Goldman Three Favorite Trades For 2026

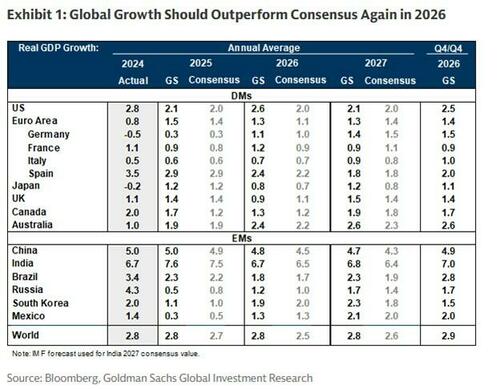

While there’s a lot to get through, as Goldman's Tony Pasquariello noted in his first report of the year, the overarching theme is that the macro backdrop remains conducive for stocks in 2026. Goldman economists expect another year of sturdy global growth of 2.8% in 2026 vs consensus at 2.5%, forecasting continued economic expansion in all regions combined with further modest (and nont so modest) easing by the Fed.

For the second year in a row, Goldman remains most optimistic on US growth (vs the rest of the world), forecasting 2.6% growth vs consensus at 2.0% on the back of reduced tariff drag, tax cuts, and easier financial conditions (note the direct effect of AI investment on GDP growth is not included as another reason for strength).

And so, as Goldman co-Head of global banking markets Ashok Varadhan told Pasquariello in a recent podcast, “US is the place to be.”

With that in mind, here is a recap of the Goldman desk’s favorite thematics & stock ideas in 2026, as summarized by the bank's derivatives guru Brian Garrett.

Goldman trading desk Favored Thematic in 2026

- Long companies that have adopted AI to increase productivity – GSXUPROD

- Short companies exposed to lower-income discretionary spend – GSXULOWD

- Long Profitable vs Vulnerable AI Pair – GSPUAIPR – Long: GSCBAIHP, Short: GSCBAIVU

1. Focus on companies that have adopted AI to increase productivity.

Goldman - and Zero Hedge - spent the last 3 years discussing the broadest brush of the so-called ‘AI beneficiaries’. Semis / working equipment / datacenters / AI power and the rest of the ‘picks and shovels’ have in that time, been the primary focus.

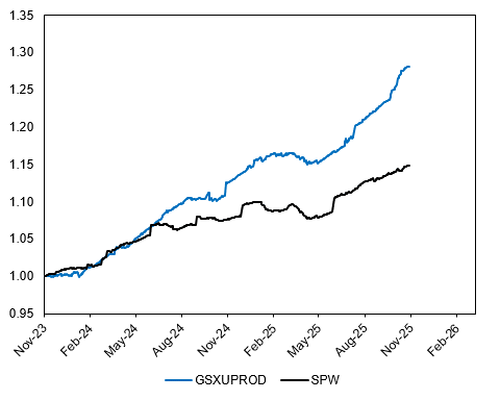

However, as AI makes its way into our everyday life, it’s time to focus on companies that are using AI to increase productivity. Goldman's US AI Productivity Beneficiaries {GSXUPROD Index} is composed of non-tech, non-AI companies that have mentioned specific plans to implement AI into their workflows, leading to lower costs and higher margins.

Earnings for this group has already started to diverge vs. SPW (SPX equal weight) since 3Q24, and the bank expects this trend to continue as the potential change to baseline EPS from AI adoption via labor productivity is higher than that of SPX & Russell 1000.

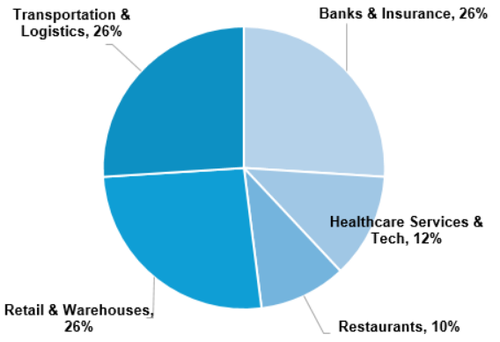

Sectors include banks/insurance, retailers/warehouse operators, transportation/logistics, healthcare, and restaurants. Click HERE for the full basket composition / details.

