Goldman Warns Of "Tough Markdown" In Crude Should No Conflict Materialize

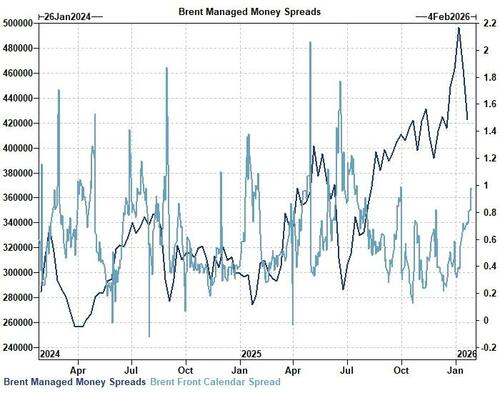

While the Brent price oscillated during January 13th - 20th, Goldman Sachs fuitures trading team note that Managed Money continued buying, mostly due to short covering.

During January 13th - 20th, Brent Managed Money net purchased +$550m according to Commitment of Traders, extending the sizeable $5.6bn of demand from the prior week.

Short covering (+$1.2bn) was partially offset by liquidation (-$600mm).

And outright flows probably understated the true extent of downside reduction.

March-April Brent gained 1c throughout the observation window, outperforming the retracement in flat price.

Notably, Managed Money spreads, which remained negatively correlated with the front calendar and thus reflective of a short imbalance, registered one of the largest percentage decreases over the past few years.

Thereafter, Iran risks returned to the forefront.

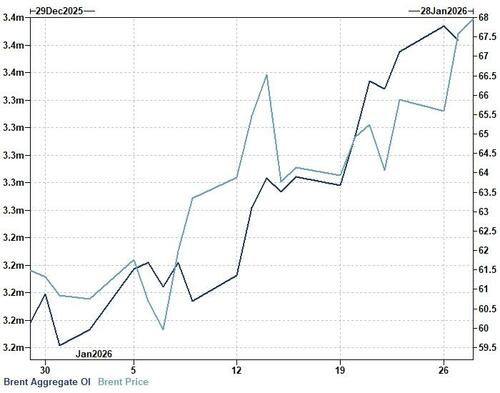

Over January 20th - 27th, April Brent rallied 3.7% and term structure strengthened. President Trump's decision to dispatch naval assets to the Middle East prompted fresh speculation of an attack against Iranian senior leadership.

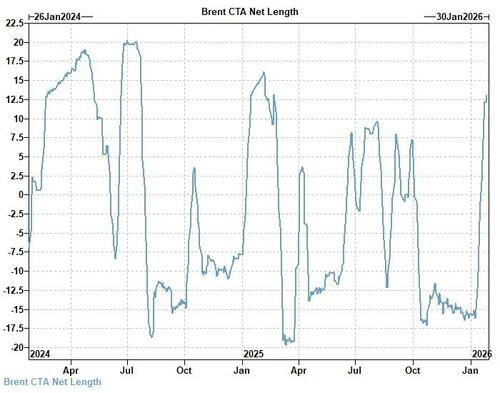

Various indicators suggested new speculative length built via futures and calls.

First, aggregate open interest gained +$4.5bn...

Second, GS Futures Strategists' CTA monitor exhibited a decent long influx...

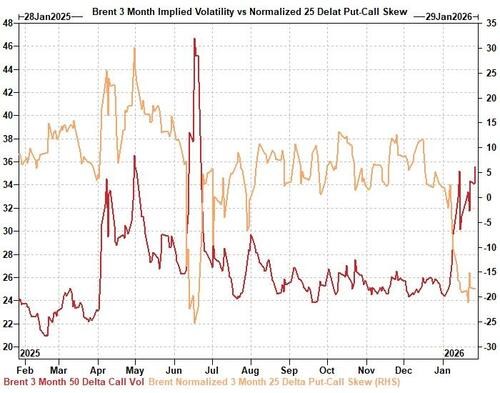

Lastly, Brent 3 month implied volatility richened to a 7 month high and normalized 25 delta put-call skew cheapened to 4% 1 year rank...

Though do not discount the potential for physical participation.

In the last Commitment of Traders report, PMPU bought +$4.9bn, entirely due to new gross longs.

Going forward, Goldman's traders warn to expect less of a tailwind from CTAs.

GS Futures Strategists' framework projects smaller flows in the coming week.

Plus a tough markdown in long call positions should no conflict materialize.

As a result of recent call buying, Brent 3 month implied volatility resides at a sizeable premium to realized.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal