Goldman Forecasts S&P 7,600 In 2026 Due To Economic Acceleration & AI Adoption

With David Kostin having retired from his 31-year career as chief equity guesser at Goldman Sachs, Ben Snider's first foray into forecasting the year-ahead is a bullish one.

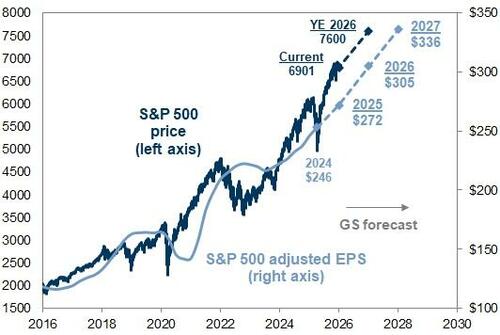

Snider and his team expect strong earnings growth will continue to be the primary driver of higher S&P 500 prices, forecasting that the S&P 500 will rise to 7600 in 2026.

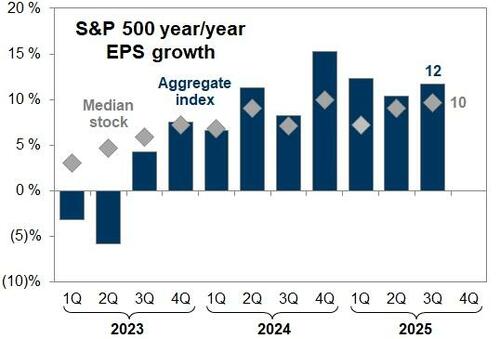

S&P 500 earnings growth has been strong and broad-based in 2025.

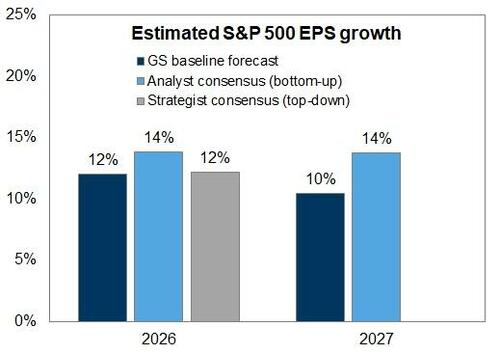

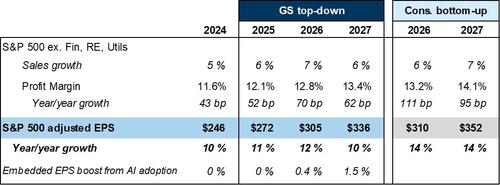

The team forecasts S&P 500 EPS growth of +12% year/year in 2026 (to $305) and +10% in 2027 (to $336).

Their estimates incorporate GS macro forecasts for solid US GDP growth and a weaker US dollar alongside GS equity analyst forecasts for continued earnings strength among the largest technology stocks.

Goldman's 12% EPS growth forecast for 2026 combines revenue growth of 7% with 70 bp of profit margin expansion.

Interestingly, Snider and his team note that the recent decline in the S&P 500 buyback yield means earnings growth should outpace EPS growth by about 1 pp in 2026.

Their forecast for a 1.7% net buyback yield next year implies a modest increase in the S&P 500 divisor, which functions as an index share count. This should create a modest headwind to S&P 500 EPS growth relative to earnings growth.

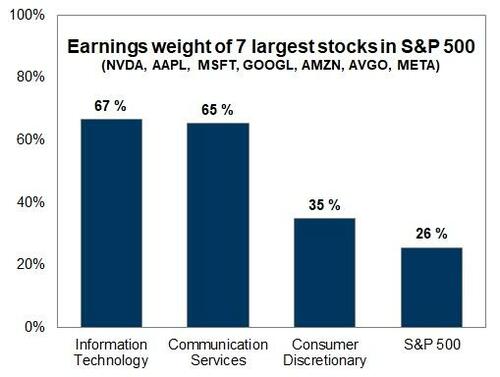

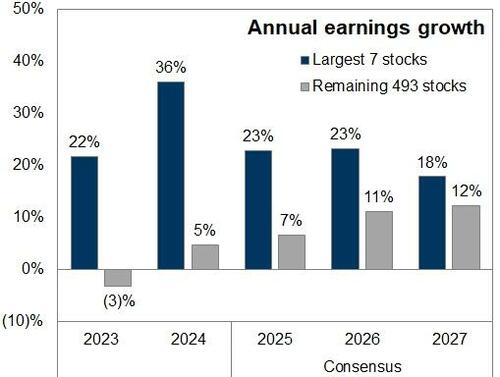

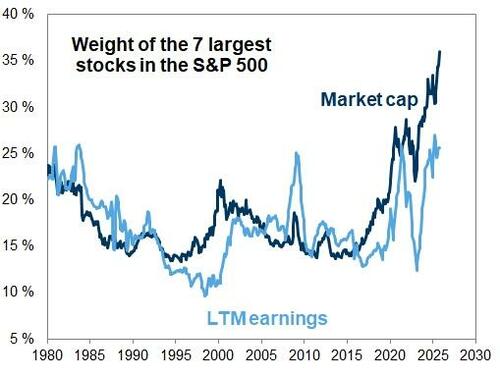

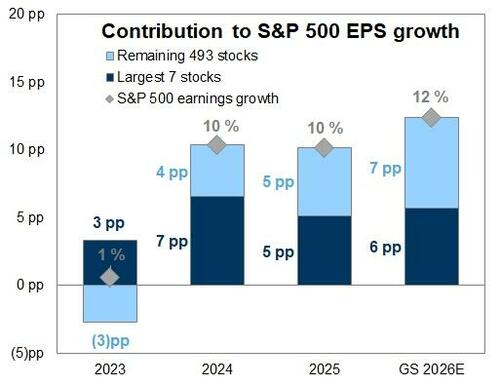

The seven largest stocks in the S&P 500 (NVDA, AAPL, MSFT, GOOGL, AMZN, AVGO, META) account for 36% of S&P 500 market cap and 26% of earnings and should contribute 46% of index EPS growth in 2026.

This represents a decline from their 50% contribution in 2025 as earnings growth for the S&P 493 accelerates from +7% in 2025 to +9% in 2026.

The mega-caps' above-average sales growth and profit margins provide a mechanical tailwind to margins for the aggregate S&P 500. For example, if NVDA sales grow by 50% in 2026 and its margins remain flat, the S&P 500 profit margin would rise by 30 bp from that boost alone.

Snider expects AI-driven productivity gains will lift S&P 500 EPS by 0.4% in 2026 and 1.5% in 2027.

The process of AI adoption remains early, but large companies report more progress so far than smaller firms.

Goldman utilizes their company-level estimates of the earnings impact of AI-related labor productivity gains and assume both corporate adoption and the realized share of the total potential productivity boost will gradually build over time.

Profit margins are the key source of difference between our forecasts and consensus estimates.

Goldman's 2026 EPS forecast is in line with the median top-down strategist estimate but below the bottom-up analyst consensus.

Consensus estimates show margins for the median S&P 500 stock expanding by 89 bp in 2026, but these bottom-up margin estimates are usually too optimistic.

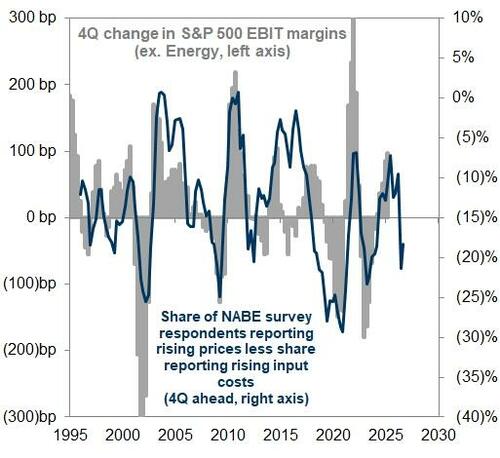

Easing tariff pressures, continued productivity growth, and labor market slack should support profit margin expansion in 2026, but recent surveys indicate corporate concern regarding the interplay between input costs and pricing.

Finally, from a fundamental perspective, the key risk to Goldman's earnings forecasts is the trajectory of profit margins.

The sustainability of exceptional margins for the largest US stocks has been a long-running topic of investor debate, and recent focus on AI competition among the largest firms suggests that will remain a key debate in 2026. Outside of the largest stocks, consensus estimates show margins for the median S&P 500 stock expanding by 89 bp in 2026. Goldman's macro margin model, however, suggests more modest margin expansion for the median S&P 500 stock next year. Furthermore, recent NABE and regional Fed surveys indicate corporate concern regarding the relative pace of input cost and pricing inflation.

In the past, similar survey readings have often signaled downside risk for profit margins, although recent readings may be confounded by tariff-driven pressure on input costs, which our economists expect will ease in 2026.

But Goldman forecasts solid productivity growth – fueled in part by AI adoption – and only modest labor market tightening; both boding well for corporate profit margins.

Professional subscribers can find the full note at our new Marketdesk.ai portal