"Halftime": Goldman's Top Tech Trader On What's Next For The Best Performing Sector

After a 25% peak-to-trough NDX drawdown in Feb-April, we kick-off the second half of 2025 with the NDX on a 6-day winnings streak, and more importantly having recovered all of its recent losses and then some, up a stunning 37% from the low tick less than three months ago, and now solidly in overbought territory (14-day RSI of ~73 = highest since July’24).

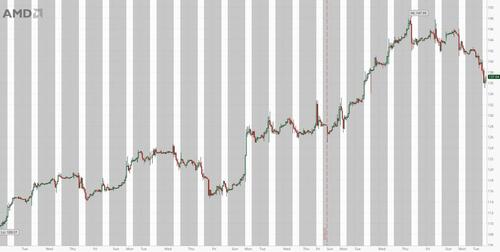

In his look back (and look ahead) note published this morning titled "Halftime" (available to pro subscribers), Goldman's head TMT specialist Peter Callahan, writes that on one hand, it feels a bit like June/July of 2024 – the most recent blow-off-the-top moment – with AI bulls firmly back in the driver seat (e.g. most days we’ve walked in over the last few weeks, you almost ‘expected’ to see an AI name like AMD up ~2-3% in the premarket)

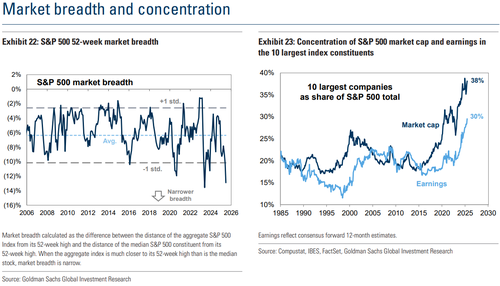

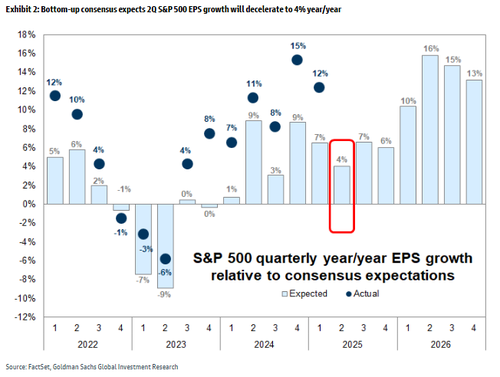

… but on the other hand, there isn’t an obvious negative catalyst ahead (tariffs, record bad market breadth and geopolitical are "known" risks, or should be), 2Q earnings expectations – on paper – are low (consensus calling for just +4% y/y S&P EPS growth in 2Q) and the market has been in buy all pullback mode as of late (the NDX has had just three 1%+ daily pullbacks since the April lows)

At a single stock level, entering H2, there is a bit of a “what’s clean & loved, has really worked” dynamic out there (e.g. META, RBLX, NVDA, BKNG, NFLX types) which, in turn, may drive more conversation and digging into more off the run names and/or laggards as the 2H gets underway (e.g. AMZN, PINS, CRM, ANET, LYFT, MDB, XYZ types etc).

So, with Tech & AI optimism only outmatched by investor fatigue (& frustration), as we begin H2 trading, here is a recap from Callahan of all key stats, charts, clients questions & more

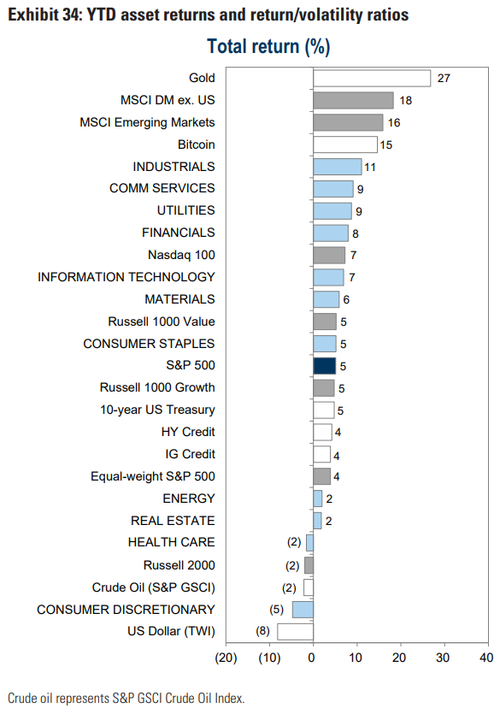

10 QUESTIONS, STATS & DATAPOINTS .. YTD (1H’25): NDX +775 bps vs SPX +560 bps vs. R2K -240 bps ..

- Best Performers YTD: thematic types (CRCL +500%, CRWV +300%, HOOD +149%, ASTS +122%, QBTS +70%); PLTR / NET 82%, RBLX +80%, SPOT +71%, Hynix +68%, STX 66%, CVNA +63%, SMCI +61%, UBER / MELI / SE +54%, JBL / NFLX / CRWD / MU +48%

- Worst Performers YTD: GLOB -58%, BILL -45%, ONTO -39%, TTD -38%, VERX / BRZE / FIVN / ASAN -35%, ALAB / AAOI -31%, MRVL -30%, GPN -29%, TER -28%, HPQ -25%, EPAM -24%, TSLA / AAPL / XYZ -20%, CRM / SNAP -19%, ON / TEAM -17%

- Most debated stocks in TMT right now: AMD (still room to go?) .. ANET (battleground re: competition) .. IBM (where to ?) .. ORCL (FCF vs RPO) .. CRM (can it turn the corner?) .. CRWD (premium growth algo intact?) .. GOOGL (AI + regulation) .. APP (how much discovery value is left?) .. UBER (AVs = oppty or risk?)

- "What’s in motion, stays in motion": some names that have been on impressive runs, lately - RBLX, IBM, CSCO, AVGO, KLAC, NET, HOOD, TTWO, STX, APH, JBL & FLEX, MSFT, ORCL, NFLX

- A golden era of Disruption: one of the long-standing ‘challenges’ for Tech has been the lack of staying power for companies given the velocity of tech innovation (e.g. the Nokia or Xerox storylines from the dotcom era), while, I am not making a call for disruption driven multiple compression’ from here – the last couple weeks (months) I’ve been struck by the velocity of ‘change’ that has driven increased uncertainty at some of today’s biggest brands and market-share positions – GenAI, Stablecoins, Autonomous Vehicles (Avs), Chatbots, Agentic Software, Space, Defense, Robotics, Nuclear and more...

- Operating Leverage (from AI): as we exit 2Q, one storyline getting more and more attention has been the drumbeat of “operating efficiency” optimism that is starting to permeate in the market (think AMZN comments here or even PANW on F2Q call); one thing I am thinking through are the mechanics here – both at a macro level (e.g. no, it doesn’t yet feel like a “NFP” consideration) and at a micro level (what velocity of Enterprise adoption is needed to realize opex efficiencies at a market level, or, are we going to watch a narrow list of fast-adopters as a leading indicator)

- Software: What does it take for these stocks to work? Amidst a (very) ‘glass half empty’ feel across Software right now (bears focused on: seats + competition from upstarts + agentic impacts), it is not easy to get conviction on the medium-term inflection in Software -- downtick in AI sentiment? .. getting over reasonable 2H bars? .. path to AI monetization?... higher prices? ... … or maybe the recent CRM/Benioff story about 30%+ of internal work in some areas being done by AI catches some momentum across Software? Regardless, with the gap between ‘loved’ and ‘unloved’ names in Semis and Internet feeling stretched these days, the confusion and apathy in Software is at least creating fertile ground for L/S spread in the 2H of the year.

- Public Cloud growth: Looking into 2H of this year, i expect 2H public cloud accelerations / growth rates to be a dominant theme and focus point – after watching MSFT Azure + ORCL OCI accelerations in the 1H’CY (with stocks going vertical after the accelerations played out), I am watching AMZN AWS and GOOGL GCP from here (and, keeping an eye on laterals like DDOG, SNOW & MDB) – both as upside nodes, but also, should potential step-ups in capacity not yield faster growth rates.

- Internet - does anyone have price-targets in Internet anymore? half joking, but yes, some stretching of multiples and/or ‘upside math’ that I am hearing from investors on names out there as of late (e.g. the NFLX, RBLX, META types).