Earnings Estimates – GSXUPROD vs SPX …

Sector exposure …

2. Short the lower-income consumer discretionary companies as the ‘K-shaped economy’ continues.

In 2025, strong GDP growth numbers have not translated into a strong labor market. We saw negative job growth over the summer months while the unemployment rate has risen to 4.6% in Nov (from 4.1% in Jun). One layer under the hood, the K-shaped economy continues with the lower income cohort continuing to feel the brunt of higher prices while the high-income cohort see significant gains in asset wealth.

Price action for this group has lagged both SPX500 and SPX493 in 2025. Goldman expects this thematic to continue as the lower-income consumer continues to struggle in 2026 in the midst of an affordability crisis – see below from the latest U.Mich survey in early Dec.

"Consumers see modest improvements from November on a few dimensions, but the overall tenor of views is broadly somber, as consumers continue to cite the burden of high prices," … "Similarly, labor market expectations improved a touch but remained relatively dismal." - UMich Survey, Dec 5 2025 (RTRS)

“The underperformance likely reflects pressures on lower-income consumers—including more limited borrowing capacity and weaker income growth—as well as the slowdown in immigration. Our distributional income growth forecasts suggest a continued underperformance of low-end spending in 2026, with tepid job growth and cuts to SNAP and Medicaid benefits from the OBBBA weighing on income growth for low-income households." - Goldman US Macro, Dec1 2025 (GIR)

Source: Low-End Consumer Underperformance; Growing AI Focus in Labor Market Discussions

Source: Macro Outlook 2026

3. Long Quality vs Vulnerable AI Pair as the market becomes increasingly discerning

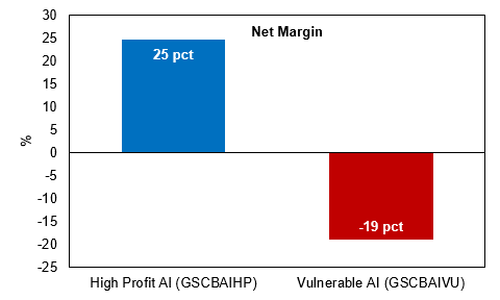

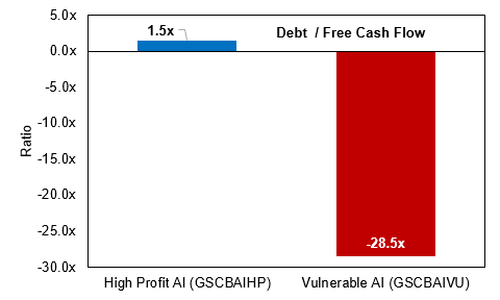

After a blistering 3 years of the AI trade (Goldman AI Basket up ~284% vs SPX ~80%), the market is increasingly looking to be more discerning on what’s happening under the AI-hood. As countless headlines that firmly fall in the ‘concerned’ bucket weigh on investor sentiment in recent months, the market has turned its focus towards the more ‘traditional’ metrics when looking at companies – profitability, balance sheet strength, credit quality, and free cash flow.

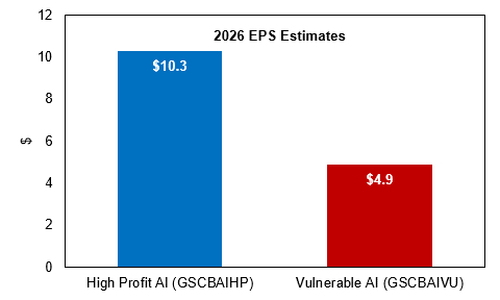

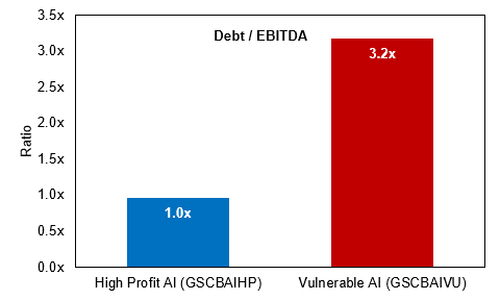

As we reported two months ago (see "Goldman Breaks Down "High Profit" Versus "Vulnerable" AI Stocks"), Goldman split the AI universe into two groups: “High-Profit AI” {GSCBAIHP Index} vs “Vulnerable AI” {GSCBAIVU Index} – using balance sheet strength, credit quality, and free cash flow resilience as factors of differentiation.

The pair of these two – {GSPUAIPR Index} – isolates the quality from the vulnerable, and aims to benefit from a market that is increasingly discerning.

One layer under the hood: net margin / EPS / debt / free cash flow.

... and credit ratings.

More in the full Brian Garrett note available to pro subscribers.