Hartnett: The 4Ps Behind "Long Detroit, Short Davos"

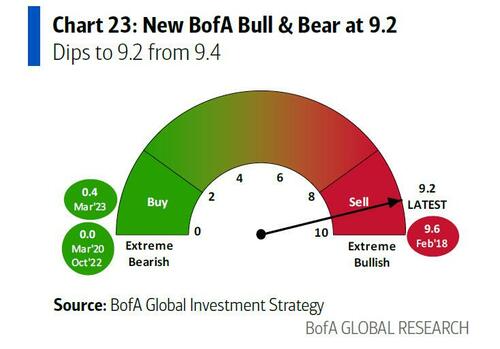

In recent weeks (here and here), BofA's Michael Hartnett has been explaining to clients that - under normal circumstances - the time to sell stocks (and short the market) would be here, now, especially considering that the BofA Bull & Bear indicator is in record, 9.2 territory...

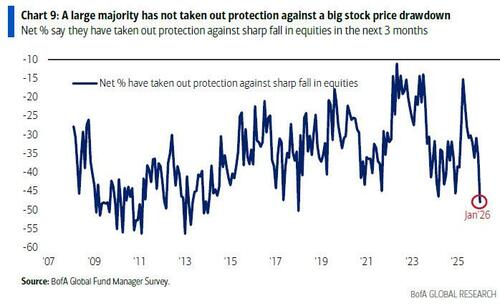

... in a time when bullish sentiment is near record highs and hedging among Fund Managers is near the lowest on record...

... the only issue is that this is not "normal circumstances", and between rapid shifts at the Fed, and Trump willing to throw everything at the market ahead of the midterms, Hartnett was been vocal in telling clients to keep buying (at least until certain events take place). Fast forward to this week's Flow Show note (available to pro subs) when he does the same.

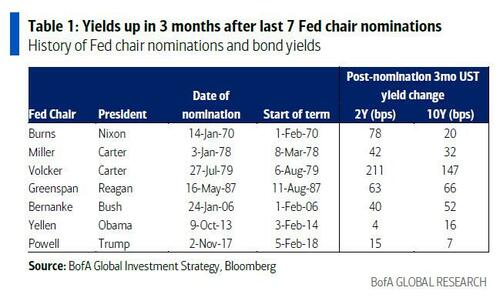

With the time until the next Fed chair arrives at the Marriner Eccles building fast approaching, Hartnett reminds us that 3 months following seven nominations for Fed Chair since 1970 (Burns, Miller, Volcker, Greenspan, Bernanke, Yellen, Powell), yields up every time (2-year +65bps, 10-year +49bps)...

... but with the MOVE index of Treasury vol at 4-year lows, indicates to Hartnett that market is confident in 2026 new Fed Chair won’t send 30-year Treasury yield above “risk-off” 5% level as QE/YCC measures coming to “fix” price of fixed income.

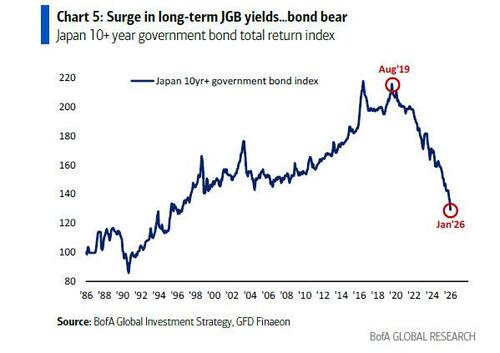

And speaking of treasuries, the bond price of the 30-year Treasury is down 50% and JGB down 45% peak-to-trough in 2020s.

This great bond bear (on new world order, debasement, populism, fiscal excess…) was the catalyst for the great first half of 2020s "Anything But Bonds" bull in US tech, EU/Japan banks & gold; but Hartnett predicts that Emerging Markets and small cap will be the new ABB bulls in the second half of the 2020s.

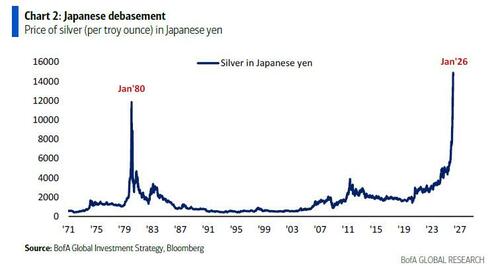

Turning from bonds, which are again selling off led by a collapse in the Japanese bond market to the explosion in silver, Hartnett shows a chart of silver priced in Japanese yen which is at all-time high, surpassing 1980 high (of course silver is at record highs in every other currency too).

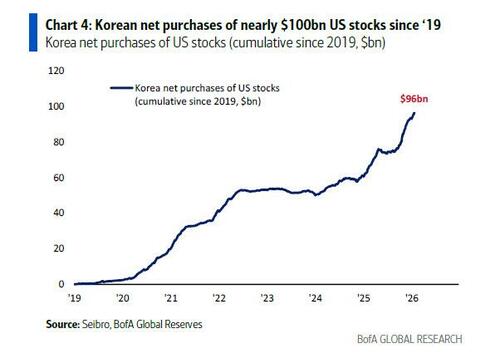

The ongoing Japan debasement and weak Asian FX, is spurring big capital outflows into US & EU assets (e.g. Korean retail $100bn into US stocks);

Watch the Aussie dollar vs Japan yen: AUDJPY>110 = multi-year breakout to 35-year high = risk-stays-on; but a failure (on BoJ, intervention) = peak of “weak Asia FX-big outflow” virtuous cycle.

With these considerations in mind, Hartnett next moves to his favorite near-tern market indicators: the 3Ps. The assessment here is that Q1 zeitgeist is “rotate don't retreat”.

- That's because big tops coincide with max bullish Positioning (check)...

- Everyone expecting Profit boom (check),

- But also Policy tightening (not this time);

In other words, as noted above, 2026 isn’t 2018 or 2022 according to the BofA CIO, as policy is easing bigly via Fed cuts, tax cuts, tariff cuts, plus $0.6tn Fed/Trump QE)… It's also why no one is retreating until 30-year Treasury yield above 5.1% (panic level of Oct’23 & May’25) signaling tighter money.

But while the selloff in US bonds is still contained, Japan - where ABB has never been more potent- can't say the same, and as we highlighted earlier this week, the surge in long-term yields in Japan to the highest since 1999 (30-year hit 3.9%) means peak-to-trough the price of 30-year JGB down 45% thus far in 2020s

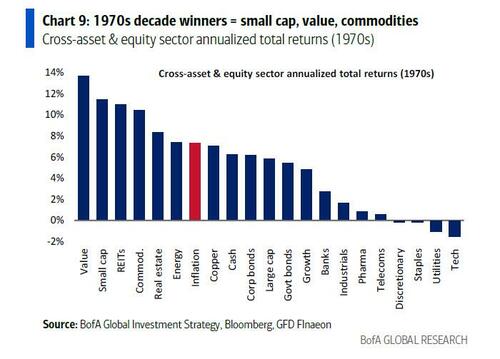

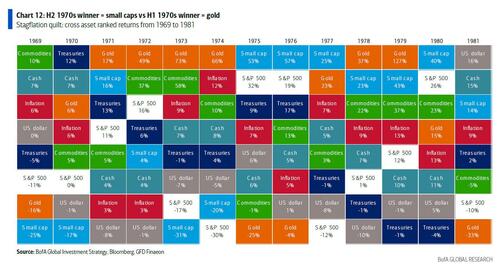

And echoing what we noted above, while the first half of the 2020s saw a bond bear market which sparked an ABB bull in gold, EU/JP banks, US tech/Mag 7; Hartnett thinks H2 2020s will see small/mid cap stocks and Emerging Markets new beneficiaries of ABB… same as in 1970s when wage & price controls, pro-cyclical fiscal/monetary policies, US$ debasement (end of Bretton Woods) caused peak of Nifty 50 bull market in 1972 and gold (1971-74) replaced by small cap (1975-77) as best asset to own.

In this context, Hartnett's favorite beneficiaries of ABB in 2026 are GLD, GNR, EEM, MDY, IJR.

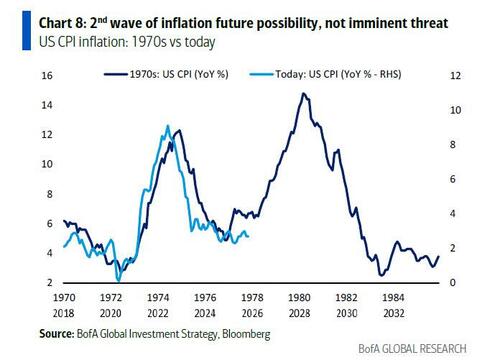

Which doesn't mean sell gold: aside from the historic performance in silver, Hartnett notes that gold remains in a secular bull intact in this new world order of debasement, populism, and fiscal excess. Gold remains attractive under-owned hedge; furthermore, great gold bull markets end with "big stuff" (end of Nixon in ‘74, Volcker rate shock in ‘80, end of EU debt crisis in ‘12, COVID vaccine in ’20). In this context, a US-China truce, central banks revaluing gold reserves, and Fed hikes to combat 2nd wave inflation...

... are future possibilities, but not imminent threats, and keep in mind that the average price gain in 4 gold bull markets of past 60 years ≈300% (implies gold price peak >$6000).

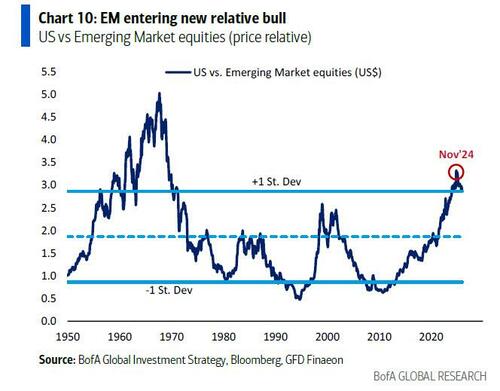

And turning from the current bull market to what Hartnett believes will be the next big bull market of 2026 beyond, the strategist says that new secular bull in International stocks in year two driven by end of deflation in Europe, Japan, China + Trump forcing Europe, Japan fiscal excess in 2020s… it's why there is big rotation out of bonds into bank stocks; Looking ahead, for 2026 Hartnett says say Emerging Markets will join the secular international bull, while strong commodity prices (powering the AI build-out) = stronger EM FX = lower EM bond yields = EM stocks entering new relative bull).

It's also why China is Hartnett's favorite long on end of deflation, while consumption is set to rebalance higher (more stimulus) from low 40% of GDP. Also, the US-China tech war means China's 3% weighting in MSCI ACWI is too low vs. US 64%

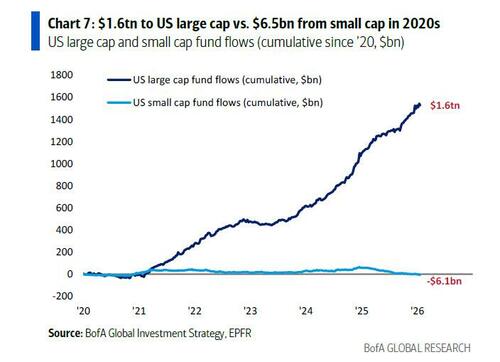

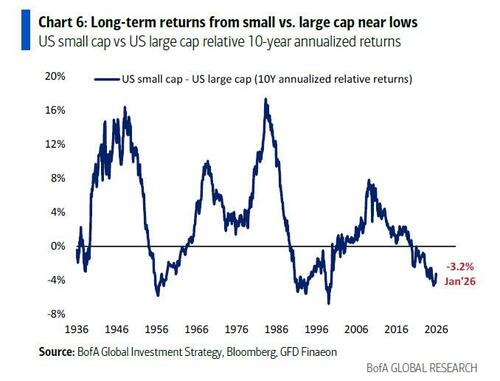

Putting it all together, the BofA strategist lays out the 4Ps behind his core 2026 thesis to be "Long Detroit, short Davos": as outperformance of small & mid caps into 2026 is driven by…

- Positioning: decade-to-date $1.6tn inflow to US large cap vs. $6.1bn outflow from small cap

- Price: long-term returns from small vs. large cap only been worse in ’56 & ’99 during the past century

- Policy: tail risk of big rise in bond yields removed by Trump admin objective to reduce “price of money” via QE/YCC;

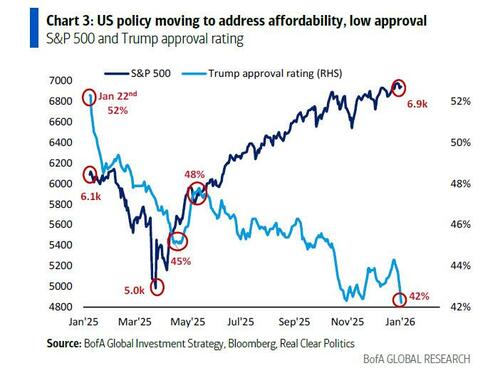

- Politics: Trump aggressive pivot to address affordability (Trump approval 42% new low last Friday) not by monetary, fiscal, trade policy, nor asset prices, but by aggressive government intervention (our “invisible hand to visible fist” view) in corporate sectors to control prices…

... “drill, baby, drill” to reduce price of energy, tariffs to reduce price of healthcare in ‘25, and in ’26 prodding banks to reduce credit card rates, stopping private equity from buying homes, making tech pay for data center power generation; government intervention to reduce price of energy, healthcare, credit, housing, electricity all via profit margins of “big” corporations why there is underperformance of big energy, big healthcare, big insurance in ‘25 mutating into PE, big banks, big tech in ’26

Putting it all together, it's why Hartnett views small & mid-cap stocks as a better play for the "boom” on Main St, reshoring, and manufacturing renaissance in run-up to US midterms.

Hartnett ends with this week's zeitgeist quote from a private client which, as usual, is perfectly apropos to our times

“Thankfully for my portfolio he’s got no intention of improving the affordability of equities”

More in the full Flow Show note available to pro subs.