Hartnett: Great Gold Bull Markets Are Only Ended By Even Greater Events

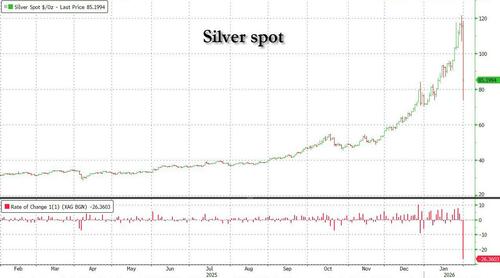

A lot happened between when Michael Hartnett published his latest Flow Show note (available to pro subs) on Friday morning, and the close of trading on Friday afternoon, most notably a slide in stocks, a surge in the US dollar, the surprise announcement that one-time Fed uberhawk Kevin Warsh would replace Jerome Powell... oh and the biggest one-day drop in silver on record.

Still that doesn't change the BofA CIO's core premise which, understandably, goes straight to gold and silver, and is the reason why the title of the report is "Debasement is Da Base Case."

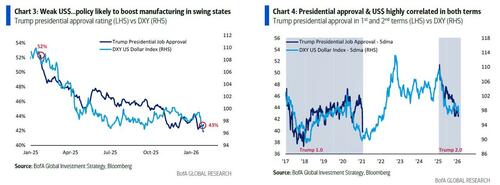

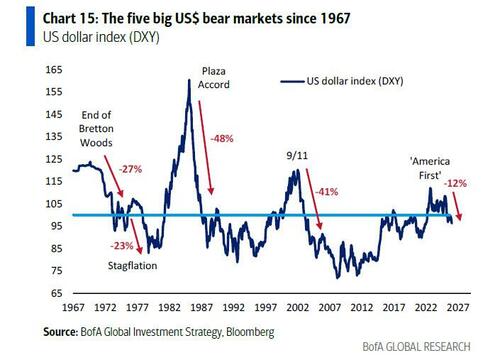

Friday's rollercoaster notwithstanding - and unlike the market, we doubt that Trump would appoint someone who would turn around and stab Trump at first opportunity, calling for rate hikes and a smaller balance sheet as soon as June - Hartnett lays out the tale of the tape as follows: US dollar down 12% since Trump inauguration; note weak US dollar is good policy to boost manufacturing in “rustbelt” swing states (PA, MI, WI); this matters because in both Trump's 1st & 2nd terms Presidential approval and the US dollar are highly correlated:

Hartnett next notes that the peak-to-trough drop in US$ bears since ’70 = 30% (naturally, gold & EM stocks are big asset outperformers in each of 5 US$ bear markets).

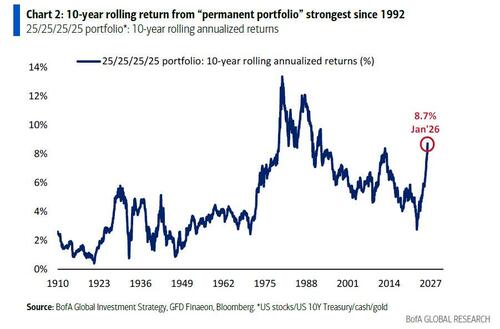

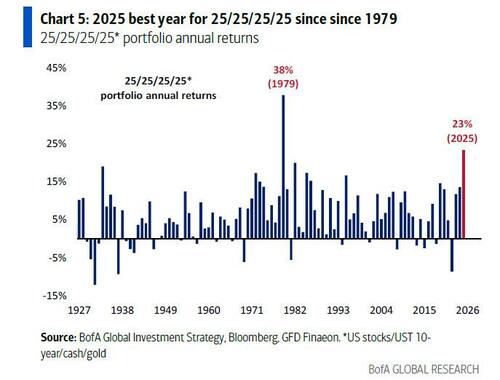

The good news is that anyone who listened to Hartnett in previous years and switched from 60/40 to 25/25/25/25 (stocks/bonds/gold/cash) is having an amazing year: as shown below, the 10-year return from 25/25/25/25 stocks/bonds/gold/cash “permanent portfolio” = 8.7% (best since 1992 )...

... and follows the huge 23% gain for the portfolio in 2025, best year since 1979

Always the contrarian, Hartnett notes that while long gold was contrarian “pain trade” in 2020 for secular asset allocators, in 2026 it’s long bonds. Then again, with the world overflowing with debt, this may be the one time the contrarian will be wrong... we'll see.

