Goldman: The 15 Most Prominent Debates Of 2025 (Which Are Likely To Carry On In 2026)

Goldman Sachs Dioni Ellinikaki drops these 15 themes (and charts) highlighting some of the most prominent debates of 2025 (all of which are likely to carry through to 2026).

Most of these charts come from in-depth thematic research from GS, which professional subscribers can find here at at our new MarketDesk.ai portal...

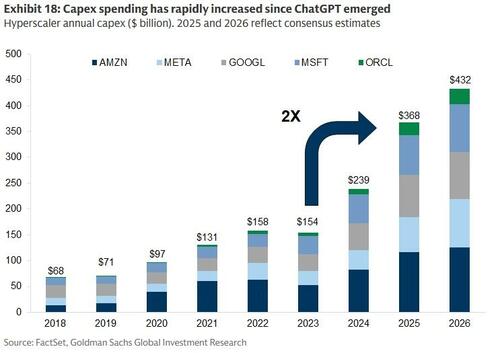

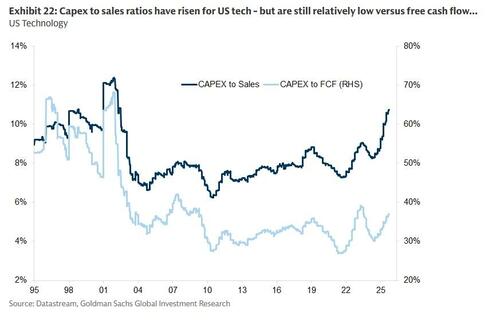

1/ AI capex

This year, our most read research report was Peter Oppenheimer’s Why we are not in a bubble... yet…

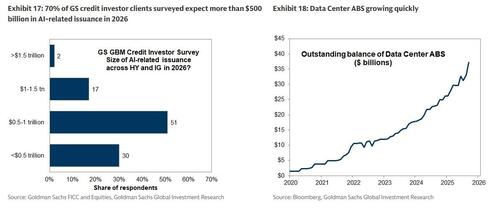

…Alongside debates on whether the magnitude of AI spending will generate sufficient return, investors have focused on the risks posed by alternative debt structures and more highly leveraged companies in the AI ecosystem:

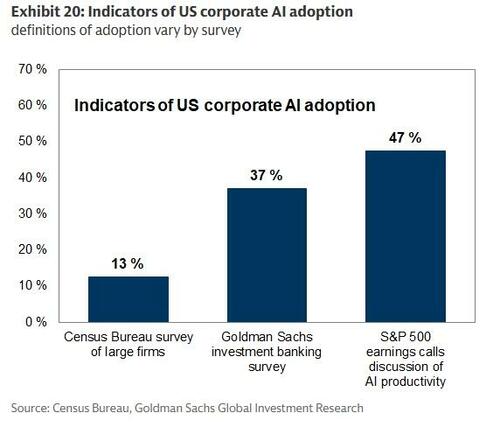

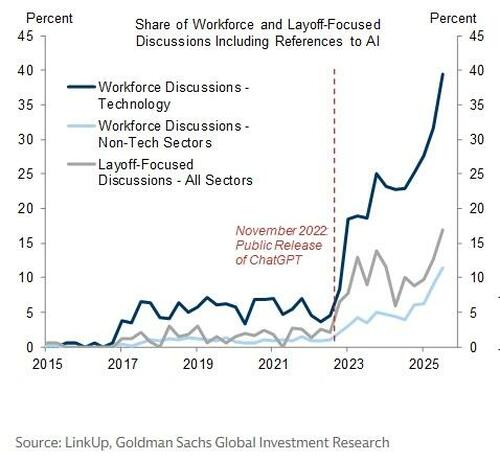

2/ AI adoption

The AI trade has remained concentrated within the infrastructure complex, but return dispersion across that complex has increased.

Looking into next year, this trade is likely to broaden out more to AI Platform stocks and AI Productivity Beneficiaries...

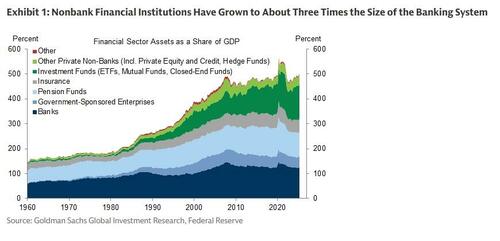

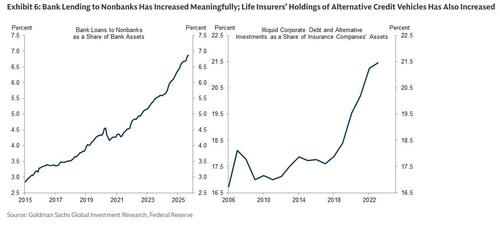

3/ Private Credit

Prominent losses and fraud allegations on three loans raised concerns around the risks of nonbank lending.

Private credit funds and other NBFIs more broadly have become increasingly interconnected with the rest of the financial system...

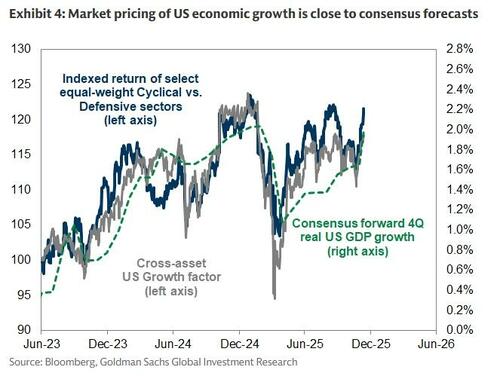

4/ The Fed trade

The recent cyclical rally in the US (GS US Cyclical vs Defensives up 13 out of 16 sessions) is pricing a more supportive macro into 2026: growth acceleration, fiscal boost, tariff drag abating, Fed cuts… But we think only a 2% growth acceleration has been priced in, vs our estimates of 2.5%, and our indicators are pointing to a pick up in US non res construction, which is still a notable cyclical underperformer...

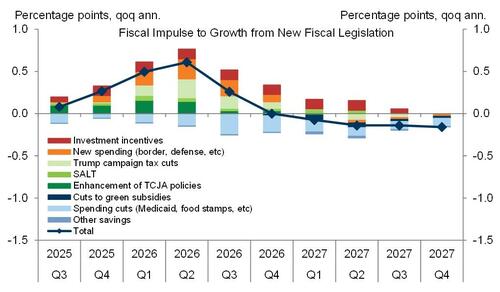

5/ US Fiscal boost

When you put the components together – tax cuts, investment incentives, new spending – the fiscal impulse turns quite positive into next year...

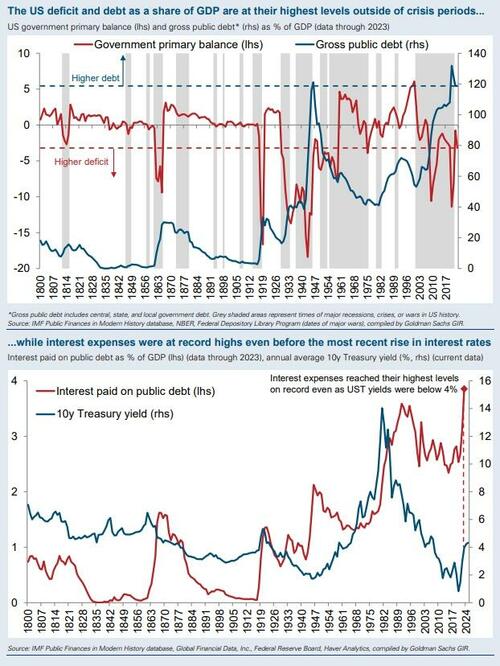

6/ US fiscal worries – different this time?

