Goldman Delta-One Head Expects 'Last Minute Compromise' By Trump Over Greenland

As we detailed earlier, there's a decidedly 'risk off' feel to markets today (EU stocks down, gold up) focus squarely shifted to Greenland and the escalation between the US and Europe over the weekend.

On the face of it, 10% tariffs are slated for early February on a series of European nations. Europe is threatening retaliation, including tearing up prior trade agreements and potentially invoking the Anti-Coercion Instrument - a tool it has never used before.

Rhetoric from Trump and White House insiders has been maximalist, with some suggesting there is no middle ground.

Given all that, Goldman Sachs Delta-One desk-head, Rich Privorotsky, says his base case, (famous last words) is that we should brace for yet another last minute compromise.

Compromise:

There are a couple of reasons.

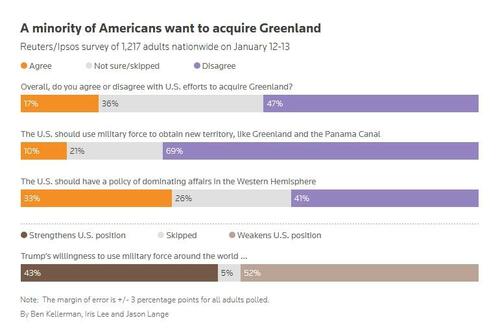

- First, this is not popular domestically.

“Just 17% of Americans approve of President Donald Trump’s efforts to acquire Greenland, and substantial majorities of Democrats and Republicans oppose using military force to annex the island, a Reuters/Ipsos poll found.” (see below)

It's a mid-term year and risking something very unpopular makes this less likely.

- Second, this fits the known escalate to de-escalate playbook.

If the objective appears more about mineral rights, an expanded military presence, a united arctic alignment… then the US is entering negotiations on the most favorable terms.

Is it a coincidence this is happening during the same week as Davos?

I think not.

Positioning:

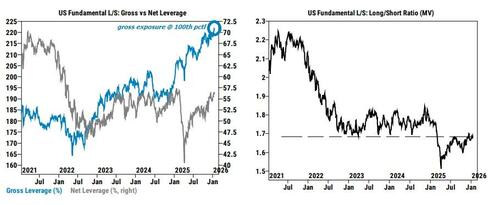

For equities the problem is not geopolitics, more positioning. GS PB shows US gross exposure sits at five year highs and net exposure near three year highs,. CFTC asset manager positioning in S&P futures is also at or near five year highs.

Sentiment indicators… NAAIM, AAII bull-bear, CNN Fear & Greed… remain elevated.

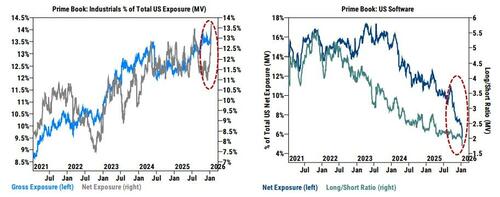

Flows show rotation out of the US and into Europe last week. There has been substantial buying of defense stocks and heavy allocation into US industrials. The tape feels very ROW centric and pro-cyclical.

At the same time, there has been acute selling in US tech, particularly software, where positioning feels locally as pessimistic as it gets. “Info Tech was by far the most net sold sector, led by long-and-short sales in Software stocks which collectively were net sold in 4 of the last 5 trading sessions.”

Rates:

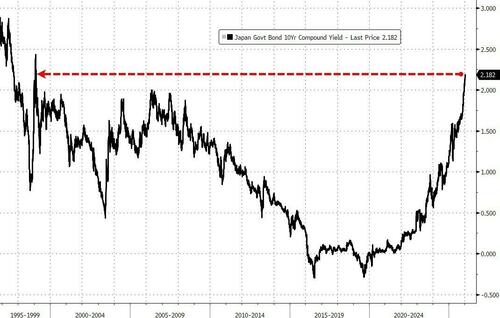

Japan rates are moving sharply again (10bps at 30yr point).

This is tied to Takaichi threatening to abandon the consumption tax on food… the “run it hot” Japan playbook continues to persist...

In the US, the week ended with a notable repricing of front end rates following better than expecting data:

a.) initial claims lower than feared

b.) better survey data from Philly def/NY fed

c.) CPI headlines miss but GIR revised core PCE 7bps higher to 37bp

d.) Powell subpoena has galvanized political support around the Fed and its independence

e.) Hassett odds dropping in Favor of Warsh for Fed Chair.

See US Ten year breakevens have drifted back above 2.3 threatening a break above the 200DMA...

For the week ahead

A few focal points.

Back to Davos, Trump is expected to speak Wednesday, with emphasis on the domestic affordability crisis. The focus will be US housing, and the levers are fairly clear… expanding 401k usage for down payments, increased MBS purchases, restrictions on institutional single-family home buying, and creative supply-side incentives to accelerate construction through permitting reform and land sales.

Other things to watch.

The credit-card cap could theoretically go live this week. The IEEPA ruling remains pending. UK CPI is due. BOJ and Japan inflation prints land at the end of the week. And on earnings, key names to flag include NFLX, FAST, KEY, MMM, INTC, and COF. Thought we had a too aggressive a start to 2026, all demand no supply and those dynamics become more balanced as we exit blackout.

Finally, Privorotsky clarifies one thing that many have missed:

Geopolitics is not the reason to get more cautious...it's rates.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal