Gold Surges To Best Month This Century, Momo Melts Up, But Warsh Washout Spoils Party

"...been around a long time and the day-level volatility was close to unprecedented..." is how the most veteran trader we know described the actions of the last 24 hours.

Even with today's nomination of Kevin Warsh, the broad fact pattern for January remains that, as Goldman's Tony Pasquariello noted, the prevailing macro trends of 2025 had very forcefully extended in 2026.

Be it equities, rates, crypto, currencies or commodities, there’s serious action most everywhere you look...

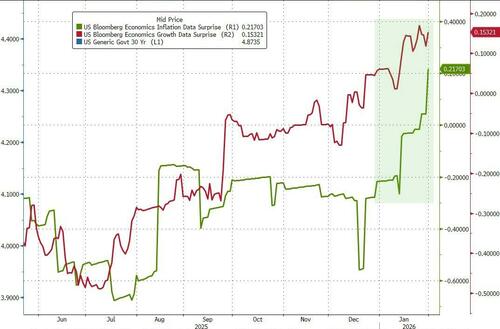

But before we dive in, let's have quick look at the macro in January: Both 'Growth' (factory orders surging yesterday, jobless claims near record lows) and 'Inflation' (PPI hot today) macro data surprised to the upside in a major way in January...

Source: Bloomberg

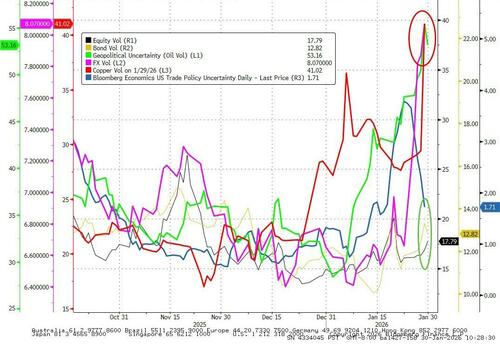

But, 'Uncertainty' - variously defined - is up bigly in January...

Source: Bloomberg

...but there is significant divergence with the 'uncertainties':

1) bond & equity vols remain unmoved,

2) trade policy uncertainty has roundtripped after TACO Wednesday in Davos, and

3) FX and commodities risks are exploding.

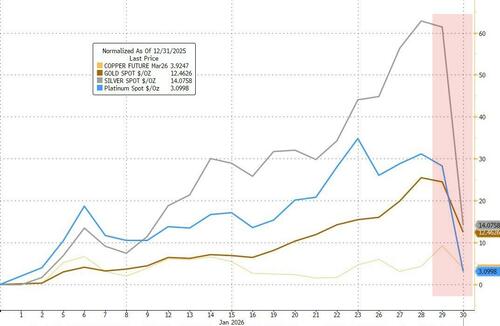

PRECIOUS METALS

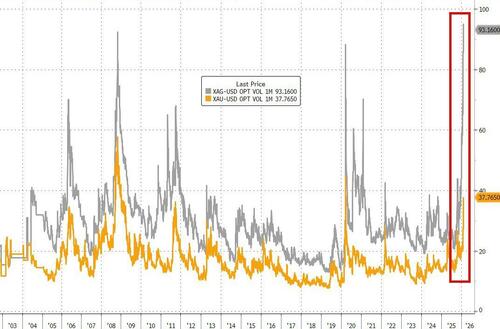

And a lot of that uncertainty just got extended with the nomination of Kevin Warsh as Fed Head which brought the record-breaking run in precious metals to a close.

Compared to the other candidates, Warsh is certainly more on the hawkish side of the spectrum, and so, most asset classes wavered, but preciopus metals were worst hit with implied vols exploding...

Goldman Sachs' Delta-One desk-head, Rich Privorotsky, offered some color on 'Why Warsh'?

It’s a surprising pick, but from a long-term perspective arguably the right tone.

It puts questions around Fed independence largely to bed.

The big asset the US system has is the USD system, and without a credible central bank that would eventually fracture.

You have to ask why the pendulum is swinging toward Warsh now.

One interpretation is reflexivity…

...in the 70s Volcker wasn't Carter's preference, it was the market's.

After a massive month, let's take a breath and look at the shitshow that includes today's 'Warsh Washout':

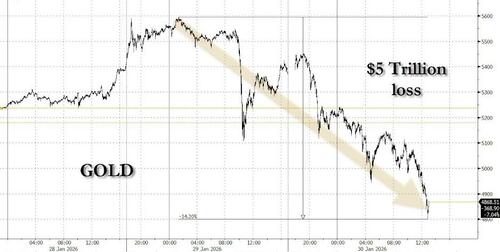

Spot gold prices fell 16% from yesterday's highs before bouncing back up towards $5000...

Gold's best month since 1999 ended with a $5 trillion loss in market cap in the last two days...

Silver crashed a stunning 39% from yesterday's highs - entirely erasing its YTD gains - before bouncing back solidly above $85 late in the day...

Metals have been extraordinary as Privorotsky noted Trump has "put questions around Fed independence largely to bed."

Classic blow-off dynamics, range expansion, vol explosion.

You could feel the herding…

I'm besieged by anecdotes of Italian dentists and dinner parties competing over how much silver they own.

Metals specialists point to aggressive buying yesterday from Chinese speculative accounts.

It’s hard to know how much capital was chasing the trade purely on the belief that Fed credibility was under threat.

Gold’s move “validates the cautionary tale of fast-up, fast-down,” said Christopher Wong, a strategist at Oversea-Chinese Banking Corp. While reports of Warsh’s nomination were a trigger, a correction was overdue, he said.

“It’s like one of those excuses markets are waiting for to unwind those parabolic moves.”

Precious metals had already been primed for extreme moves, as soaring prices and volatility strained traders’ risk models and balance sheets.

A record wave of purchases of call options, contracts which give holders the right to buy at a pre-determined price, had also “mechanically reinforcing upward price momentum,” Goldman said in a note, as the sellers of the options hedged their exposure to rising prices by buying more.

Morgan Stanley's Quant desk noted massive forced rebalancing in levered ETFs (~$3.5bn to sell in SLV and ~$650mm to sell in GLD today on QDS estimates). SLV and GLD are having their worst days since 2006 (-13 zScore move in SLV and -9 zScore move in GLD).

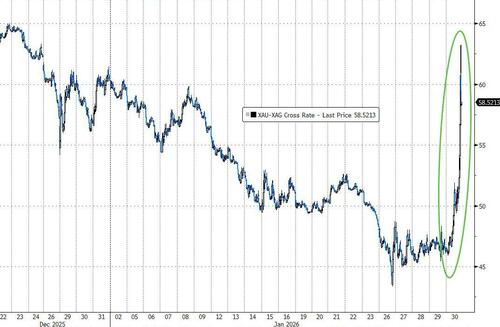

One more thing before we leave precious metals. The Gold/Silver ratio snapped higher again today, bursting back above the 50x Maginot Line...

Here's how Goldman's top trader concluded his thoughts on metals: A structural inflationary boom can very easily morph into a inflationary bust if speculative money is forced to sell.

EQUITIES

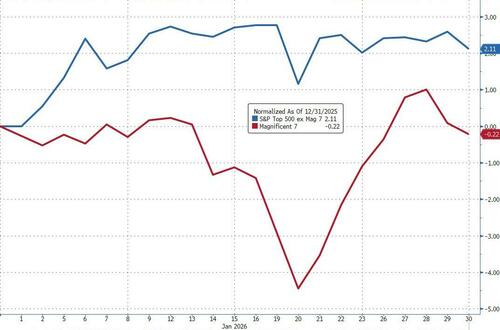

'Broadening' was the word of the month for equity traders as dispersion started to accelerate notably (without implied correlation accelerating)...

Equity markets saw some notable vol this week but ended the month higher (with Small Caps leading and Nasdaq lagging)...

Source: Bloomberg

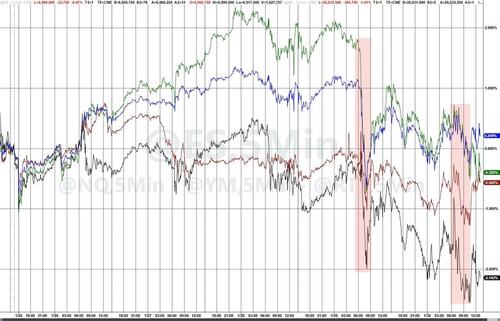

This week was wild for most of the US Majors with the S&P 500 managing to close unchanged (and everything else red). Two major legs lower (yesterday's perhaps-copper-driven crash at the cash open and today's Warsh-is-a-hawk-fearmongery plunge)...

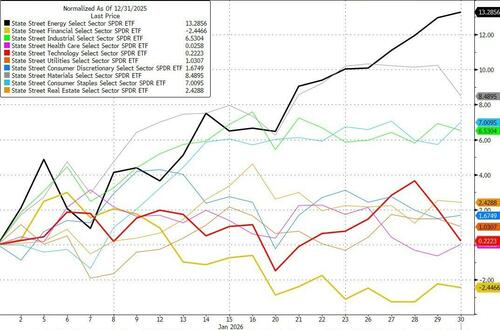

Energy was best on the month, while Financials were January's biggest losers and Tech basically unchanged (thanks to today's ugliness)...

The Mag7 basket actually ended January in the red, while the S&P 493 rallied 2%...

Mega-Cap tech managed to eke out a tiny gain on the month...

But, big-tech credit worsened notably in the month (as dispersion increased across the space). ORCL probably the cleanest example of the Capex-funding fears as CDX continued to soar in January...

Quality stocks worst drawdown since COVID reopening

Momentum stocks puked in the last two days after a big month...

After 14 straight days of outperformance, the Russell 2000 has underperformed the S&P 500 for the last six days...

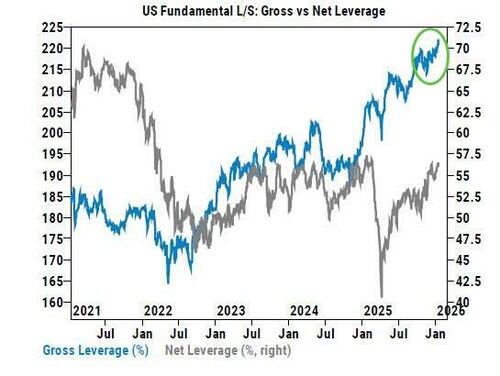

Goldman's Delta-One boss warned before this shitshow today that broader risk feels heavy, summing up his outlook in two words: "Not great."

It’s hard to hold risk when people are already running high: gross and nets are at five and three-year highs.

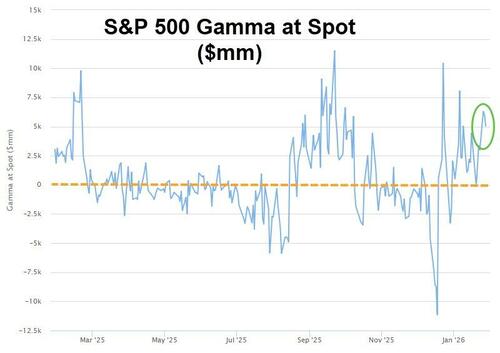

On the bright side, Goldman trader, Nelson Armbrust, notes that looking towards Gamma, we estimate S&P Gamma to be long $5bn… which is a healthy number historically.

But the majority of this long Gamma will expiry very soon and we could see the market become almost flat gamma.

The below table shows our estimate of Gamma expiring over different expiries.

Over the next week (I assume the majority is today) we have $4.3bn of long Gamma expiring.

In English: we could see a more volatile tape over the next few days.

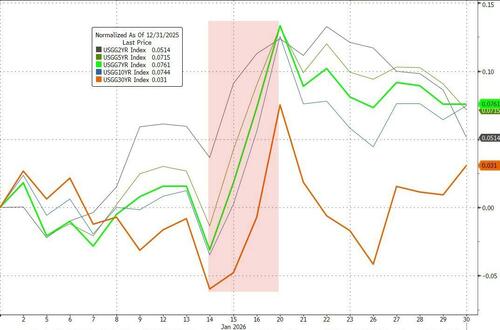

BONDS

Global sovereign yields were higher in January, as they followed the surge in global macro surprise data to the upside...

The month was dominated by the chaos in Japan (as bond vigilantes stepped in to push back on a too-dovish-BoJ and Takaichi's fiscal largesse)...

US Treasury yields were all higher on the month with the long-end outperforming (and the belly lagging)...

The yield curve (2s30s) ended basically unchanged on the month but saw multiple periods of flattening and then steepening this week after The Fed meeting and on Warsh...

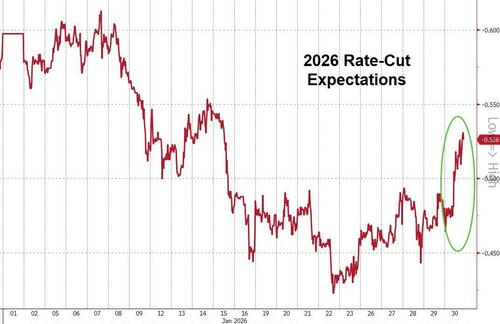

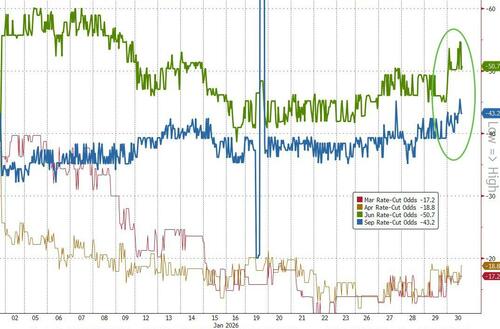

Rate-cut expectations are lower on the month but the last few days have oddly seen a dovish shift higher (FOMC and Warsh - both 'hawkish')

With the odds a cut in both June and September picking up (but but but we thought Warsh was hawkish?)

FX

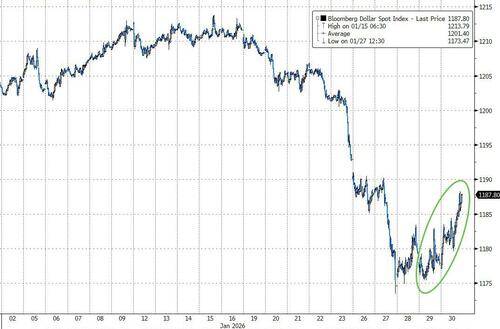

The dollar was dumped for the 3rd straight month trading to its weakest since July 2022 relative to its fiat peers...

The last couple of days saw some buying return to the greenback amid the market chaos. Today was the dollar's best day since May 2025...

Like in bond-land, Japanic dominated the price action with a 'rate-check' by The Fed (at the request of the US Treasury on behalf of The MoF) sent yen surging higher...

CRYPTO

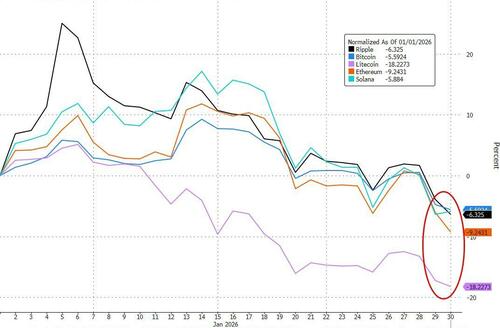

Crypto was down for the fourth month in a row in January.

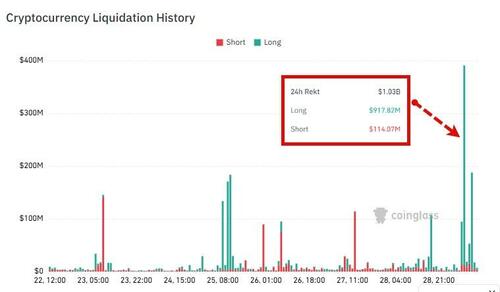

Yesterday's massive billion dollar liquidation in bitcoin...

...was not helped by the Warsh headlines, but we note that by the close today, bitcoin had rallied back and erased the Warsh washout...

Source: Bloomberg

Ethereum underperformed bitcoin on the month but all the major cryptocurrencies were red in January

Source: Bloomberg

COMMODITIES

Commodities had a strong month (if not overshadowed by the last two days of carnage)...

Copper had a seriously wild ride this month - exploding higher yesterday early before collapsing back during yesterday late... and then bouncing back late on today towards the $6 level. The rip was driven by a sudden wave of buying by Chinese speculative investors with few precedents. The end-of-week drop came as mainland buyers pulled back, other commodities including gold sank, and the US currency rose.

Copper has been at the heart of a remarkable period of trading, fueled by optimism over demand from the energy transition, as well as a steadily weaker US dollar, which hit a four-year low earlier this week. Some investors have been caught up in a bid for hard assets that swept through precious metals in January, including gold. Still, banks including Citigroup Inc. have said manufacturing demand can’t justify recent gains for industrial commodities.

“Many traders feel that the current market behavior has overturned their trading experience and strategies,” said Zhou Zhentin, a trader at KS Commodities Co.

“It’s forcing everyone who used to study traditional nonferrous trading to switch toward studying gold, AI and geopolitics.”

Amid a surge in geopolitical risk premia, Crude prices ripped over 14% higher in January (its first monthly rise in six months and its best month since July 2023).

Crude had earlier fallen alongside other markets on the Warsh nomination but Iran-related risks still linger in the background, which is why oil has given back very little of its gains.

And Finally...

...as Rabobank's Bas van Geffen notes, while the retracements are notable, we wouldn't say that the debasement trade or diversification from the US have now stopped.

The FX market may respond optimistically to the prospect of Warsh's nomination, but broader US policy uncertainty is still not doing the dollar any favors.

But, Goldman traders concluded: the real risk to the party is that rates come in and pull the punchbowl.

For now, the wedge between rate-cut expectations (less and less dovish) and stocks (at record highs) remains vast...

The gap between economic growth and job growth is uncomfortable...

What continues to unsettle them is the disconnect between assets and macro pricing.

Risk assets are screaming late cycle, run it hot, with markets reaching for fiat alternatives everywhere, while inflation and rate expectations recently look oddly decoupled (we are still pricing 2 cuts)...

If there’s a real risk to the current equilibrium, it’s that disconnect snapping back into focus (and the potential for rate-hikes?).

Goldman's Privorotsky points out that nominal reflation, "run it hot", and the push into real assets remain a secular theme that won't just disappear.

But things ran a little too hot, too fast... a tactical correction was always likely.

In trying to keep an eye on the big picture, Goldman's Mark Wilson says its unclear too much has really changed YTD with regard to the biggest variables & drivers of markets:

-

moves in the US$ have extended (as shown below, the evolution of the move from here will be fascinating as prices challenge the millenium-t0-date range & the new Fed Chair begins to articulate his path),

-

the focus on AI remains high as ever-burgeoning capex intentions (META now on for $180b capex spend this year) speak to the disruptive impact that lies ahead,

-

all signs point to sustained momentum to US growth,

-

and a shifting geo-political world order are leading to a wholly new prioritisation of ‘sovereignty’ (in terms of defense, supply chains, & industrial capacity).

The YTD score board reflects those key trends – rare earths +35%, nuclear stocks +21%, EU defense +20%, copper stocks +18%, US defense +17%, high beta 12m winner + 17%, but arguably no trade captured the debasement, reflation, & geopolitical mood better than silver & gold.

So, with all that said - and it was a lot - we probably shouldn’t read too much into a positioning washout whose severity should be assessed versus the magnitude of the month-to-date run-up.