Goldman Warns Pain-Trade Not Over Despite Historic Hedge Fund Degrossing

There's good news, bad news, and ugly news in the current trading environment.

While hedge funds experienced strong returns in January, performance has become choppier in recent weeks (especially in the US).

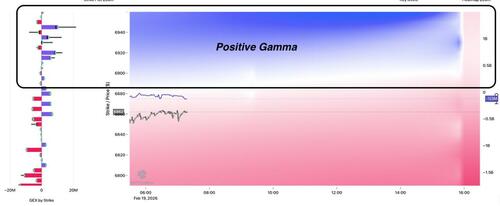

Almost two weeks ago, we pointed to hedge fund degrossing and the potential for a bounce. The bounce happened, but once again (for the S&P 500) stalled around 7,000 'wall of gamma'...

The last couple of days saw VIX expiration seemed to allow for a quick 1% rally yesterday morning - a rally that stopped dead at 6,900.

At 6,900 we saw heavy S&P call selling, which finally broke the market into the mid-afternoon, pushing the SPX back to 6,860.

Today, we are seeing a 'free-er' (post Gamma flush) market that is extending the losses...

So where are we now?

The Good News - De-Grossing Has Begun

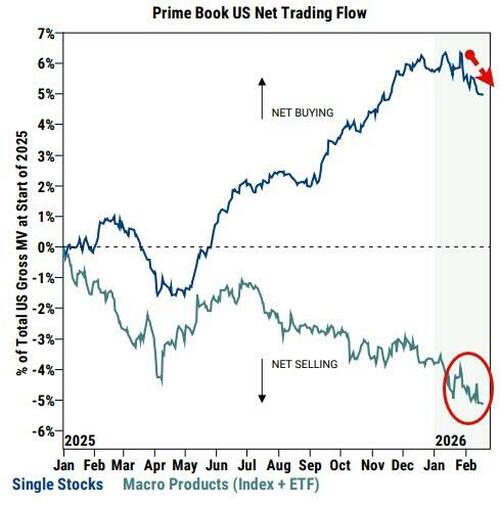

Goldman Sachs traders note that against a more challenging performance backdrop and tougher technicals, hedge funds have turned more defensive and net sold US equities MTD at the fastest pace since Mar ’25.

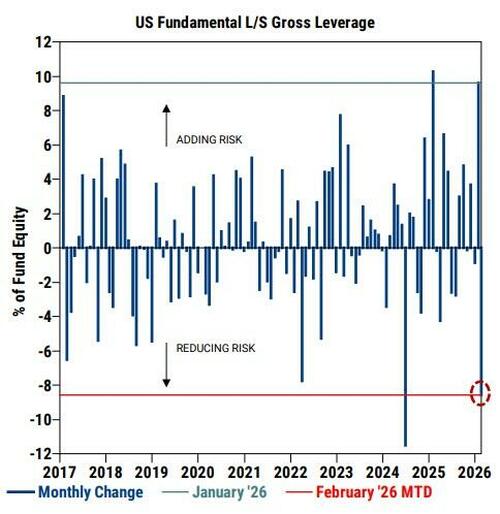

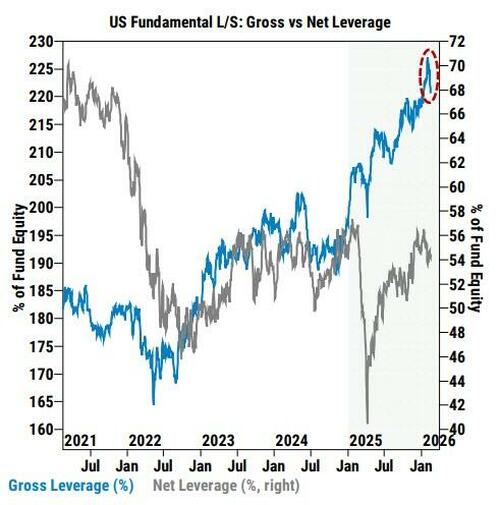

US L/S Gross leverage has fallen -8.6 pts so far in February, which is tracking to be one of the sharpest monthly declines on our record (since 2016) and reversing nearly all of January’s increase...

These are the themes that hedgies are staying with for now:

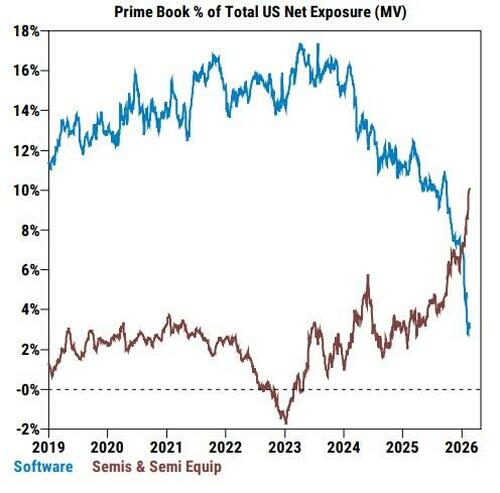

1) Hedge funds are still pressing the long Semis vs. short Software trade where the positioning divergence has become more extreme, though the pace of selling in Software has slowed in recent sessions.

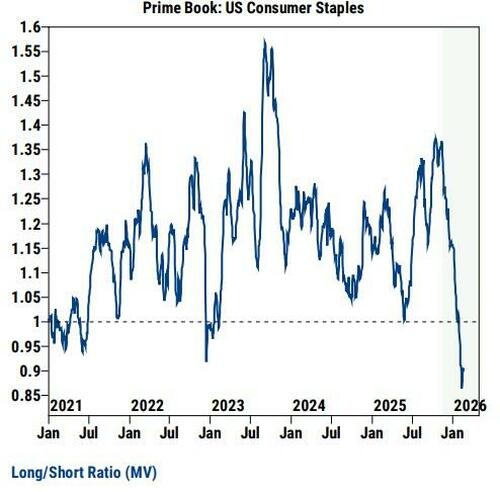

2) Managers have become more bearish on Consumer stocks as both Discretionary and Staples are among the most net sold sectors YTD. Despite Staples’ price outperformance this year, the sector’s long/short ratio has fallen to 5-year lows and is now net short, suggesting this year’s rally has not been driven by hedge funds - our US Custom Baskets team believes Staples (GSXUSTAP) and expensive Defensives (GSXUEDEF) can be tactically shorted (l given they are now expensive relative to history, have seen slower earnings growth, and technicals are not favorable.

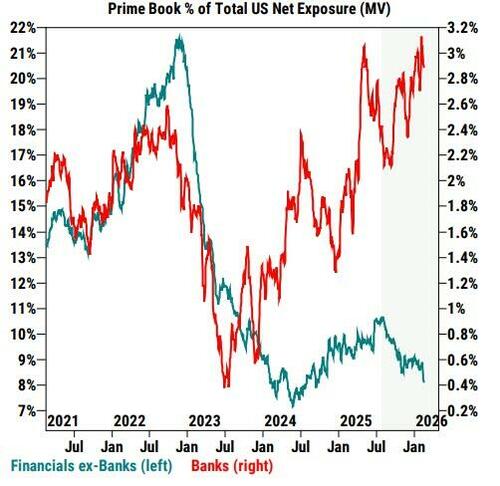

3) Within cyclicals, recent net flows have skewed better for sale across Financials ex-Banks as well as pockets of Industrials & Real Estate amid increased anxiety around AI disruption.

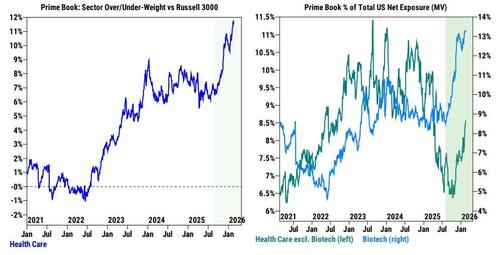

4) Health Care is now by far the most net bought sector YTD, and the recent buying has been broad-based across most subsectors.

The Bad News - Pain Trade Has Further To Go

Hedge funds are suffering...

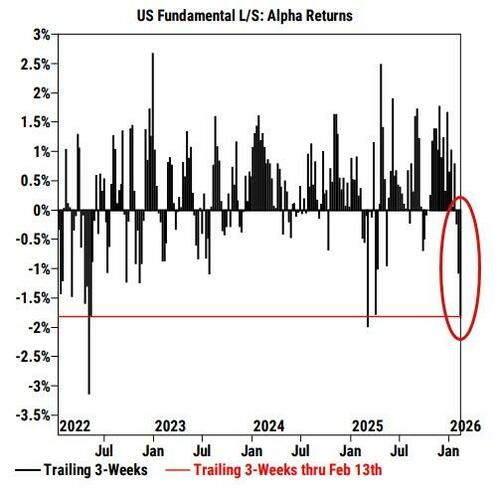

US L/S managers are down -66 bps MTD (+0.8% YTD) and coming into this week had lost ~200 bps of alpha returns since January 27th – the second worst alpha drawdown over a 3-week period since 1H ‘22.

And there may be more pain to come, as Goldman's Vincent Lin points out...

Although the speed and magnitude of this month’s leverage reduction point to cleaner positioning now and suggest we could be in the later-innings of this de-risking episode, US L/S Gross exposure remains elevated – in the 96th percentile on a 3-year lookback – and is not yet at a level where positioning can become a sustained equity market tailwind, in our view...

The Ugly News - (Out)Flows, Gamma, & Seasonals

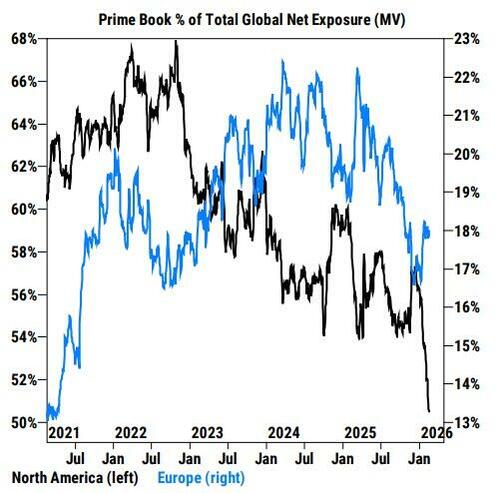

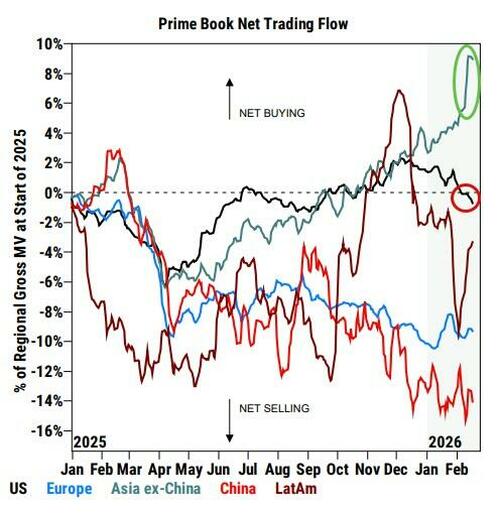

The clearest trend among Goldman's flow-watchers has been a continuation of strong inflows into Asia (DM + EM).

North America is the only notionally net sold region YTD, as short sales have outpaced long buys, while Europe is net bought, driven by both short covers and long buys.

Asia ex-China is by far the most net bought region YTD globally by hedge funds, driven by long buys – Japan, Korea, and Taiwan have all seen significant inflows so far this year. Hedge funds are now overweight Asia (DM + EM) by more than +10 pts vs. MSCI World ACWI, the most O/W level on our record

So pressure continues in the US (as inflows go elsewhere) with SpotGamma still marking 6,900 as the Risk Pivot, as under 6,900 there remains a soft underbelly, with negative gamma and the specter of implied vol spiking.

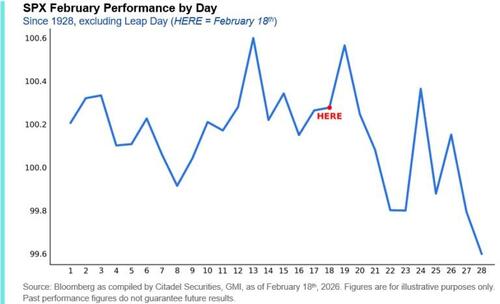

And seasonals for the rest of February are not your friend...

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal