Goldman Traders See 'Less Panic' As Retail Buyers Return To Market

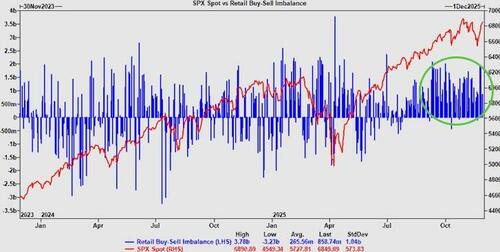

Retail sentiment has been difficult to read recently with Bitcoin down more than -16% over the past month (and down more than -21% at the November lows) but, as Goldman Sachs Nelson Armbrust points out, the equity narrative is telling a more complex story.

While the euphoric buying has cooled, the overall buying has not.

Retail has almost exclusively bought the dip in the second half of the year and the pace of buying has remained largely inline with YTD averages but, yes, below the highs of this year.

Source: Goldman Sachs FICC and Equities

Additionally, since so much of the recent price action has been driven by technical factors, the Goldman traders have focused on the GS Panic Index as a proxy for sentiment and an indicator for price action.

This index looks at 1-month S&P implied volatility, VIX volatility, S&P 1m put-call skew, and the S&P term structure slope (1m vs. 3m).

The weighted average is then calculated and percentile ranked on a rolling 2y lookback (High readings suggest fear / low readings suggest complacency).

The index reached a reading of 9.6 on November 20th and has since fallen 235% to 4.09.

Source: Goldman Sachs FICC and Equities

The traders believe this reading will normalize back and are watching closely to see which input in the volatility market drives the change as seasonals shift in the bulls' favor...

Professional subscribers can find the full note at our new Marketdesk.ai portal