Hartnett: AI Hyperscaler Announcing A Capex Cut Will Trigger The Next Great Rotation

There's still 9 months left until the Midterm elections, but to Wall Street strategists like Michael Hartnett, the biggest political event of 2026 is already the key drivers for the stock market, and as we explained last week in "Why Hartnett Is Going Long Main Street, Short Wall Street Into The Midterms",this is how Hartnett is bracing for November:

long Main St plays, e.g. EM, small cap, banks, REITs, and other assets punished in the first half of the 2020s by big bond bear market; Hartnett expects that 2026 inflation surprises downside as AI chills labor market, and politicians address voter concerns over affordability; it's why Trump aggressive intervention to reduce price of energy, healthcare, credit, housing, electricity via Big Oil, Big Pharma, Big Banks, Big Tech means small & mid-cap best play for "boom" on Main St in run-up to US midterms; plus flip from asset-light to asset-heavy business model suggests major threat to 2020s market leadership of Big Tech/Magnificent 7…

One week later, Hartnett's conviction has gone up, because as he writes in his latest Flow Show note (available to pro subs), Trump's approval on Wall Street is at all-time highs, while on Main Street at new lows (42.1%, and 36.4% on inflation); and if there is no "Trump bump" after the Feb 24th State of the Union, expect an aggressive affordability policy pivot to win midterms… more aggressive policies:

- US-Japan FX deal at Mar 19th summit to use Japan capital to cap UST yields,

- a big April Trump-Xi trade deal to cut tariffs,

- and most importantly, Universal Basic Income via Yield Curve Control to soothe AI labor market disruption for Gen Z.

Which is not to say that all is well in the market: consider the "AI disruption trade" which nuked multiple sectors in the past week: insurance brokers on Monday, wealth advisors on Tuesday, real estate services on Wednesday, logistics on Thursday… Hartnett calls this "wildfire AI disruption"... note the first AI-disrupted sector was India tech Q1’25 (INFO, TCS), and there is still no bid yet.

It's appropriate then that for this week's zeitgeist quote, Hartnett picked that “Not even AI’s best LLM could unravel the raw emotions of this tape.”

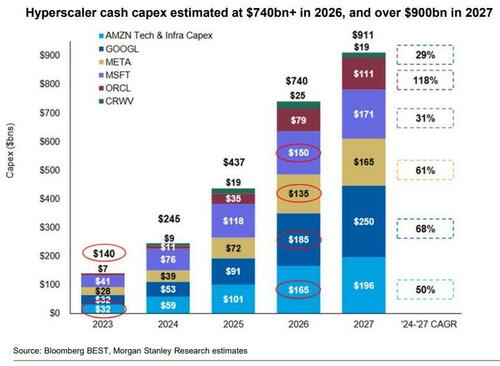

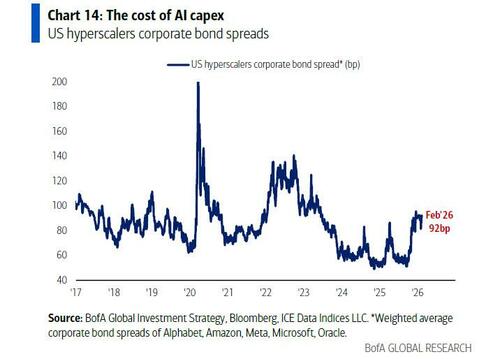

To those wondering what may short-circuit this AI sector nuke fest, recall what we said tin "Bond Market Faces Historic Shock As Mag 7 Giants Turn Cash Flow Negative To Fund CapEx Tsunami", namely that hyperscaler capex is now expected to reach a mindblowing $740BN in 2026...

... which will push Mag 7 Free Cash Flow among the to zero (and even negative), and forces them all to unleash a bond issuance spree, as the Mag 7 bubble goes full credit.

In this context, where everything hinges on more, more, more capex, Hartnett says that the most obvious catalyst to reverse significantly the "AI-awe to AI-poor" rotation would be a AI hyperscaler announcing a capex cut.

And while markets in the US remain on edge over the AI bubble, the rest of the world is levitating just fine to daily all-time highs, especially in Korea, where the entire market is now just a couple of bubbly memory stocks...

When your entire market is a couple of memory stocks:

— zerohedge (@zerohedge) January 25, 2026

"This number really blew my mind. GS earning est for Korea in 2026 is - wait for it - 75% (granted its mostly only 2 names). followed by 12% in 2027. And trading at ~11x forward." - GS S&T pic.twitter.com/UZsIrcngMD

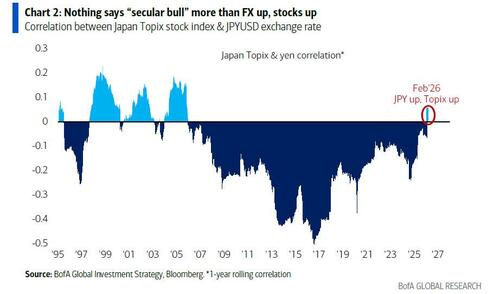

... and Japan, where the yen & Nikkei price correlation just flipped positive for the 1st time since 2005…

To Hartnett, nothing says “secular bull” more than FX up, stocks up (see Japan '82-'90, Germany '85-'95, China '00-'08); but in the short-term, the strong Japan yen adds to crypto, silver, PE, software, energy, unwind pain; it also means that Japan can’t have disorderly yen surge now (i.e., JPY below 145) as it will crush Japanese exporters (and their stock), will hit global liquidity, and has always coincided with global deleveraging.

For now, however, there are no signs of global deleveraging. On the contrary, in the latest week, Hartnett notes that according to EPFR, there were massive stock inflows to the tune of $46.3 - i.e., massive BTD, as well as $25.4bn to bonds, $14.5bn to cash, another $3.4bn to gold ("no panic selling"), and a modest $0.1bn to crypto, where the selling has also ended after Bitcoin's 50% drop from its all time high last October on aggressive levered liquidations.

That said, the risk of aggressive unwinds remain: recall that a little over two months ago, the BofA Bull/Bear Sell indicator was triggered, and has been stuck there ever since, even though in the latest week, the B&B indicator is down to 9.4 from 9.6 on lighter inflows to global equity & EM debt funds, wider financial subordinated debt spreads (AT1s), hedge funds adding to oil shorts & VIX longs;

In other words, BofA Bull & Bear Indicator contrarian “sell signal” for risk assets (started Dec 17th) remains in place; but that could change once the next Fund Managers Survey is released on Feb 17. According to Hartnett, the following metrics would signal that “excess bull” positioning has moderated sufficiently to push BofA Bull & Bear Indicator back toward 8, thus ending “sell signal”…

- Big jump rise in cash level from record low 3.2% to 3.8% or above;

- Short-covering in bonds from net 35% UW (biggest UW since Sep'22) to an UW of 25% or less;

- De-grossing in tech stocks from net OW of 17% to neutral;

- Short-covering in consumer staples from net 30% UW (biggest UW since Feb'14) to an UW of 10% or less.

Additionally, watch for extreme sector positions to signal contrarian buys/sells, eg. staples UW in Jan (biggest since Feb’14) = buy, banks OW in Dec’25 (biggest since Jan’22) = sell, sharp unwind in pharma OW in Aug’25 (smallest since Jan’18) = buy, tech UW in Apr’25 (biggest since Nov’22) = buy...

From positioning we next turn to price: here Hartnett pivots to his core point from last week, and writes that since the Oct 29th Fed rate cut at all time asset price highs, and despite Trump's policy pivot to affordability after Nov 5th NY/NJ/VA election losses… the beneficiaries are Main St inflationary boom exposure… silver 56%, KOSPI 34%, Bovespa 30%, materials 25%, energy 20%, US regional banks 19%, US small-cap value 11%, SOX 10%, industrial metals 8%… while laggards are Wall Street wealth boom exposure, such as Magnificent 7 -8%, “Bro Bubble” index -15% (PLTR, ARKK, COIN…), Bitcoin -41%, plus the disrupted (software -30%).

Here Hartnett cautions that run-it-hot trades always run-out-of-steam once positions adjust; but big profit & policy events - such as a breakdown in XLF bank stocks which triggers a jump in credit spreads, hyperscaler capex cuts, or massive tariff reduction at Xi-Trump April summit - are needed for big reversal of the 2026 Main St>Wall St, manufacturing>services rotations.

And speaking of rotations we will have much more to say there but first a quick look at a sector largely left for dead, namely bonds:

