Goldman Warns "Stretched Positioning" And "Exceedingly Bullish Sentiment" Paves Way For "Headline Shock" Tipping Point

Earlier this week, we cautioned readers that according to the latest note from Goldman's flow trading desk, positioning was extremely stretched and had led the market to be increasingly fragile and prone to outsized moves. Fast forward to today when another corner of the Goldman trading desk, namely Tactical Flows, echoes its 200 West trading peers and writes that while "positioning is stretched and sentiment reads exceedingly bullish" which "paves the way for outsized moves on headline shocks, the immediate flows set up remains supportive for US equities." Thus, the Goldman team writes, "we see the case for contained selloffs coupled with relief rallies as the most likely path forward in the near term."

Below we excerpt the main highlights from the note (available to pro subs in the usual place).

First, here's why the Tactical desk is bullish: "fund flows into equities have been robust (that rotation from MM funds finally appearing) corporates are entering their buyback windows, capital markets activity is picking up, and gamma will be resupplied to the market."

Yet despite the tailwinds mentioned above, Goldman sees potential headwinds that are mounting which could result in a painful tipping point: "we are watching out for a possible weakening in the flows complex across both top of book liquidity and systematic cohorts supply."

Let's take a closer look at the various market metrics tracked by the bank:

1. Fund Flows

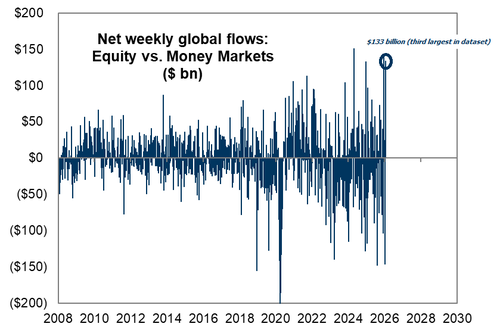

Goldman saw strong net flows into global equity funds last week, led by stronger inflows into US and EM equity funds (+$71bn vs $2bn in the previous week) – more than 35x-ed the flows. While equity flows increase, money market fund assets fell by $62bn. This is the 3rd largest level in the bank's dataset.

At the sector level, commodities, technology, and financials saw the strongest net inflows. Over the past four weeks, net inflows into commodities and industrials have been particularly strong.

2. Sentiment, Positioning

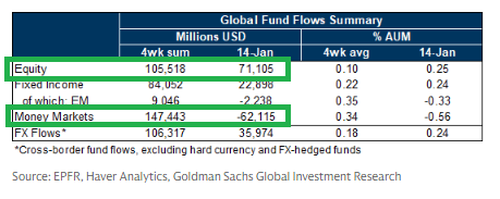

The Goldman Sentiment Indicator is the bank's measure of positioning in US equities (yes, not a measure of sentiment at all) .

The latest reading of -0.2 highlights how skittish investors are despite an AAII Sentiment reading at a 1y high as of last week. With the bustle of activity on the headline front, the bank expects this divergence to start to collapse.

3. PB

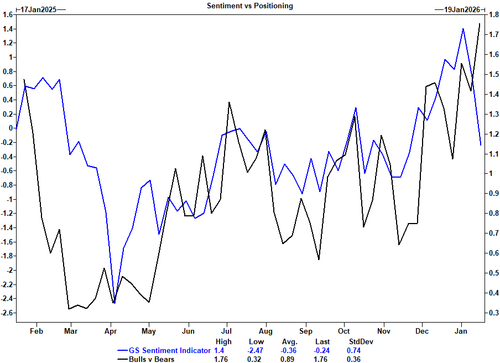

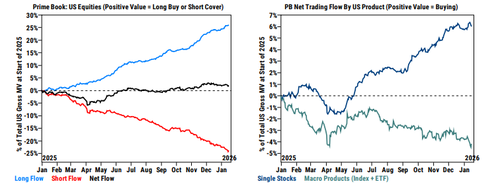

For week ended Jan 15th, Macro Products (Index and ETF combined) saw the largest net selling in 4 weeks (-1.1 SDs one-year), driven entirely by short sales. US-listed ETF shorts decreased -1.1% (still up +8.1% MoM), driven by covering in Large Cap Equity ETFs.

Single Stocks collectively were slightly net bought (+0.2 SDs one-year), driven by risk-on flows with long buys modestly outpacing short sales (1.2 to 1). Signs of the “Broadening” times – we expect to continue to see a continued interest in looking for micro level winners.

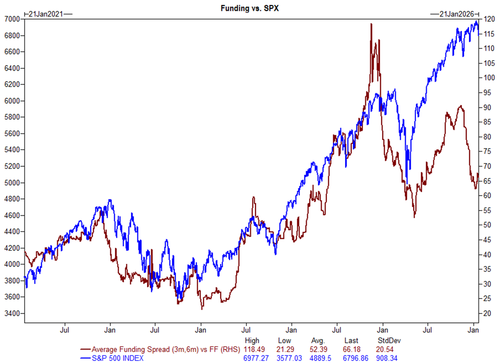

4. Funding spreads

Funding spreads, and the demand for leverage, have bounced off the lows going into the end of last year – this has corresponded with the re-leveraging in the systematic community.

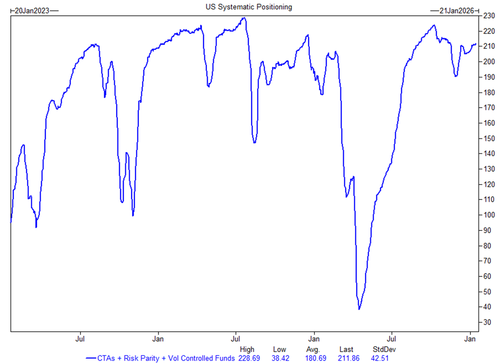

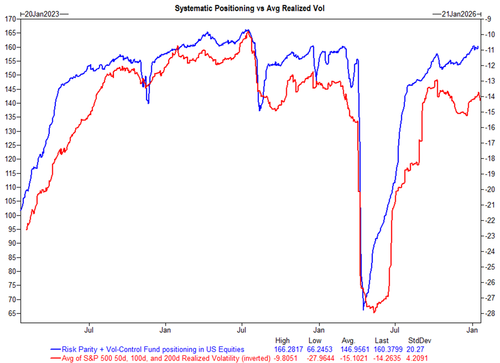

5. Systematics

Systematics have added ~$5B collectively in US equity exposure since the start of the year due to the continuation of low medium- and long-term realized vol levels. However, recent price action has caused CTAs to flip to moderate sellers of US equities. That being said, SPX is right around the short-term threshold of 6874 and >100 handles from the medium-term of 6657 (major supply). Translation = this can change quickly.

Over the next 1 week…

- Flat tape: Sellers $6.72B ($9.19B out of the US)

- Up tape: Buyers $1.76B ($813mm out of the US)

- Down tape: Sellers $44.63B ($25.85B out of the US)

Over the next 1 month…

- Flat tape: Sellers $15.91B ($19.95B out of the US)

- Up tape: Buyers $14.82B ($5.47B into the US)

- Down tape: Sellers $210.2B ($74.67B out of the US)

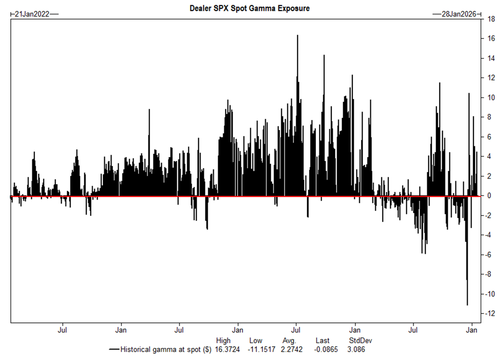

6. Gamma

Hard to remember the days when OpEx freed up the market to move for more than 1 trading session – gamma was resupplied particularly to the upside, which has made the 7k in SPX cash seem miles away (i.e. link).

Following yesterday's selloff, dealer gamma positioning has gotten cleaner, and dealers are max long S&P gamma +3% from here: a relief rally will send the market straight back into a gamma pocket and calmer skies. Until then, buckle in for a bumpier ride.

7. Dispersion

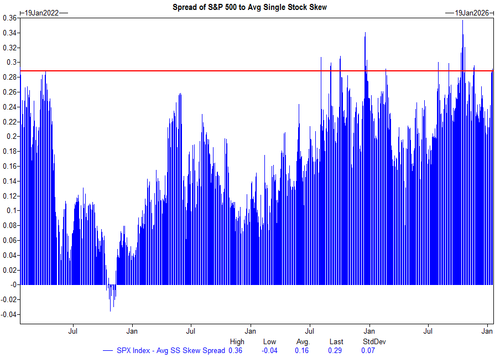

The rise in index dispersion has been well-broadcasted in correlation, but GS has been seeing the stock picker's market manifest in key vol metrics highlighting the chase for upside in single stock winners and a fade of a dramatic index rallies. The spread of SPX Index skew to the average of its constituents is in the 93rd percentile on a 1y lookback and in the 97th percentile on a 4y lookback.

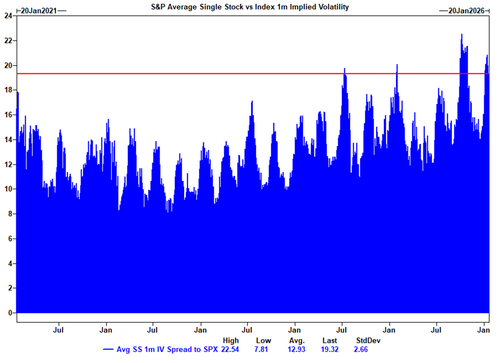

The spread of SPX average single stock 1m implied volatility to the index is in the 89th percentile on a 1y lookback and in the 97th percentile on a 5y lookback

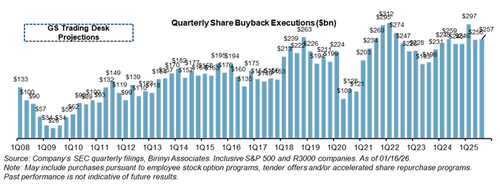

8. Buybacks

Welcome to the final week of the buyback blackout window.

Virtually all companies in buyback blackout as of today pic.twitter.com/BktPLsqMWI

— zerohedge (@zerohedge) January 20, 2026

Goldman's flows started to see a slight pickup in activity vs the prior week; last week finished 1.3x vs 2025 YTD ADTV and 0.6x vs 2024 YTD ADTV. Still light volumes given blackout but we expect to see flows increase as open window picks up.

Basically, the market will receive a source of supportive flows starting next week.

Finally, how does the tactical team trade all of this? As Goldman trader Lee Coppersmith writes, "rates affecting Equities affecting Rates" is the bank's favorite trade for growth and geopolitical risks rising, and this is one representative trade:

- USD 17Apr26 .SPX<95% & 10YSOFR<ATMF CMS-0.2% indicatively @ 8%

More in the full note available to pro subs.