Goldman Partner Warns 'Beware CTA Triggers' As Tech Firms Face 'Moat Check'

As the week has progressed, there appears to be few (if any) places to hide as a "sell now - ask questions later" type of feeling spreads out there. Velocity has picked up to the downside without a real catalyst outside of AI fears reverberate across more and more sub-sectors.

The magnitude of the moves are significantly hitting sentiment with no one willing to step in and defend.

Creative Destruction

We are witnessing the rolling ball of creative destruction finding its way across global sectors in real-time, according to Goldman Sachs Partner, Rich Privorotsky.

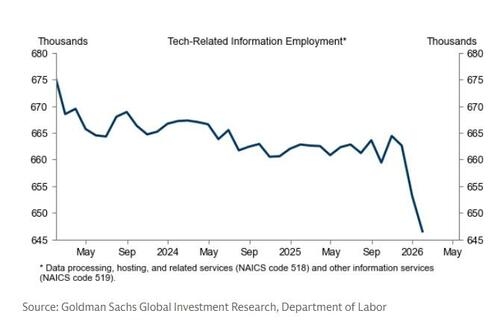

Last week it was software, earlier in the week insurance and brokers…yesterday it was shipping. AI has been framed as supportive for equities, but what it is now doing is aggressively rooting out rent seekers across the economy.

In many places where we thought moats existed, they are being rapidly challenged by new entrants as technological advancement chips away at what we presumed were fortresses built on experience and knowledge work.

In essence, the One-Delta desk-head believes, this is a MOAT CHECK...

-

What you really make, is it defensible against technology?

-

If there were an army of bots, could they disrupt an incumbent?

-

Do you now have to race to spend or acquire…or risk being dislodged?

Read here for a list of potentially 'safe' and 'in harm's way' stocks...

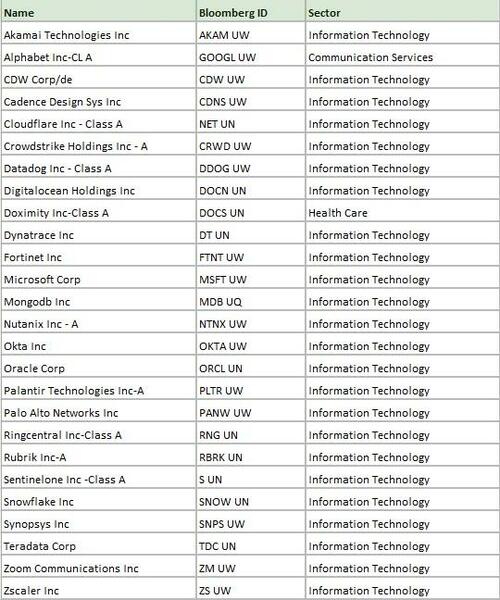

Software Losers

Software Winners

Multiples

In my experience as a trader, multiples are the hardest thing to anchor. It’s a wheezy... it’s a woozy…it’s ephemeral and hard to judge. What one person is willing to pay versus another is the central function of markets. People can point to earnings…over the long term that’s what stocks should follow. But once multiples start getting debated, they rarely stop. That’s the issue here…software multiples and terminal value are being questioned. How do you falsify the view that in the next five years AI won’t seriously disrupt some of these incumbent businesses? Are people still going to be using ADBE when image generation is provided by innumerable agentic processes?

That’s the question today…particularly in software/tech.

Public valuations have come in from mid- 30s p/e multiples (blended next 24ms) into the mid-20s, but private portfolios are often marked at far higher levels.

Hence the disruption spills from public to private…and into private credit, particularly the leveraged loan market.

There are real economic implications from a debate on terminal value.

CPI today

Risk skewed to the upside. January brings annual resets and they tend to surprise on the high side.

I’ve got Amazon comments reverberating in the back of my head about inventory depletion…plus the LMI survey showing multi-decade lows in inventories.

Core inflation is on a downward path thanks to powerful secular forces, but goods inflation may be turning back up.

Corporates held back price increases and ran down inventories accumulated last year…political pressure likely played a role. There is a risk goods prints a bit hotter, especially with metal inputs running firm (see overnight White House considering rolling back some Aluminum Tariffs).

Regime Change

That said, we should look through it. The market is sending an emphatic signal. Bonds are rallying aggressively while cyclical/defensives have sold off over the past week.

It feels like a short-term growth shock regime. The curve is flattening while bonds are rallying.

The market is less worried about inflation, consistent with a narrative that AI is going to disrupt multiple industries faster than expected.

The end result is disinflation…and potentially outright deflation in pockets as rent seekers lose pricing power.

Risk

I like EU reits/long German residential, though today’s inflation data complicates timing (Wouldn’t touch office reits).

Physical assets are the longs... hence the rip in commodities, though not chasing that here.

Companies with true moats...aerospace feels timely again, Airbus type exposures.

Industrials should work, but there are few worries about cyclical risk so you need to hitch your wagon to those benefiting from the investment cycle, not just short-cycle cyclicals.

On the short side, banks look vulnerable for four reasons.

-

First, in Europe they’ve been crowded longs…pro-cyclical, returning cash, solid fundamentals.

-

Second, they’ve priced almost zero risk of AI disruption or NIM compression (up until yday).

-

Third, a disinflationary regime with a weaker dollar is problematic for the rates curve…think flatter and slower.

-

Fourth, more US-specific, prediction markets have the odds of a Democratic sweep around the high-30% range…that meaningfully increases regulatory risk and that feels underpriced, particularly for regionals.

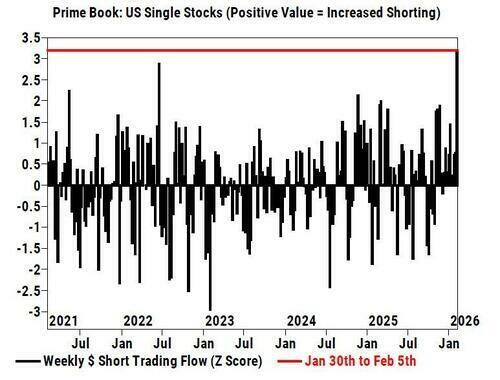

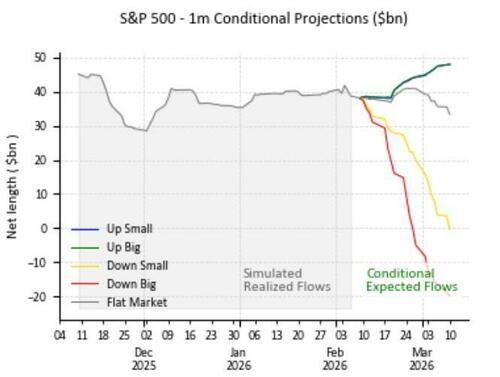

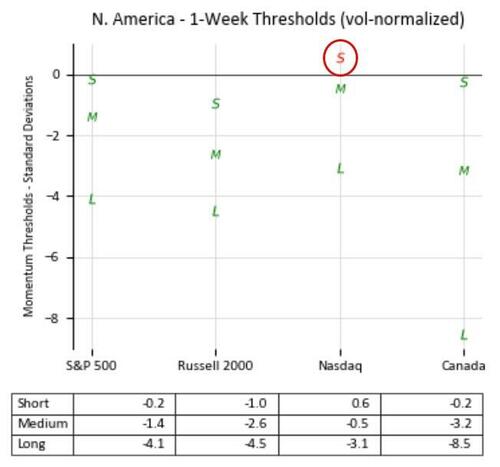

Beware CTA triggers now across US indices.

In North America, the heaviest selling forecast is not the SPX but rather NDX.

The S&P is now through 50dma (6895) and CTA ST threshold (6911).

The good news is that the selling remains modest: Goldman currently estimates CTAs will sell $1.5-2bn of US equities over the next one week.

Also, the S&P is still ~110 handles above the medium-term threshold of 6723 which would accelerate the magnitude of selling.

It’s a market of winners and losers as AI lowers barriers daily.

I can’t tell you what tomorrow’s shipping sector will be.

What I can say is terminal multiples are in question…and that is structurally problematic.

This environment favors companies with real moats and tangible value over long-duration growth.

EM remains the cleaner relative hideout…and I think the ROW trade continues to drive relative outperformance.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal