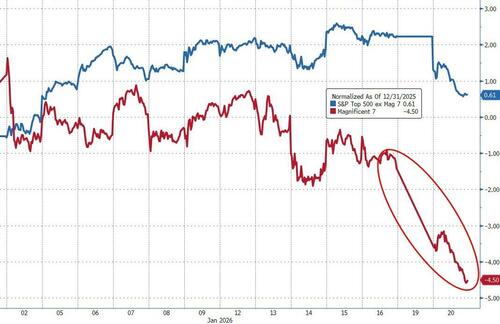

Mag7 stocks massively underperformed today (extending their losses YTD)...

Source: Bloomberg

Peaking under the hood of the S&P 500, traditionally more defensive sectors, including Healthcare, Consumer Staples, and Utilities, are among the best performing sectors, although they are also lower. Unsurprisingly, growth is underperforming, with Tech, Communication Services, and Consumer Discretionary all weighing on the index.

Source: Bloomberg

Goldman's trading desk note that flow was mostly macro and no liquidity:

With significant macro news backdrop, as expected ETF % of tape elevated at 37% (10pp higher than where they finished on Friday)...

Top of book down by more than 60% and at the lowest level in 2mths

We are currently a 6 out of 10 in terms of overall activity levels skewed 3% better for sale across the floor

-

LOs are skewed better for sale with notable supply in info tech and macro products versus demand in comms services and financials

-

HFs are skewed better to buy with demand in info tech, energy, and industrials versus supply in comms services, materials, and macro products

At the top of the leaderboard we have Rare Earths GSXGRARE +330bps, Natural Gas GSENNATG +155bps, and commodities GSXUCOMO +205bps.

Source: Bloomberg

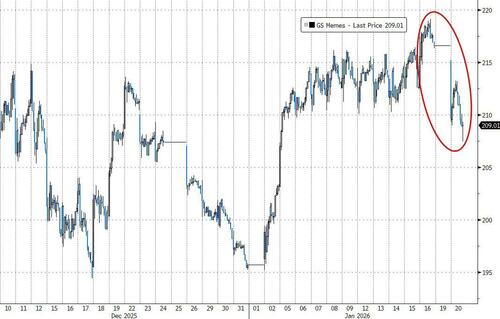

More risk-on, speculative pockets of the market sitting at the bottom of the leaderboard with Bitcoin sensitive GSCBBTC1 -330bps, meme stocks GSXUMEME -200 bps...

Source: Bloomberg

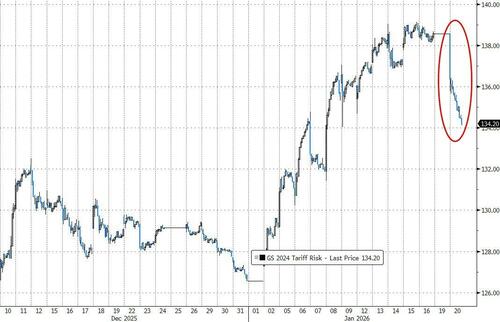

Also keeping an eye on Tariff names given Trump headlines with US Tariff Risk names GS24TRFS -230bps.

Source: Bloomberg

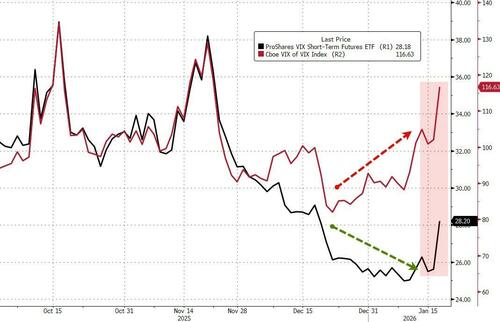

Finally, before we leave equity-lend, we note that vol finally started to snap higher today. As have previously noted, the surge in VVIX signaled something was afoot and now we see short-term VIX futs starting to surge...

Source: Bloomberg

Long-end Treasury yields are up dramatically since Friday's close (while the short-end is unchanged), but notably as stocks weakness accelerated this afternoon, bonds were bid (ending well off the yield highs of the day)...

Source: Bloomberg

Rate-cut expectations barely budged amid all the chaos, prompting a sizable re-steepening of the yield curve...

Source: Bloomberg

With the sharp global yields move, Goldman's traders said they are fielding questions today on when the rates move really starts to impact equity markets.

-

From GIR, a ~2σ move (= 50bps today) over 1 month on US10YR is when equities historically see a pullback.

-

That level is ~4.6% vs the late December lows.

Source: Bloomberg

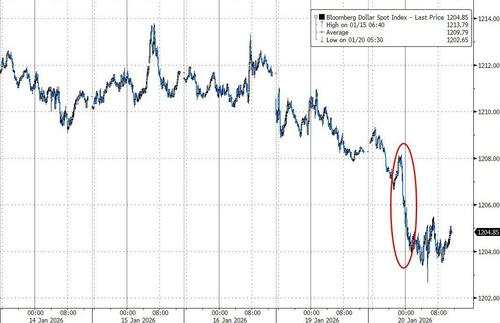

The dollar was sold off overnight (as JPY spiked) and while the Japanese currency weakened later, the USDollar remained at its lows...

Source: Bloomberg

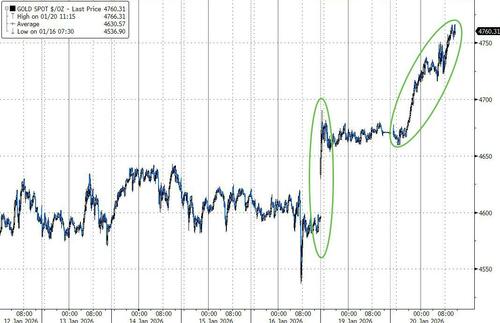

As the dollar fell, gold was aggressively bid as the main safe-haven in the world, topping $4750 for the first time ever...

Source: Bloomberg

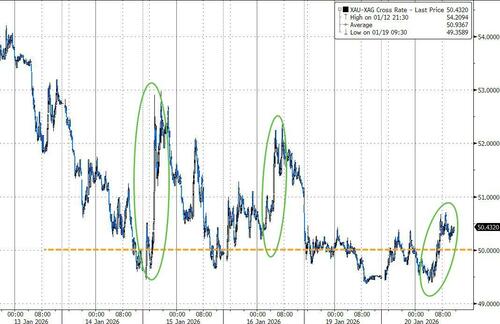

However, silver was unchanged at record highs (around $94)...

Source: Bloomberg

...prompting another rebound from support at the 50x Gold/Silver ratio...

Source: Bloomberg

Despite the 'sell America' theme, crypto was once again clubbed like a baby seal on a geopolitical headline. Bitcoin puked back below $90,000 - its biggest drop since the liquidation crisis on Oct 10th (also triggered by Trump threatening 100% tariffs on China)...

Source: Bloomberg

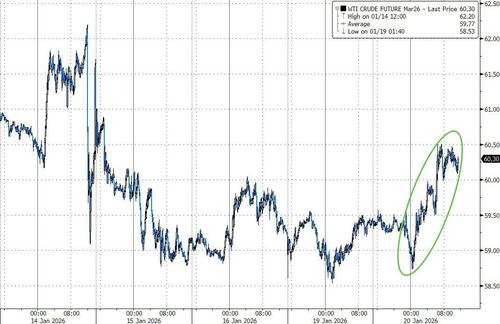

Crude prices jumped amid fears of an escalated trade war and finding some support from better-than-expected fourth-quarter Chinese GDP data

Source: Bloomberg

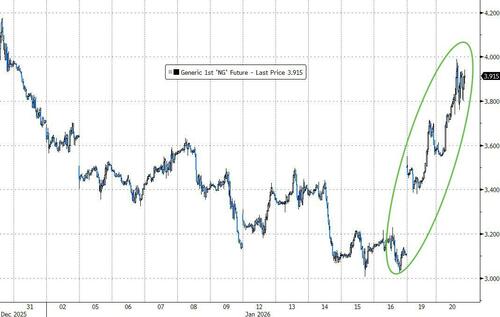

NatGas prices exploded higher (biggest jump since 2022) as forecasts turned much colder over the long holiday weekend in the US, calling for a deep freeze to grip much of the country during the weeks ahead.

Source: Bloomberg

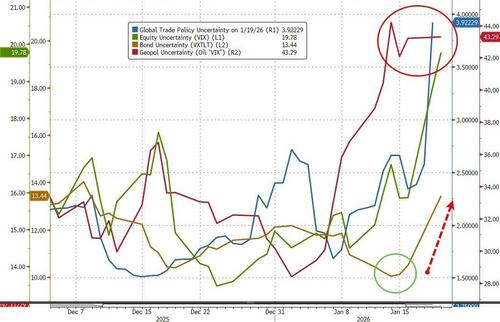

Finally, back to where we started, bond volatility is finally starting to pick up as equity vol accelerates and catches up to the geopolitical and trade policy uncertainty we have been pounding the table on for a while (and seeing options markets - under the hood in skews - show signs of hedging flows into last week's strength)...

Source: Bloomberg

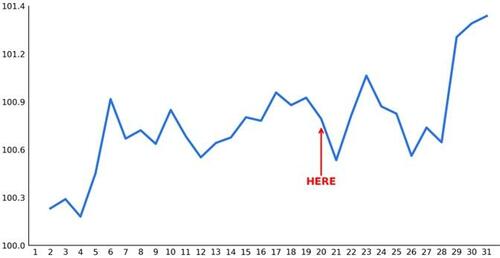

But, on the bright side, seasonals are in your favor...

SPX Performance (average since 1929)

SpotGamma’s 6,890 SPX risk pivot level broke meaningfully overnight, leaving the new must-hold line at 6,800, where positive gamma is starting to build.

Source: Bloomberg

Below 6,775 is where the tape risks flipping into negative gamma and the sell off can accelerate.

Will Trump and the Europeans find an off-ramp?