- Other topics … any pull forward concerns? (autos? PCs? Phones?) ….. Tariffs = still a thing? (July 9th?)… Spending on AI = Good? (see META recent headlines vs stock price) .. how much room left in cyclicals like Analog Semis? … do ‘durable’ names (limited tariff / AI risks) continue to work in 2H (e.g. NFLX, LYV, AT&T types) ..

TECH + A.I. EVENTS to WATCH in 3Q (besides earnings):

- Samsung Galaxy Unpacked event 7/9

- AMZN: Amazon Prime Day 7/8-7/11

- EA: College Football 2026 available on 7/10

- Trump reportedly (link) to attend the Pennsylvania Energy and Innovation Summit on 7/15

- GOOG potential DoJ / Search ruling (could be in August 2025, per reports)

- FMS: The Future of Memory & Storage 8/5-8/7

- SIGGRAPH 2025 on 8/10-8/14

- AVGO: VMWare Explore 8/25-8/28

- NVDA hosting F2Q earnings on 8/27

- RBLX hosting RDC '25 on 9/5-9/6

- Fortune Brainstorm Tech 9/8-9/10

- BOX hosting BoxWorks 9/10-9/12

- AAPL annual iPhone event/launch in early Sept (?)

- CRWD hosting Fal.Con in Vegas 9/15-9/18

- WDAY hosting Workday Rising US 9/15-9/18

- META hosting Meta Connect 9/17-9/18

- MNDY hosting Monday Elevate 9/17-9/18

- The AI Conference (industry) on 9/17-9/18

- MDB hosting MongoDB.local NYC on 9/17

- INTU hosting annual analyst day 9/18

CHARTS IN FOCUS

NDX: despite the ‘euphoric’ feeling in markets as we hit the half-way mark (GS PB data notes that US equities have been net bought for 8 consecutive weeks), it's worth pointing out that the Nasdaq is "only" up ~7% YTD (with AMZN, GOOGL, AAPL all down on the year .. as are ~25% of NDX constituents) and the NDX is only trading at a NTM P/E multiple ~28x (more-or-less inline with its 5yr avg and solidly below peaks in the 3-handle range) with bulls able to argue Rate Cuts, GenAI “efficiencies" and de-regulation are still on the come, though, locally, investors have to contend with a possible ‘pull-forward’ of July seasonality as the Nasdaq enters 3Q in overbought territory – similar to the feel ~365 days ago.

3 up, 3 down (or flat): some intense dispersion at the midway point with AAPL, AMZN & GOOGL lagging the leaders (NVDA, MSFT, META) by ~20pts+ this year and, what’s more, it doesn’t feel like investors are ‘positioning’ for 2H reversions (e.g. META, MSFT, NVDA sentiment (still) much more bullish than that of AMZN, GOOG & AAPL).

AI is (so) back: a Datacenter Infra / Semi AI basket – see below: GSTMTDAT Index

Below is a chart of the GS cyclicals vs defensives pair plotted against the 1y1y sofr rate: The equity market has adopted the narrative that the Fed will cut into an ok growth picture and is pricing the benefits of upcoming Fed cuts to the cyclical parts of the market.

Market Breadth: not an ‘issue’ unto itself, but something to monitor at these levels (charts via Kostin / GIR)

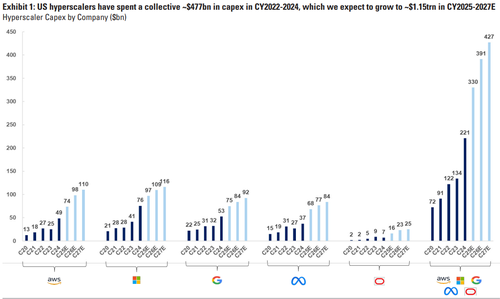

This chart has been seen a few times: latest update from a recent GIR note on ‘Profit Pools’ in scope for AI disruption (link)– one dynamic that I think about sometimes is the bottoms-up $$ required to be spent by individual companies (webscalers) to drive upside to these estimates ..

2Q S&P500 earnings expectations: consensus calling for 2Q to be the low-water mark on y/y growth over a 3yr window [3Q’23 – 4Q’26]

More in the full Goldman note available to pro subs.