Goldman Calls The Bottom For The Historic Software Rout: Here's Why

First the bad news. The software selloff, now in its 8th day, has snowballed into a trillion dollar tech wipeout, and retail traders (once again) played a part. There were huge factor rotations below the surface with some historic moves in Value, Growth and Momentum.

According to Morgan Stanley's QDS mid-day note, today was another day of broad institutional selling (institutional cash and futures supply in the sub-20th 1Y %ile for this time of day, i.e. thru 1pm). The bank calculated that if SPX closed the day down -1.5%, there would be equity selling worth $30bln, growing to $45bn at SPX closing -2%, with about half of that selling today and the rest over the next few days. The S&P closed -1.2% thanks to a last minutes bounce, so not quite as bad, but still lots of systematic selling on deck. And while dealers are still long 7bn in gamma - the main driver for some modest stability in today's selloff - they get longer on upside than downside.

Nextx, Goldman's trading floor also chimed in, noting that it was again extremely busy, 8 on a 1-10 scale in terms of overall activity levels. The floor finished -635bps for sale vs a 30-day avg of -101bps. LOs finished -$1b net sellers, primarily by macro products vs some demand in software from clients trying to pick a bottom in this group. HFs finished -$2b net sellers driven by supply in macro expressions and tech vs demand in industrials and comm services. They also note that should the selling persist, it will only get uglier: expect CTA supply estimates to ramp with SPX, NDX, and RTY all through short term thresholds and medium term (where most notional lives) within reach SPX (6704), NDX (24,708 already below), and RTY (2467).

So, all else equal, more selling which begets more selling, liquidations, etc.

But there was some good news, this time from Goldman's derivatives desk which wrote that following an extended move lower across all three major indices today, the desk continued to see the monetization and unwinding of index hedges (usually a precursor to a bottom). They also note that it feels like "clients are slowly repositioning themselves now that we're below the 100d moving average in SPX, and an aggressive rally back to all-time highs feels less priced into the distribution of outcomes."

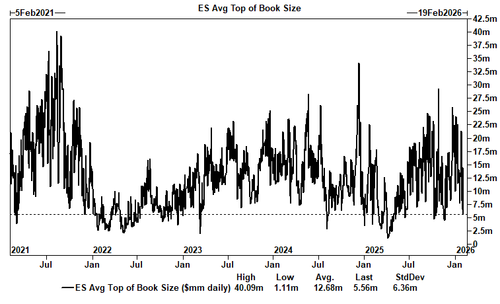

Additionally, and this will come as a surprise to nobody, "moves under the surface have been extreme this week with sparse liquidity at these levels" as one can see from the emini top of book chart below...

... which means it won't take make to spark a relief rally, even though - like Morgan Stanley - Goldman sees dealers flatter gamma here, getting shorter on continued selloffs. Yesterday's momentum unwind impacted the vol market, causing Goldman's US Panic Index to hit 8.3 (89th percentile on 3yr lookback). Flow wise, the Goldman derivatives desk saw several clients selling puts to monetize on the hopes of a potential end to the current selloff.

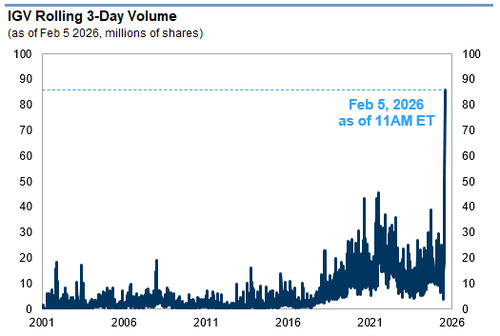

But the biggest incremental news comes from Goldman's ETF desk, which understandably, is focused largely on the ongoing turmoil in the IGV Software ETF. "It has been a very active week for Software stocks, which have plunged by 15% over the past week and 29% from their highs last September. IGV has been the ETF that clients have gravitated towards most for quick and tactical exposure (ETFs as an aggregate are tracking 37% of the tape this morning). The fund has seen back-to-back days of record volumes over its 25-yr tenure, and over 11 million shares have printed on the tape as this note was written (11ET). Said differently, but conveying the same message, over 85+ million shares have traded since Tuesday."

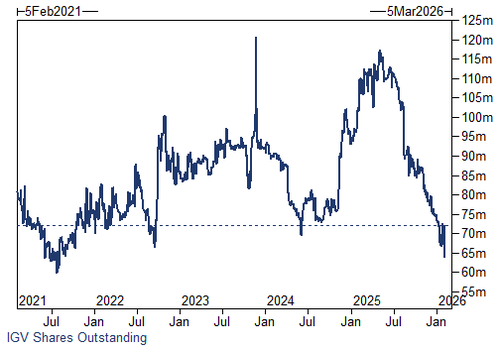

The good news here is that positioning in IGV has now been completely flushed, and is significantly reduced since last summer, with the ETF shares outstanding reaching near 5-year lows earlier this week. Goldman's research division also notes that large-cap mutual funds had moved underweight software in the middle of last year. In short: there is almost nobody left to sell.

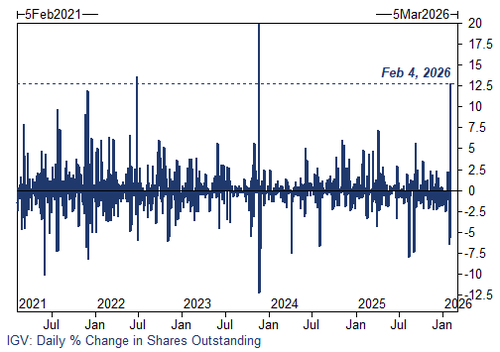

The best news for those seeking the bottom in software is that together with the purge of almost all existing legacy longs in IGV, Goldman has "finally seen buyers of IGV across the institutional community yesterday and today." The fund also registered a 12% increase in shares outstanding on Wednesday (its largest 1-day change since 2023) which "feels like a culmination of outright purchasers trying to find a bottom and potentially participants covering shorts."

Finally, it also seems like retail is starting to dip a toe back in the water: Morgan Stanley writes that net retail demand of $1.7bn as of 1pm was in the 50th %ile for this time of day (Single-Names +$435mm, ETFs +$1.3bn), or about $115mm above average. The dip buyers are starting to come back.

Combined with the institutional interest for IGV, we wouldn't be surprised if we saw a big (thanks to the extremely illiquid market) relief rally tomorrow (incidnetally, the implied move through tomorrow is 1.10% in either direction).

More in the full Goldman ETF note available to pro subs.