Goldman's Delta-One Desk-Head Sees A 'Subtle Rhetoric Shift From Wall Street To Main Street' By The Trump Admin

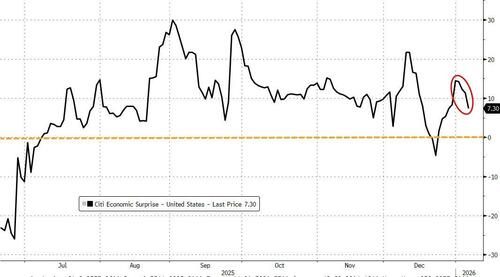

US macro data yesterday was genuinely mixed. JOLTS was objectively soft and ADP came in on the weaker side, but ISM services surprised to the upside, firmly in expansion territory, with particularly strong employment and new orders components.

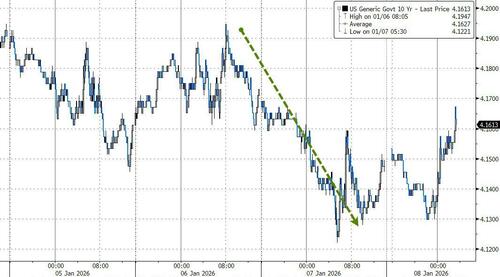

Rates were choppy but ultimately firm, largely supported by the weaker labor data (equally European inflation has come lighter).

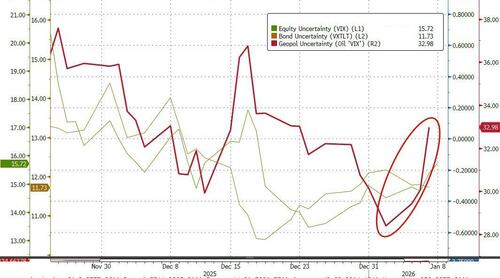

But, away from domestic macro considerations, Goldman's Delta-One trading desk head, Rich Privorotsky, warns that the geopolitical backdrop feels noisier, spanning Russian tanker incidents, Venezuela border rhetoric, and an escalation in Iranian protests.

Individually, none of these typically alter the global economic trajectory, but taken together they are starting to form a broader risk narrative that markets can’t entirely ignore.

There were also a couple of notable developments in corporate America that feel thematically important.

US Housing:

First, the Trump administration is attempting to ban large institutional investors from purchasing single-family US homes.

This reads as a clear populist move ahead of the midterms, framed as protecting middle class and aspirational homebuyers who have been crowded out of the market. It is an unusual stance for a Republican president to take so explicitly against “large institutional investors.”

Blackstone down around -5.5% feels emblematic of the rhetoric shift. While large institutions only own roughly 2–3% of the US single-family housing stock, they have accounted for a much larger share of marginal demand in recent years, with some estimates closer to high single digits of flow.

The concentration of this exposure in the Sunbelt adds a compounding risk (can be in the 20% in some parts)… a region already cooling post-Covid now potentially losing one of its most consistent buyers. US homebuilders closed -2%.

Defense:

The second point that ties into this broader theme was the overture toward US defense contractors. Trump called for a rapid increase in capex and weapons output, but went further by threatening to restrict dividends and buybacks until production accelerates. As reported:

“President Donald Trump vowed to block defense contractors like RTX from paying dividends or buying back shares until they speed up weapons production, a rare presidential strike at Wall Street norms.” (RTRS)

This is another precedent being tested, reinforcing a tone that is increasingly skeptical of shareholder-first outcomes.

As an aside the proposal included boosting annual defense spending by 50% to $1.5trn (bond market appreciate the magnitude of the fiscal expansion?)

The executive proposals on defense and housing fits a bit of narrative that wall street/shareholders taking a back seat to voters ahead of midterms.

Hard to believe this administration is anything but friendly for markets but its a subtle rhetoric shift to watch.

All eyes now turn to NFP and the potential IEEPA ruling tomorrow.

PC1 has broken higher, growth expectations are ramping aggressively, and for now rates remain stable, which keeps the macro backdrop very encouraging.

Privorotsky warns, the risk is more around sentiment and positioning.

What's in the price...

Aggressively short vol amid an aggressive catalyst heavy calendar?

What could go wrong?

Professional subscribers can read much more from Goldman's at our new Marketdesk.ai portal