7/ K-shaped economy

GIR notes “…healthy aggregate trends mask divergences between companies that face lower- and higher-income consumers: for retailers whose stores are generally located in lower-income zip codes, sentiment around the consumer turned negative on net and nominal same store sales have grown only 0.2% over the last year (vs. 2.5% for companies exposed to middle- and higher-income zip codes)… our distributional income growth forecasts suggest a continued underperformance of low-end spending in 2026, with tepid job growth and cuts to SNAP and Medicaid benefits from the OBBBA weighing on income growth for low-income households.” ... Clear downside risk still concentrated in the low-end consumer...

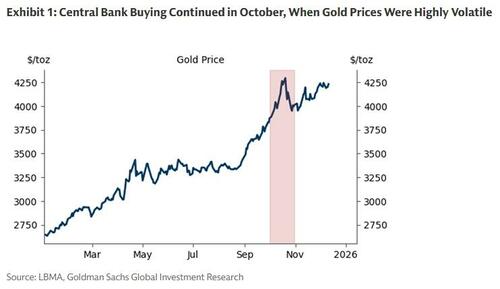

8/ Commodities

USD down, inflation up, real assets pull. 2026 could well be a year of old economy... We think copper continues marching on into 1H, Ali is at capacity and mkt is tight, central bank demand a driving force for Gold and Silver...

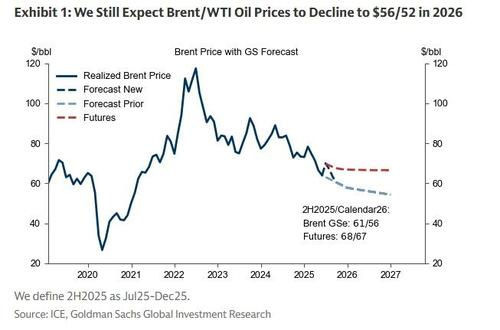

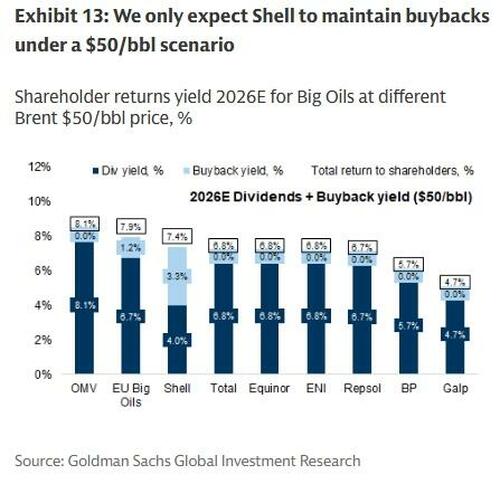

9/ Energy

On the other side of the coin, we see material downside to Brent price and consensus estimates for 2026E...

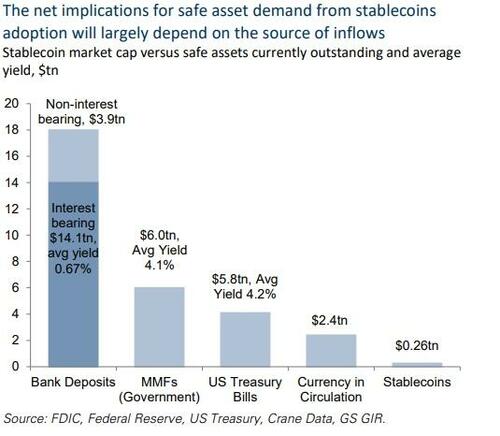

10/ Stablecoins

The size of the stablecoin market currently sits at ~$307bn, dominated by two issuers: Tether and Circle...

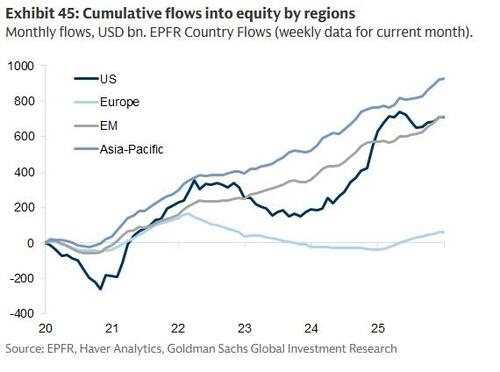

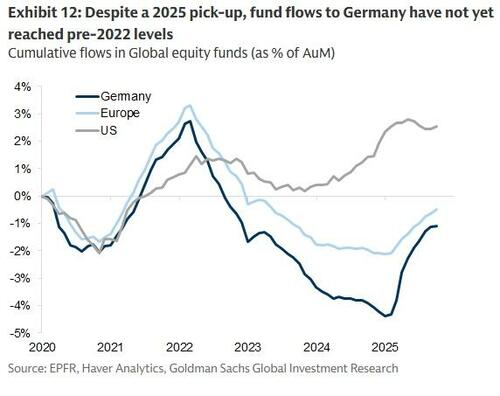

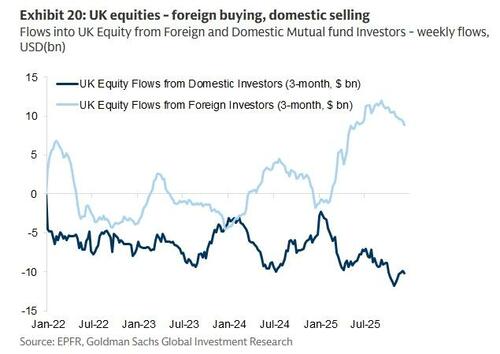

11/ Europe: Inflows still challenged

Despite H1 European outperformance (German fiscal boost, European defense, banks) European inflows are still materially lagging...

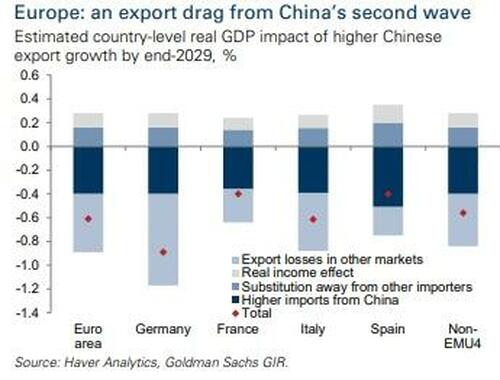

12/ China GDP upgrade = Europe growth headwind

We recently made one of the biggest upgrades to China GDP Growth forecasts in the last 10 years. This is largely due to powerful export growth out of China... We think the hit to foreign manufacturers will be material and the net effect on global ex China GDP growth is negative...

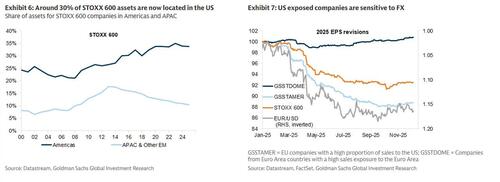

13/ Europe FX headwinds

Companies with a high proportion of US and international sales (GSSTAMER) continue to underperform due to euro appreciation, and our FX strategists expect EUR/USD to strengthen further to 1.25 over the next 12 months….

14/ EM: Korea – best performing market YTD

Despite the 60% YTD rally in KOSPI, ‘we are still in the early innings on the Korea Value Up trade. In my mind, we’re at the “2020 stage” of the Japan trade: the government has made their stance clear, activists have started to dabble in the region, and corporates are making improvements here and there.’ From: Korea is the new Japan?

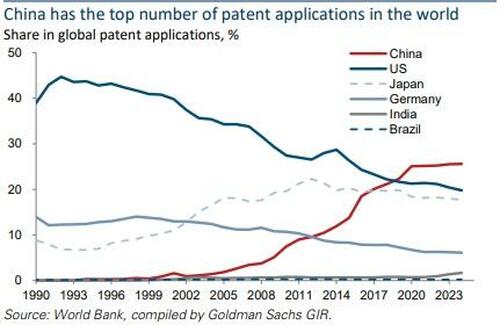

15/ China-US Tech race

While the US and China have reached a new trade deal, their fierce race to achieve tech superiority remains as intense as ever, with both pursuing policies to develop self-sufficient tech stacks.

So, will such policies prove successful, and what investment opportunities do they provide?

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal