Goldman Desk: "The Forceful Rotation Below The Surface Has Been A Shock For Many Portfolios"

Another rollercoaster week for stocks ended with S&P sliding 1% on Friday - from a new all time high hit the previous day - to close at 6,827, despite a Market on Close of $3BN to buy (most likely due to CTAs who are now buyers in every scenario). Others fared worse: Nasdaq closed down -191bps to 25196 as both AVGO and ORCL tumbled on rising AI spending concerns; the Russell2K slid 146bps to 2,552 while the Dow was the best performer, down only 50bps to 48,458.

As noted above, it was another big move lower for momentum, driven primarily by AVGO (-12%) and ORCL (-4.5%). Flow was predominately macro driven with ETFs tracking 36% of tape (vs a 28% YTD avg) as hedge funds once again hedged by shorted risk using macro products. Here is Goldman's desk on why markets were disappointed by AI, again:

- ORCL spent too much (raised FY26 Capex, market no longer rewarding off-balance sheet spend),

- AVGO didn’t raise AI Revenue forecast by enough

- OpenAI’s release of ChatGPT 5.2 didn’t spark the market’s interest like Gemini 3 did in early Nov

- Friday's report of ORCL datacenter pushouts didn’t help matters (even if it was refuted later).

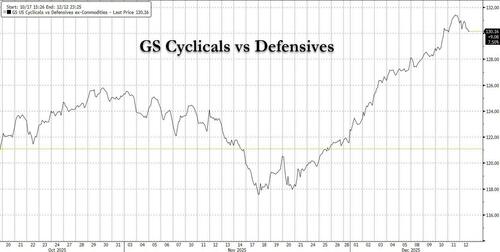

After a solid 2 week rally in the trade, some air is clearly getting let back out today, and most AI stocks are now back to flat on a 2 month+ basis. As a result, the powerful rotation observed in recent weeks went into reverse, and the Cyclical and AI unwind was evident in sector products (XLV vs XLK).

And while is dropped on Friday, Goldman's GSPUCYDE pair trade basket is now up 14 of 15 sessions taking consumer discretionary/retail along with it.

Not all cyclicals got hammered: on Friday, LULU soared +11% on beat and gave better FY26 guidance while CEO transition and action plan also creating optimism on recovery; RH (+8%) as investors seemed setup to buy post print on housing recovery regardless (it lagged yesterday despite peer strength). COST (unch) also better but largely inline with the usual expectation for solid execution.

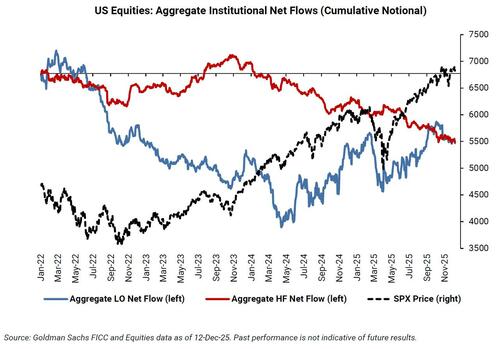

Turning to the various Goldman trading desks, first we look at the bank's share sales trading desk, where the floor was a 4 on a 1-10 scale in terms of overall activity levels, and floor finished -439bps for sale vs a 30-day avg of -136bps.

- Long Onlies finished -$900m net sellers driven by broad supply scattered across every sector.

- Hedge Funds finished -$1BN net sellers driven by supply in industrials and tech.

Both cohorts finished ~$1BN net sellers on the week.

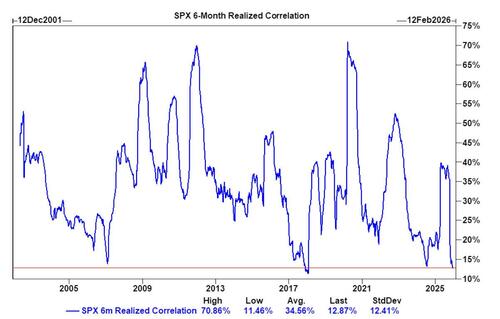

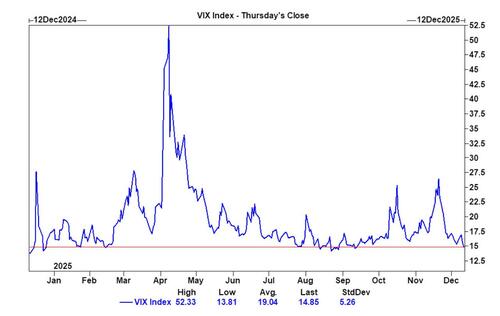

Next, we turn to Goldman's Derivatives desk, where the story of the day was the dramatic underperformance of vol despite the S&P straddle >2x realizing. In other wrods, US stocks remain a stock-picker’s market. Six-month realized correlation is sitting near the lows of the past 25 years. That has helped suppress index-level volatility, but it masks the increasingly violent moves happening beneath the surface – the kind of tape investors have grown accustomed to this year.

What’s unfolding now is a forceful rotation. The core debate has shifted to AI leadership vs. broadening participation. As more investors question whether AI continues to narrow leadership while non-AI names begin to work, Goldman cautions that "the starting point matters, and for many portfolios, this has been a shock."

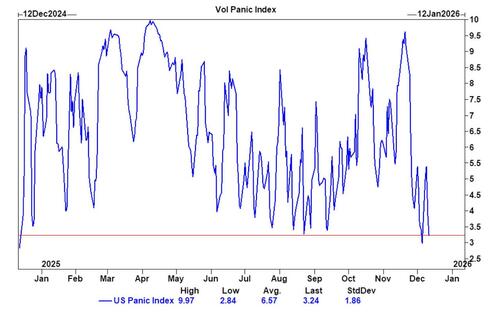

While this dynamic can often net out as neutral for the index (a sell equals a buy), it’s notable that hedging demand picked up Friday as volatility metrics reset although clients came in to fade vol later in the afternoon; heading into Friday’s session Goldman's Vol Panic Index was sitting near one-year lows.

Looking ahead, bank notes that complacency helped catalyze renewed demand for protection through year-end and into Q1 – particularly as investors reassess the durability of the AI underpinnings that have carried the market. Even so Goldman's traders anticipate more sellers of vol ahead of VIX expiry next week so the desk still sees further room for vol to come in. Monday's straddle went out at just 60bps.

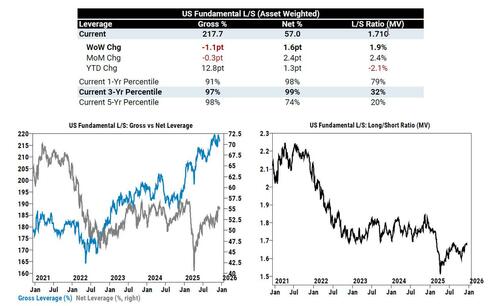

Next, here are the latest insights from Goldman's Prime desk: US Fundamental L/S Gross leverage fell -1.1 pts to 217.7% (91st percentile one-year), and US Fundamental L/S Net leverage rose +1.6 pts to 57% (98th percentile one-year).

Single Stocks saw little net activity, as long buys were offset by roughly an equal amount of short sales.

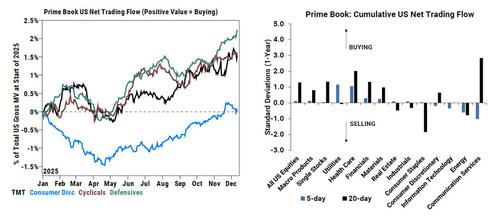

Health Care, Utilities, and Financials were the most notionally net bought sectors, while Communication Svcs, Info Tech, and Energy were the most net sold.

Financials was among the most $ net bought sectors on the week and has now been net bought for 3 straight weeks (10 of the last 13), driven entirely by long buys which outpaced short sales (2 to 1). In contrast, Energy was among the most $ net sold sectors this week as HFs sold the sector for the 6th straight week as WTI crude oil hovers multi-year lows. Some more thoughts on Energy and Financials from Goldman's sales coverage:

- Energy (Adam Wijaya): Within Energy, sentiment on the Refining equities has quickly soured over the last week – with most pointing to the negative rate of change on crack spreads (down 30% in some cases over the last month) – with equities holding in on a relative basis. Refining has been the top trade within traditional energy this year – though the bull pitch on a positive revision cycle into 4Q has quickly deteriorated given the recent fade in cracks. Within the Majors, on the back of XOM’s Corporate Plan update – feedback has been more positive on the FCF growth through the end of the decade, buyback levels remaining elevated and downside to low carbon spend – though the bull pitch on owning XOM with more Refining torque over the last 6 months is now more debated. Lastly – OFS is dominating conversations – particularly BKR, SLB, HAL and LBRT on the back of expectations for an International activity cycle to inflect in late 2026/2027 and idiosyncratic power stories for HAL / LBRT.

- Financials (Christian DeGrasse): The top focus this week in Financials was the GS Financials Conference, where we got a preliminary look into the state of the sector into 2026. Overall, the tone of the conference was ‘optimism’ into 2026, with broadly positive/upbeat commentary on capital markets into ’26 (M&A, monetization/realizations, alt fundraising, middle market activity), consumer spend (4Q had a slight acceleration), lending (commercial), AI Productivity/efficiency gains (large banks), while there were several ‘this is the bottom’ calls in real estate from the alts who pointed to greater transaction activity and early greenshoots in LP allocations. In terms of a few single stock focuses, JPM disappointed in its presentation, guiding up on expenses in 2026 (the bulls’ pushback emphasized that it’s mostly due to a better revenue/growth outlook), while OWL and BX came under pressure vs. peers (despite an overall positive tone from the alts around fundraising & the realization outlook) as BCRED, the largest private BDC (owned by BX) reported a 4Q redemption rate of 4.5% of NAV, which runs higher than recent qtly run rate of 1.5-2.0%, potentially implying recent private credit noise has impacted retail’s appetite for these products (and reigniting some fears around OWL’s retail brand). Next week, the top catalysts we’re watching include 1) AJG mid-quarter update (looking for any sign of organic growth stabilization), 2) FDS earnings (where there have been AI-risk fears at various points this year), 3) KMX earnings, which while small, has caused some generalist fears around auto and consumer credit several months ago.

Next Week is the last full week before 2026: main highlights are NFP Tuesday (street at +52k) + a handful of central bank decisions: BOE (91% odds of 25bps cut), ECB (expected to hold), BOJ (25bps hike expected), Norges Bank, & Riksbank.

Much more in the full must-read Goldman Weekly Rundown note available to pro subs.