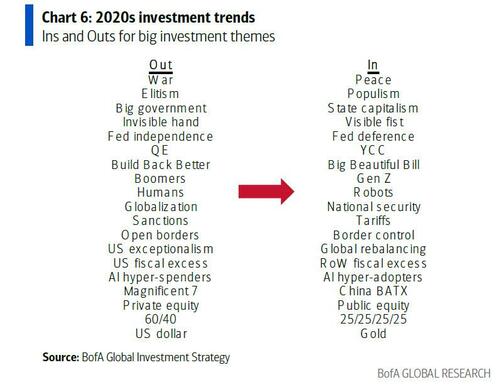

Next, with the decade more than halfway over, the BofA Strategist takes a quick walk down memory lane, to summarize the big trends of the 2020s.

2020s investment trends are...

- political populism,

- globalization to national security,

- global fiscal excess,

- Fed independence to deference,

- US exceptionalism to global rebalancing,

- AI nationalization,

- AI = UBI = YCC…

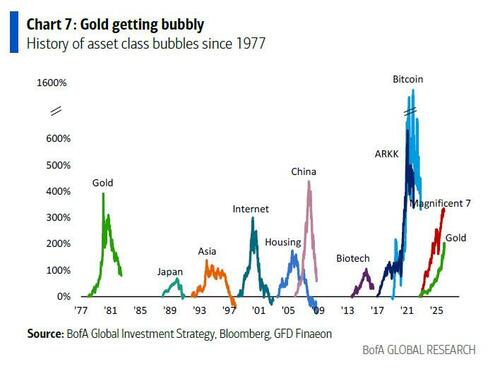

It's why gold is going “bubbly”, or at least was until the Friday crash...

... why there are new bulls in small/mid cap & international equities,

... why US$ debasement trades are frontrunning the risk of peaks in US 64% global equity market cap, 55% global corporate bond market, 50% global government bond market... if non-US asset allocators cut stock & Treasury holdings by only 5% = $1.5tn capital outflow at time of $1.4tn current account deficit & $1.7tn budget deficit.

Next, cutting straight to 2026, Hartnett writes that his favorite trades for 2026 are BIG + MID (as discussed in recent notes)

- long Bonds: Main St disinflation & Wall St deleveraging hedge…buy 30-year Treasury as yield approaches 5%;

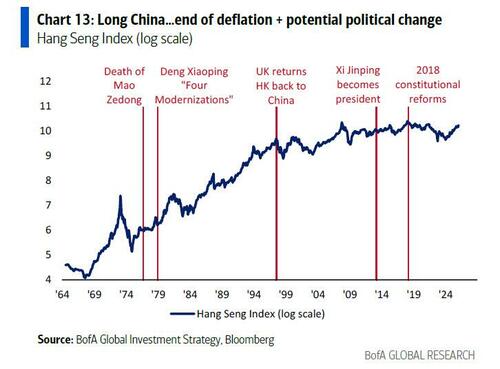

- long International: New World Order = New World Bull + US exceptionalism flips to global rebalancing…buy China to position for end of China deflation & potential political change (Chart 13);

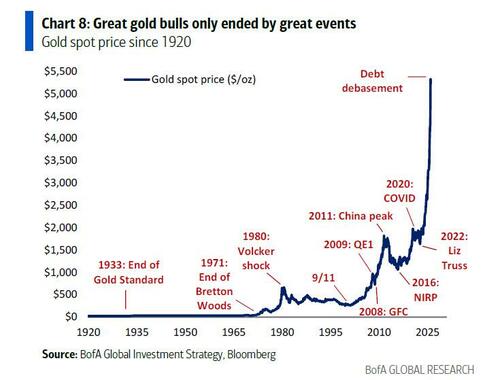

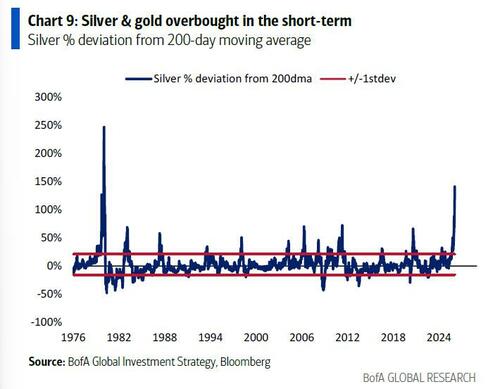

- long Gold: world’s favorite US$ debasement hedge & great gold bulls only ended by great events (end of Nixon in '74, Volcker rate shock in '80, end of EU debt crisis in '12, COVID vaccine in '20); ahead of Friday's historic plunge, Hartnett warned that "gold/silver are nutty overbought short-term", which is why he thinks that long oil is a better debasement play;

- long Midcap stocks: these are the best plays for a Main St “boom” and MAGA manufacturing renaissance… buy any retracement to new floors for Midcap 400 (MID 3333) & Smallcap 600 (SML 1500);

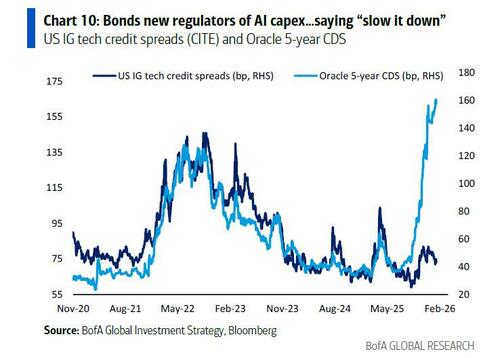

- short IG tech bonds: big Tech AI flip from asset-light to asset-heavy business model mean bonds new regulators of AI capex and bonds saying “slow it down", especially in the case of Oracle.

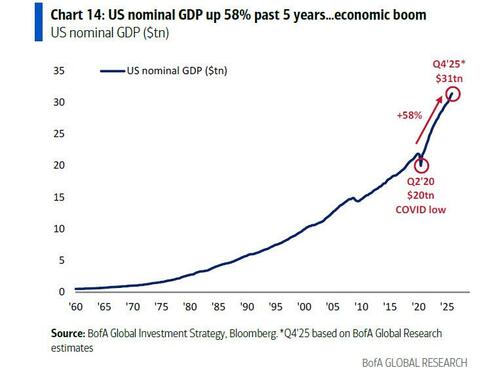

- short US Dollar: peak US exceptionalism + weak US$ aids financing of $39tn national debt (up $15tn or 64% in past 5 years) needed to maintain economic boom (US nominal GDP $31tn, up $11tn or 58% in past 5 years ); DXY to 90 means buy any retracement to new floors for Emerging Markets (MXEF 1400) and natural resources (SPGNRUP 3500).

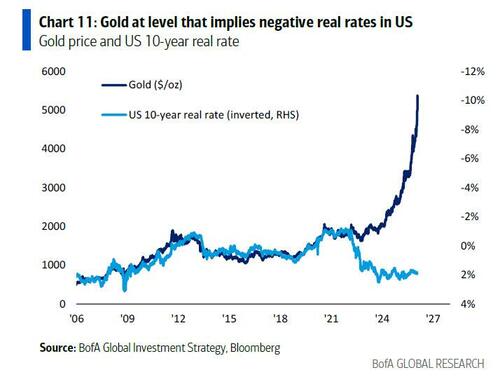

Hartnett concludes his latest note with gold, and specifically Debasement, which is now "De Base Case": he writes that gold now at level that implies negative real rates in US …

... as excess liquidity, US $ debasement, US economic boom in run-up to US midterm elections suddenly everyone’s base case, all at time of excess bull sentiment; triggers for a H1 deleveraging of liquidity, debasement, boom winners…

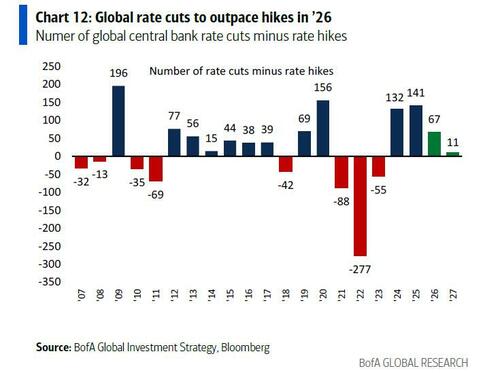

- Central banks: rally in liquidity, debasement plays sparked by Oct 29th Fed rate cut with asset prices at highs; 71 global rate cuts to outpace 11 rate hikes in ’26, but some big central banks set to hike (Australia in Feb, Japan in April, NZ in Sept) and liquidity bull reverses if Fed cuts in ’26 are priced out (which is what the market thought happene on Friday with Warsh's appointment, even if the number of rate cuts priced in actually rose).

- Bonds & currencies: How to track key inflection points? According to Hartnett, a 30-year US Treasury yield >5.1% and jump in MOVE UST volatility index >80 would confirm “peak liquidity” in Q1 (as would bitcoin <$80k, which is where we are right now); and Japanese yen surge to 140 vs US dollar would signal end of global bullish “weak Asia FX = big Asia capital outflows = gold/US/EU asset inflation” cycle.

- Trump: rally in boom plays (resources, banks, industrials) sparked by Trump “policy panic” (cut tariffs, taxes, price of money while “fixing” Main St inflation) following Nov 4th election losses in NY, NJ, VA; a recovery in Trump Presidential approval from 43% to >46% would signal end of bullish “policy panic” phase (courtesy of Democrats, however, that is unlikely and if anything, expect even more negative approval ratings).

More in the full BofA note available to pro subs.