Goldman: Current Combination Of Extreme Valuation And Concentration Has Preceded Major Market Drawdowns

Just when you thought that Goldman would stop its 2026 year-ahead outlooks at around 100... here comes # 101.

This morning Goldman's new chief US equity strategist, Ben Snider, who replaced David Kostin late last year, published his 2026 outlook report saying that he expects another year of solid gains for US equities in 2026... although there is a but.

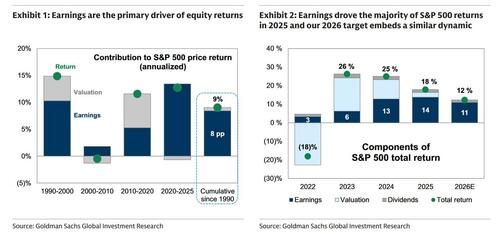

First the good news: according to Snider, earnings growth accounted for 14% of the 16% S&P 500 price return in 2025 and has accounted for 8% of the 9% annualized gain for the index since 1990. Against a friendly macro backdrop of healthy US economic growth and continued Fed easing, the strategist expects the S&P 500 to generate a total return of 12% to a year-end level of 7600 driven by "healthy economic and revenue growth, continued profit strength among the largest US stocks" while an "emerging productivity boost from AI adoption should lift S&P 500 EPS by 12% in 2026 and 10% in 2027, providing the fundamental base for a continued bull market." Incidentally, we would take the under, but the real driver of stock market upside - the Fed's monthly injections of $40-60BN in Bill purchases, which no bank wants to admit because it is so cavemanish, will be there for a long time so anyone who want's to fight the Fed's CTRL-P, do so at your own risk.

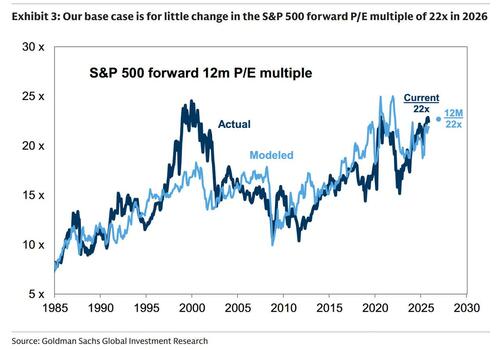

Snider hints as much, warning that the "key tension in the US equity market is between a solid fundamental backdrop and valuation multiples that rank near the highest levels on record." Indeed, the S&P 500 trades at a forward P/E of 22x on consensus forward 12-month EPS, matching the peak multiple in 2021 and registering just two turns shy of the record 24x multiple in 2000. Still, the Goldman base case is one for steady long-term interest rates and earnings growth rates, which suggest there will be little change in equity valuations during 2026. But even the bullish Snider concedes that "elevated multiples are hard to ignore, and they increase the magnitude of potential equity market downside if earnings disappoint expectations." So more autopilot there, which again is largely driven by Fed generosity, and since Trump will appoint his own Fed head in 5 months, this is a rather safe assumption.

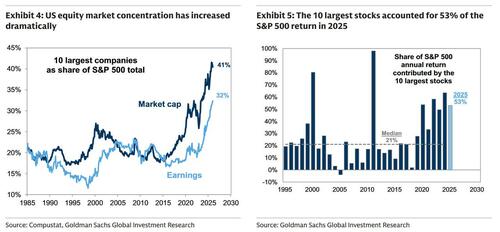

There's more bad news: focusing on the downside risks, the Goldman strategist warns that in addition to the challenge of elevated valuations, "the record current degree of

concentration within the US equity market means that the micro, not just the macro, will drive the path of the S&P 500 in 2026 – for better or worse." He then notes that the 10 largest stocks in the S&P 500 account for 41% of market cap and 32% of earnings. To be sure, this concentration has been a clear positive for the market during the last few years; fueled in part by the spending associated with the AI boom, the top stocks accounted for 53% of the S&P 500 2025 return. The flip side is that as concentration has risen, "so has the idiosyncratic risk embedded in the S&P 500 and investor dependence on the continued strength of the largest US companies."

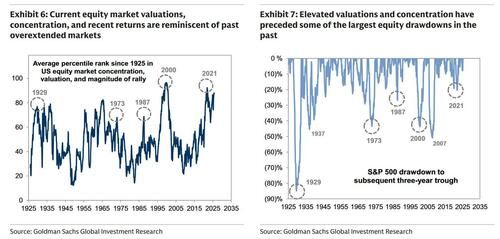

And this is where Snider gets as close as he possibly can without triggering a whole lot of compliance alerts, making a very strong hint at the bubble - pin analogy, only he uses some very creative terms, namely kinetic and potential energy, to wit: "Ultimately, valuations and concentration are measures of potential energy and require a catalyst to translate into equity market kinetic energy." Consider that the S&P 500 rose by 18% in 2025 despite entering the year at a 21.5x P/E multiple, only slightly lower than the 22.0x multiple at the start of 2026. Likewise, a similar P/E multiple in early 1999 did not prevent the S&P 500 from rising by 20% that year. Of course, it won't take much to rerate that multiple substantially lower.

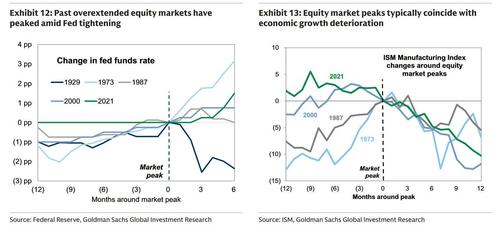

And that's where the Goldman strategist comes the closest to warning that another market meltdown may be coming, to wit: "the US equity market’s current combination of elevated valuations, extreme concentration, and strong recent returns rhymes with a handful of overextended equity markets during the last century.

These features to varying extents were also characteristics of the 1920s market boom, the “Nifty Fifty” dominance in the early 1970s, and the 1987 bull run before Black Monday, in addition to the markets in 2000 and 2021. Not lost on investors is the fact that these episodes also ended with large equity market drawdowns, and the risk of experiencing a similar downturn in the near future underpins many of the current debates about whether the market is in a bubble.

And charted:

To be sure, it won't be all smooth sailing: the combination of extreme equity market concentration and an evolving AI trade will spur micro rotations with the potential for macro consequences in 2026, Snider warns. He goes on to note that "the 10 largest stocks in the S&P 500 account for 41% of market cap and drove 53% of the S&P 500 2025 return." And while the GS strategist expects AI spending will again exceed consensus estimates this year, it will begin to decelerate in growth terms while corporate adoption increases, causing rotations among the largest US tech stocks that create two-way risk for the aggregate index.

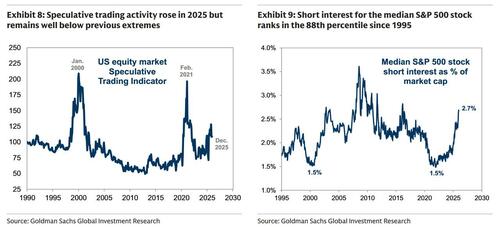

There is a silver lining: encouragingly, some common features of the overextended equity markets of the past are absent from today’s market, according to Goldman which goes on to note that speculative trading activity rose sharply in 2025 but remains well below the highs of 2000 or 2021. Meanwhile, short interest across the market is high.

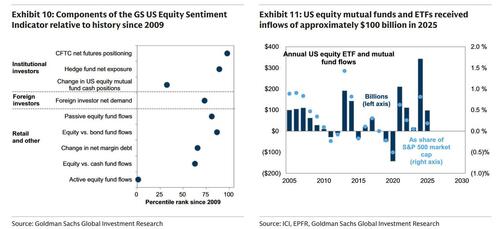

In addition, recent investor flows have not been extreme for a market near record highs that generates frequent discussions of bubble risk. The median component of Goldman's US Equity Sentiment Indicator ranks in the 73rd percentile since 2009, with particular recent restraint in measures of equity fund flows. Last year, US equity ETFs and mutual funds received inflows of approximately $100 billion, equating to 0.2% of S&P 500 market cap and ranking in the 45th percentile relative to the past 20 years. In comparison, US bond funds received inflows of roughly $700 billion and money market assets grew by over $900 billion

Snider then looks at past equity cycles, and concludes that "the biggest macro downside risks to the market are a growth disappointment or a shock from interest rates." Instead, Goldman's 2026 macro outlook for healthy economic growth and continued Fed easing is "one that typically supports rising valuation multiples." He is correct: 2026 will be all about the Fed and "exogenous liquidity."

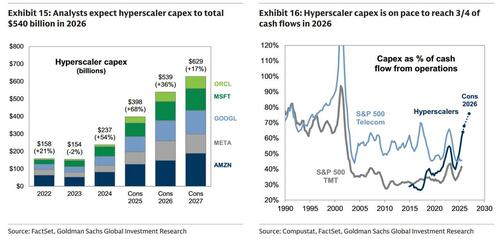

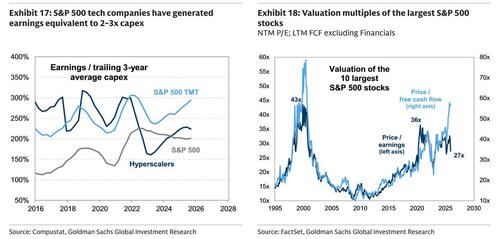

Turning away from the macro, the key micro risks today relate to the trajectory of AI capex, returns on that investment spending, and the impact of AI adoption. Capex spending by the largest public hyperscalers totaled roughly $400 billion in 2025, nearly 70% growth relative to 2024 and 150% above spending prior to the release of Chat-GPT in 2022. While AI investment should continue to grow this year, with capex on track to reach 75% of cash flows – similar to tech spending in the late 1990s – spending growth going forward will increasingly rely on debt funding, something we have been warning about for the past year. And here, the Goldman strategist makes the exact same warning we issued about a year ago: "As spending and debt grow, so do the necessary eventual profits to justify ongoing investments."

And here an interesting aside from the Goldman strategist who notes that the rise of a new technology "inherently introduces uncertainty regarding the size and shape of future profit pools, and these uncertainties are unlikely to be resolved in the next 12 months. During the past decade, the large public hyperscalers have typically generated profits at a rate of 2-3x their trailing capex expenditures. Given consensus estimates for an annual average of $500 billion in capex from 2025-2027, maintaining the returns on capital to which their investors have become accustomed would require these companies to realize an annual profit run-rate of over $1 trillion, more than double the 2026 consensus estimate of $450 billion in income."

Alas, Goldman here warns that "history shows a mixed track record regarding the eventual success of first movers in periods of major technological innovation." Translation: if you are expecting a profit surge commensurate with the explosion in capex, you will be disappointed. The bank writes that "while odds are good that some of today’s largest companies achieve that success, the magnitudes of current spending and market caps alongside increasing competition within the group suggest a diminishing probability that all of today’s market leaders generate enough long-term profits to sufficiently reward today’s investors."

Translation: don't hold the losers when the game of musical circle jerking chairs stops.

Still, Snider ends his report on a cheerful note, writing that "investors enter 2026 with the potential to capture significant beta and alpha. For index investors, low implied volatility and tight credit spreads present tools to maintain exposure to equity upside while managing downside risk. Within the equity market, a dynamic macro environment, wide valuation spreads, and low correlations create a robust opportunity set for stock-pickers."

Much more in the full Goldman report available to pro subscribers.