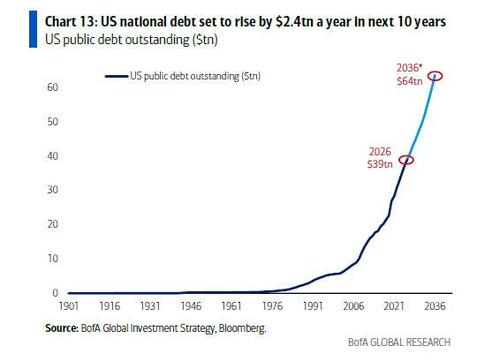

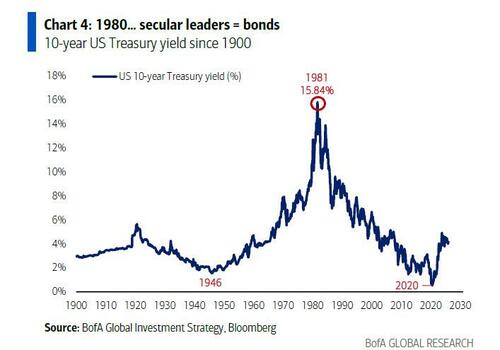

Hartnett writes that when it comes to Bonds: zero-coupon bonds ZROZ up 4% YTD, Nasdaq 100 QQQ -2%; he still thinks big unwind levels hold (big tech XLK $133, bitcoin 58k, gold $4550/oz) but if bonds rally more after strong payroll an d Friday's s CPI… those levels will be tested again, especially now big financials breaking down (XLF<$52.50). This would open the door for wider credit spreads, and Hartnett believes the long bond remains best 2026 risk hedge, as the Trump admin is unlikely to allow GT30 to trade above 5%, while the Fed may be done which means yield curve steepening done (everyone has a steepener on). To this add in the electoral need to address affordability in ’26, acceleration of deflationary AI disruption, and the BofA strategist thinks that a government bond yields surprise to the downside is his favorite exposure for ‘25-‘26 inflation-hiatus (and yes, inflation will come roaring back up in 2027 after US midterms, where with a laundry list as to why “Anything But Bonds”, ABB will remain the correct secular (not cyclical) investment theme of 2020, with some factors of note:

- US national debt (>$40tn by midterms) rising $1.0tn every 100 days, and hitting $64 trillion by 2036

- Annual US interest payments $1.0tn to $2.1tn next 10 years (per CBO),

- $4.0-4.5tn net issuance of govt bonds in US/EU/Japan in ’26 (plus record net $1.0tn US/EU corporate bond supply),

- US policy for economic boom to (run inflation hot) to reduce debt to GDP,

- The coming Yield Curve Control (YCC) will curb interest payments (= weak US dollar), and so on…

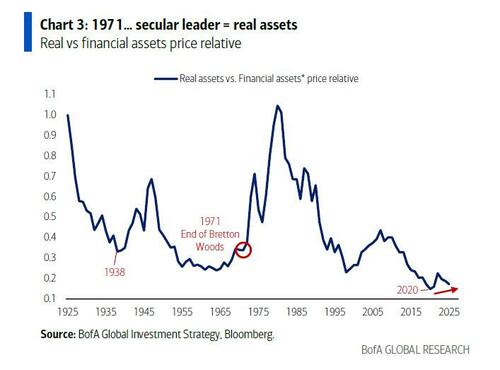

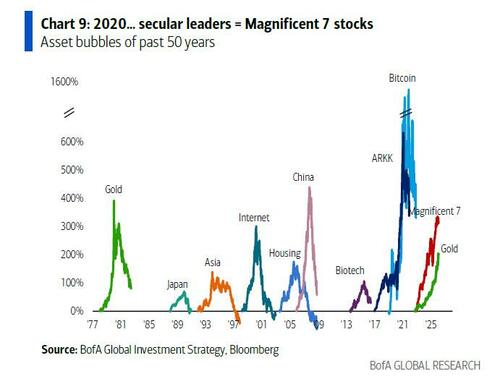

Which brings us to the core topic of this week's Flow Show, namely the Great Rotations in recent history, and why big political, geopolitical, financial events of past 50 years have always ignited big asset market leadership changes…

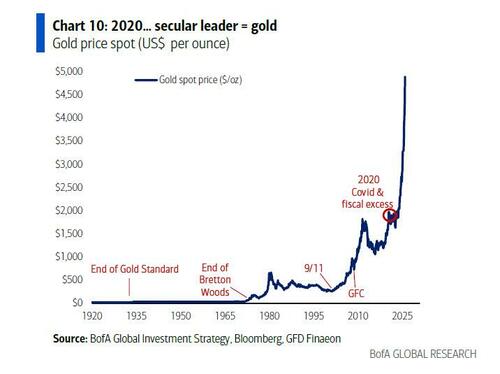

- 1971: end of Bretton Woods, era of stagflation, oil shocks, end of Nifty Fifty bull market… new secular leader was gold & real assets (up 417% from ’71 to ’80), laggard bonds & financial assets (paltry 67%);

- 1980: Reagan/Thatcher/Volcker shocks, peak inflation (14.8% in Mar’80), peak government… secular leader was bonds (10-year Treasury yield fell 16% to 6% by 1985);

- 1989: fall of Berlin Wall, start of era of globalization, disinflation… secular leader US stocks (in 1989 hit lowest level vs global stocks in past 75 years), laggard commodities (copper only asset to record negative annual return in 1990s);

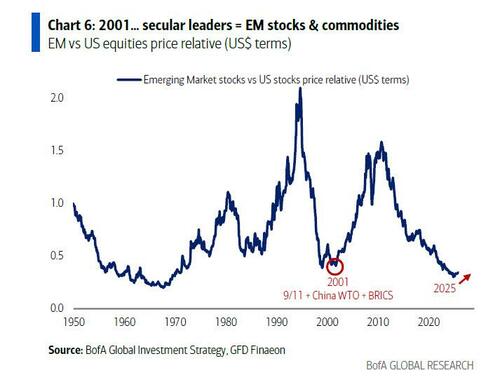

- 2001: 9/11, China enters WTO, start of “rise of China & BRICS”… laggard was US$ & tech stocks, leaders EM/commodities , financials/resources sectors

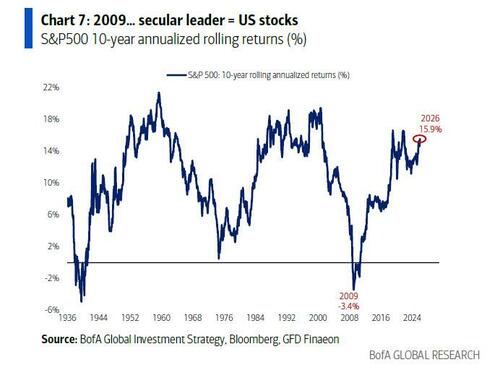

- 2009: Global Financial Crisis, era of QE, era of buybacks… new secular leaders US stocks (10-year rolling returns hit 90-year low in Feb’09)...

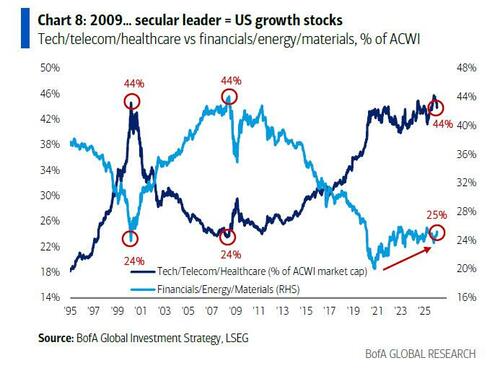

- ... private equity and growth (tech/telecom/healthcare up from 24% of ACWI in ’08 to 44% by ‘20 financials/energy/materials down from 44% to 20% );

- 2020: COVID, era of monetary (QE) and fiscal excess (US govt spend +56%), big nominal GDP growth (>50%), US exceptionalism… leaders gold...

- ... “Magnificent 7” and Japan/EU banks (end of deflation), laggard bonds (30-year US Treasury 50% loss in ‘20-‘23) & China stocks;

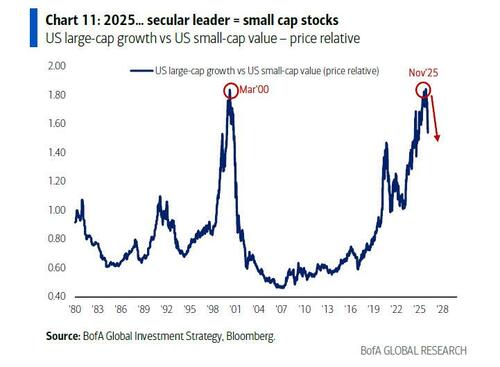

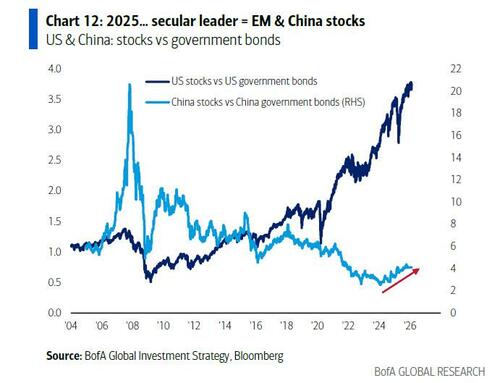

Looking ahead, Hartnett predicts that the next great rotation/secular leaders will be Emerging Markets and small cap stocks:

- US large-cap growth to small-cap value: the rotation of elitism to populism, capitalism to socialism, services to manufacturing, globalization to isolationism… Hartnett sees better trends for small cap on Main St not large cap on Wall St, plus the soaring cost of AI arms race: hyperscaler debt issuance $170bn past 5 months - vs. $30bn yearly issuance ’20-’24 - has started an avalanche of rising hyperscaler spreads....

- ... plus the Trump admin's decision to cap 30-year yields at 5% will be a big secular turning point for small cap value vs large cap growth stocks

- US to EM: new world order = new world bull, US exceptionalism flips to global rebalancing, US ‘run it hot’ policy means new ABD “Anything But Dollar” trades… the next leader will be international stocks, and especially Emerging Markets (AI devours commodities, EM produces commodities, plus very little asset allocation yet to China & India, which are two of four largest economies in world); note China bank stocks have hit 8-year highs very quietly… Chinese policy and end of trade war… next “end of deflation” leader will likely be Chinese assets (banks, real estate, consumer) signaling great rotation from China bonds to China stocks

More in the full Hartnett Flow Show note available to pro subs.