Goldman Desk Warns Of Momentum Carnage, Recommends This Trade As Crash Hedge

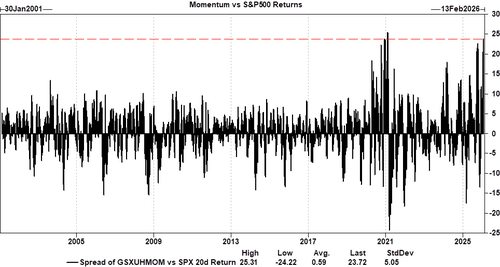

Coming into today's clusterfuck of a day, Goldman's high beta momentum long basket was up over 20% to start the year and had outperformed the S&P by nearly 24% over the last 20 sessions, which according to Goldman derivatives trader Cullen Morgan was one of the largest outperformances on record.

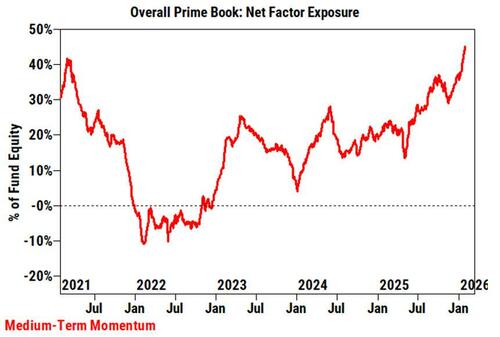

To be sure, the factor looks stretched: coming into this week, GSXUHMOM had rallied for 5 consecutive weeks, and Goldman's Prime Brokerage book had net exposure in the 100th percentile...

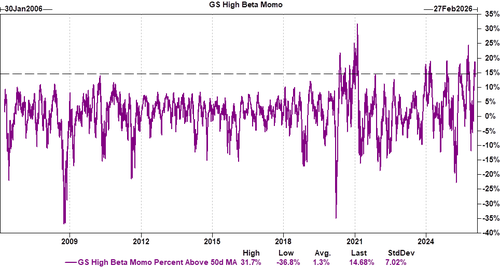

... with the basket nearly 15% above its 50dma.

Fast forward to today when it's time to pay the piper: As Morgan writes, "exploding cross asset vol and underwhelming tech earnings are starting to cause broader indigestion across equities. High beta momo is the worst performing factor on my board today, down 5%."

Cullen's conclusion: Goldman is of the view that a larger unwind of momentum could cause more pain than a rotation given where nets are in the Prime Book (95th percentile).

And since next week we get another handful of tech earnings plus NFP, Goldman's trading desk likes adding put spreads in momentum as a portfolio hedge or tactical trade here, specifically the following:

- GSXUHMOM 20Feb2026 92.5% / 80% put spread costs 1.5% (-16% delta, 8x gross max payout)

More in the full note available to pro subs.